“Ball of confusion, that’s what the world is today”.

Back in January of this year, we presented a solid case for approaching the broader markets with extreme caution in a piece titled, A “skies the limit” stock market = a house of cards?

An excerpt:

“Equities appear invincible. Indestructible. It would seem nothing—not a damn thing—can knock them off their “skies the limit” trajectory.

And market participants appear to have no conception of the concentrated risk—the ruin the market is capable of unleashing from these dizzying levels.

Of course, the history books are full of reminders of how seemingly functional markets’ can all-of-a-sudden malfunction—blow apart at the seams—in the blink of an eye. That’s history.

It’s gotta be different this time… right?

Fact is, there are a number of catalysts that could erupt and wreak havoc in the days/weeks/months ahead.

It might be time to consult your financial advisor and ponder the idea of reducing your exposure to general equities, and perhaps increasing your weighting in securities that function as a hedge.”

More importantly (to this humble observer anyways), we also laid down the logic for accumulating gold and gold stocks in a timely December 2019 piece titled, Gold – the time is nigh.

Rarely have the fundamentals underpinning gold been so legion, so well-aligned.

The recent and sudden strength in the metal is the product of a surfeit of forces—negative real rates, out of control money printing, debt levels that have taken on a surreal quality… a global economy brought to its knees.

Gone are the days when one mocked and ridiculed the mere mention of gold as a hedge against uncertainty, let alone as a viable, earnings-driven investment vehicle.

Even fund managers, bumped off the longest-running uptrend in broader market history, are now looking at the sector in an attempt to divine real value.

Gold Miners are in an enviable position now. After years of fiscal discipline—cutting costs and developing greater operational efficiencies—the recent and sudden strength in the metal is having a dramatic and positive impact on their earnings and balance sheets.

Gold Miners are in an enviable position now. After years of fiscal discipline—cutting costs and developing greater operational efficiencies—the recent and sudden strength in the metal is having a dramatic and positive impact on their earnings and balance sheets.

read: Gold miner Newmont posts 641% jump in profit

Newmont is currently the S&P 500’s top gainer YTD.

If these producing companies have one weakness, it’s in their project pipelines.

The fact that Senior Producers dramatically scaled back exploration spending during the lean years—the bear market years—means that project pipelines, the foundation of future reserves and resources, are not nearly as robust as they should be.

Every day a gold producer digs ore out of the ground—every day they’re open for business—they reduce their mineral inventory.

If a Producer wants to keep pumping out gold bars ten, twenty years from now, they need to replace the ounces they mine today.

The best and easiest way to bulk up a project pipeline is to take a run at a smaller company—one with significant resources on its books.

The best and easiest way to bulk up a project pipeline is to take a run at a smaller company—one with significant resources on its books.

Recent Guru stock-picking success

Many of the companies we shortlisted in these pages over the past year or so have experienced tremendous success on the exploration and development front, rewarding shareholders with multi-bagger gains. Some, those with existing resources and positive economic studies, have simply benefited from a higher gold price, creating a re-rating scenario.

Who doesn’t love a good re-rating event?

A few examples of our stock-picking prowess:

ELY Gold Royalties (ELY.V) caught our interest 14 months ago at $0.17 – it’s now trading in the $1.10 range, up 550%.

Great Bear Resources (GBR.V), first brought to your attention back in January 2019 at $2.03, is nearly a twelve dollar bill now, up 485%.

Blackrock Gold (BRC.V) was highlighted in these pages 14 months back – it’s climbed from $0.04 to its current $0.22, up roughly 450% (the stock has traded significantly higher in recent months).

Fiore Gold (F.V), another company featured 14 months ago, has risen from $0.32 to its current $0.95, up a solid 195%.

Skeena Resources (SKE.V) is a company we shortlisted just over one year ago at $0.44 – it’s currently trading well north of one dollar, last at $1.24, up 180%.

There are others, but you get the idea.

Wait, one more… a silver this time:

Alexco Resources (AXU.T), our go-to Yukon explorer/developer, first featured in these pages at $1.25 in January 2019, last traded at $3.20, up 155%.

Despite broader market uncertainty, some of these high-quality junior exploration companies have been catching a serious bid of late, creating significant shareholder value in the process.

Our shortlist of gold n silver juniors companies – those with significant assets on their books (and endgame potential)

The following companies have been featured here in recent weeks/months and are either paving the way to a production scenario, or are in the process of drilling off a significant resource.

All of these companies have endgame potential, that is, falling prey to a resource-hungry predator looking to ensure its long term survival by beefing up its development project pipeline.

If you’re convinced your company has an endgame, be right and sit tight. A takeover offer from a larger entity will likely come with a premium that far exceeds the current valuation of your stock. A successful endgame removes all the guesswork from picking an optimum exit point. Have patience, allow the predator to cash you out.

To prevent this article from turning into War and Peace, I’m giving you a quick summary, some recent news, and perhaps a personal comment or two. By clicking on the company name, you’ll find a list of related articles in the Equity Guru database.

Our journey begins in Canada’s Yukon Territory. It then works our way south, to Nevada, then turns northeast towards Ontario and Quebec (please excuse any typos).

The Yukon

Alexco Resources (AXU.T)

- 124.05 million shares outstanding

- $396.96M market cap based on its recent $3.20 close

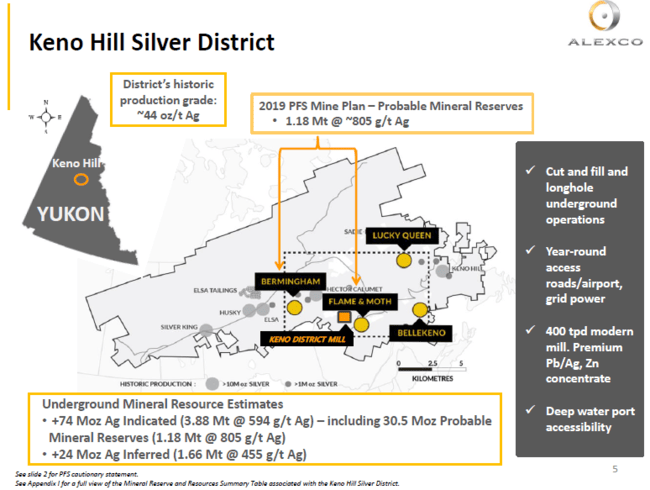

Alexco operates in the Keno Hill Silver District.

The company’s goal is to become Canada’s primary’ silver producer and is on the verge of making a production decision.

