If you haven’t noticed, many of the junior ExploreCo stocks we follow here at Guru Central are popping. If it’s a gold or silver company with ounces in the ground, or a geologically prospective exploration project getting a proper probe with the drill bit, chances are it’s pushing higher.

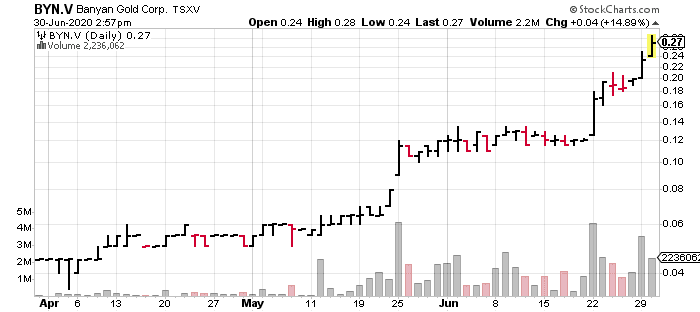

Chances are it’s already in an established uptrend with several consolidation patterns on its chart (bull flags or pennants)—patterns that served as a spring board before a launch to higher ground. Banyan (BYN.V) is a good example of the technical price action I’m talkin bout.

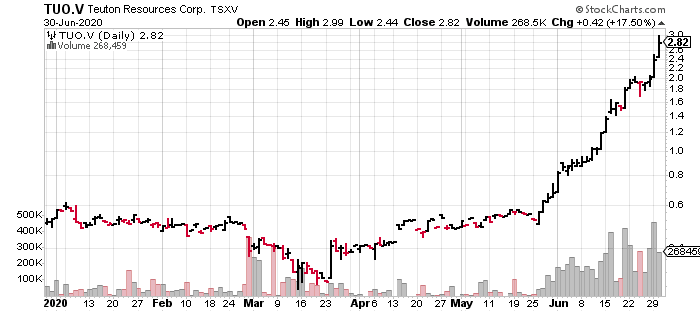

The following chart is a more extreme example of the price trajectory witnessed among some of the stocks we’ve been following closely in these pages—Teuton (TUO.V), a stock we first took a shine to in March of 2019 when it was trading at a mere $0.20…

The following chart is a more extreme example of the price trajectory witnessed among some of the stocks we’ve been following closely in these pages—Teuton (TUO.V), a stock we first took a shine to in March of 2019 when it was trading at a mere $0.20…

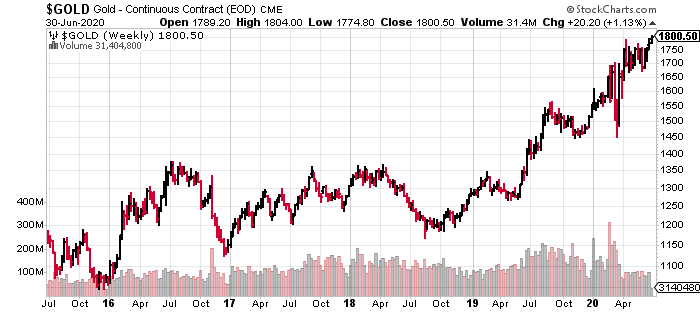

Gold is currently challenging $1,800 as I type. These big round numbers serve as an important psychological level, and resistance.

Gold is currently challenging $1,800 as I type. These big round numbers serve as an important psychological level, and resistance.

The following is a 5-year gold chart.

Companies on the Guru ExploreCo client list—six goldies and one nickel play.

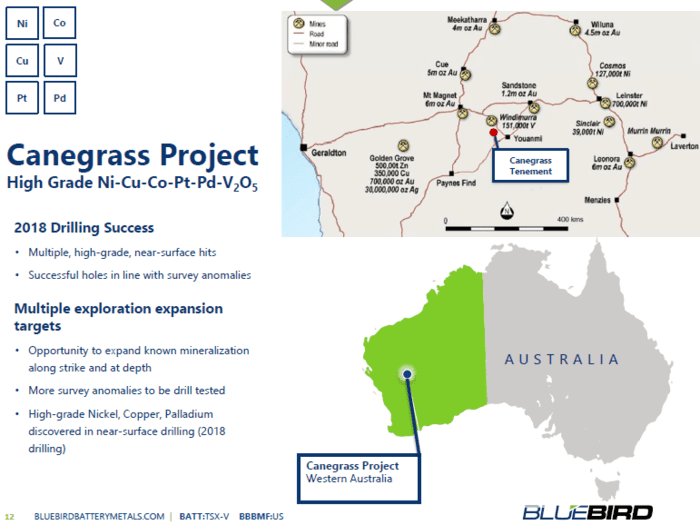

Bluebird Battery Metals (BATT.V)

- 67.06 million shares outstanding

- $8.72M market cap based on its recent $0.13 close

Bluebird’s flagship Canegrass Project—a 4,200 hectare chunk of highly prospective terra firma—lies within a prolific geological setting in mining-friendly Western Australia.

The Windimurra Complex is Australia’s largest, exposed, layered mafic intrusion complex measuring some 85 kilometers x 37 kilometers by some 11 kilometers thick.

This Archean-aged complex is geologically similar to the Bushveld Igneous Complex in South Africa, the source of much of our planet’s nickel, copper, cobalt, and platinum group elements.

Within the Windimurra Complex, the prospective Shepards Discordant Zone—a 600 meter thick sequence of magnetite-rich leucogabbro—can be traced for more than 50 kilometers and trends directly onto Bluebird’s Canegrass ground.

