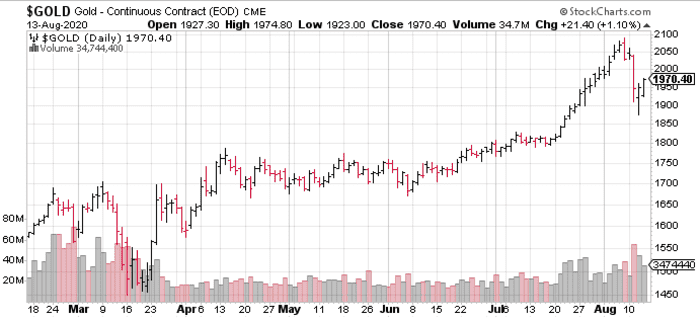

After carving out all-time historic highs in recent sessions, gold has entered a corrective phase marked by violent price swings, and heaps of volatility.

I saw $1,876.00 (Dec contract) cross my screen in overseas trade a few nights back. That could be the low for this rout, but I wouldn’t rule out a re-test in the days to come.

These are uncharted H2Os after all.

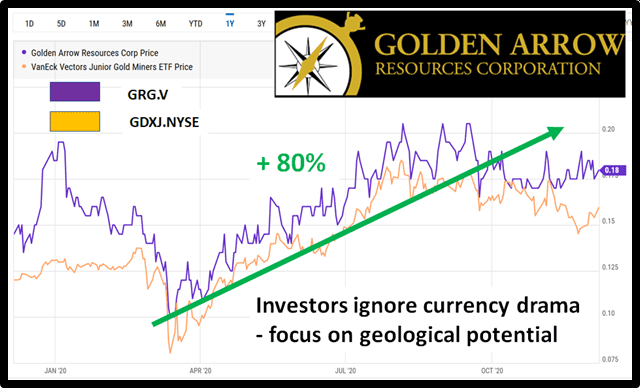

In the meantime, shortlisting high-quality entities and targeting sudden, anomalous weakness is a strategy that could pay off handsomely in the medium to long term.

In the meantime, shortlisting high-quality entities and targeting sudden, anomalous weakness is a strategy that could pay off handsomely in the medium to long term.

Here’s one such “high-quality entity” for your consideration:

- 119.51 million shares outstanding

- $22.11M market cap based on its recent $0.185 close

- Roughly $30M in cash and marketable securities on its books

- No debt.

Golden Arrow’s (GRG.V) heart is in Argentina. Backed by the Grosso Group—pioneers in the Argentine mineral exploration arena since the region was opened up in the early 1990s—the company has its sights set on yet another significant South American discovery as a burgeoning bull market in mining stocks is finding a whole new gear.

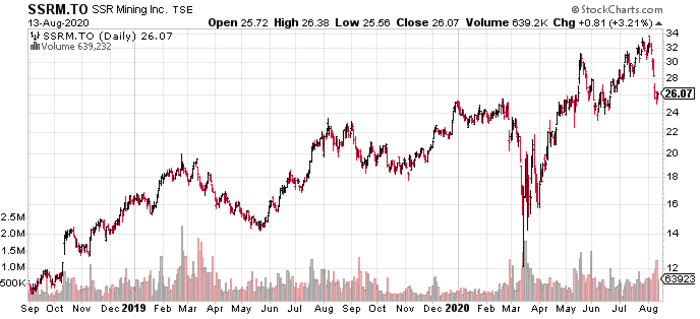

If you’re unfamiliar with the Grosso Group, they have a solid track record of discovery success and creating shareholder value. Examples: the world-class Gualcamayo project that was put into production by Yamana (YRI.T), the Navidad Silver project, THE world’s largest undeveloped silver deposit currently held by Pan American Silver (PAAS.T), and the Chinchillas Mine that was recently put into production by SSR Mining (SSRM.T).

The company has three main projects in its portfolio, one in Argentina (Flecha de Oro), one in Paraguay (Tierra Dorada), one in Chile (Rosales), and the way I see it… all three are vying for flagship status. And importantly, all three will receive a proper probe with the drill bit before year-end.