Regarding that decision, the company stated the following on March 30:

As previously reported, the Company is awaiting issuance of an amended and renewed Water Use License (“WUL”) from the Yukon Water Board. The Yukon Water Board completed the public hearing phase of the licensing process in February 2020, and the Company understands that deliberation and progress on the terms and conditions of the renewed WUL is ongoing. Given the disruption in most routine activities, the Company advises that issuance of the WUL will be deferred into the second quarter, 2020. The Company reiterates that a final production decision at Keno Hill requires amongst other considerations, the issuance of a renewed WUL. Issuance of the WUL in the second quarter continues to be within the broader schedule of mine development activities now contemplated at Keno Hill and the ability to reach concentrate production in 2020.

Current reserves stand at 1.2 million tonnes grading 800 g/t silver + a further 7% combined lead and zinc.

Current resources, both indicated and inferred, total more than 107 million ounces plus significant zinc and lead credits.

A 2019 PFS demonstrates an after-tax NPV (5%) of $101.2M and an IRR of 74%.

All-in sustaining costs (AISC) are pegged between $11 to $12.00.

CapEx is a very modest $23M.

To fund a big chunk of that CapEx, the company recently monetized its reclamation business, taking in $12.1M (another $1.25M is due Feb. 14, 2021).

Since then, the company closed an $8.6 Million Common Share Public Offering—no dilutive bells and whistles.

Along with all of this recently raised cash—roughly $22M if my arithmetic is correct—the company has an untapped US $15M credit facility.

The company’s shares, beautifully correlated with the recent price strength in silver, have been on a roll of late.

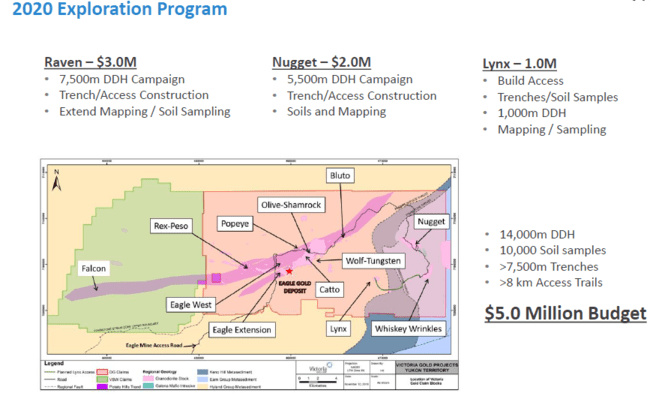

Victoria Gold (VGCX.T)

- 61.39 million shares outstanding

- $780.82M market cap based on its recent $12.72 close

Further evidence that serious-minded money is flowing into the gold n silver arena is Victoria’s recent price trajectory, which began on May 12 with an initial 28% pop on big volume.

Victoria’s Eagle Gold Project has evolved from a development project to an operating mine.

The project boasts a constrained in-pit measured and indicated resource of 3.6 million ounces of gold (180 million tonnes grading 0.63 g/t) with a super low stripping ratio (< 1:1).

I worked at a large open-pit mine where for every eight haul trucks that sped by, only one carried ore—the rest were destined for the waste heap.

The Eagle Gold project has good metallurgy—favourable, lower-cost heap leach processing.

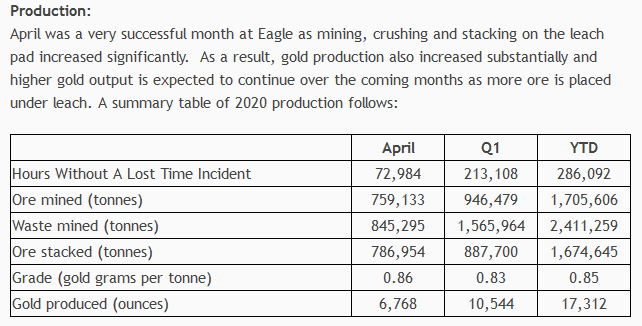

On May 11, the company dropped an operational update:

Victoria Gold Provides Operations Update

John McConnell, President & CEO:

John McConnell, President & CEO:

“With production ramping up and gold price at record highs, Eagle is poised to exceed our projections!” Too cool—it’s not often you see a CEO trot out exclamation points.

There’s also exploration upside here…

White Gold (WGO.V)

- 124.79 million shares outstanding

- $107.32M market cap based on its recent $0.86 close

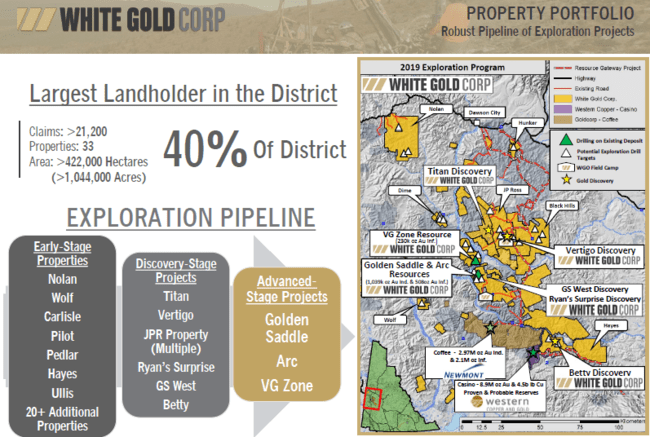

White Gold holds a dominant land position in the White Gold District of Canada’s Yukon.

This is an explorer-developer that appears to have it all: ounces-in-the-ground, multiple new (high-grade) discoveries, top-shelf management, unparalleled district scale exploration upside.

One has the right to ask, “so why the lack luster share price performance”? Valid question, but I suspect these lowly price levels are a temporary phenomenon.

The company’s Golden Saddle and Arc deposits hold the bulk of the resources:

- 1,039,600 gold ounces within 14,330,000 tonnes at 2.26 g/t Au in the indicated category;

- 508,700 gold ounces within 10,696,000 tonnes at 1.48 g/t Au in the inferred category.

Located directly across the river from Saddle and Arc, the VG Zone holds an inferred resource of 230,000 gold ounces within 4.4 million tonnes at 1.65 g/t Au.

Of the multiple discoveries tagged in recent months, Titan and Vertigo stand out.

Titan discovery highlight- 72.81 g/t Au over 6.09 meters from 10.67 meters depth, including 136.36 g/t Au over 3.05 meters from 12.19 meters depth.

Vertigo discovery highlight – 23.44 g/t Au over 24.38 meters.

