PredictMedix (PMED.CN) has been a stock garnering a lot of attention throughout this Covid pandemic. Our team and esteemed writers have covered the company extensively, and the fundamental information which I will summarize, can be read on our latest article here.

In terms of a technical approach, the analysis is mine.

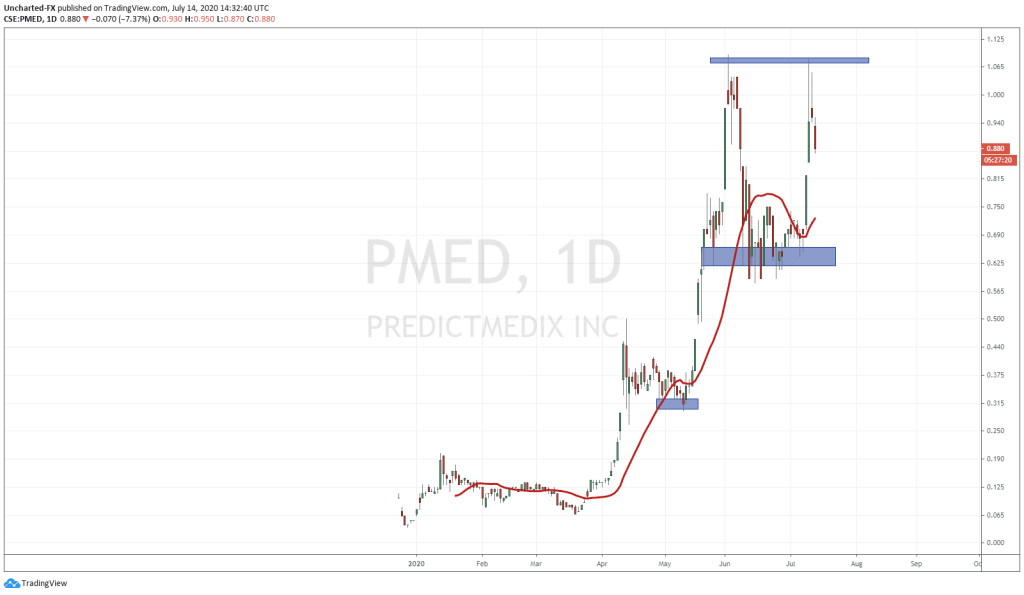

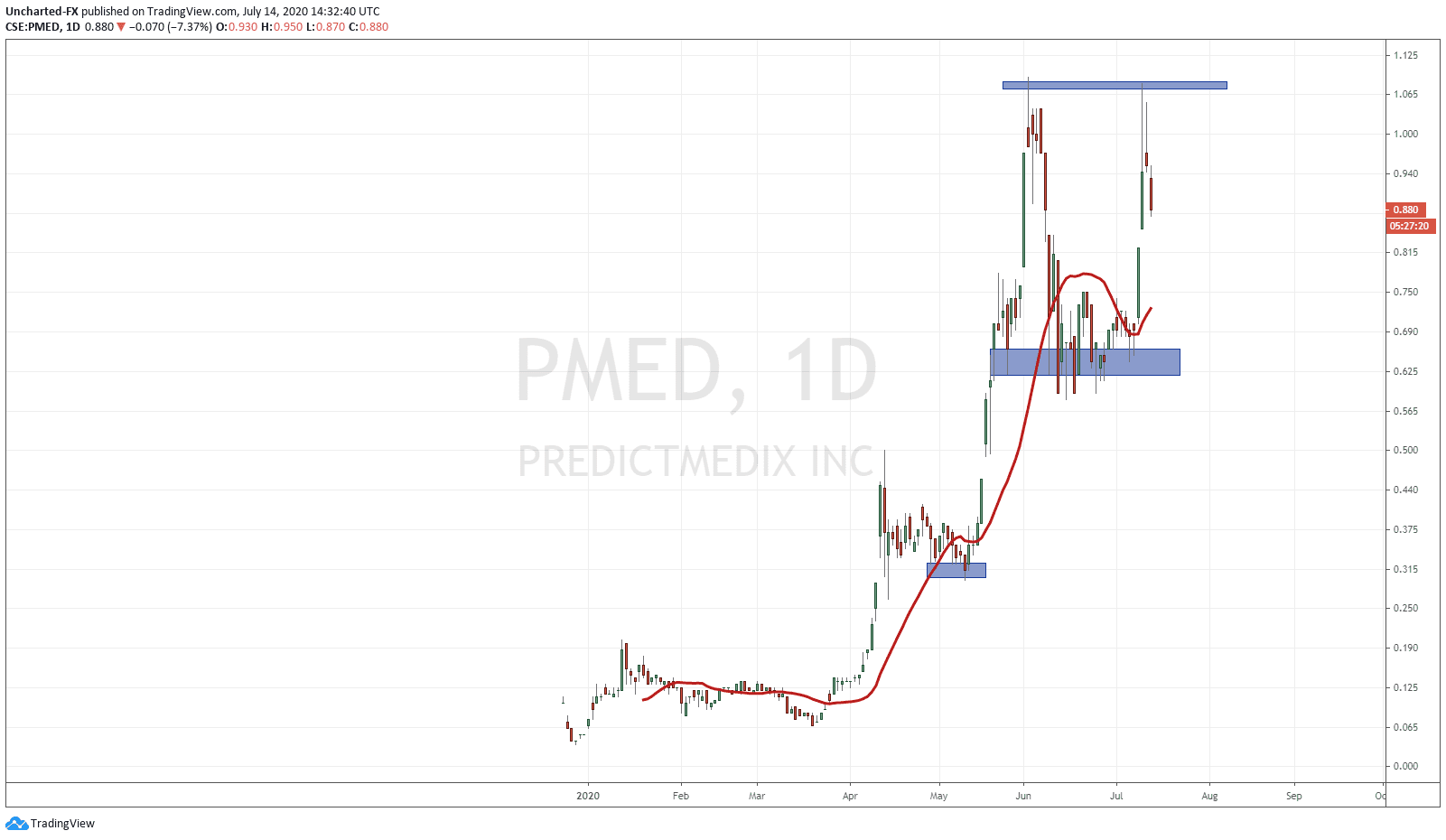

Looking at the daily chart of PMED, we can clearly see the higher lows and higher highs in an uptrend. On its run from breaking resistance way back at 0.195, we formed two higher lows on the road to the all important 1.00 zone. These higher lows have been highlighted for you on the chart in blue. Remember, a higher low is what defines an uptrend. As long as we remain above, we are in an uptrend. Our job as market participants is to ride these waves if you are a swing trader rather than an investor. After hitting the 1.00 zone, we pulled back towards the previous higher low zone at 0.65. This was expected as many investors/traders do consider the 1.00 zone an important psychological resistance zone for small caps.