All three of these projects are near-surface and should the surface grades extend to depth, they’ll be advanced quickly. This is an important consideration as these are early-stage projects.

The company is also actively kicking tires, looking for an advanced stage project to add to their lineup.

Before we explore further, I should mention that the company dropped its option on the advanced stage Indiana gold-copper project in Chile last month. Some felt it was a bad move on the company’s part—Indiana had a (historic) resource with decent grades and significant exploration upside. The (historic) resource was spread out across multiple zones though (guts n feathers by my reckoning). Management felt there were too many issues with the project and decided to drop it.

Fair enough.

Moving along…

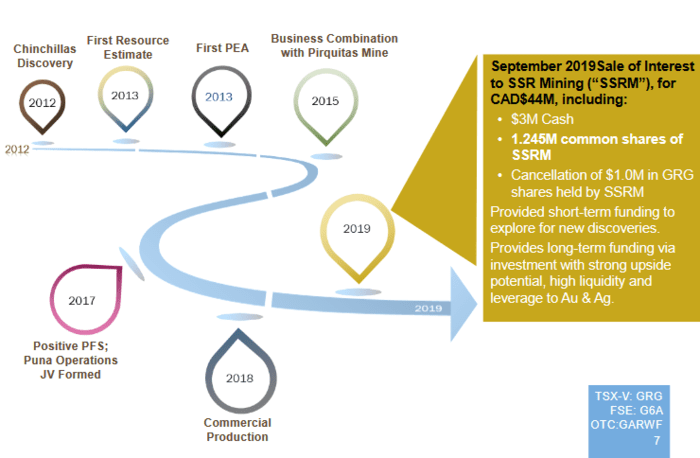

Golden Arrow’s most recent success story was Chinchillas.

The following slide traces the company’s journey with Chinchillas, from discovery to monetization.

As noted in the above slide, on September 19, 2019, the company sold its 25% interest in the Chinchillas Mine (Puna Operations) reaping the following benefits:

- C$3.0 million in cash;

- 1,245,580 common shares of SSRM representing a value of approximately C$25.9 million at the time;

- Approximately C$15.1 million in cash, an amount used to repay in full the outstanding principal and accrued interest owed by Golden Arrow under the credit agreement entered into in July 2018 with SSRM.

Those SSRM common shares went on a bit of a tear since the transaction was completed late last summer.

With mineral exploration being a capital intensive game, Golden Arrow is in an enviable position with this SSRM stock position. Even though the company liquidated a good chunk of said position, they should have sufficient cash (and cash equivalents) on hand to advance any one of their current projects to the PFS (prefeasibility study) stage, or acquire one or more weighty advanced stage projects.

With mineral exploration being a capital intensive game, Golden Arrow is in an enviable position with this SSRM stock position. Even though the company liquidated a good chunk of said position, they should have sufficient cash (and cash equivalents) on hand to advance any one of their current projects to the PFS (prefeasibility study) stage, or acquire one or more weighty advanced stage projects.

Brian McEwen (Golden Arrow’s VP of Exploration), during a recent interview, was determined to pound home the point that the company is actively kicking the tires on a number of projects, stating:

“This money in the bank is burning a hole in our pocket… we are actively pursuing and looking at other opportunities… we’re looking at many many things right now.”

$30M will buy a lot of geology, says this humble observer.

An acquisition headline could be the next major catalyst for the company.

The projects

Keep in mind that these are all early-stage.