Other high-priority zones are highlighted by the following hits:

Ryan’s Surprise – 20.64 g/t Au over 6.09 meters.

GS West – 2.97 g/t Au over 10.0 meters.

Betty – 1.08 g/t Au over 50.29 meters.

With so many moving parts to this story, painting an accurate picture is difficult in such a limited space. My maiden White Gold article from two months back offers far greater detail (note the critical role soil samples play in this unglaciated part of the world)…

read: White Gold – unparalleled discovery potential in Canada’s Yukon

The company, unusually quiet of late, dropped the following headline late last week:

White Gold Corp. Announces Fully Subscribed C$6 Million Private Placement of Flow-Through Common Shares; Agnico Eagle and Kinross to Maintain Interest; Eric Sprott to Participate

I covered this market-moving piece of news in my most recent Highballerstocks piece two days back:

read: Big moves in the Highballer portfolio

This is one to keep an eye on as the 2020 field season draws nearer.

The Golden Triangle of British Columbia

Skeena Resources (SKE.V)

- 165.97 million shares outstanding

- $205.8M market cap based on its recent $1.24 close

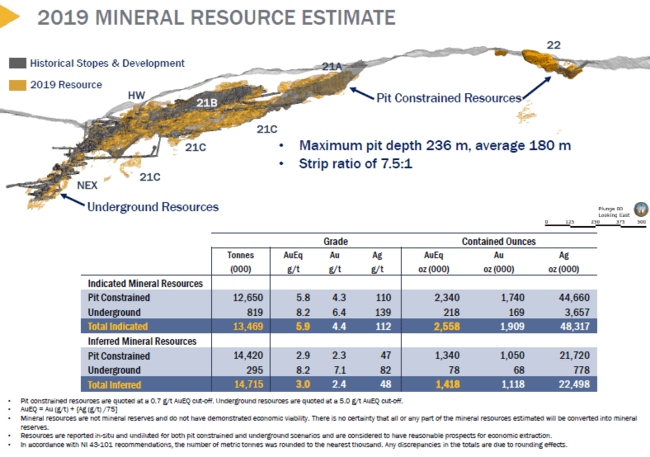

Skeena continues to push its flagship Eskay Creek Project further along the curve and is in the midst of a 28,000 meter, multiple rig drilling campaign.

Eskay Creek went into production in 1994 after an intense bidding war wrestled the deposit away from its original (junior) owners—Consolidated Stikine and Calpine Resources. Mind-boggling riches were realized by early investors when the dust finally settled post bidding war.

Eskay Creek was THE highest-grade gold producer on the planet back in the day. It produced some 3.3 million ounces of gold at a grade of 45 g/t and 160 million ounces of silver at a grade of 2,224 g/t—a gold equivalent grade north of 2.5 ounces per tonne.

The mine produced for the better part of 14 years, finally winding down operations in 2008.

Due to the remoteness of the project and a low gold price environment, the cutoff grades applied to Eskay Creek were crazy high—up to 30 g/t Au.

With markedly higher precious metals prices and significant improvements to the region’s infrastructure, sub-economic ore leftover from the historic operation appear to offer compelling economics today.

Skeena now boasts one of the highest grade open pit development projects in the world—some four million ounces grading 4.4 g/t AuEq.

There’s currently more gold in Eskay Creek’s subsurface layers than was ever mined back in the day.

The current resource does NOT include results from a 2019, 14,000-meter drilling campaign designed to upgrade the resource and step out from known areas of mineralization.

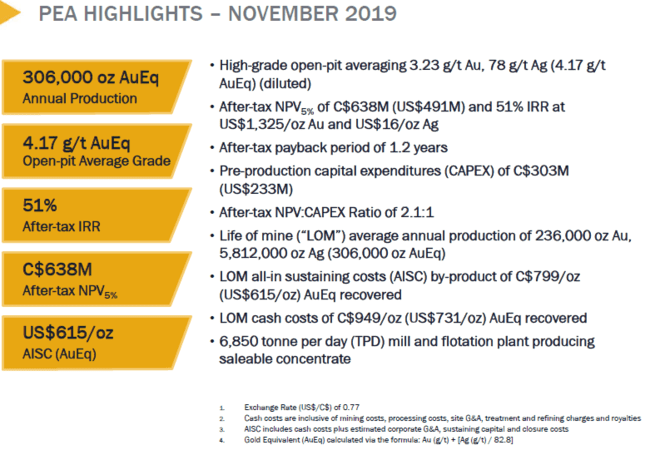

The PEA delivered last November was nothing short of outstanding. Note the after tax NPV and IRR…

A couple weeks back the company presented an insightful webinar, one well worth your time, especially if you’re looking to shortlist new investment candidates in this arena.

Skeena Resources Webinar April 29

A few (webinar) takeaways…

Eskay Creek is a VMS type deposit, and Kelly Earle takes us on a virtual tour of the two styles of mineralization present—the mudstone horizon and the rhyolite horizon. Kelly offers some interesting details regarding the geology i.e. 70% of the deposit is in clean rhyolite (no deleterious elements such as mercury, arsenic, antimony) and 30% is in mudstone (deleterious elements occur only in ‘hot spot’ patches).

On May 5, the company dropped final assays from their phase-1 program surface drilling campaign (the first 4,327 meters completed so far this year):

Phase I Eskay Creek Drilling Highlights

- 32.21 g/t Au, 121 g/t Ag (33.82 g/t AuEq) over 22.50 meters (21B Zone) including 753.00 g/t Au, 445 g/t Ag (758.93 g/t AuEq) over 0.83 meters

- 5.90 g/t Au, 14 g/t Ag (6.09 g/t AuEq) over 24.55 meters (21B Zone) including 25.60 g/t Au, 56 g/t Ag (26.35 g/t AuEq) over 1.50 meters

Solid hits. Super solid.

All told, due to the excellent continuity of the mineralization, the company envisions a resource of 5 million ounces at a grade of 5.0 g/t AuEq. An increase in grade—from 4.4 to 5.0 g/t AuEq—would have a dramatic impact on the project’s already robust economics.