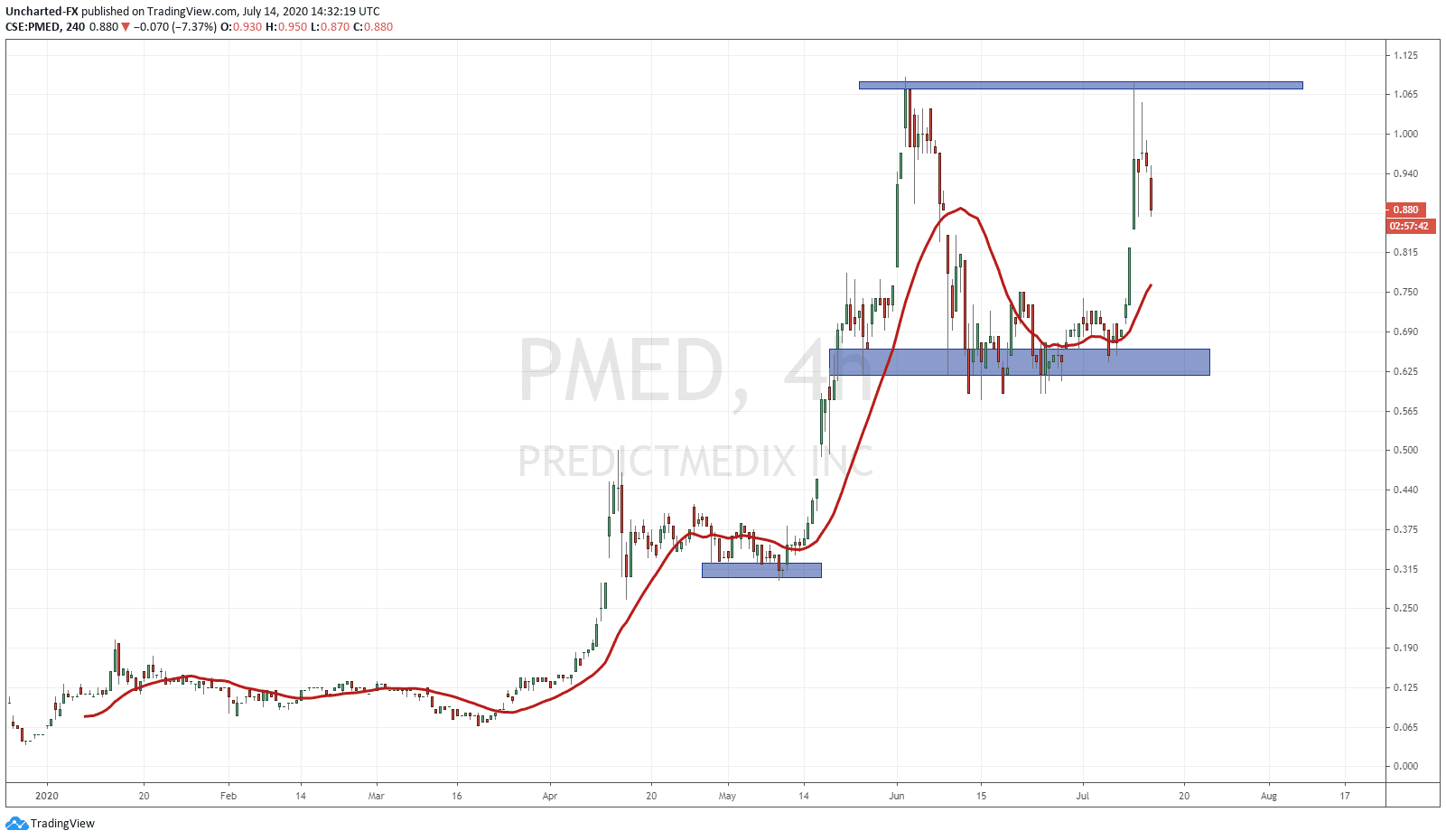

The price action which then grabs my attention is how price began to range at 0.65 rather than continue the move lower. This indicates strong price action and buyers stepping in defending this zone. If you go down to a lower time frame (4 hour or less) you will see that we did in fact base and create a range with resistance up at 0.75. We have been watching this zone for the breakout. This breakout happened. The 4 hour breakout candle gave us our signal.

Price immediately went up to retest previous highs but failed to break above and form new all time highs on the retest. There are two questions going forward. Will PMED break above to establish new higher highs and continue the uptrend? Or are we going to be forming a double top pattern? Which would need a break and close below the neckline, all the way down at the 0.65 zone for a trigger. Remember, technically as long as we remain above this higher low, we are still in the uptrend.

This is where the fundamental evaluation and analysis of the company comes into play. Does the value PMED provide warrant a move higher? Is there a catalyst incoming which will see us break above 1.07? Keep in mind the overall market conditions as well…PMED being a covid play certainly does help.

This is where our writers step in. Firstly, if you want to read more about the company, you can read about past articles on their value proposition, their strategic partnerships, and their team which includes accomplished advisors.

On Tuesday (July 7th 2020), PredictMedix continued its demonstrated execution of strategy led by COO Rahul Kushwah. It partnered with a UK based firm to enter the European market and announced that it filed for two patents in the United States.

PredictMedix partnered with UK-based Taurus Medical Solutions for the execution of a sales contract for Predict’s COVID-19 screening technology.

A medical distributor and supplier to the UK National Health Service “NHS”, Taurus specializes in supplying diagnostic displays and medical monitors that are at the forefront of medical imaging technology. As a supplier to the NHS, their equipment has been deployed in hospitals throughout the UK, predominantly in operating theatres and X-ray departments.

Utilizing PredictMedix COVID-19 mass screening technology, Taurus will deploy modules to the healthcare, retail, and entertainment sectors in the UK. The contract is for a 12-month period beginning July 6, with an option for renewal following the onboarding of a certain number of clients.

Here, PredictMedix will first make money by charging an upfront customization fee for each camera and scanner installation, and then price it’s offering with a SaaS (software-as-a-service) model that brings in monthly revenue based on the number of screenings.

So while Predict’s technology can be deployed for:

Impairment detection

Mental illnesses, and

Infectious disease diagnostics