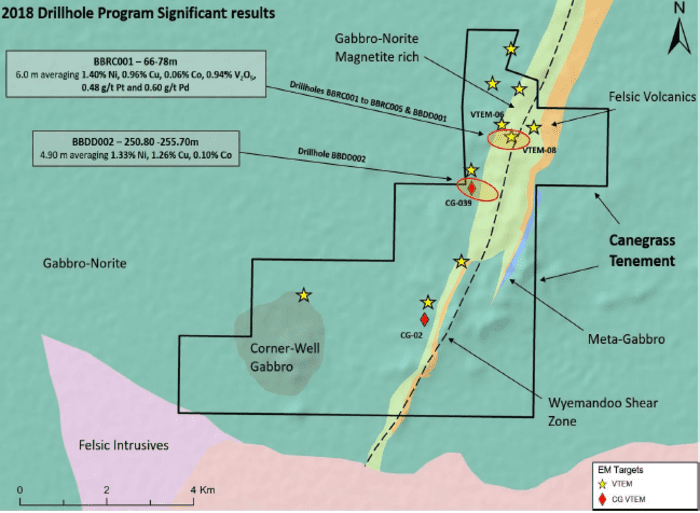

With drilling partner’ NEWEXCO—geological sleuths renowned for methodically planning and executing exploration campaigns in the region—the company is on the cusp of an 18 hole drilling campaign: 3,160 meters of RC and DD to follow-up on a successful 2018 program, and also test high priority areas along 8.5 kilometers of magnetite-rich gabbro-norite paralleling a shear zone (map below).

Highlights from 2018:

– All holes returned anomalous Ni, Cu, Co (and PGE) values, and included some of the highest grades intersected on the project to-date:

- BBRC001 (Winx) 14 meters @ 1.17% Ni, 0.88% Cu and 0.05% Co from 65 meters (including 1 meter @ 2.70% Ni, 0.23% Cu and 0.12% Co);

- BBDD001 (Sunline) 0.57 meters @ 3.07 % Ni, 0.62% Cu and 0.24% Co from 144.1 meters;

- BBDD002 (Tulloch) 14.25 meters @ 0.69% Ni, 0.82% Cu and 0.05% Co from 243.2 meters (including 4.9 meters @ 1.33% Ni, 1.26% Cu and 0.10% Co).

On June 10, the company announced a $2,500,000 PP, enough funds to probe Canegrass proper.

We should see an update from the company in the coming days.

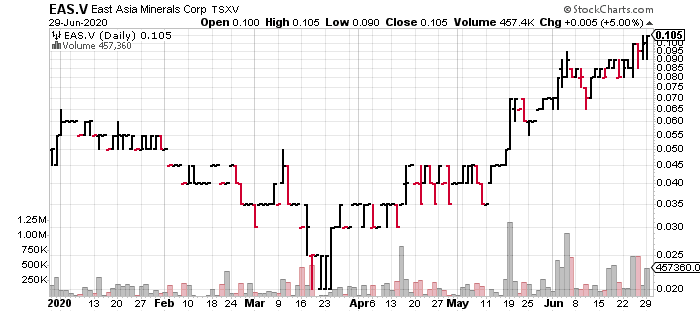

- 104.96 million shares outstanding

- $10.5M market cap based on its recent $0.10 close

With two highly prospective projects located in a country boasting truly spectacular Tier-1 deposits—Grasberg’s 67 million-plus ounces in gold reserves being the standout—East Asia’s Indonesian projects are beginning to attract attention.

The company’s stock has risen from its two-cent crash-day lows on March 16 to a recent high of $0.105.

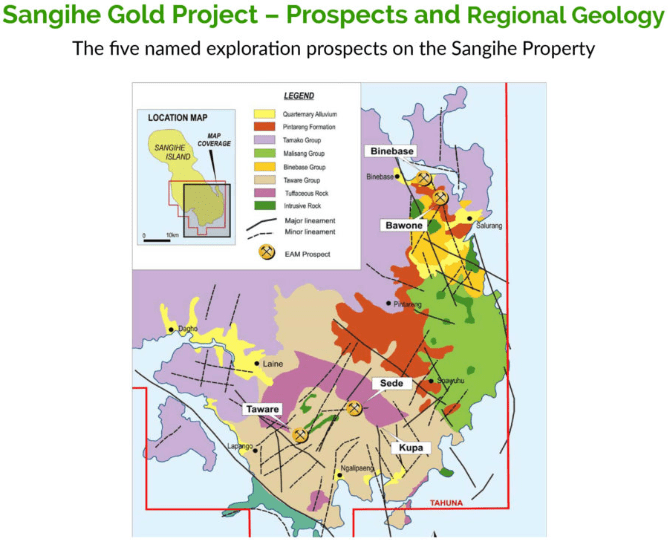

The 42,000 hectare Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—is the East Asia’s flagship.

The 42,000 hectare Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—is the East Asia’s flagship.

The company has its sights set on a modest heap leach production scenario at Sangihe. We should see the first gold pour within 6 months of gov’t approval.

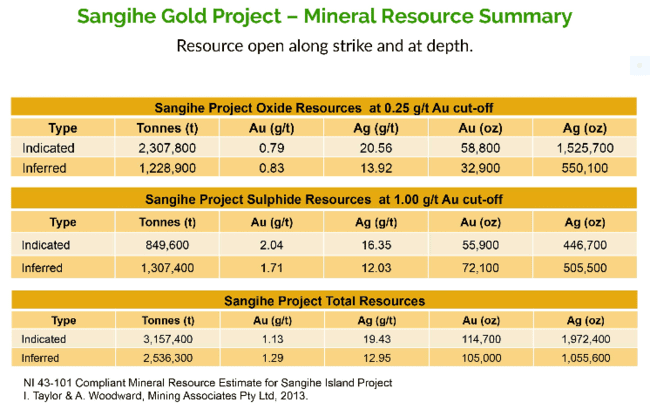

Sangihe’s near-surface, easily exploitable resources are as follows:

Stage one will see 1,000 ounces of gold per month when the production plant is fully operational (roughly 12 months from gov’t approval and project funding).

