Sector Summary

The medical sector is a doozy. From cancer to cardiovascular diseases, areas of high unmet medical need are appearing faster than they can be dealt with. According to the U.S. Food and Drug Administration (FDA), unmet medical need refers to situations in which currently available therapies do not adequately address a serious condition. For context, the FDA defines a serious condition as a disease or condition associated with morbidity that has a substantial impact on day-to-day functioning.

Instances That Constitute Unmet Medical Needs:

- areas where there is an identifiable subset of underserved patients

- when there are few molecules in late phase clinical studies

- or, if there are no approved molecules

- where existing molecules are compromised

In the European Union, rare diseases account for 5,000 to 8,000 life-threatening diseases, which together affect between 27 and 36 million people. With this in mind, a lack of efficient treatment and accurate diagnosis for the majority of rare diseases represents a significant unmet medical need. Closer to home, the lives of approximately 30 million Americans, half of whom are children, are affected by roughly 7,000 rare diseases.

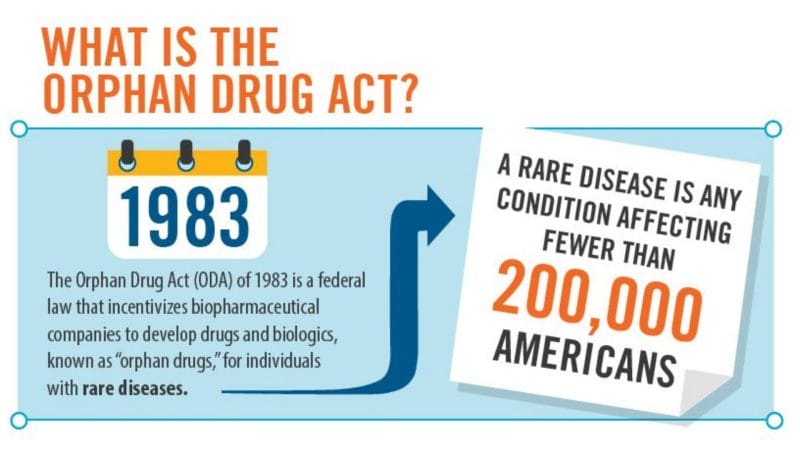

What’s the solution? The Orphan Drug Act (ODA) of 1983 was passed by congress to promote the development of drugs for rare diseases. As defined by the ODA, a rare disease is one affecting fewer than 200,000 people in the United States (US). In reality, many rare diseases only affect tens of thousands to hundreds of people in the US. As a result, this level of rarity hinders progress towards the improvement of diagnostic and therapeutic options to better serve this population.

In the past three decades, while the ODA has stimulated a significant increase in the drug development of biologics for rare diseases, the development of devices has been largely overshadowed. To put things into perspective, of the almost 7,000 diseases the FDA classifies as rare, only 5% of these diseases currently have FDA-approved treatments. However, emerging technologies could enable or accelerate pathology diagnosis or treatments in areas with small underserved patient populations. Speaking of which.

Bionano Genomics Inc.

- $548.929M Market Capitalization

Bionano Genomics Inc. (BNGO.Q) is a genomics company, credited for its Saphyr System. For context, genomics refers to an interdisciplinary field of biology focusing on the structure, function, evolution, mapping, and editing of genomes. The Company went public on August 21, 2018, with an Initial Public Offering (IPO) of 3.36 million units at $6.125 each. Following its IPO, Bionano was able to generate total gross proceeds of $20.58 million.

Put simply, Bionano’s Saphyr System is an Optical Genome Mapping (OGM) platform intended to identify structural variations (SV). Let’s rewind a bit. OGM is used to analyze entire DNA sequences of an organism’s genome. This enables scientists to isolate DNA and identify different codes as well as SVs. Keep in mind, some SVs are responsible for genetic diseases such as autism. With this in mind, Bionano’s Saphyr System is intended to identify these SVs in one streamlined workflow, compared to the overcomplicated process of traditional genome analysis methods.