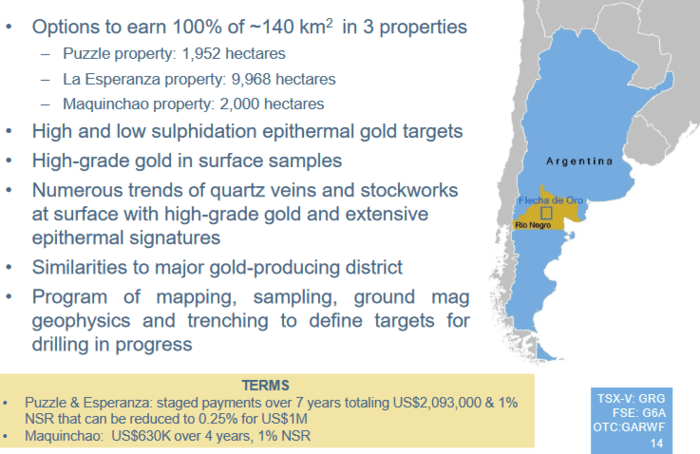

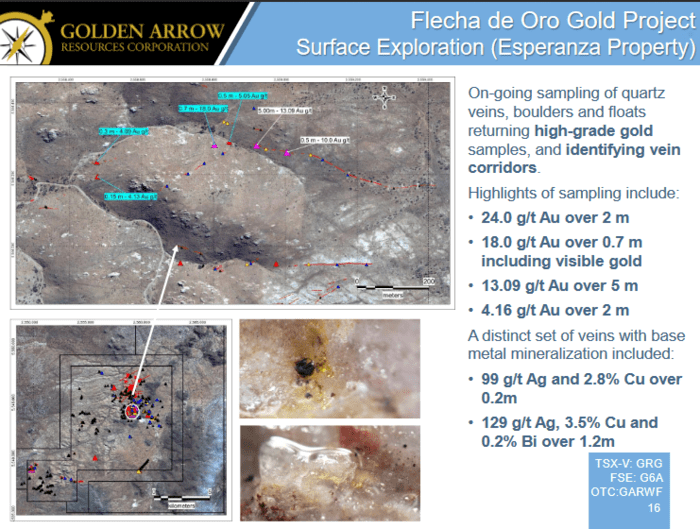

The Flecha de Oro Gold Project, Rio Negro Province, Argentina

The Flecha de Oro Project encompasses three properties including Puzzle (1,952 hectares), La Esperanza (9,968 hectares), and Maquinchao (2,000 hectares). All three enjoy easy road access and are located below 1,000 meters elevation allowing for year-round exploration.

- Nearly 120 square kilometres of mineral rights in an area known for its high and low-sulphidation epithermal gold mineralization;

- Due diligence sampling included 5 meters grading 13.1 g/t gold and 0.2 meters grading 11.2 g/t gold from chip samples across two parallel quartz veins located 600 meters apart (La Esperanza property);

- Ground Magnetic surveying successfully delineated a mineralized vein corridor coincident with a magnetic low on (Puzzle property).

The gold mineralization at the Puzzle property occurs in epithermal quartz veins, stockworks and hydrothermal breccias, hosted by a 150-250-million-year old volcanic complex. Gold mineralization at Puzzle was originally identified by previous owners in an outcropping epithermal quartz vein which can be traced for over 1,400 metres along strike as a series of showing, and in an adjacent area with quartz float material. Due diligence surface sampling and ground magnetic surveying confirmed the presence of a SW-NE corridor at least 2.3 kilometres long and up to 200 metres wide defined by a main quartz vein forming a topographic high and an adjacent quartz stockwork zone.

The La Esperanza property is located in the same regional geological environment, with mineralization hosted by an older suite of granites and granodiorites with aplitic and pegmatitic dikes associated with the volcanic complex underlying the Puzzle property. At the La Esperanza property 17 kilometres of veins, with widths of up to 7 metres, occur as swarms of quartz and chalcedony veins with banded, colloform and crustiform epithermal textures.

On June 8th, the company reported results from a mapping and surface sampling campaign—an effort that successfully delineated a new high-grade gold target on the Esperanza property.

Highlighted surface samples include:

- 24.4 g/t gold and 13.6 g/t silver from a float/boulder sample;

- 5.23 g/t gold and 32.3 g/t silver over 0.30 metres from a vein chip sample;

- 4.3 g/t gold and 2.3 g/t silver over 0.30 metres from a vein chip sample.