Stage one will see 1,000 ounces of gold per month when the production plant is fully operational (roughly 12 months from gov’t approval and project funding).

Estimated all in costs = approx $700 per ounce. This will throw off free cashflow of roughly $1,100 per ounce, or $1,100,000 per month once in Stage one (based on current spot Au prices).

The goal is to self-fund exploration and add to the ounce count.

There’s 25,000 hectares of prospective terrain where company geologist, Frank Rocca (former Barrick,) estimates the potential for at least 2,000,000 ounces of Au.

On that note, the company anticipates three phases of exploration:

- A phase one drilling campaign to upgrade the 835,000 Inferred ounces along the Binebase-Bawone Corridor;

- A phase two drilling program to test the mineralization potential from Bawone to the south of Salurang;

- A phase three exploration and drilling campaign designed to test the remaining 20,000-plus hectares of geologically prospective terrain surrounding Taware , Sede, and Kupe.

In answer to your numerous email queries re project approval: Final gov’t approval for development work at Sangihe could come any day.

In answer to your numerous email queries re project approval: Final gov’t approval for development work at Sangihe could come any day.

It’s conceivable that the gov’t could step in for a piece of the action at the local level as the company is finalizing its license upgrade to Operation Production status.

And then there’s Miwah…

The Miwah Gold Project is a high-level, high sulphidation epithermal gold prospect where gold and copper mineralization is contained in andesitic / dacitic lavas and tuffs, with the precious metal hosted mainly in andesite.

The project, located within a Protected Forest Reserve, currently boasts a resource of 3,140,000 ounces of gold.

The deposit is open on along strike, across width, and at depth.

Those who were around during the previous gold bull cycle might remember the wild ride Miwah put shareholders on. East Asia emerged from penny staus to a market cap of some $600M on the strength of that project.

Miwah could see a monetizing event. I suspect it will come back into play once Sangihe is pushed sufficiently along the development curve.

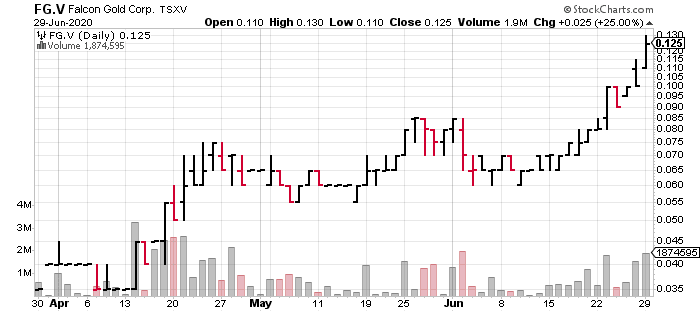

- 60.44 million shares outstanding

- $7.25M market cap based on its recent $0.12 close

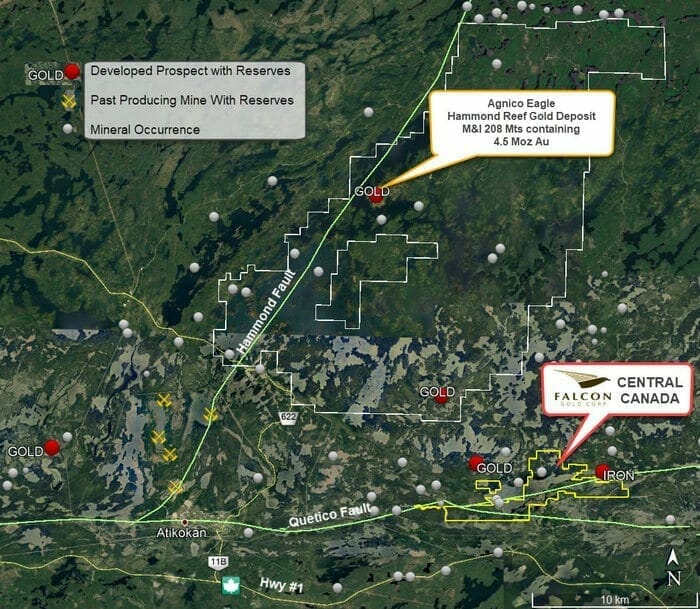

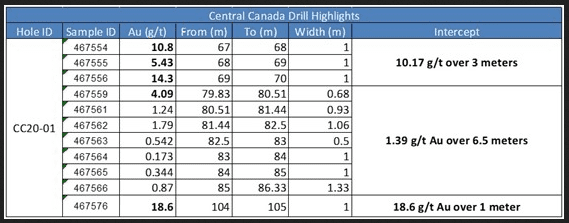

The company tagged the following hit earlier this month at its Central Canada Gold Project…

The company tagged the following hit earlier this month at its Central Canada Gold Project…

On June 23, Falcon dropped the following headline, an update from its flagship project:

On June 23, Falcon dropped the following headline, an update from its flagship project:

Falcon Continues Drilling Along Strike of Historic Deposit – Central Canada Project

The company completed two additional holes totaling 221 meters along strike of the historical Central Canada Gold Mine, for a total of five holes.

These initial holes successfully intersected the historical mine trend to a depth of 75 meters.

Two additional holes are in the planning stage.

