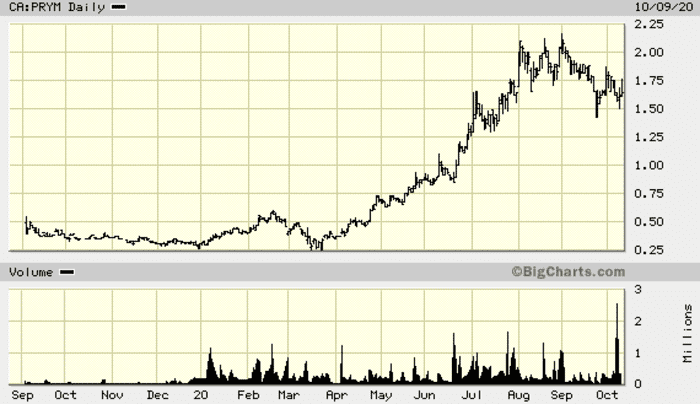

Prime Mining (PRYM.V) began its journey as a publicly-traded entity in Sep of 2019. The company raised $8.7M at $0.30 to lay claim to its flagship asset—the Los Reyes Project—acquired from Vista Gold (VGZ.T).

Prime’s price trajectory, particularly from the mid-March crash day lows, generated significant shareholder value for those who recognized the latent potential early in the going.

The Project

The Project

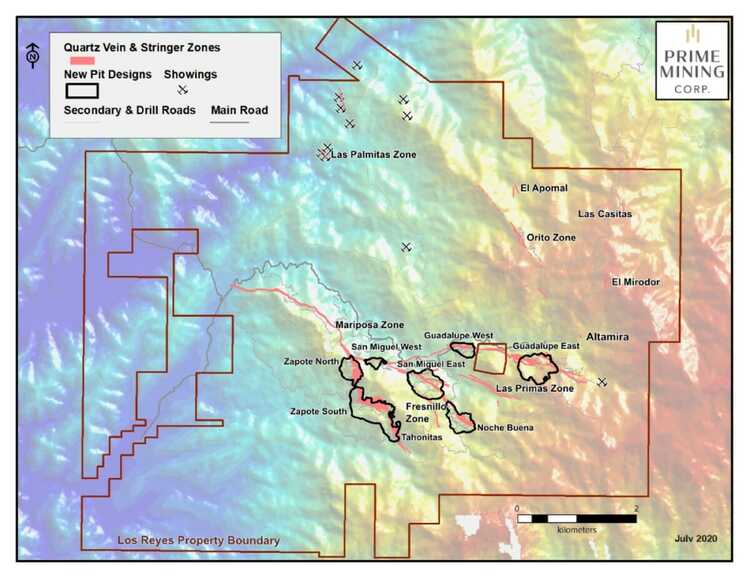

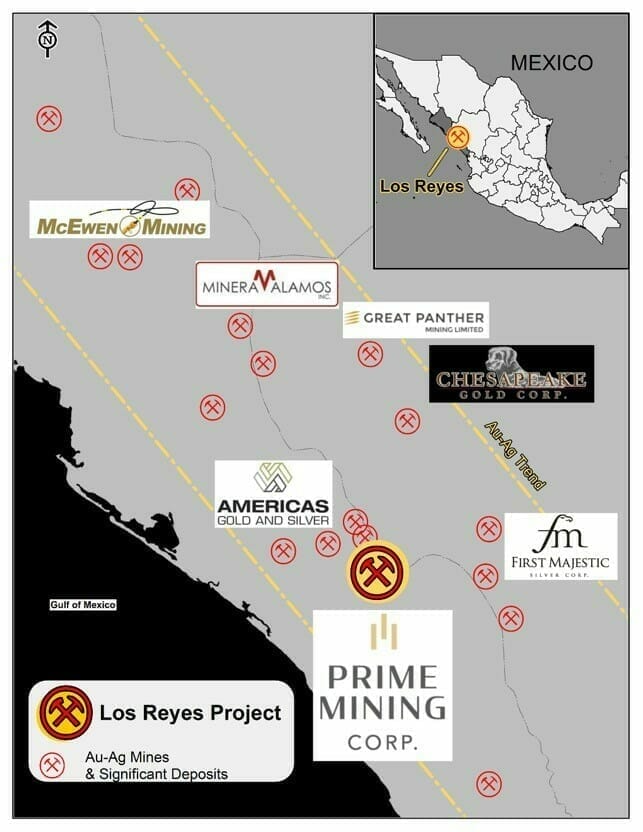

The 6,300 hectare Los Reyes Project is located 43 kilometers southeast of Cosala, in the mining-friendly state of Sinaloa, Mexico.