Seabridge Gold (SEA.T)

- 64.94 million shares outstanding

- $1.47B market cap based on its recent $22.63 close

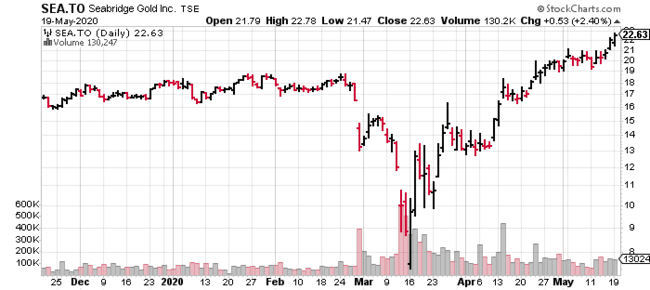

I’m including SEA, even though its market cap dwarfs the vast majority of the companies profiled here by the widest of margins, to demonstrate how a well heeled gold oz-rich company can motor when the conditions are right.

Note the share price trajectory from the lows registered on March 16, 2020 (crash day)…

Seabridge’s KSM Project, a quartet of deposits known as Kerr, Sulphurets, Michell, and Iron Cap, represents one of the largest untapped resources of gold and copper on the planet.

Current measured and indicated resources = 49.694,000 ounces of gold.

Inferred resources = 56,330,000 ounces.

All told, the company boasts 106 million ounces of gold in all categories, plus significant copper, silver, and moly credits.

Proven and Probable reserves stand at an eye-popping 38.8 million ounces of gold.

On March 30, the company announced it had acquired the 3 Aces project from Golden Predator (GPY.V)

read: Seabridge Gold To Acquire 3 Aces Project in Canada’s Yukon

More recently, they dropped an updated PEA:

read: Updated PEA Study Enhances Seabridge Gold’s KSM Project

2020 PEA Highlights (these are some big ass’d values/numbers):

- After Tax NPV at a 5% discount rate of US$6.0 billion using Base Case three-year average price assumptions of US$1,340/oz gold, US$2.80/lb copper and foreign exchange rate of US$0.76 per C$1.00:

- 44 year mine production plan capturing 19.6 million ounces of gold and 5.4 billion pounds of copper from the measured and indicated categories plus an additional 20.8 million ounces of gold and 13.8 billion pounds of copper from the inferred category:

- Life of mine recovered production of 27.6 million ounces gold and 17.0 billion pounds copper:

170,000 tonne per day processing rate capturing 2.4 billion tonnes (Bt) of mill feed, or only 30% of the total mineral resource: - 4.0-year payback on US$5.2 billion initial capital:

- Average annual pre-tax Free Cash Flow of US$1.45 billion from 1.3 million oz gold and 265 million pounds copper produced per year during the initial 5 years of production:

- Life of mine average operating cost of negative US$472 per ounce of gold produced, net of copper and silver by-product revenues:

- Life of mine total cost of US$4 per ounces of gold produced, inclusive of all project capital and net of copper and silver by-product revenues;

- 57% reduction in mine waste rock compared to the approved EA;

- 33% reduction in greenhouse gas emissions from mine operations compared to the approved EA.

CEO Rudi Fronk:

“These PEA economic projections, if achieved, would rank KSM among the best large-scale producing mines in the world.”

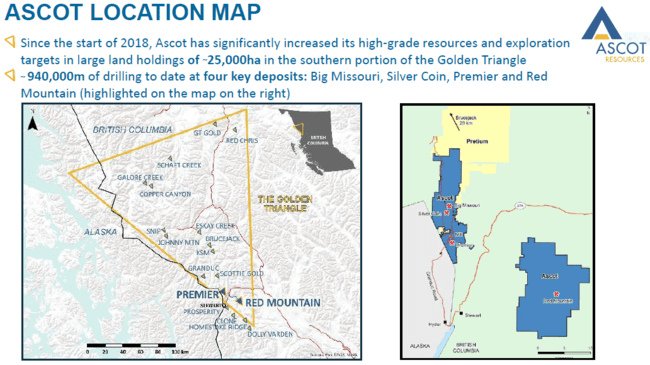

Ascot Resources (AOT.T)

- 233.13 million shares outstanding

- $207.49M market cap based on its recent $0.89 close

Ascot is looking to re-start the historic Premier Gold Mine, just a stone’s throw from the town of Stewart.

The project is steeped in mining history.

Hailed as one of THE greatest gold and silver mines on the planet, Premier began production back in 1918, hitting its peak during the Great Depression. It’s interesting to note that while the rest of the world was surrounded by poverty—dirt poor—employees at the Premier mine were raking in the cash, enjoying the fruits of life.

Current Premier Gold Project resources:

- Indicated Category: 1,066,000 ounces of gold and 4,669,000 ounces of silver

- Inferred Category: 1,180,000 ounces of gold and 4,673,000 ounces of silver

When you include the company’s Red Mountain deposit next door, resources increase to:

- Measured & Indicated: 1,849,000 ounces of gold and 6,824,000 ounces of silver

- Inferred: 1,250,000 ounces of gold and 4,769,000 ounces of silver

That’s a nice high-grade ounce count for two projects within a stone’s throw of one another.

On April 15, the company dropped a feasibility study for both Premier and Red Mountain.

read: Ascot Reports Robust Feasibility Study With After-Tax IRR of 51%

Assuming US$1400 gold, $17.00 silver, and a CAD to US exchange rate of 0.76, we arrive at the following values (note how current spot metal prices drive values higher):

- Base case Pre-Tax Net Present Value (“NPV”) NPV5% of $516M, internal rate of return (“IRR”) IRR of 62%;

- Base case After-tax NPV5% of $341M and IRR 51%, and after-tax payback period of 1.8 years;

- Assuming a spot gold price of US$1710 per ounce and a CAD to US exchange rate of 0.71, the project economics increase to an after-tax NPV5% of $602M and an IRR of 78% (editors personal note: “BOOM”);

- The base case utilizes Proven and Probable Reserves of 6.2Mt at 5.9g/t gold and 19.7g/t silver; this includes the impact of the mining dilution and excludes all resources outside of planned stopes;

- Low initial capital expenditure of $147M, including a 9% contingency, and 22% indirect costs;

- Life of Mine (“LOM”) payable production of 1.1Moz of gold and 3.0Moz of silver with peak production of 180 thousand gold equivalent ounces;

- LOM operating costs (“C1”)* of $145 per tonne processed or US$642 per payable ounce produced and LOM all in sustaining costs (“AISC”)* of $174 per tonne processed or US$769 per payable ounce produced.

They say “Good Grades Make For Good Miner’s”.

read: Ascot certainly has the grade.