“The Company believes that the intersections in its first drill hole that assayed high-grade gold mineralization over a 3 meter interval of 10.17 g/t Au at 67 meters depth may be confirmation of the reported historical mine resource. Falcon’s first drill hole also outlined a new mineralized zone untested by previous operators at 104 meters depth, which sampled 18.6 g/t Au over 1 meter. Falcon will continue drilling along strike to confirm historical results, expand the strike length, and test the depth of mineralization to 100 meters below surface with the next holes currently being drilled totalling 360 meters.”

History at the Central Canada Gold Mine:

- 1901 to 1907 – Shaft constructed to a depth of 12 meters and 27 oz of gold from 18 tons using a stamp mill;

- 1930 to 1935 – Central Canada Mines Ltd. deepened the shaft to 40 meters with about 42 meters of crosscuts and installed a 75 ton per day gold mill;

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft;

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au;

- 2010 to 2012 – TerraX Minerals Inc. – conducted programs that included line cutting, geological surveys and drilled 363 meters.

Spitfire and Sunny Boy

After acquiring additional ground along the Spitfire-Sunny Boy trend in resource-rich Meritt B.C., Falcon was quick to put boots on the ground.

Falcon Mobilizes Field Crew on Spitfire and Sunny Boy Claims, Meritt, B.C.

“The company will be conducting prospecting, field reconnaissance mapping, and channel sampling near the historic Master Vein which sampled up to 50.53 oz/t Au. The goal of the project will be to delineate and constrain the styles of gold mineralization on the project and assess the geological setting and deposit type as limited geological work has been performed by past operators. An exploration permit application has been submitted outlining planned surface trenching and diamond drilling along the Master zone.”

The company’s shares have gone on a high volume tear of late. A pic is worth a thousand words.

Golden Lake Exploration (GLM.C)

- 27.8 million shares outstanding

- $5.56M market cap based on its recent $0.20 close

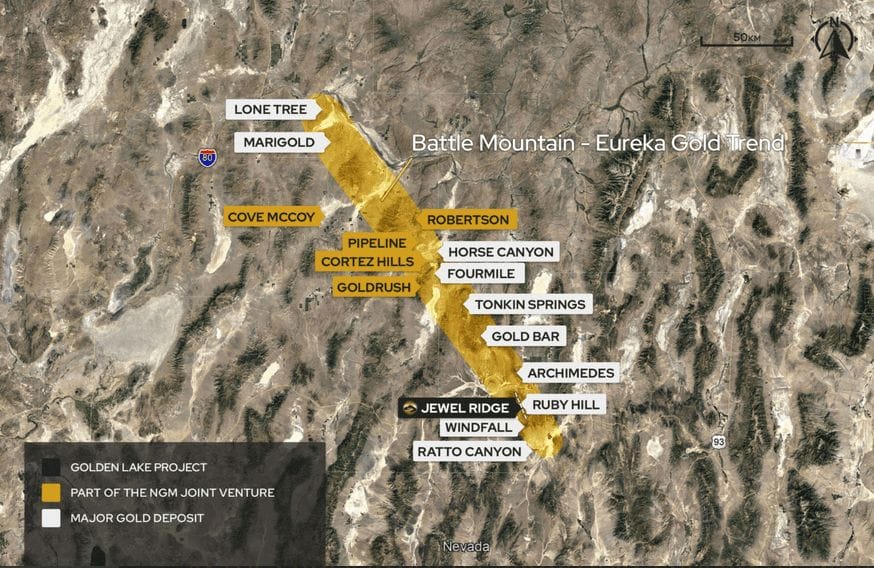

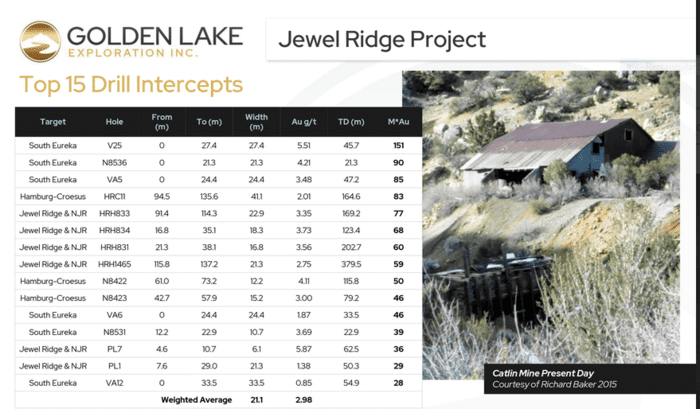

Golden Lake’s flagship Jewel Ridge Project is located at the south end of Nevada’s prolific Battle Mountain–Eureka trend, strategically along strike and contiguous to the Barrick Gold’s (former) two million ounce Archimedes/Ruby Hill mine to the north, and Timberline Resources’ advanced-stage Lookout Mountain project to the south.

This is an upscale neighborhood…

… in close proximity to Nevada Gold Mines’ (NGM) Pipeline, Cortez Hills, and Goldrush deposits.

Nevada Gold Mines (NGM) is a partnership between mining behemoths Barrick Gold (61.5%) and Newmont-Goldcorp (38.5%).

Pipeline, Cortez Hills and Goldrush represent three of the largest Carlin-type gold deposits in the world. They make up NGM’s lowest-cost assets with over 50 million ounces of gold reserves & resources.

Nevada Carlin type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated in four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

The Carlin-type gold deposits Golden Lake is targeting at Jewel Ridge are of the large bulk tonnage kind.