Gold and silver were first discovered at Los Reyes by the Spanish in the late 1700s. This sparked over 150 years of mining.

From the 1950s through the 1980s, there was limited activity in the area—mostly reconnaissance exploration.

In the 1990s, drill rigs were mobilized to the project, targeting shallow, lower-grade gold-silver mineralization in areas surrounding the Los Reyes underground workings.

During that time, over 50,000 meters of RC and core drilling probed Los Reyes’ subsurface layers resulting in an extensive area-wide database.

Los Reyes was on track to become a heap leach mine in 1998… and then the bottom of the gold market fell out.

Today, Los Reyes is proximal to a plethora of deposits operated by the likes of Americas Gold and Silver (USA.T), Minera Alamos (MAI.V), First Majestic (FR.T), McEwen Mining (MUX.T), and Chesapeake (CKG.V).

Today, Los Reyes is proximal to a plethora of deposits operated by the likes of Americas Gold and Silver (USA.T), Minera Alamos (MAI.V), First Majestic (FR.T), McEwen Mining (MUX.T), and Chesapeake (CKG.V).

Within days of its debut on the TSXV in September of 2019, a general meeting with members of the local Ejido (Ejido Tasajera) was convened where the membership voted unanimously in support of Los Reyes development.

With this blessing, the company immediately put boots on the ground.

With this blessing, the company immediately put boots on the ground.

(An Ejido is an area of land in which community members collectively maintain communal holdings).

The project has direct access to roads, line power, abundant H2O, and a local labor force immersed in the mining culture.

As Los Reyes is pushed further along the development curve, the economics should prove enticing.

To further its development goals, the company secured a 30-year surface access rights agreement ensuring continued exploration, development, and the timely receipt of mining and construction permits.

To facilitate a broader approach to regional exploration, a permit application has been submitted to drill-off new (untested) targets in the region.

The Resource

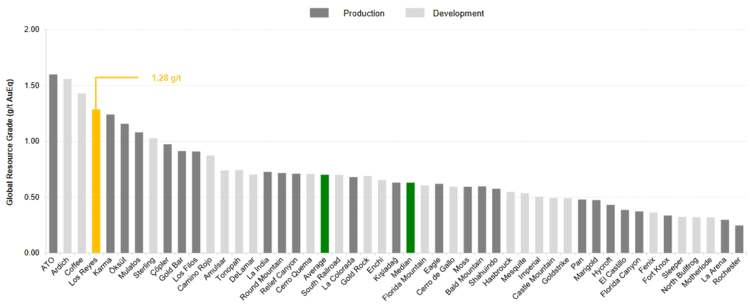

Back in February of this year, the company dropped an in-pit oxide gold resource estimate of 833,082 gold equivalent (AuEq) ounces in the Measured and Indicated category at a grade 1.31 g/t, and 261,132 AuEq ounces in the Inferred category at a grade of 1.14 g/t.

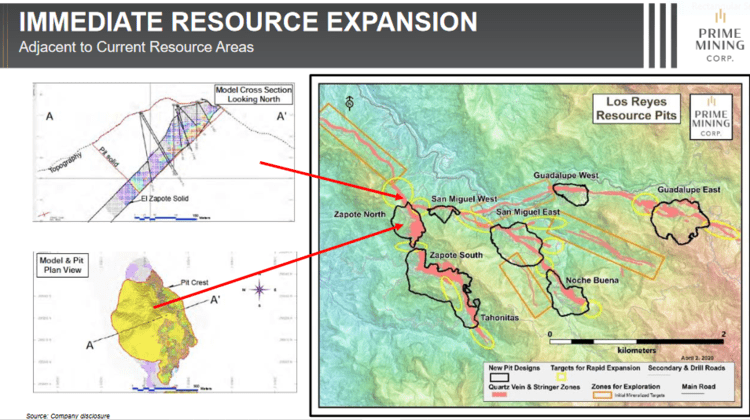

The current (oxide) gold resource is open along strike and at depth.

