Investing your money in health or medical companies is difficult. The complexity of the science often deters investors from allocating a portion of their portfolio to said industry, despite those companies having proven potential to provide the largest gains for its investors.

We’re not criticizing – everyone knows that medical terminology is only second to legalese in utter lack of comprehensibility. There is a lot to keep track of and a steep learning curve to differentiating between duds and deals. The different types of trials, structures and business models, industry-specific methods of valuation and standards of risks, different ways of valuing the companies…we could go on forever.

It is perhaps the only industry that you can find companies with market caps of over USD$2 billion with a whopping $0 of revenue. (I’m talking to you, Karuna Therapeutics.)

Having said all that, potential to make money investing in this industry is unparalleled. This makes the time spent doing due diligence well worth it for investors, assuming we remove the learning obstacles.

Lucky for you, we are here to do most of that due diligence for you.

The health and medical category encompass way too many different subcategories. One of our favourite (if not the most favourite) sub category is Medical Technology, known by its friends as “Medtech”.

Medtech is an prominent part of the healthcare sector. Amongst other things, this industry includes medical devices that simplify the prevention, diagnosis and treatment of diseases and illnesses. It relies on technological advances and data to remove human error out of designating zebras vs horses when it comes to illnesses, which in turn allows targeted approaches to treatment. Needless to say, medtech is an important part of improving on healthcare.

According to Statista, the whole global medical technology industry’s market size stands at some 430 billion U.S.

Why do we like medtech?

Biotech here gets a bad rap, often because the deep and sophisticated science behind it *and the consequentially equally convoluted language) prevents shareholders from easily assessing the nature of the opportunity at hand. But medtech is different.

In healthcare, medtech companies aren’t the ones burning cash on researching a drug that may very well fail to meet the stringent standards to go to market. They’re the ones building the equipment and tools that are necessary for scientists and professionals to do better.

Unlike biotech, the moat around a medtech company is easily identifiable. It’s the stability of hardware (tools) coupled with the scalability of software (technology). These are the companies that build better and more sophisticated equipment such as imaging devices, medical robotics, etc.

Because of this, MedTech companies have often become safe havens for investors looking to capture long term gains. In fact, for the first half of the last decade, medtech companies within the S&P 500 led the way when it came to providing total shareholder return “TSR”.

Small Cap Medtech Companies

In more junior markets, the criteria used to assess medtech companies is slightly different than the ones in the big leagues.

Revenue, though still important, is less of a factor. The factors, more appropriately used to judge small cap medtech companies are the following:

- The technology and its potential market,

- The team behind the company, and

- The network infrastructure possessed by the company and its potential end game

Let’s look at an example, with samples from a renowned investment bank analyst’s report.

Profound Medical Corp

Introduced to Canadian public markets over 5 years ago and listed on the Nasdaq as of Oct 19, 2019:

Profound Medical develops customizable, incision-free therapies which combine real-time Magnetic Resonance (“MR”) imaging, thermal ultrasound and closed-loop temperature feedback control for the radiation-free ablation of diseased tissue

The technology and its market potential

Profound is commercializing TULSA-PRO®, a technology that combines real-time MRI, robotically-driven transurethral ultrasound and closed-loop temperature feedback control. TULSA-PRO® is designed to provide customizable and predictable radiation-free ablation of a surgeon-defined prostate volume while actively protecting the urethra and rectum to help preserve the patient’s natural functional abilities. We believe TULSA-PRO® is demonstrating to be a flexible technology in customizable prostate ablation, including intermediate stage cancer, localized radio-recurrent cancer, retention and hematuria palliation in locally advanced prostate cancer, and the transition zone in large volume benign prostatic hyperplasia (BPH). TULSA-PRO® is CE marked and received 510(k) clearance from the U.S. Food and Drug Administration in August 2019.

In layman’s terms, TULSA-PRO is able to reduce unnecessary damage through improving the targeted removal of affected tissue.

Rahul Sarugaser, an analyst from the American multinational independent investment bank Raymond James Financial, gave Profound Medical the 2020 “Best Pick” honours.

Sarugaser likes Profound’s move from a capital equipment sales model to a pure-play recurring revenue model, where the company will charge a pay-per-use fee with no installation costs. The analyst figures the model will reach a steady state COGS margin of 30 per cent by 2023, with Sarugaser projecting installations of ten, 22 and 38 units in years 2020, 2021 and 2022, respectively.

These units, we estimate, will have average utilization rates increasing from 74, to 90, to 106 annual patients per device during those same years, driving revenues of $11.1 million, $27.2 million, and $63.4 million, respectively. Given that we anticipate PRN generating $5.4 million in 2019FY, we recognize that $11.1 million in 2020 appears relatively modest. These light 2020 revenues we see as a function of PRN substituting short-term capital equipment revenue with massive, long-term recurring revenue. We view this as a deft strategy enacted by PRN’s veteran management,

In other words, a pay-per-use model allows for continued revenue coming in as long as the machine is in use, rather than Profound registering revenue from only the initial payment for the equipment. It’s also a model that would appeal to the users. Rather than having clients pay a lot upfront with no real way to guarantee quality, Profound is confidently backing their technology by allowing users to continually test their machine at low-cost, knowing that as their technology speaks for itself with its success, their clients will continue to increase usage rate, thus triggering more revenue for Profound.

The team behind the company

The company’s all-star management roster is led by Dr. Arun Menawat, CEO, and Mr. Aaron Davidson, CFO and Senior Vice President of Corporate Development.