Latest News

Most recently, on January 26, 2022, Bionano announced the publication of a study evaluating the performance and clinical utility of combining OGM and a 523-gene next-generation sequencing (NGS) panel for comprehensive evaluation of myeloid tumors. The study compared this combination with standard cytogenetic methods, namely karyotyping, fluorescence in situ hybridization (FISH), and a 54-gene NGS panel.

Broadly speaking, cytogenetics refers to the study of chromosomes. Cytogenetics involves testing samples of tissue, blood, or bone marrow to look for changes in chromosomes, including broken, missing, rearranged, or extra chromosomes. Any of the following may indicate a genetic disease, condition, or some type of cancer. As alluded to earlier, Bionano’s Saphyr System OGM is intended to be superior and more effective compared to traditional cytogenetic methods.

“This research demonstrated that the combination of OGM and a 523-gene NGS panel is superior to standard methods and cost-effective for comprehensive genomic profiling of myeloid cancers.

When compared to whole-genome sequencing approaches that others have suggested, I believe it has better detection performance at a lower cost,”

commented Dr. Ravindra Kolhe, Associate Dean for Translational Research at Medical College of Georgia and Director of the Georgia Esoteric and Molecular Laboratory at Augusta University.

With this in mind, study results demonstrated superior performance compared to standard cytogenetic methods. This marks two major developments in the ongoing evaluation of combined OGM and NGS workflows. In summary, the combined workflow applied in the context of myeloid cancer demonstrated higher sensitivity, resolution, accuracy, and ability to reveal clinically relevant variations in myeloid cancers as compared to standard methods.

The research was conducted by a team led by Dr. Kolhe at the Medical College of Georgia/Augusta University. In terms of specifics, the study evaluated the use of OGM and a 523-gene NGS panel for genomic profiling of 15 myeloid tumors and compared results to karyotyping, FISH, and a 54-gene NGS panel. In conclusion, OGM better characterized SVs previously reported by karyotyping in five cases and was able to identify additional translocations as well as 11 copy number variations (CNVs), which refers to when sections of the genome are repeated.

The first time I wrote about Bionano, the Company’s shares were trading at $8.03. Just by looking at the Company’s chart, you don’t need me to tell you that Bionano has hit a steady decline. However, this is likely the result of correction following the Company’s nearly 3,000% growth beginning in February 2021. Keep in mind, this is around the time basement-dwelling Redditors like me were manipulating the market in favor of stocks like GameStop. Bionano was one such victim, on the verge of delisting.

Regardless, I am hopeful for Bionano. The Company’s technology is superb and Bionano has announced multiple publications in favor of its Saphy System OGM. If Bionano’s products sucked, the Company wouldn’t be able to boast an installed base of 164 Saphyr Systems, each of which costs a minimum of $150,000.

Bionano’s share price opened at $2.06 on January 27, 2022, up from a previous close of $2.03. The Company’s shares were down -4.9261% and were trading at $1.9310 as of 12:30 PM EST on January 27, 2022.

