On October 28, 2020 Sentinel Resources (SNL.C) announced that its crack exploration team of Dr. Peter Pollard, director and Chief Geologist of Sentinel and Dr. Christopher Wilson, senior advisor to Sentinel, have provided an initial review of Sentinel’s seven silver-focused exploration licenses located in New South Wales, Australia.

Dr. Peter Pollard is a recognized expert in intrusion-related mineralized systems including copper-gold porphyry, tin-tungsten-molybdenum-bismuth-gold, iron-oxide copper-gold-uranium and gold-silver systems. He has published 70 peer-reviewed scientific articles.

Dr. Chris Wilson is an innovative exploration geologist with over 30 years of global experience in area selection and prospect generation, target generation, and the design and management of large resource definition drilling and pre-feasibility programs. He has worked in over 75 countries, on most commodities and deposit styles.

Pollard & Wilson are – to finding-valuable-metals – as Laurel & Hardy were to creating comedy. They’ve been through the wars. They know their craft.

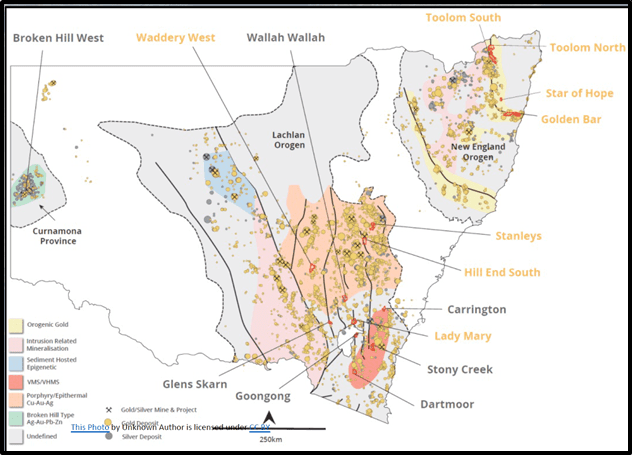

The exploration licenses are known as Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarns, Broken Hill West and Goongong.

“First-pass review of the extensive historic data for the Silver Projects indicates that Wallah Wallah, Stoney Creek and Carrington are high priority projects,” confirms SNL, “All are located in a significantly silver-mineralized part of the southern Lachlan Orogenic Belt.

Highlights:

Wallah Wallah (ELA 6065)

- A 99 km2 licence hosting 6 historic silver mines and showings with reported rock-chip grades of over 1,000 g/t Ag.

- The historic Wallah Wallah prospect comprises mineralized lodes which crop out as gossans over a strike length of 2 kilometres.

- Historic records indicate that one lode was exploited to a depth of at least 46 m on four levels. Records indicate several thousand tonnes of material was processed at grades of 950 g/t Ag and 30% Pb1.

- The system is relatively unexplored, but the presence of minor tin, topaz and tourmaline with the silver-lead mineralization suggests it forms part of an intrusion-related system possibly related to nearby Devonian granites.

Stoney Creek (ELA 6082)

- An 81 km2 licence hosting 7 high-grade, historic silver and gold mines and showings. Mineralization is likely of a low-sulphidation epithermal type — characterized by vein-hosted high-grade shoots.

- The Stoney Creek prospect comprises quartz-sulphide veins within an 85 m wide zone of alteration. Historic rock-chip grab samples assayed up to 18 g/t Au and 212 g/t Ag.

- Gundillions Reef is defined by a series of shafts, drives and small open pits that have been worked to a depth of approximately 200 metres. Rock-chip grab samples have returned assays of up to 50 g/t Au.

Carrington (ELA 6080)

- Carrington contains a number of historic mines and workings within gold-silver mineralized gossanous lodes. Gossans form when sulphide mineralization is exposed to surface and “rusts” to an iron oxide residue. Gossans are important vectors to underlying sulphide mineralization.

- Three historic silver-gold mines targeted silver-gold mineralized gossans. Historic rock chip grab samples of this material assayed up to 85 g/t Au, 6037 g/t Ag, 24.85 Pb and 16.75% Sb (antimony).

- Significantly, the NSW government “minview” website states that over 0.5 Mt of iron gossan is present. This is significant given silver-gold mineralization is associated with gossans developed above primary sulphide mineralization. The tonnage cited suggests a robust system.