“The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits. Carlin-type deposits include many deposits that occur in the Battle Mountain-Eureka Trend, Carlin Trend and other well-known mineral trends in north central Nevada. Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property, which was operated by Homestake Mining Company from 1997 until 2002 and produced about 680,000 ounces of gold from the Archimedes open pit. In February 2007, Barrick Gold Corp. commenced production on a 1.1-million-ounce gold resource from the adjoining East Archimedes deposit. From 1976–2012, production from these Carlin-type deposits in the Eureka district was approximately 44.9 tonnes (1.38 million ounces) of gold (NBMG, 2014).”

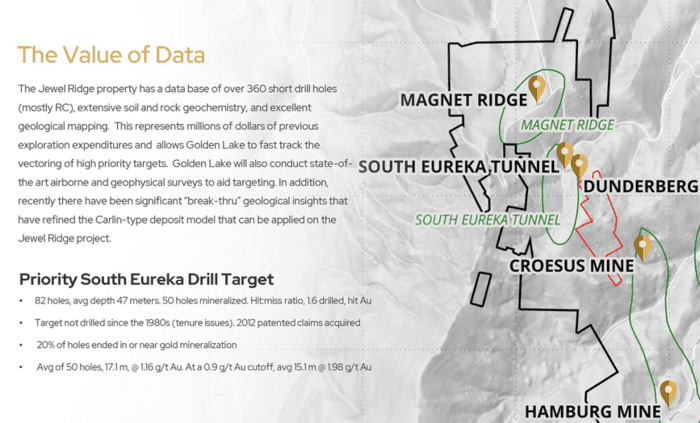

The following slide reflects highlights from historic drilling on the project:

After closing a $1,225,000 PP on June 10, the company is prepping to drill. A phase one campaign consisting of roughly 1,500 meters will target the South Eureka Tunnel Zone.

After closing a $1,225,000 PP on June 10, the company is prepping to drill. A phase one campaign consisting of roughly 1,500 meters will target the South Eureka Tunnel Zone.

With a new round of geochemical and geophysical surveys, Golden Lake continues to prioritize drill targets across the project.

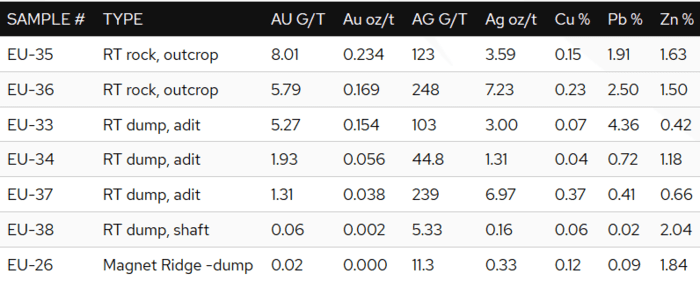

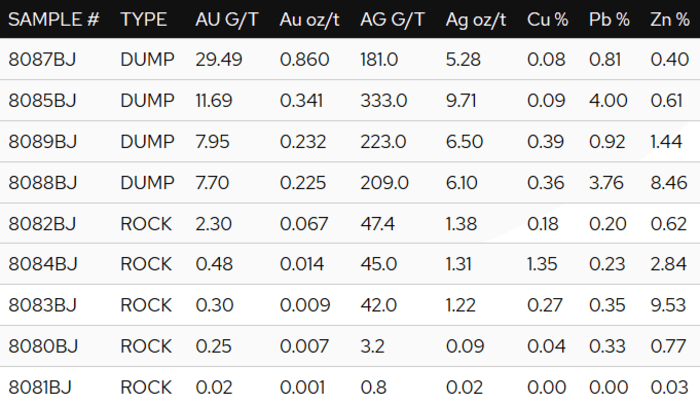

On June 26, the company dropped the following headline…

This campaign confirmed recent results at the Radio Tower target and succeeded in tagging a new zone called the A&E Target (historic results up to 29.49 g/t Au, 333.0 g/t Ag).

Radio Tower Target

“Radio Tower Target – sampling by Company personnel of dumps from adits, shafts, old trenches and outcrop have returned a median (based on gold values) of seven (7) samples of 1.93 grams gold per tonne Au g/t), 44.8 g/t silver (Ag), and 0.04 percentage copper (% Cu), 0.72 % lead (Pb) and 1.18 % zinc (Zn). Historic sampling acquired from a third-party reported on May 14, 2020 returned a median (based on gold values) of 0.39 g/t Au, 12.2 g/t Ag, 0.07 % Cu, 0.78% Pb and 0.92 % Zn from 9 samples in the area. While grab rock samples are not representative of the grade of mineralization of an occurrence, they are useful in determining prospectivity and geological features, and the comparison between the Company’s assays and the historic assays are supportive of a carbonate-replacement style of mineralization at the Radio Tower Target.”

“Radio Tower Target – sampling by Company personnel of dumps from adits, shafts, old trenches and outcrop have returned a median (based on gold values) of seven (7) samples of 1.93 grams gold per tonne Au g/t), 44.8 g/t silver (Ag), and 0.04 percentage copper (% Cu), 0.72 % lead (Pb) and 1.18 % zinc (Zn). Historic sampling acquired from a third-party reported on May 14, 2020 returned a median (based on gold values) of 0.39 g/t Au, 12.2 g/t Ag, 0.07 % Cu, 0.78% Pb and 0.92 % Zn from 9 samples in the area. While grab rock samples are not representative of the grade of mineralization of an occurrence, they are useful in determining prospectivity and geological features, and the comparison between the Company’s assays and the historic assays are supportive of a carbonate-replacement style of mineralization at the Radio Tower Target.”