GT Gold (GTT.V)

- 125.89 million shares outstanding

- $198.91M market cap based on its recent close at $1.58

GT Gold’s 100% owned Tatogga Property encompasses two areas of intense interest:

Saddle North:

• Large-scale, high-grade Cu-Au porphyry system, mineralized to near surface with grades increasing at depth;

• Grades exceeding 1.0% CuEq /1.5 g/t AuEq over 777 meters including 1.5% CuEq / 2.0 g/t AuEq over 342 meters.

Saddle South:

- An extensive near-surface zone of high grade Au-Ag epithermal mineralization spanning some 1,000 m X 150 meters X 700 meters;

- High-grade zones locally show good continuity across sections both near surface and at depth;

- Mineralized system remains open along strike and at depth.

Of the two deposits, Saddle North bears flagship status.

A few months back, GTT announced results from metallurgical test work:

On April 28, the company completed a geological model for the Saddle North project and announced exploration plans for the upcoming field season:

read: GT Gold Provides Saddle North Geological Model and 2020 Plan for Exploration

There’s a lot of geological detail in the above press release. The company states, “An initial 10,000 metre diamond drill program has been budgeted, as a first phase of follow-up, on these two high priority target areas, planned for the summer 2020 field campaign.”

NEVADA

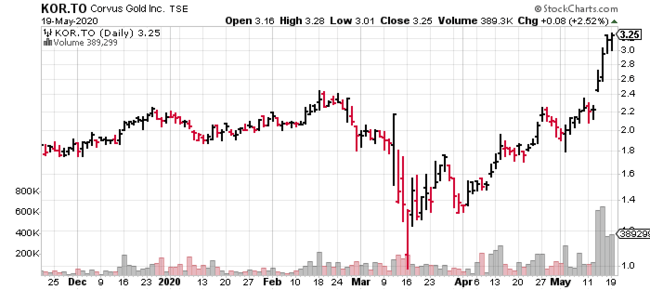

Corvus Gold (KOR.V)

- 123.99 million shares outstanding

- $402.96M market cap based on its recent $3.25 close

Corvus’ primary focus is developing its two flagship projects along the Walker Lane Trend.

North Bullfrog, situated eight kilometers north of the Bullfrog mine formerly operated by Barrick, encompasses some 86.6 square kilometers of prospective terrain.

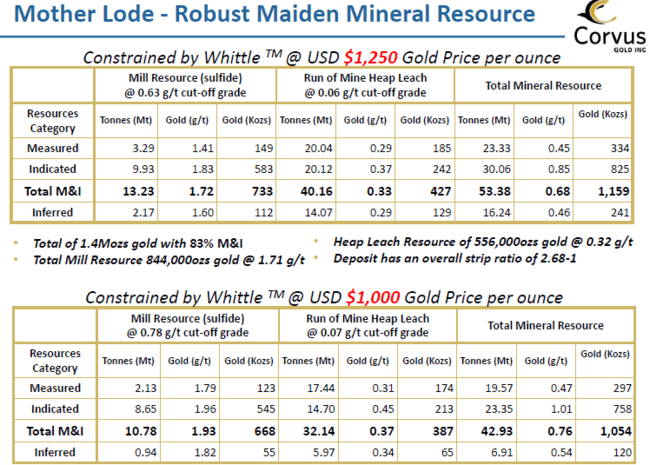

The Mother Lode project covers an area of roughly 36.5 square kilometers.

Both projects have also seen their geological footprints expand in recent months, the Motherlode project having delivered long drill intercepts including 126 meters of 1.85 g/t Au.

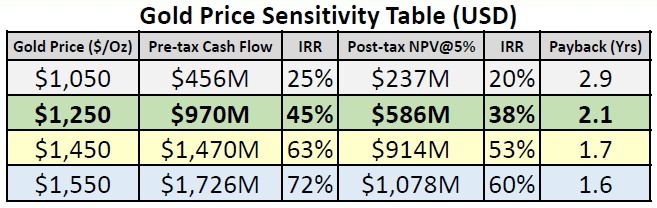

A PEA tabled back in 2018 demonstrates the following values (assuming a conservative $1,250 gold price):

- Post tax NPV 5% = $586M;

- Post tax IRR = 38%;

- Initial Capex = $424M;

- Sustaining Capital = $60M;

- A 2.1 yr payback period;

- LOM avgerage production = 282Kozs/yr.

Recent headlines continue delivering value with the drill bit:

Recent headlines continue delivering value with the drill bit:

- Jan. 14, 2020 – Corvus Gold Expands Mother Lode Main Zone with 36.6m @ 2.43 g/t Au & New Central Intrusive Oxide Zone Below Main Zone with 41.2m @ 1.60 g/t Au (incl. 15.2m @ 3.60 g/t Au & 6.1m @ 5.3 g/t Au)

- Jan. 30 – Corvus Gold Continues to Expand Mother Lode Main Zone with 59.4m @ 1.51 g/t Au & Additional Intercept of Lower Central Intrusive Oxide Zone with 22.9m @ 1.62 g/t Au

- Feb. 20 – Corvus Gold Intersects High-Grade Gold in First North Deep Target Core Hole Returning 19.3m @ 2.79 g/t Gold & 6.3 g/t Silver, including 11.4m @ 4.01 g/t Gold & 10.4 g/t Silver

- Feb. 25 – Corvus Gold Expands Main Zone with 88.4m @ 1.92 g/t Au and Central Intrusive Oxide Zone at Mother Lode Deposit, Nevada (nice hits)

- April 15 – Corvus Gold Continues To Expand Main Zone With 42.7m @ 1.98 g/t Gold and 47.2m @ 1.47 g/t Gold at Mother Lode Deposit, Nevada

This monster hit just dropped while I was editing this piece…

That’s a nice hit. The market seems to agree.

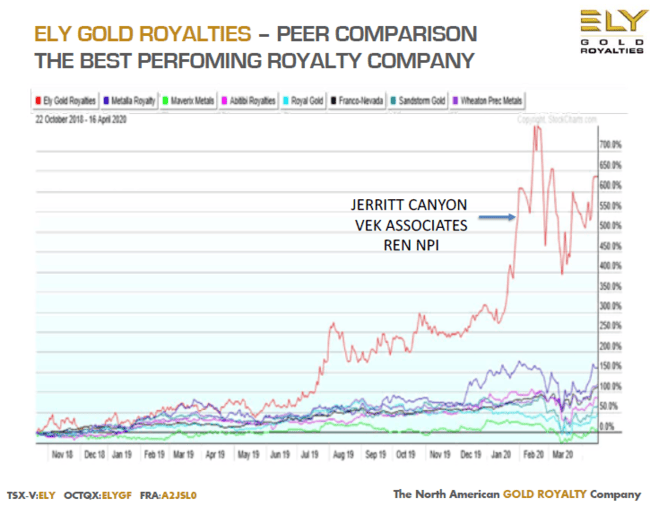

ELY Gold Royalties (ELY.V)

- 130.93 million shares outstanding;

- $119.03M market cap based on its last trade at $1.10

ELY is an emerging royalty company with projects based in Nevada and the Western U.S.

