On November 18, 2020 Harborside (HBOR.C) reported its Q3,2020 financial results.

Unless otherwise indicated, all dollar amounts reported in the press release are in U.S. dollars.

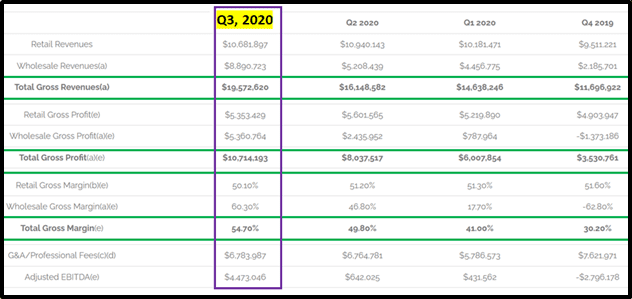

During Q3 2020, Harborside generated total gross revenues of approximately $19.6 million, representing a 21.2% sequential growth over Q2, 2020 and a 42.9% year-over-year increase when compared to the approximately $13.7 million of gross revenues reported in the period ending September 30, 2019 (Q3 2019).

Combined gross profit before excise taxes and adjustments for biological assets was approximately $10.7 million, an 85.8% year-over-year increase as compared to the $5.8 million reported in Q3 2019. On a year over year basis, combined gross margins increased from 42.1% in Q3 2019 to 54.7% in Q3 2020.

Growth in wholesale operations was more dramatic.

HBOR reported gross wholesale revenues of approximately $8.9 million, representing 70.7% sequential growth compared to Q2 2020 and a year-over-year increase of 169.4% as compared to the approximately $3.3 million in gross revenues reported for Q3 2019.

Wholesale Gross Margins are higher than Retail Gross Margins because the build-out for the whole-sale business does not require additional brick & mortar stores.

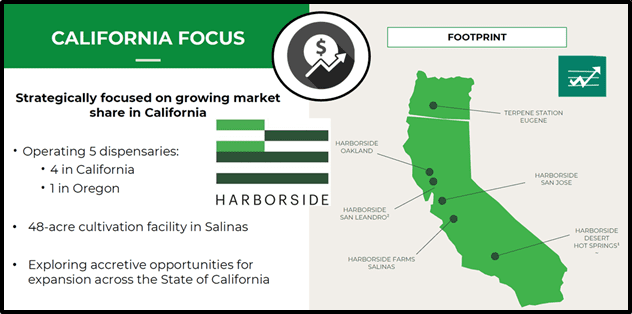

Last week, HBOR announced that it is “upgrading of one of its approximately 45,000 square foot greenhouses at its 47-acre integrated production campus in Salinas, California”.

Expected outcomes from the upgrade in this greenhouse:

- 50% increase in production of this greenhouse

- 10% increase in bulk wholesale revenue capacity of this greenhouse.

- 7% increase in the total productive capacity of the Salinas facility.

HBOR projects that the upgrades will be complete by Q1, 2021 and the costs will be recouped within the first 12 months of operation.

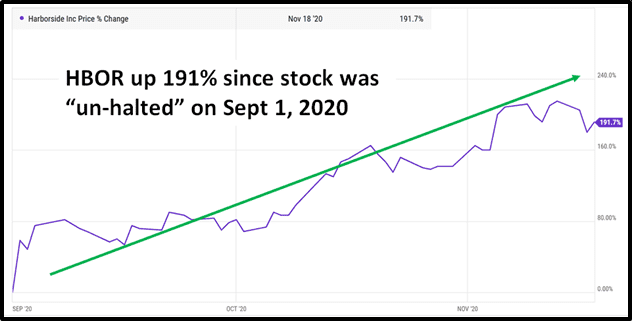

While HBOR was halted in June, 2020 – the company continued to grow weed, sell weed, manufacture products and do good things in the community.

On July 3, 2020 Harborside announced a $10,000 charitable contribution to Oakland-based Peralta Colleges Foundation which serves a diverse population of over 21,000 students largely consisting of African American, Hispanic American and Asian American students.

When HBOR began trading again the beginning of September 2020, it got “re-rated”.

Five weeks ago, we stated that HBOR “is a $22 million company that operates three big dispensaries in the San Francisco Bay Area, a dispensary in the Palm Springs, a dispensary in Oregon and a cultivation/production facility in Salinas, California“.

HBOR now has a market cap of $37 million.

The dramatic year-over-year increase in retail revenue was driven primarily by the Company’s enhanced merchandising and pricing initiatives which resulted in, amongst other things, improved product mix, selected pricing changes and higher sell-through of internally produced products.

Across Harborside’s retail stores in California, the Company’s branded products represented from 9 to 14 of the 25 top-selling SKUs in Q3 2020.

Total operating expenses for Q3 2020 were approximately $7.8 million, including $1.15 million in one-time costs related to the audit and restatement of prior year financials. This was a 7.5% year-over-year decrease when compared to approximately $8.5 million of costs incurred in Q3 2019

The year-over-year decrease in operating expenses is primarily related to a decrease in general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses of $1.1 million to $4.1 million as compared to $5.2 million in Q3 2019.

Net loss and comprehensive loss were $2.4 million, compared to a net loss and comprehensive loss of $1.9 million in Q3 2019, a 24.2% decrease on a year-over-year basis.

HBOR expects Q4 2020 gross revenues to follow “a more historically typical seasonal pattern”, with lower flower production and wholesale revenues, resulting in total combined gross revenues of $11 million to $12.5 million for the fourth quarter.

Sales of Harborside Farms products have grown year-over-year by 229% at Harborside’s iconic dispensaries capturing 42% of its total retail flower sales through the end of Q3, 2020

At its retail dispensaries, clones (inclusive of seeds and seedlings) are expected to generate 5% of HBOR’s total annual retail sales, or approximately $2-million in annual net retail revenue in 2020.

HBOR recently signed a definitive agreement to acquire 50.1% of FGW Haight – a California co. that has the “conditional-use approval” to operate a cannabis dispensary and related businesses in the iconic Haight Ashbury area of San Francisco, Calif.

With HBOR’s track record of revenue-growth-per-location, the addition of FGW is likely to pad the bottom line.

“We’ve implemented strong operational improvements that have continued our progress towards long term profitability and sustained growth,” stated Bilodeau on November 18, 2020, “As our production capacity is expected to ramp up in early 2021, following the completion of the planned upgrades at our Salinas greenhouse facility, we expect to be well-positioned to accelerate our growth and continue to gain wholesale market share. I’m thrilled with how far Harborside has come this year and look forward to further growth in 2021.”

HBOR’s $37 million market cap is less than its total 2020 projected revenues.

As of September 30, 2020, Harborside had approximately $13.3 million in cash.

- Lukas Kane

Full Disclosure: Harborside is an Equity Guru marketing client