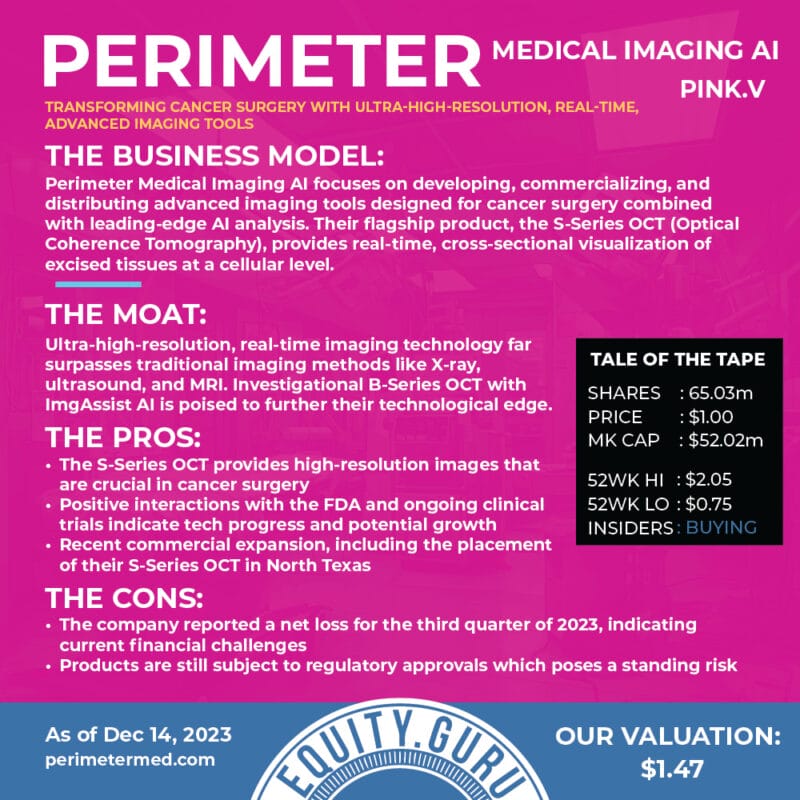

Perimeter Medical Imaging AI Inc.

- $143.149M Market Capitalization

Perimeter Medical Imaging AI Inc. (PINK.V) is a medical technology company transforming cancer surgery with ultra-high resolution, real-time, advanced imaging tools to address unmet medical needs. With this in mind, Perimeter’s S-Series Optical Coherence Tomography (OCT) platform is capable of delivering 2mm subsurface imaging of excised tissue margins, allowing surgeons to make informed decisions in real-time during an operation.

For context, OCT refers to an optical technology that uses low-coherence light, designed for high-resolution, cross-sectional imaging. In addition to delivering 2 mm subsurface imaging of excised tissue margins, the Company’s Perimeter S-Series OCT also provides image review manipulation software and orientation labeling. This enables surgeons to identify and annotate microscopic tissue structures, as well as label and capture images of individual margins.

Ultimately, Perimeter’s technology is intended to reduce the prevalence of positive margins during breast-conserving surgery (BCS). Positive margin refers to when a pathologist finds cancer cells at the edge of the tissue, suggesting that the cancerous legion has not been removed during BCS. That being said, breast cancer recurrence risk doubles when positive margins are not excised, with 48% complication rates for re-operations. For a closer look at Perimeter, check out this article.

Latest News

Most recently, on January 27, 2022, Perimeter announced the closing of its previously announced private placement of units for gross proceeds of CAD$48.7 million to the Company. The private placement includes the CAD$43.4 million strategic investment in the Company by Social Capital, announced on December 15, 2021. As a result of its CAD$43.4 million investment, Social Capital acquired 14,466,667 common shares and 14,466,664 warrants.

“This strategic partnering with Social Capital comes at a time when we are ramping up our Perimeter S-Series market development activities and commercialization efforts across the U.S., while also supporting the ongoing clinical development of our next-gen AI technologies,”

commented Jeremy Sobotta, Perimeter’s Chief Executive Officer.

Referring back to Perimeter’s latest news, the Company’s private placement was completed on a non-brokered basis for gross proceeds of CAD$48.7 million at a price of $3.00 per unit for a total of 16,234,333 units. Each unit consisted of one common share and a total of one warrant to purchase an additional common share. Furthermore, Perimeter and Social Capital have entered into an investor rights agreement.

According to the agreement, Social Capital will have the right to nominate one director to Perimeter’s board, as well as anti-dilution rights to participate in future financing and customary registration rights. On a non-diluted basis, Social Capital now holds approximately 23.3% of the outstanding common shares of Perimeter.

In addition to Social Capital’s investment, Perimeter issued an additional 1,767,666 units to other investors for gross proceeds of CAD$5.3 million. Aside from investors and Social Capital, insiders of Perimeter also participated in the private placement. The subscription breakdown is as follows:

- Jeremy Sobotta, Chief Executive Officer – 10,000 units

- Tom Boon, Chief Operation Officer – 5,000 units

- Andrew Berkeley, Vice President, Business Development – 6,000 units

- Aaron Davidson, Director – 84,000 units

- Suzanne Foster, Director – 42,000 units

Moving forward, Perimeter intends to use the net proceeds of the private placement for working capital, clinical studies, general corporate purposes, as well as the commercialization and development of Perimeter’s technology.