Recent share price strength boosted the company’s market cap to > $100M. Shareholders are celebrating this newfound wealth.

The company’s royalty portfolio is extensive. It consists of royalties on 3 producing assets, 8 projects that’ll see production within three years, 22 development projects, and a plethora of exploration stage projects.

The company has an interesting chart in its i-deck making comparisons with its peers…

To generate this steep share price trajectory, newsflow has been steady over the past few months. The company’s acquisition spree continues.

Recent headlines include:

- February 4, 2020 – Ely Gold Royalties (TSX-V: ELY, OTCQB: ELYGF) Announces Intent To Purchase Producing Royalty On Jerritt Canyon Mine, Elko County, Nevada

- February 25, 2020 – Ely Gold Royalties (TSX-V: ELY, OTCQB: ELYGF) Options Tonopah West Project in Nevada to Blackrock Gold Corp.

- February 28, 2020 – Ely Gold Royalties Acquires Key Nevada Royalty Portfolio

- March 13, 2020 – Ely Gold Closes Purchase of Net Profit Royalty from Liberty Gold

- March 30, 2020 – Ely Gold Royalties (TSX-V:ELY, OTC:ELYGF) Announces Closing of Additional Claims at Producing Gold Bar Mine, Nevada

- April 3, 2020 – Ely Gold Royalties (TSX-V: ELY, OTCQB: ELYGF) Closes the Purchase of Tonopah Patented Claims

- April 14, 2020 – Ely Gold Royalties (TSX-V: ELY, OTCQB: ELYGF) Closes Additional Carlin Trend Royalty

You see a trend developing here?

This is how you create shareholder value.

Over the past few sessions, the company dropped the following headlines:

read: Ely Gold Royalties (TSXV: ELY) (OTCQX: ELGYF) Announces Closing of the Purchase of Jerritt Canyon NSR

read: Ely Gold Royalties (TSXV: ELY) (OTCQX: ELYGF) Closes Purchase of Important Nevada Royalty Portfolio

It’s a challenge keeping up with this one.

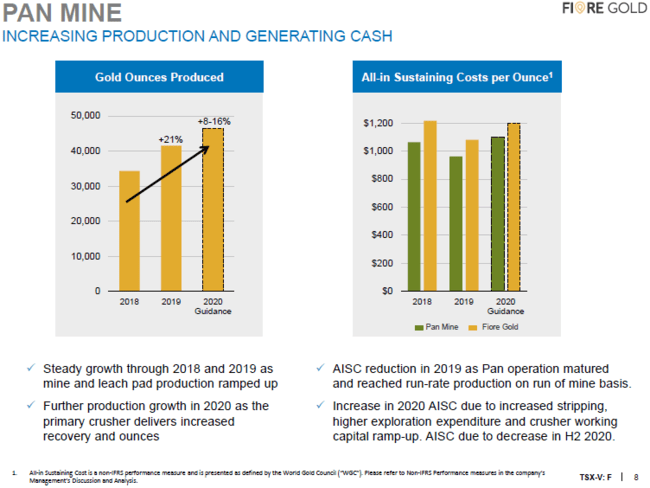

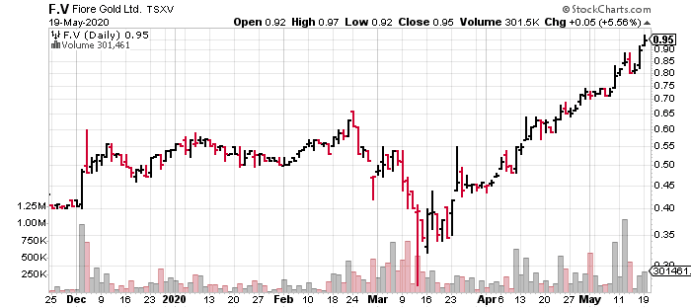

Fiore Gold (F.V)

- 98.05 million shares outstanding

- $93.15M market cap based on its recent $0.95 close

Fiore is a relatively new producer in the gold space.

The company’s Pan Mine in Nevada—a Carlin-style, open-pit, heap-leach mine on the prolific Battle Mountain-Eureka Gold Tend—is just the beginning of what the company believes will evolve into a 150,000 oz-per-year production scenario.

On April 9, the company dropped a PEA for its Gold Rock project located approximately 8 miles southeast of its Pan Mine:

read: Fiore Gold Announces Gold Rock PEA Results

Gold Rock PEA Highlights:

- Pre-tax NPV5% of US$49.7M and a 22.8% IRR (after-tax NPV5% of US$32.8M and a 17.8% IRR) at base case gold price of US$1,400/oz Au, with a life of mine cash flow of US$77.2M;

- At US$1,500/oz Au the Project returns a pre-tax NPV5% of US$78.3M and a 31.5% IRR (after-tax NPV5% of US$55.0M and a 25.4% IRR), with a life of mine cash flow of US$113.1M;

- Based on a sensitivity analysis at approximately the current spot price of US$1,600/oz Au the Project returns a pre-tax NPV5% of US$106.8 and a 39.7% IRR (after-tax NPV5% of US$77.2M and a 32.5% IRR), with a life of mine cash flow of US$149.0M;

- The updated resource estimate shows a 69% increase in Indicated resource to 403,000 gold ounces, in addition to the Inferred resource of 84,300 gold ounces, with excellent potential to grow the resource with next phase of planned drilling;

- Mine life of 6.5 years with life of mine (“LOM”) total gold production of 362,750 oz, averaging 55,800 oz annually;

- LOM cash costs of US$903/oz Au and LOM all-in sustaining costs (“AISC”) of US$1,008/oz Au

Pre-production capital expenditures of $64.6 million, sustaining capital expenditures of $7 million and reclamation costs of $16 million.

There’s good leverage here in a rising gold price environment.