As per slide 20 on the company’s investor deck, Los Reyes is ranked among the highest grade oxide gold deposits in the world…

Los Reyes is a low sulphide epithermal system with over 17.5 kilometers of mineralized strike.

Los Reyes is a low sulphide epithermal system with over 17.5 kilometers of mineralized strike.

A full 10 kilometers of this strike length remains untested—multiple high-grade surface showings wait in line for a proper probe with the drill bit.

With a solid resource base already in hand, the real upside here is in the project’s resource expansion and exploration upside potential.

The resource expansion potential…

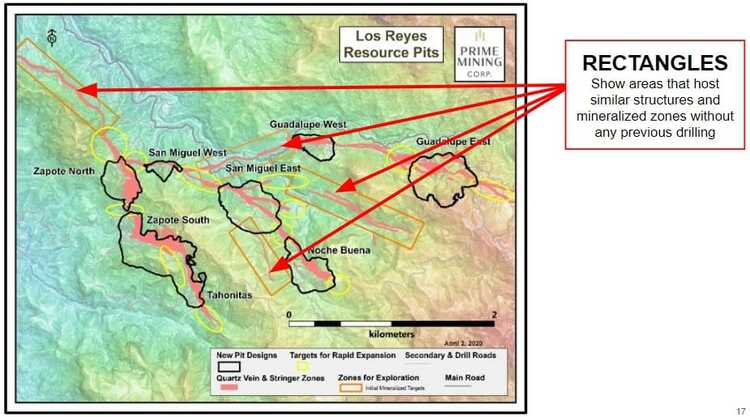

This next map gives us a view of the resource expansion potential within the current resource blocks of Zapote North, Zapote South, and Tahonitas (nice maps fellas)…

This next map gives us a view of the resource expansion potential within the current resource blocks of Zapote North, Zapote South, and Tahonitas (nice maps fellas)…

The exploration upside (the company also has numerous untested claim blocks that have yet to be explored)…

The exploration upside (the company also has numerous untested claim blocks that have yet to be explored)…

Due to the vertical orientation of these vein systems—there’s plenty of outcropping material between and beyond the eight known deposits (along the top of the unmined ridges, for example)—the company is employing a trenching campaign that will connect with the mineralization at depth.

Due to the vertical orientation of these vein systems—there’s plenty of outcropping material between and beyond the eight known deposits (along the top of the unmined ridges, for example)—the company is employing a trenching campaign that will connect with the mineralization at depth.

This mineralization also outcrops along road cuts. On such cuts (image below), work crews carve out a deep chip channel, effectively creating a horizontal drill hole as it progresses along the cut.

Trenching and drilling appear to carry equal weight at Los Reyes—both have the potential to add to the current Au-Ag ounce count.

Outcrop sampling and trenching over the past 10-months generated the following highlights:

Outcrop and trench sampling results (Main road cut highlight) reported Dec 12, 2019: 34.5 meters grading 4.2 g/t Au

Trench sampling results (between Zapote North and Zapote South highlight) reported January 21, 2020: 30 meters grading 3.9 g/t Au and 40 g/t Ag

Trench sampling results (Zapote South highlight) reported February 5, 2020: 37.5 meters grading 3.9 g/t Au and 36.5 g/t Ag

Trench sampling results (Zapote South highlight) reported February 26, 2020: 39.0 meters grading 6.75 g/t Au and 58.2 g/t Ag

Trench sampling results (Guadalupe West highlight) reported April 21, 2020: 58.5 meters grading 0.83 g/t Au and 20.2 g/t Ag

Surface rock chip sampling results (Tahonitas highlight) reported June 30, 2020: 63.0 meters grading 1.78 g/t Au and 71.0 g/t Ag

Surface sampling results (Noche Buena highlight) reported August 19, 2020: 42 meters grading 1.93 g/t Au and 25.7 g/t Ag

Los Reyes – the next steps

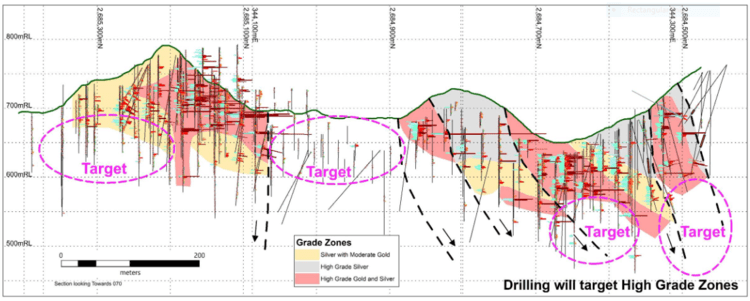

Drilling is expected to commence in early November.