Perimeter’s share price opened at $3.30 on January 27, 2022. The Company’s shares were down -2.1472% and were trading at $3.19 as of 3:49 PM EST on January 27, 2022.

Full Disclosure: Perimeter is a marketing client of Equity Guru.

Canntab Therapeutics Ltd.

- $26.126M Market Capitalization

Canntab Therapeutics Ltd. (PILL.C) is a Canadian phytopharmaceutical company focused on the manufacturing and distribution of hard pill cannabinoid formulations in multiple doses and timed-release combinations. Now there’s a name I haven’t heard in many moons. The first time I wrote about Canntab was on March 30, 2021, when I was just starting out as a fledgling writer at Equity Guru. However, much like my father, Canntab vanished without a trace for months.

The Company’s last press release before disappearing mourned the loss of Jeffrey Ward Renwick, Canntab’s Co-Founder, Director, and President. On the same day, Canntab also announced the receipt of CAD$1,259,250 in gross proceeds from the early exercise of 1,679,000 warrants into common shares. Getting back to what Canntab is all about, the Company creates cannabinoid and terpene blends in hard pill form for therapeutics applications. With this in mind, Canntab is recognized for providing its hard pill formulations to doctors, patients, and consumers with medical-grade solutions.

Before you get too excited, I won’t be focusing on Canntab’s cannabinoid formulations. Instead, let’s talk about the Company’s drug-delivery technology. Conventional methods of cannabis consumption include smoking or edible consumption. However, smoking cannabis can result in a large initial dose followed by a rapid drop in effect. On the other hand, cannabis edibles are unpredictable and slow to take effect in comparison. Speaking from experience, I end up on my ass either way.

With this in mind, Canntab offers three tablets including instant release, extended-release, and oral dissolving tablets. Compared to oils, edibles, and smoking, Canntab’s hard pill formulations provide superior precision dosing and stability. Looking forward, Canntab intends to initiate clinical trials utilizing its patent-pending delivery technology for other indications including sleep, pain, arthritis, Irritable Bowel Syndrome (IBS), and Temporomandibular Joint Disorder (TMJ) in 2022.

Latest News

Most recently, on January 20, 2022, Canntab announced the official launch of its online e-Commerce platform and website at www.canntab.ca. Through Canntab’s new website, the Company is able to script patients directly online, take in existing or new prescriptions from doctors, or share prescriptions with other licensed producers.

“Today marks another significant milestone in the history of Canntab. We are excited to launch our E-Commerce platform and website making medical-grade THC and CBD accessible to all Canadians.

So many medical patients have been anticipating the launch of our website to purchase our THC and CBD solid exact dosage pharmaceutical grade product to help with alleviating widespread medical conditions including pain, inflammation, stress, anxiety and sleep to name only a few”,

states Larry Latowsky, CEO of Canntab Therapeutics Inc.

Canntab’s latest news comes on the heels of the Company’s first shipment of 5 mg THC tablets to the Ontario Cannabis Store on January 7, 2022. Similarly, in December 2021, Canntab announced the completion of the Company’s second shipment of both THC and CBD tablets to Australia. Additionally, on January 10, 2022, Canntab announced that it has entered into a strategic partnership with Levitee Labs Inc.

“…our manufacturing capacities are not limited. In the future, I see the potential for our production expertise to be extremely synergistic with Levitee’s compounding capabilities to provide a diverse portfolio of therapeutics, including those in the psychedelics space when regulations allow,”

said Richard Goldstein, Co-Founder and Chief Financial Officer of CannTab.

According to the terms of the agreement, Canntab will leverage Levitee’s network of specialized clinics and pharmacies in Alberta and British Columbia to inform customers of the Company’s products. In total, Levitee owns five addiction clinics and three specialized pharmacies which have conducted more than 35,000 patient visits in the last twelve months.

If Canntab is able to extend its operations into the psychedelics space, a sector that is heavily dependent on dose accuracy and stability, the Company’s hard pill formulations could provide Canntab with strong incentives for partnerships.

Canntab’s share price opened at $0.72 on January 27, 2022, up from a previous close of $0.70. The Company’s shares were trading at $0.70 as of 10:44 AM EST on January 27, 2022.