On April 14, the company reported good quarterly numbers out of its Pan mine:

read: Fiore Gold Reports 38% Increase in Gold Production Compared to Q1 2020

Tim Warman, Fiore’s CEO:

“In Q2 2020, the crushing circuit at Pan demonstrated its true potential as the mine produced over 12,000 gold ounces at the higher recovery levels we expected after transitioning to crushing. These higher production levels came at the same time as increased gold prices allowing us to put cash on the balance sheet while continuing to invest in drilling at Pan. We are pleased we can reiterate our 2020 guidance but acknowledge the uncertainty of the upcoming period. With our strengthened balance sheet and contingency planning in place we are well prepared to meet potential challenges.”

On May 12, the company reported the following values from an ongoing drilling campaign at their Pan Mine project:

- Hole PR20-006 returned 32.0 metres of 0.75 g/t gold;

- Hole PR20-008 returned 30.5 metres of 0.76 g/t gold;

- Hole PR20-013 returned 27.4 metres of 0.74 g/t gold;

- Hole PR20-016 returned 38.1 metres of 0.92 g/t gold;

- Hole PR20-031 returned 25.9 metres of 0.74 g/t gold;

- Hole PR20-040 returned 74.7 metres of 0.74 g/t gold;

- Hole PR20-052 returned 27.4 metres of 0.68 g/t gold;

- Hole PR20-053 returned 30.5 metres of 0.60 g/t gold;

- Hole PR20-055 returned 15.2 metres of 2.60 g/t gold

The company’s stock is on a roll, showing some impressive price trajectory (note the handsome star-stepping symmetry)…

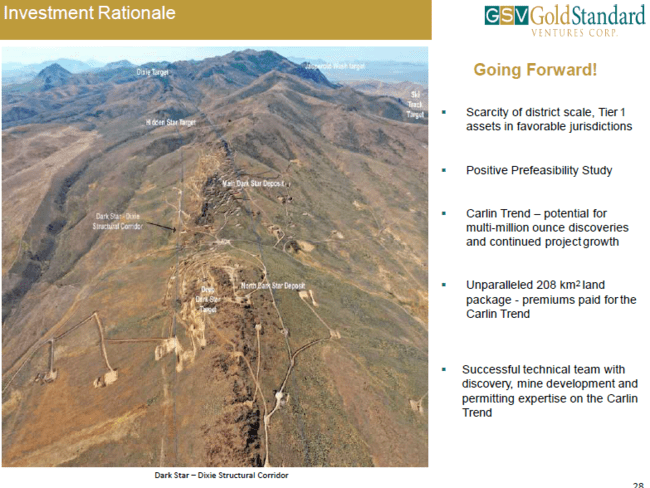

Gold Standard Ventures (GSV.T)

- 278.32 million shares outstanding

- $281.11M market cap based on its recent $1.01 close

Gold Standard’s flagship Railroad Project is located along the Piñon mountain range of the Railroad Mining District of Nevada.

The company’s Pinion deposit has an indicated resource of 31.61 million tonnes grading 0.62 g/t Au for 630,300 ounces of gold and an inferred resource of 61.08 million tonnes grading 0.55 g/t Au for 1,081,300 ounces of gold.

This resource is due for revision to include recent success with the drill bit.

Dark Star, 2.1 kilometers to the east of Pinion, has an indicated resource of 15.38 million tonnes grading 0.54 g/t Au for 265,100 ounces of gold and an inferred resource of 17.05 million tonnes grading 1.31 g/t Au for 715,800 ounces of gold.

This resource is also due to be revised.

A few months back, the company tabled an updated PFS for the South Railroad portion of the Railroad-Pinion project consisting of the Dark Star deposit and Pinion deposit.

(Updated) PFS highlights:

- An after tax NPV of $265.0M with a mineral reserve pit designs based on a gold price of $1,250 per ounce and a silver price of $15.30 per ounce;

- After-tax IRR of 40.0%;

- Average annual gold placement of 156,000 ounces of gold per year over an initial 8-year mine life;

- Average life of mine cash cost of $582 per ounce after by-product credit, and all in sustaining costs (“AISC”)1 of $707 per ounce;

- Proven and probable mineral reserves of 1.246 million ounces of gold and 2.705 million ounces of silver;

- Life of mine strip ratio of 3.1:1;

- Initial capital expenditures of $132.9M;

- Project economics include 15% contingency.

More recently, on May 5, the company announced a maiden resource estimate for its Lewis project:

- Inferred Mineral Resource of 205,827 troy ounces of gold and 3,537,268 troy ounces of silver contained in 7.74 million tonnes at a grade of 0.83 g Au/t and at a grade of 14.22 g Ag/t (at a lower cutoff of 0.20 g Au/t), yielding a combined total of 248,300 troy ounces of gold equivalent (“AuEq”) at a combined grade of 1.0 g/t AuEq (using a ratio of 80 to 1 silver to gold).

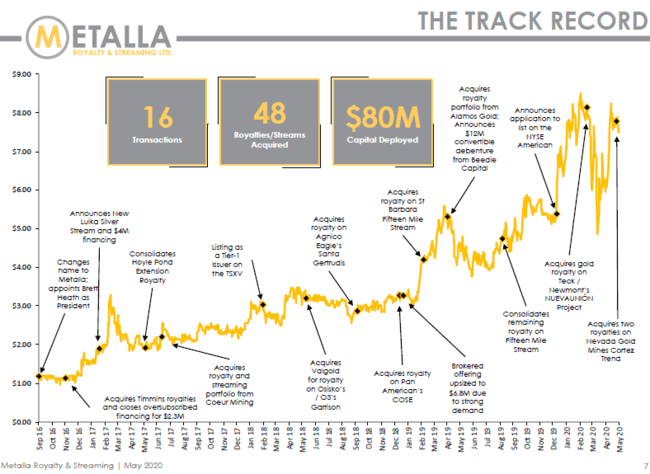

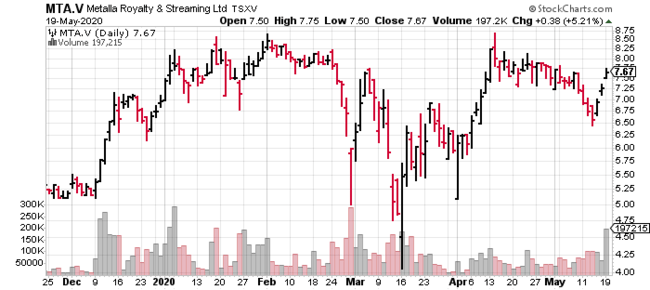

Metalla Royalty and Streaming (MTA.V)

- 34.44 million shares outstanding

- $263.45M market cap based on its last trade at $7.65

We’re slotting Metalla into the Nevada space due to its recent NV acquisition.