Both Dr. Arun and Mr. Davidson possess a track record of success within the medtech industry, especially as highlighted by their work at Novadaq, a company focused on imaging products used during surgery. It’s reasonably expected that their expertise with Novadaq will translate into steady and sensible decision-making with Profound, especially since Profound operates in the same sphere.

They successfully steered Novadaq towards a $701 million USD exit in June of 2017, a valuation that represented a 96% premium for Novadaq’s shareholders.

The network infrastructure possessed by the company and its potential end game

Profound’s strong global networks have helped the company initiate commercialization of its product TULSA-PRO® in Europe and Asia initially, and recently in the US.

However, the potential end game of the company is what has excited so many involved. As mentioned above, the company is led by Dr. Arun and Mr. Davidson, who between the two of them, know a thing or two when it comes to lucrative exits in this industry.

Profound is a great company that demonstrates the value medtech can bring to its investors, and gives us a solid idea of how a good medtech company should be performing on the criteria we mentioned earlier.

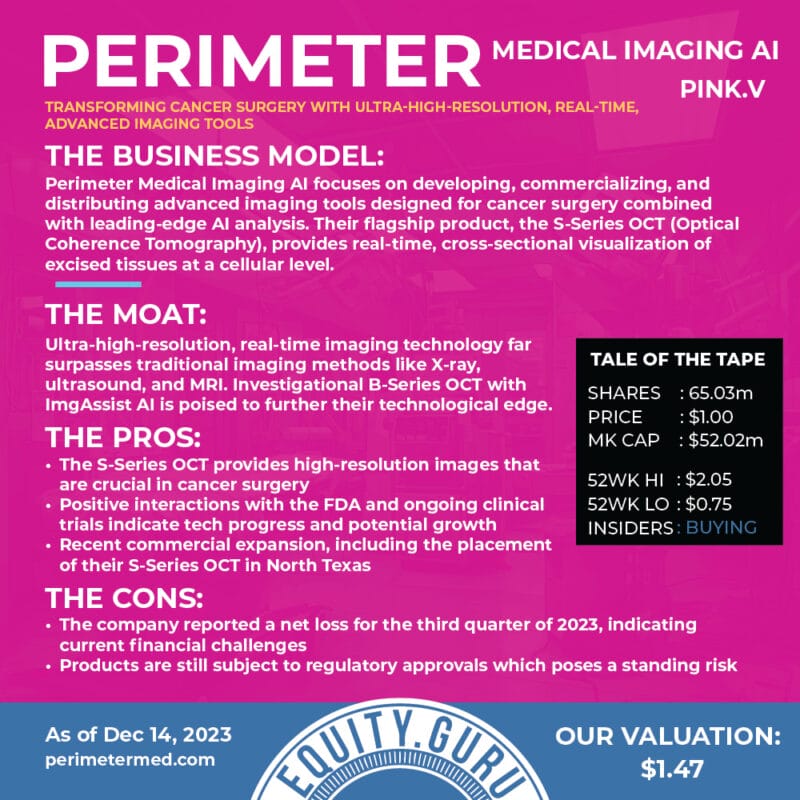

So, based on what we’ve learned so far, we’re more than comfortable approving of this next company: with its success markers, Perimeter Medical Imaging is downright impressive when it comes to the potential value it offers.

Perimeter Medical Imaging AI

Previously, we had conducted a deep dive about Perimeter’s technology and business model. For those of you that are more audio-visual learners, here is a video interview with Perimeter’s Mr. Jeremy Sobotta, with an explanation about the company, its products and its important relationships.

The article and video above effectively demonstrates the strength of the company in the 3 categories used to assess medtech companies.

Yet, there are so many other facts that make Perimeter’s future bright. Here are some of the top ones

- As impressive as Profound Medical is, the company received its 510(k) clearance for TULSA-PRO over 4 year after being publicly listed . In comparison Perimeter was publicly listed just over a month ago, however it already possesses a 510(k) clearance for its OTIS™ platform. This was granted to them by FDA last April.

- The Team. Perimeter is led by an incredible team of professionals poised to carry Perimeter to achieve all its goals, which is only further enhanced by the recent addition of Profound’s Aaron Davidson to the guiding board of directors. (Stay tuned for our management profile article next week)

- The University of Texas MD Anderson Cancer Center, one of Perimeter’s working partners, was recently ranked No. 1 in cancer care in the U.S. News & World Report’s 2020-21 “Best Hospitals” survey.

- Potential for Perimeter to be listed on Nasdaq. A Nasdaq listing often leads to significant attention and investments from financial institutions for the company.

- Artificial intelligence. According to an article posted in Future Healthcare Journal in June 2019: “AI has an important role to play in the healthcare offerings of the future. In the form of machine learning, it is the primary capability behind the development of precision medicine, widely agreed to be a sorely needed advance in care. Although early efforts at providing diagnosis and treatment recommendations have proven challenging, we expect that AI will ultimately master that domain as well. Given the rapid advances in AI for imaging analysis, it seems likely that most radiology and pathology images will be examined at some point by a machine”.

- Steady growth since its public market initiation. Perimeter stock price has been rising calmly and steadily. From its initial price of $1.50 to $2.40.

For individuals looking to invest long term in the healthcare industry, medtech should be on top of their list. And, Perimeter Medical Imaging AI has all the signs of a medtech company set up to provide its shareholders incredible long-term value.

Full Disclosure: Perimeter Medical Imaging AI is an Equity Guru marketing client.