A and E Target

“Designated as the A & E Target (based on the two patented claims) this area is located approximately 500 meters south-southeast of the Radio Tower Target. The A & E Target is also located approximately 300 meters southwest of the western edge of the South Eureka Tunnel zone (Carlin, oxide gold target)., and is approximately 185 meters (600 feet) higher in elevation. Significant historic mine dumps are scattered in the A& E area, interpreted to be from the “Sterling Mine” operations (note: limited historic data available), focused on carbonate-replacement style mineralization.

“Designated as the A & E Target (based on the two patented claims) this area is located approximately 500 meters south-southeast of the Radio Tower Target. The A & E Target is also located approximately 300 meters southwest of the western edge of the South Eureka Tunnel zone (Carlin, oxide gold target)., and is approximately 185 meters (600 feet) higher in elevation. Significant historic mine dumps are scattered in the A& E area, interpreted to be from the “Sterling Mine” operations (note: limited historic data available), focused on carbonate-replacement style mineralization.

The A & E target has no known drill holes, but the area has been recently visited by Company personnel to determine the logistics of accessing the area during the Company’s forth coming RC (reverse circulation) drill program, planned for July 2020. Samples comprise grab rock samples from dumps of old mine workings and rock outcrop exposures. Grab rock samples are not representative of the grade of mineralization of an occurrence, but are useful in determining prospectivity, and geological features.”

We’re near a point when a drill rig will be mobilized to the property. In the meantime, the company is stacking good science—geochem and geophys—to home in on the sweet spots.

- 158.07 million shares outstanding

- $14.23M market cap based on its recent $0.09 close

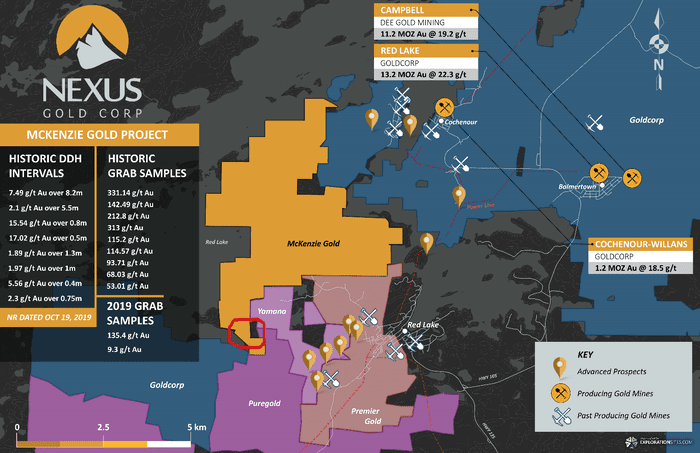

Nexus is currently in the midst of a muchly anticipated phase one drilling campaign at its MacKenzie Gold Project in the Red Lake Mining Camp.

June 19 news: Nexus Gold Commences Drilling at the McKenzie Gold Project, Red Lake, Ontario

This phase one program will consist of 1000 meters (minimum) of diamond drilling to test the mineralized potential of several gold targets occurring within an east-west trending corridor along the southern contact of the Dome Stock volcanic rocks of the Balmer Assemblage.

A 2005 campaign along this corridor tagged values that included 7.49 g/t Au) over 8.2 meters, 15.54 g/t Au over 0.8 meters (includes 13.08 g/t over 0.3 meters and 17.02 over 0.5 meters), 4.47 g/t gold over 1.4 meters, and 2.15 g/t Au over 5.5 meters.

A 2005 campaign along this corridor tagged values that included 7.49 g/t Au) over 8.2 meters, 15.54 g/t Au over 0.8 meters (includes 13.08 g/t over 0.3 meters and 17.02 over 0.5 meters), 4.47 g/t gold over 1.4 meters, and 2.15 g/t Au over 5.5 meters.

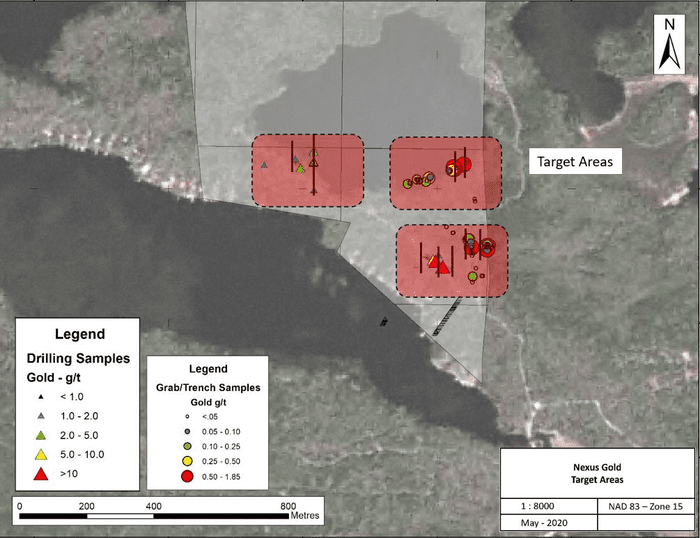

The initial drill program will also follow up on a successful 2019 fall prospecting program completed in the St. Paul’s Bay area of the project.

Phase one drill target locations are outlined in red (map below).

The company is a good ten days in—they should have several holes drilled by now. It’s possible we could see this first phase expanded.

The company is a good ten days in—they should have several holes drilled by now. It’s possible we could see this first phase expanded.