That’s not the only thing it can do. The technology can be repurposed for different types of diagnostics or impairment detection. It means Predict’s AI product suite will exist long after COVID-19.

In this context, the partnership is only the beginning of the firm’s market entry into the UK. Given that Predict has a SaaS pricing model, it has created “sticky” customers, for whom the firm will be able to provide customized solutions.

So imagine a post-COVID world where a hospital (or an airport, or any place with a high volume of people) wishes to screen for possible symptoms of another infectious disease or impairment detection at large for patients/people entering a building/public space. All Predictmedix has to do then is to rewrite a piece of its software (code) for the diagnostic criteria at hand.

Artificial intelligence with respect to Predict’s operations means the following: the longer the software runs to perform some type of detection or diagnosis, the better it will become at detecting or diagnosing.

So the longer the AI-enabled software runs, the better it becomes, and the harder it is for any competitor to enter the same market and do things better. Add to that the fact that the technology solution can be customized for clients. No matter where in the world, these customized solutions can then be implemented almost instantly.

It should then come as no surprise that the company has filed for two patent applications with the US Patent and Trademark Office for its telehealth/telemedicine and remote patient monitoring platforms:

Patent 1: A system and method to automatically recommend and adapt a treatment regimen for patients, and

Patent 2: A system and method to manage a rewards program for patient treatment protocols

What’s revealing about these patents is PredictMedix’s vision. Their technology is already deployed in several parts of the world for impairment detection and diagnosis, but these patents say that COO Rahul Khushwah has his eyes set on the broader (and bigger) predictive analytics and telemedicine marketplace.

“The two patents are the key to further expand the offering of our telehealth/telemedicine, remote patient monitoring platform and these patents clearly help us distinguish ourselves in the telehealth space by providing cutting artificial intelligence-based tools which go beyond the traditional scope of telemedicine”, said Dr. Rahul Kushwah, COO of PredictMedix.

The scalability and asset-lite nature of a tech company coupled with the monopoly capture of big pharma, PredictMedix has the ability to not only capture a lot of the value it creates but also ensure that it is the only one doing so.

In the middle of a global pandemic where international travel is shut down, the company was able to enter its target market across the pond.

With solid leadership, partnerships with multi-billion dollar conglomerates like TechMahindra and Hindalco, and acquisitions, the firm is aggressively capturing new business.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA