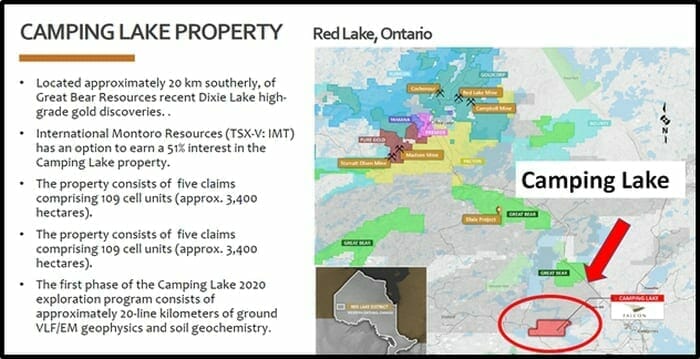

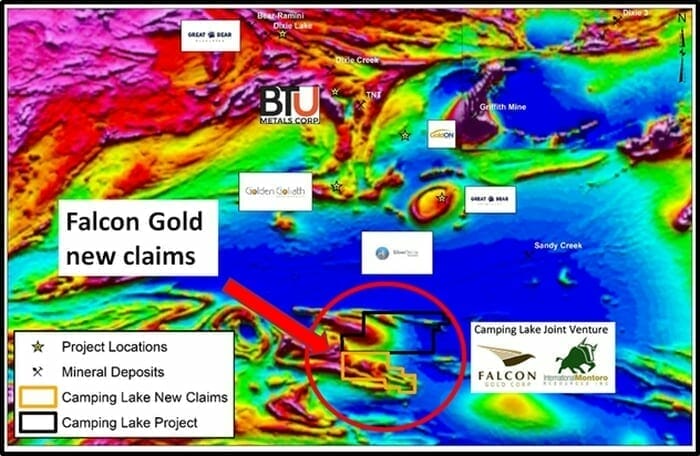

On July 14, 2020 Falcon Gold (FG.V) and Montoro Resources (IMT.V) announced that they have staked an additional 57 mining claims at the Camping Lake Gold Property, in Red Lake Ontario.

The claims are contained within the Birch-Uchi-Confederation Lakes greenstone belt which hosts the world-renowned Red Lake gold deposits, including the Dixie project currently being drilled by Great Bear Resources (GBR.T).

Montoro Resources has an option to earn a 51% interest in the Camping Lake property.

To exercise the option, Montoro has agreed to issue 1,000,000 shares upon exchange approval – and 500,000 shares a year later. Montoro will also assume Falcon Gold’s payments totaling $65,000 over a four-year period.

The Agreement contains a 2% Net Smelter Royalty (NSR) with the original vendor holding 1.5% and Falcon Gold 0.5%.

The new claims announced July 14 add 1,200 hectares to the Camping Lake Project, increasing the project land package 55% to 3,400 hectares of contiguous mining units.

The new claims announced July 14 add 1,200 hectares to the Camping Lake Project, increasing the project land package 55% to 3,400 hectares of contiguous mining units.

Montoro’s May 2020 sampling and geological mapping program confirmed historical “gold in soils” anomalies.

The land package expansion incorporates a major magnetic anomaly which may correlate to these “gold in soil” anomalies.

As the price of gold soars to CAD $2,450/ounce – this area in Ontario has become a hive of gold exploration activity.

Magnetic anomalies similar to Montoro’s are currently being explored by BTU Metals. Fall 2019 drilling uncovered a potential Cu-Ag-Au VMS – style system with a 44.1-meter intersection of precious-metal mineralization.

“With limited bedrock exposure due to overburden, exploration companies in the area have successfully implemented the use of soil and glacial till analyses for gold and base metals,” stated Falcon Gold.

“With limited bedrock exposure due to overburden, exploration companies in the area have successfully implemented the use of soil and glacial till analyses for gold and base metals,” stated Falcon Gold.

On July 7, 2020, Golden Goliath Resources announced a sampling program on its Kwai property and “the discovery of 17 till samples with pristine gold grains indicating a possible ‘close-by’ gold mineralization source”.

The Kwai property is located immediately west of the Camping Lake claims.

Montoro and Falcon will use similar sampling methodology (till sampling and gold grain analysis) to search for gold mineralization along the multiple targets identified by the magnetic data.

On July 6, 2020 Great Bear released drill results for the Dixie project in Falcon Gold’s neighbourhood, which included 10.06 g/t gold over 31.25 meters and 57.32 g/t gold over 3.95 meters.