Over on the African continent, the company surveyed the artisanal scene at their Dakouli II property, and delivered the following headline:

Nexus Gold Extends Strike Length at Dakouli II Gold Concession, Burkina Faso, West Africa

“Company geologists have been reviewing the Dakouli concession for potential drill set ups, and during recent site visits noted an increase in artisanal mining activity along strike at the main mineralized zone. The crew collected three rock samples from new areas being exploited artisanal miners (“orpailleurs”). A result of 10.8 grams-per-tonne (“g/t”) gold (“Au”) was returned from sample DK-27. This sample consisted of crushed mined material which had undergone preliminary gold extraction by panning. The remaining two samples were taken from workings proximal to the location of the orpailleurs extraction operations and returned 0.02 g/t au and 1.6 g/t Au respectively.”

The company says it’s encouraged by the increased artisanal strike activity which now extends the limits of the eastern zone some 200 meters to the east, expanding the zone of mineralization to over 400 meters along an east-west trend.

The company is monitoring this artisanal activity as it prepares for an upcoming drill program later this summer or early fall.

- 17.7 million shares outstanding

- $2.92M market cap based on its recent $0.165 close

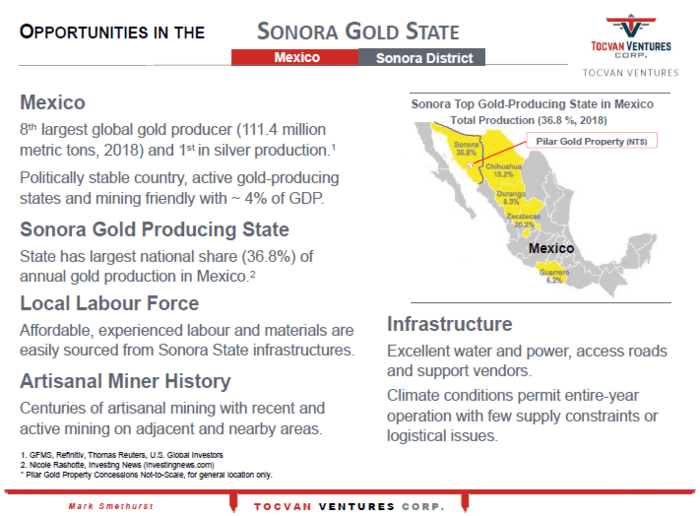

Tocvan’s flagship Pilar Gold Project is located along the historic Sonora gold district within the Sierra Madre Occidental geological province.

The project is road accessible and is located roughly 140 kilometers south-east of the city of Hermosillo.

On June 24, the company dropped the following headline…

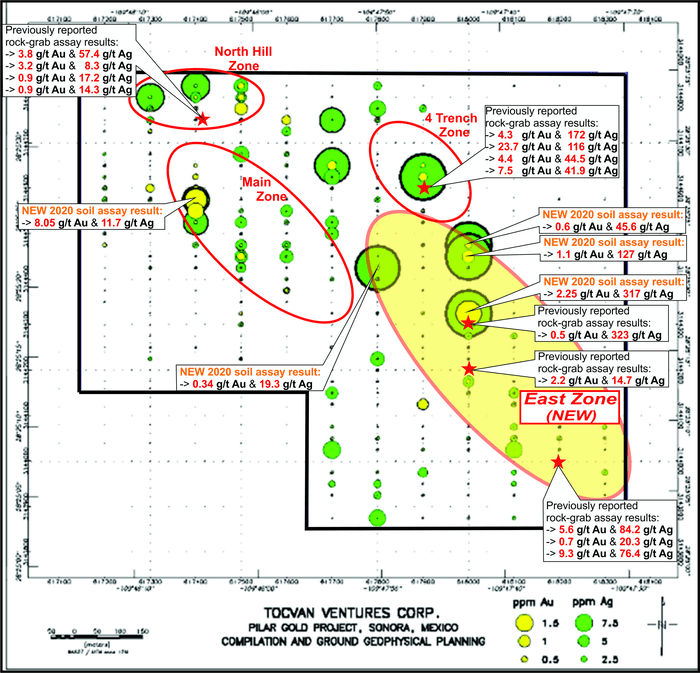

The headline numbers—8 g/t Au & 317 g/t Ag—represent the highest values returned to date.

The company also tagged a new gold and silver zone—the East Zone.

The following map shows gold-silver values from the soil sampling campaign conducted last spring. Also included are gold-silver assays from grab samples collected last November— these are included here to offer a “holistic view” of what’s going on along surface.

“Historically, the focus for development on the Pilar property has been in the north-west part of the property in the Main Zone and North Hill Zone. These zones along with the 4-Trench Zone have received over 17,700 meters of drilling. The Pilar property is a low-sulphide epithermal system, structure is key in mineralization deposition. In order to know where the mineralization is located, the structures need to be known and understood. In the efforts to define the structures controlling mineralization in the Main, North Hill, and 4-Trench zones, discoveries have been made elsewhere on the property, and those discoveries collectively have revealed a new zone of gold-silver mineralization, the East Zone.”

“The new East Zone is represented by high grade gold and high grade silver assay results from rock grabs and soil sampling, and is a new trend of mineralization parallel to the NW-SE trend of mineralization of the Main Zone and North Hill Zone (see the bottom of this press release for summary drill results of the Main and North Hill zones). This trend/zone first started to reveal itself after a rock sampling survey conducted this past November. Some significant results include over 5 g/t gold and over 9 g/t gold (Figure 1), but also notably 323 g/t silver, 317 g/t silver, 127 g/t silver, and at the south-east corner of the property 84 and 76 g/t silver (Figure 1). This area roughly covers 600m x 200m and trends in the same direction as the Main Zone (which has been drilled to a depth of ~100m) and with NW-SE trending structures. Historically, previous operators have focused on developing gold on the Pilar property, clearly silver should be included as a part of that focus as well, and will be.”