The company is eager to push this project further along the curve, but C-19 travel restrictions are currently holding things back. We should see a drill rig mobilized to the project before 2020 draws to a close.

The company is eager to push this project further along the curve, but C-19 travel restrictions are currently holding things back. We should see a drill rig mobilized to the project before 2020 draws to a close.

Brian McEwen again:

“The Flecha de Oro exploration program is advancing nicely with the addition of this new high-grade gold target at the Esperanza property, located more than a kilometre and a half north of the high-grade samples we reported in early March. In addition, the new Maquinchao properties expand our prospective area, further increasing our chances to discover a major epithermal deposit at the project.”

The high-grade samples McEwan referred to above are as follows:

- four chip samples across quartz veins ranging from 0.15 to 0.70 metres in width returning results of 18.00, 5.05, 4.12 and 4.10 g/t gold (see map here);

- Visible gold was observed in the vein sample which assayed 18 g/t gold.

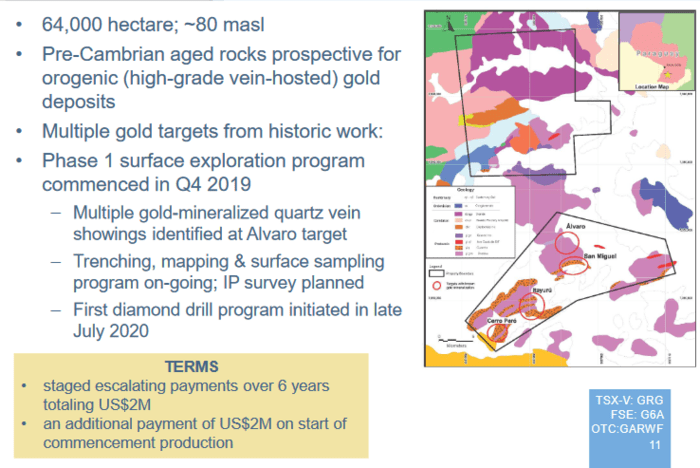

The Tierra Dorada Project, Paraguay

Tierra Dorada consists of two separate property blocks—34,566 hectares and 29,288 hectares—situated six kilometers apart. Flat topography, road-accessible, powerlines cross both properties.

- District-scale high-grade gold project in one of the last frontiers of mineral exploration in South America;

- Under-explored, with characteristics similar to those of orogenic-type gold deposits;

- Multiple gold targets defined in an area dominated by flat topography and sparse outcrop;

- Due diligence sampling included rock chip assays of 3.3 g/t to 15.1 g/t gold from a 2.5 km trend of sub-outcropping quartz veins;

- visible gold locally observed.

The southern property block has been the focus of most of the historical exploration work to date in the area, with four main target areas delineated. The most advanced of the four targets, San Miguel, includes two parallel northeast trends approximately three km in length, with iron rich laterites developed in quartzites and gneisses. Previous work at San Miguel included soil and rock sampling, and pan concentrate collection from stream sediments. Previous operators included The Anschutz Co. in the late 1970´s and early 1980´s, and Yamana Gold Inc. in the 1990´s. Yamana carried out trenching and drilled six shallow reverse circulation holes along the eastern trend defining gold mineralization in laterites. There is no public report available for this work, however drilling sections have been obtained showing geology and assays from four vertical holes up to 88 m deep.

Historic drilling highlights include:

- 6.1m @ 1.12 g/t Au, including 1.5m @ 3.32 g/t Au in SM-H3 starting at 12.2 metres depth;

- 3.05m @ 2.87 g/t Au, including 1.5m @ 3.74 g/t Au in SM-H4 starting at 19.8 metres depth;

- 4.57m @ 1.72 g/t Au, including 1.5m @ 2.85 g/t Au in SM-H5 starting at 9.2 metres depth;

- 3.05m @ 1.35g/t Au, including 1.5m @3.6g/t Au in SMH6 starting at 27.5 metres depth.

On May 27th, the company released results from a Tierra Dorada trenching campaign:

Golden Arrow Reports High-Grade Gold from Trenching at its Tierra Dorada Gold Project, Paraguay

Here, the company tabled assays from the first four trenches of an eight trench program (map here)

Highlights include 89.5 g/t gold and 61 g/t silver over 0.93 metres, including 143.40 g/t gold and 95.8 g/t silver over 0.58 metres, in Trench 1.

Over one kilometre to the south of Trench 1, a boulder sample returned 13.7 g/t Au.

Satisfied they have a prospective target in their crosshairs at Tierra Dorada, the company dropped the following headline on July 30th:

Golden Arrow Starts First Diamond Drill Program at Tierra Dorada Gold Project, Paraguay

This is a modest drilling campaign—500 meters—one that will test the Alvaro target area.

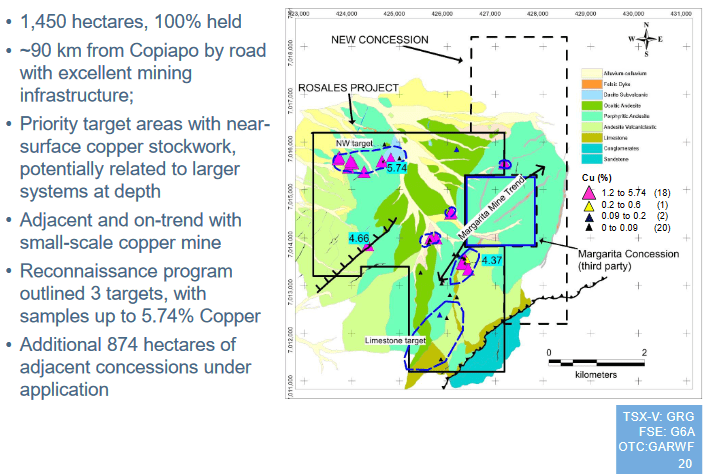

The Rosales Copper Project, Atacama Region, Chile

Rosales is a recent acquisition:

July 20, 2020 news: Golden Arrow Acquires Rosales Copper Project, Chile

This wholly-owned project has several high priority targets characterized by zones of near-surface copper stockwork mineralization, with the potential for a larger mineralized system at depth. The area is surrounded by infrastructure.

The prolific Atacama mining region is host to numerous large precious and base metal mines and deposit types—iron-oxide copper-gold (Candalaria, Mantos Verde), porphyry copper-gold (Inca del Oro), epithermal gold-silver (El Peñon, Guanaco) and Maricunga type gold deposits (Cerro Casale-Caspiche, Refugio, Marte, Maricunga).

The prolific Atacama mining region is host to numerous large precious and base metal mines and deposit types—iron-oxide copper-gold (Candalaria, Mantos Verde), porphyry copper-gold (Inca del Oro), epithermal gold-silver (El Peñon, Guanaco) and Maricunga type gold deposits (Cerro Casale-Caspiche, Refugio, Marte, Maricunga).

Project highlights:

- Situated along-trend with a small-scale underground copper mine, with mineralized occurrences returning up to 4.37% copper in reconnaissance sampling, and multiple targets on the trend;

- Additional target 3km to the northwest with up to 5.74% copper in reconnaissance sampling.

Rosales has high-grade, near-surface copper. As stated further up the page, should the surface grades extend to depth, the project can be advanced swiftly. High-grade rock requires fewer tonnes to pile on the pounds. These high-grade vein settings DO require more drilling though.

A phase one exploration program will include detailed mapping, surface sampling, and property-wide geophysics.

We should see a drilling campaign here by year-end too.

Final thoughts

For me, Golden Arrow is a no-brainer. The company has three prospective projects, $30M in cash and marketable securities on its books, and a market cap of $22.11M. You do the math.

END

—Greg Nolan

Full disclosure: Golden Arrow is an Equity Guru marketing client.