Additional Silver Projects (ELA 6080)

- Sentinel’s review of Broken Hill West (EAL 6078), Glens Skarns (ELA 6066), Goongong (ELA 6091) and Dartmoor (ELA 6084) is ongoing:

- Broken Hill West is located 2.5 km to the west of the Broken Hill mine complex and shares similar geology and structure. There has been minimal exploration due to an extensive cover of recent alluvium.

- Glens Skarns has four mineralized skarns over a strike length of 7.5 km. The Sentinel team believes these are four priority targets.

- up to 80 g/t Ag, 5% Cu, 0.28% Pb, 1.26 % Zn, 100 g/t Sn and 1700 g/t W (tungsten).

- Dartmoor hosts Kuroko-style VMS mineralization which can be traced as gossanous outcrops over a strike length of 1.5 km. Small scale historic production records cite silver grades of up to 900 g/t.

- Goongong hosts four historic silver mines and prospects of polymetallic skarn style with anomalous silver, copper, lead, zinc, tin and tungsten.

“Whilst the review of historic data is ongoing, Sentinel’s technical team has now identified Wallah Wallah, Stoney Creek and Carrington as very high priority exploration licenses,” states Rob Gamley, CEO of Sentinel, “The very large historic dataset available adds significant value to first pass project ranking.”

Gamely reports that the SNL technical team “continues to review and model this data in order to prioritize the remaining silver licenses.”

“The huge task of fully assessing this portfolio of assets continues,” added Gamely, “In addition to high-grade silver mineralization, Stoney Creek and Carrington, also report extremely high gold assays”.

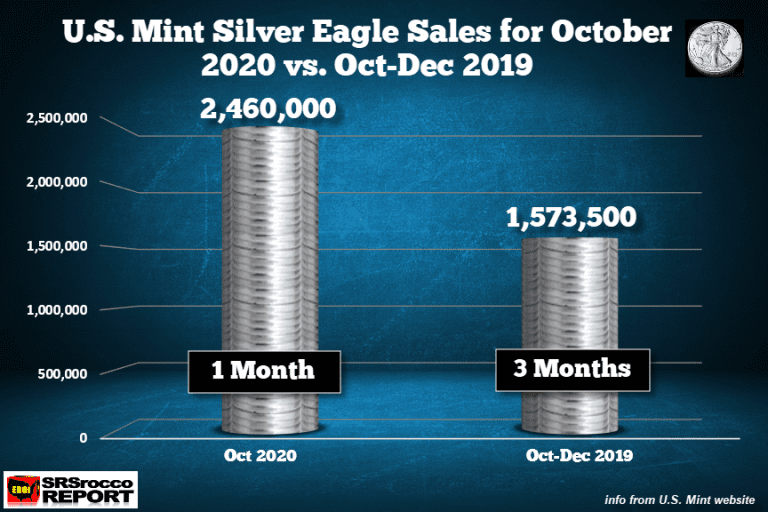

In September, 2020 2.90 million 1-ounce American Eagle Silver coins were sold — the highest volume since January, 2020. The monthly sales figure went up by 47% from August’s 1.53 million coins sold.

As well as Australia, SNL is developing precious metals projects in Peru and British Columbia, Canada.

SNL guiding principles:

- Acquisition of strategic exploration properties

- Mining-friendly jurisdictions

- Mature mining industries

- Low-cost of entry

- Easy access to infrastructure

- Minimize capital and operational explorational costs

This week, the U.K.-based research firm Metals Focus predicted that silver prices will move higher than $30 an ounce next year.

“The comments come as silver prices have dropped through initial support at $24.00 an ounce,” reports Kitco News, “The analysts noted that even during silver’s nearly two-month consolidation period, investment demand has remained robust”.

“Irrespective of the outcome of the U.S. election, fresh large-scale fiscal and monetary stimuli seem inevitable,” stated the analysts, “The case for silver (and gold investment) will therefore remain strong. This is the main assumption behind our forecast that the silver price will break through the $30 mark during 2021.”

“The U.S. Mint just updated its sale figures on Monday to show the total for October was 2,460,000 compared to only 1,110,500 during October 2019,” reports SRSrocco.

On October 29, 2020 SNL announced that it has engaged Mr. Mart Rampe to oversee regulatory filings, land-holder access, and to provide additional geological support and services as required. Rampe has a strong background in environmental, planning and community disciplines, working on most deposit types for gold, silver, base metals and uranium.

Review of the other Australian Silver Project licenses is ongoing. Once complete, Sentinel will provide an update on the planned work program.

- Lukas Kane

Full Disclosure: Sentinel is an Equity Guru marketing client.