These results, past and current, will be used to help create a structural model to prioritize drill targets for an upcoming campaign.

Drilling is expected to commence later this summer or early fall.

- 62.8 million shares outstanding

- $7.22M market cap based on its recent $0.115 close

X-Terra currently has boots on the ground at its wholly-owned 93 square kilometer Troilus East property along the Frotet-Evans Greenstone Belt in northern Québec.

The June 12, Troilus East headline:

X-Terra Resources Begins 2020 Exploration Program on Troilus East

Troilus East shares a common border with Troilus Gold (TLG.T).

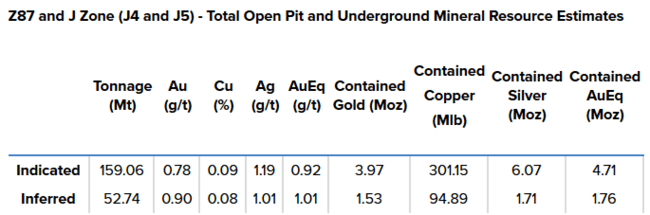

The Troilus Gold-Copper project boasts a current resource of 6.4 million gold equivalent ounces (AuEq)—4.71 million ounces of Indicated AuEq and 1.76 million ounces of Inferred AuEq.

“A technical report completed in 2019 confirmed there are significant open pit and underground mineral resources remaining at Troilus, where mineralized gold grade and thicknesses are very continuous and the mineralization remains open at depth.”

The Frotet Evans Greenstone Belt has seen limited exploration, far less than the better known Abitibi Greenstone Belt.

X-Terra’s claims along this under-explored belt of metamorphosed volcanic-sedimentary rocks stretch more than 22 kilometers.

“The Troilus East property straddles a structural zone parallel to the Troilus Deposit. For a strike length of about 20 kilometres, highlighted mostly by a mafic volcanic sequence which is interlayered to elongated mafic to ultramafic intrusions. Historical governmental mapping programs have already highlighted a prominent potassic alteration taking the form of biotite. In addition, more than 23 sulfides occurrences were documented during these mapping program which were completed by the provincial government (Sigeom, Énergie et Ressources Naturelles Québec).”

In preparation for a summer-of-2020 drilling campaign, the company stacked multiple layers of good science:

- a detailed magnetic survey flown at 75 meter spacings;

- a 3D inversion VOXI modeling for magnetic intrusions;

- an electromagnetic survey;

- a property wide till sampling program.

Of the 78 samples extracted during the till sampling campaign, 72 tested positive for gold grains using both visual cues and the ARTGold recovery technology developed by IOS Geoservices.

“Of the 283 gold grains, a total of 71 have been classified as pristine, meaning that the location of the till samples in which such gold grains have been recuperated is most likely located less than 500 meters from the source of the gold sample.”

X-Terra engaged Technominex of Rouyn-Noranda for this current phase of systematic prospecting and sampling of predetermined targets on the property.

“The exploration team will fly over the territory using a helicopter to maximize the program efficiency. Manual outcrop stripping and channelling could also be completed depending on the presence of mineralization. Depending on the results received, additional works such as an Induced Polarization survey could be necessary before undertaking additional exploration work, including a first ever diamond drill program.”

We should see a drill rig mobilized to Troilus East later this summer.

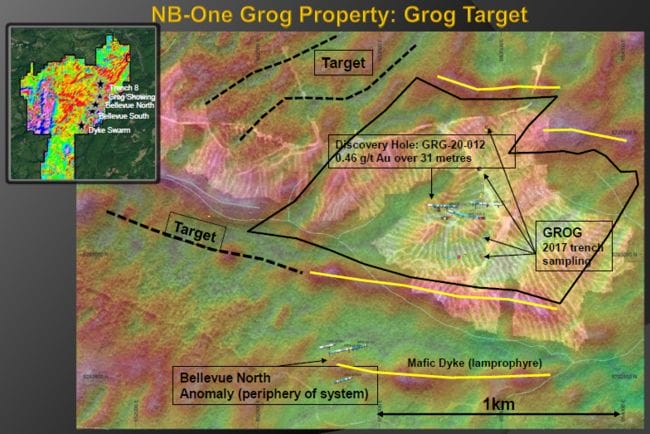

Grog and Northwest

The company’s 280 square kilometer Grog and Northwest projects are located along the McKenzie Gulch Fault in Northeastern New Brunswick.

The target at Grog is a large intrusion-related epithermal system.

An 11-hole drill program conducted earlier this year yielded a new discovery in hole GRG-20-012: 0.41 g/t Au over 36 meters (including 0.46 g/t Au over 31 meters and 7.59 g/t Au over 0.6 meters) at a vertical depth of 81 meters.

On the Northwest claims, a 2012 bulk sampling program on the Bonanza vein saw 16-tonnes of material grading 24.37 g/t Au hauled to surface.

Initial drill results from a limited first pass drilling campaign by the company tagged modest values, including 6.93 g/t over 0.5 meters at a depth of 34 meters. The company plans additional geochemical work to better home-in on the area’s higher-grade subsurface potential.

In a recent news release, the company stated:

X-Terra has put a temporary hold its work programs in New Brunswick due to provincial government response to the recent increase in Covid-19 cases in the Campbellton region zone 5, where the Grog and Northwest projects are located, which has led to significant restrictions on non-essential travel in New Brunswick. X-Terra will be closely monitoring the provincial government efforts in re-opening its inter-provincial borders.

That’s it for this round-up.

END

—Greg Nolan

Full disclosure: Equity Guru has a marketing relationship with all of the companies featured above.