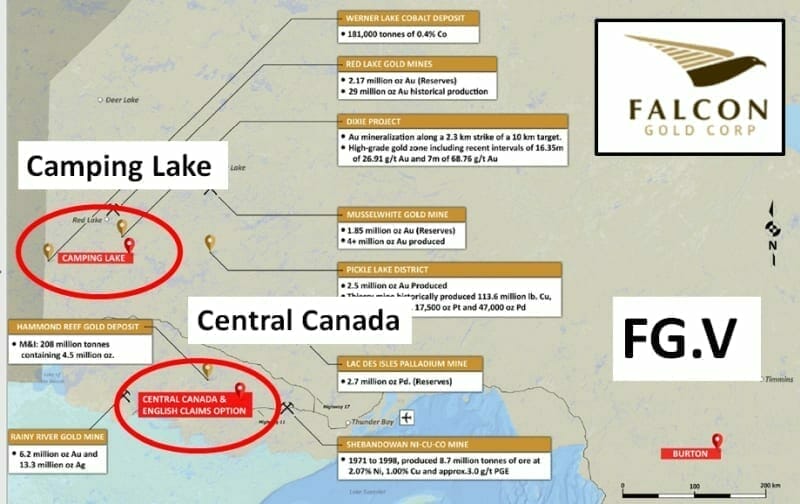

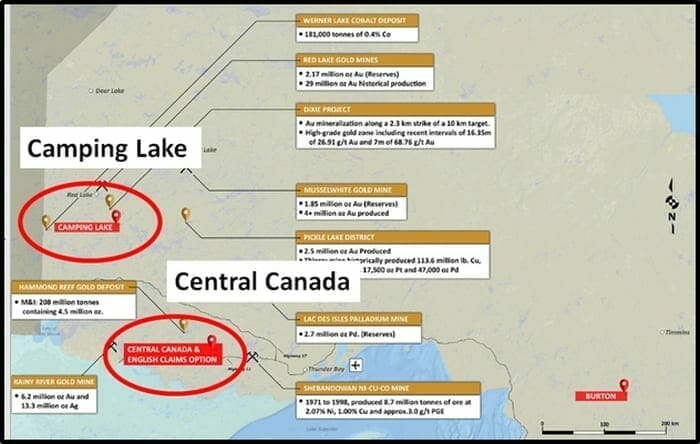

Camping Lake is not Falcon Gold’s only iron in the fire.

Overview of Falcon’s assets:

Wabunk Bay Copper and Nickel, PGM – hosts the world-renowned Red Lake gold deposits as well as Great Bear Resources’ (GBR:V) Dixie project

Burton Gold Property – Located in the Swayze Greenstone Belt, Ontario, IAMGOLD earned a 51% interest by paying $150,000 in cash to Falcon Gold and completing $600,000 in exploration expenditures

Bruce & Camping Lake – located approximately 20 km southerly, of Great Bear Resources recent Dixie Lake high-grade gold discoveries

Spitfire & Sunny Boy Claims – Located approximately 16 km east of Merritt near the Nicola Lake Property, Master Vein with over a 300-meter strike length with samples ranging from 0.33 to 2.74 oz/t Au.

Central Canada Gold & Polymetallic Project – 10 km of highly prospective Quetico Fault Zone, Historical Gold Production

In his June 30, 2020 “Explorer Co Roundup” Greg Nolan reviews the History at the Central Canada Gold Mine:

In his June 30, 2020 “Explorer Co Roundup” Greg Nolan reviews the History at the Central Canada Gold Mine:

- 1901 to 1907 – Shaft constructed to a depth of 12 meters and 27 oz of gold from 18 tons using a stamp mill;

- 1930 to 1935 – Central Canada Mines Ltd. deepened the shaft to 40 meters with about 42 meters of crosscuts and installed a 75 ton per day gold mill;

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft;

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au;

- 2010 to 2012 – TerraX Minerals Inc. – conducted programs that included line cutting, geological surveys and drilled 363 meters.

Earlier in June, Falcon published assay results from its drill program on the Central Canada Gold Project near Atikokan, Ontario.

Results included 10.17 g/t Au over 3 Meters, 1.65 g/t Au over 5.83 Meters and 18.6 g/t Au over 1 Meter.

The Central Canada gold project in Ontario is 20 clicks SE of Agnico Eagle’s Hammond Reef Gold Deposit which has a Measured & Indicated 4.5 Million ounces of Gold.

Falcon Gold’s CEO Karim Rayani has already raised some eyebrows with the speed and efficiency of his development program.

“Karim Rayani is a deal guy from way back, a non-stop money raiser,” recounts Equity Guru’s Chris Parry, “When he stumbled upon Falcon Gold,” he thought: “why not just take them over and make sure, this time, things are done the right way?”

“Nobody has bought more stock on the open market than me,” Rayani says, who’ll own 18% of the company if warrants and options are exercised. “It’s cheap, so I buy some, and when we need more money, I provide it by buying into a raise. When we say we’re going to drill, we drill.”

“He ain’t lying,” continues Parry, “There are so many green marks on his insider trading chart, it’s like someone attacked my monitor with a paintball gun”.

Global ETF holdings are at a new all-time highs of 3,621 tonnes. H1 global net inflows (the first 6 months of 2020) to soared to 734 tonnes (USD $39.5 billion).

Current gold ETF inflows are higher than the record-setting central bank net purchases seen in 2018 and 2019, and “could absorb a comparable amount of about 45% of global gold production.”

Falcon’s Camping Lake project is now 8 X larger than Stanley Park.

Full Disclosure: Falcon Gold is an Equity Guru marking client.