The initial 10,000-meter drill program, at a cost of roughly $6M, is expected to continue from November until June 2021.

Historic drilling at Los Reyes did not exceed 200 meters below surface. This, and a lack of systematic exploration of some 60% of the known mineralized structures, opens up significant resource expansion and exploration upside.

A three-pronged approach is underway to:

1) Upgrade 7.1 million tonnes of the current Inferred resource to the Measured and Indicated category:

- 2,000 meters of surface rock chip sampling in trenches;

- 1,500 meters of drilling in 12 to 15 shallow drill holes;

- Focus areas include Noche Buena, Tahonitas, and Zapote, including surface rock chip sampling (in trenches) at San Miguel East and San Miguel West.

2) Add to the current ounce count by drilling along strike and down dip in areas adjacent to the existing eight open pit-constrained mineral resource areas:

- 1,500 meters of surface rock chip sampling in trenches;

- 3,500 meters of drilling with some holes targeting a depth of 200 meters;

- Focus areas include the mineralized structures at Zapote, San Miguel East, and south-east extensions to Noche Buena and Tahonitas.

3) Define the potential to add new gold and silver ounces in unexplored areas where data obtained from new mapping and sampling confirm the target potential:

- 3,500 meters of surface rock chip sampling in trenches;

- 5,000 meters of drilling with some holes targeting a depth of 350 meters;

- Focus areas include potential mineralized structures extending between San Miguel East, Guadalupe East, and Las Primas, and between Guadalupe West and the Zapote/Mariposa trend. A structural re-interpretation indicates that new northwest-trending structures, parallel to the Zapote trend, may exist.

The Company expects to release an updated geologic resource estimate after this first phase of drilling.

The company also anticipates a follow-up drilling campaign for the second half of 2021, one that tests the ultimate potential of Los Reyes’ multiple (eight or more) deposits.

A word on metallurgy

Past metallurgical tests show heap leach recovery as a viable option.

Grinding and vat leaching showed gold and silver recoveries in the high 90% and high 80% range, respectively.

Drill and channel sample material sent to the assay lab will be analyzed for cyanide solubility using bottle roll testing to build a database of recovery rates across the project.

Management

At the risk of sounding like a broken record… you can have a great project, but without the right team in place, shareholder-value-creation is often compromised.

Let’s face it, management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and enterprising business types— things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises (PPs).

Prime boasts a top-shelf crew with numerous wealth-creating exits under their collective belts. Their resumes can be perused here.

Importantly, CEO Dan Kunz has been operating in the Sinaloa region for the better part of 18 years. He knows the region, its politics, and the local communities well.

I’d be remiss in not mentioning that management’s values (and incentives) appear to be well aligned with their shareholder base. There is no cheap stock underpinning this deal ($0.30 was the initial ante). Management isn’t drawing a wage. They are taking down stock in lieu of salary—compensation is based largely on share price performance/appreciation.

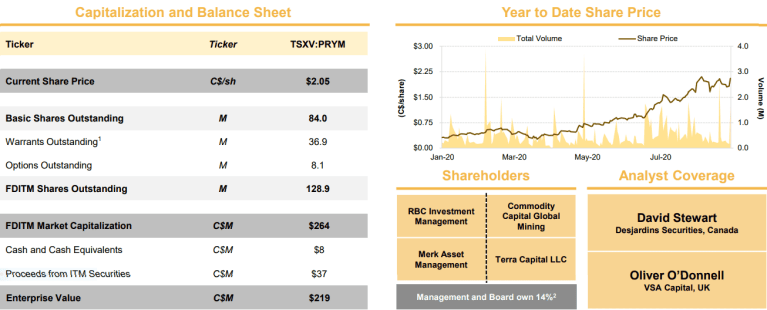

Under the hood (slide #4 of the i-deck)

Final thoughts

Los Reyes drilling is set to commence in roughly 3 weeks. With regional exploration, ongoing trenching, and a 10,000-meter dd campaign, expect strong newsflow going forward.

END

—Greg Nolan

Full disclosure: Prime is not an Equity Guru marketing client.