First…

Metalla has inked a number of high-quality deals with third parties on existing royalties and streams operated by some of the biggest and best in the gold and silver arena: Agnico Eagle (AEM.T), Newmont-Goldcorp (NGT.T), Pan American Silver (PAAS.T), St. Barbara (SBM.AX), Osisko (OR.T), and more recently, NGM, a JV between Newmont and Barrick (ABX.T).

The pace on the acquisition front has been impressive.

Earlier this year, the company announced a royalty acquisition on a massive Teck-Newmont project in Chile…

read: Feb. 18, 2020 news: Metalla Acquires an Existing 2.0% Gold Royalty on Teck / Newmont’s Nuevaunión Project

Here, the company acquired a 2.0% NSR royalty on future gold production from a portion of the La Fortuna deposit and prospective exploration ground forming part of the NuevaUnión Project located in the Atacama region of that country.

Metalla’s recent Nevada deal

read: Metalla to Acquire Strategic Cortez Trend Royalties

For $4M in cash and shares, Metalla secured two Gross Overriding Royalties (GORs) on a pair of claim blocks strategically located along the prolific Battle Mountain-Eureka Trend.

The Anglo/Zeke claims (0.5% GOR):

These claims cover more than 7,500 hectares of exploration land owned by NGM east and southeast of the Goldrush deposit.

- NGM is a joint venture between Barrick Gold (61.5%) and Newmont (38.5%), a JV created in July 2019 to combine Barrick and Newmont’s significant assets across Nevada. This union between mining giants helped create the single largest gold producer in the world.

- The Goldrush deposit is a large Carlin-type gold development project targeting 450,000 ounces of gold per annum during its first full five years of operation beginning in 2021. Reserves currently stand at 2 million ounces at 9.7 g/t gold. Measured and Indicated resources currently stand at 9.4 million ounces at 9.4 g/t gold.

The company’s shares came off in recent sessions. Buying weakness in the $6.50 range last week paid off handsomely for value seekers.

If you don’t have exposure to a royalty- streaming company in your precious metals portfolio, why not???

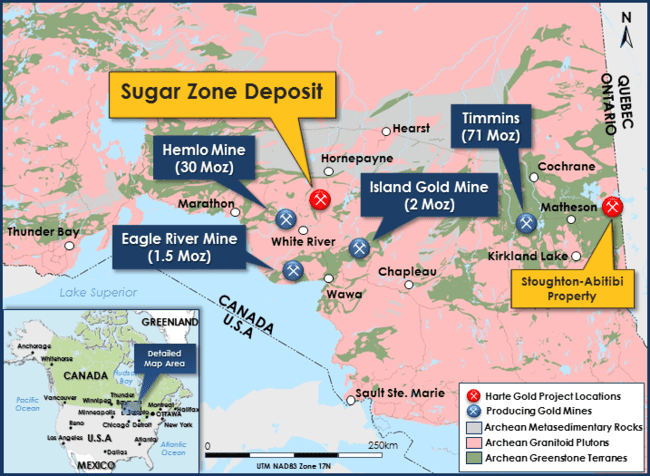

Ontario – Quebec

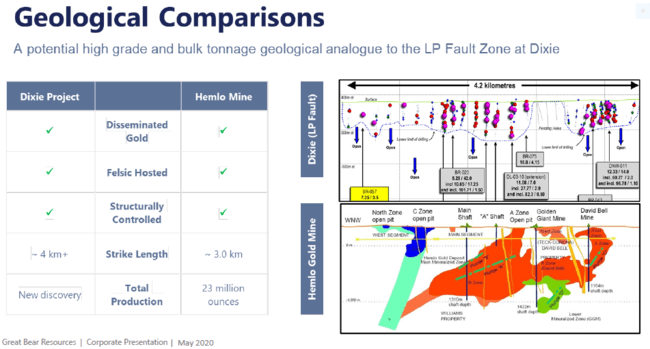

Great Bear Resources (GBR.V)

- 48.03 million shares outstanding

- $568.62M market cap based on its recent close at $11.84

Great Bear traveled from mere pennies to a twelve-dollar bill in a compressed period of time. How did it achieve this extraordinary trajectory? Tagging a world-class asset certainly helped. But the company also kept its share structure super tight. The fewer the shares outstanding, the bigger bang for the buck when the drill bit hits its mark.

We recognized the early potential of Great Bear’s Dixie Project in the Red Lake region of Ontario, shortlisting the stock at $2.00 back in January of 2019.

Since then, the 18-kilometer long LP Fault Zone has received the lions share of attention where the company is targeting broader zones of potentially economic mineralization.

The high-grade zones at Dixie are pretty damn sexy, but the LP Fault Zone’s long intervals of lower to moderate grade material is where the resource ounces will pile up in a hurry.

It would require multiple pages of dense reporting to fully capture the underlying dynamics here. A brief summary of recent drill results will have to suffice.

On April 9, the company dropped the following headline:

read: Great Bear Expands Shallow High-Grade Gold at LP Fault Including 42.70 g/t Gold Over 3.00 m Within 4.24 g/t Gold Over 52.15 m; Results From Gap in Drilling Include 9.35 g/t Gold Over 6.50 m Within 1.66 g/t Gold Over 46.10 m

As of April 9, the company completed 83 of a planned 300 hole campaign, one designed to test the LP Fault target as part of a 5,000 meter long by 500 meter deep (grid) drill program.

Here’s the thing—gold mineralization has been intersected in all (100%) of the drill holes for which assays have been returned to-date. How freaking cool is that?

Highlights from this early April press release:

- New lateral and vertical drill spacing on 25 – 100 metre centres has confirmed apparent continuity of gold mineralization on multiple drill sections.

- Drill hole BR-101 intersected multiple shallow mineralized intervals along 110 metres of core length. Assays include 42.70 g/t gold over 3.00 meters, including 118.00 g/t gold over 0.50 metres, within a broader interval of 4.24 g/t gold over 52.15 metres.

- Drill hole BR-102 intersected the on-strike continuation of the same shallow mineralization and is collared 143 metres to the southeast of BR-101. Assays include 23.17 g/t gold over 3.50 metres, within a broader interval of 3.10 g/t gold over 48.00 metres.

- Previously reported drill hole BR-020 (September 3, 2019), which assayed 10.65 g/t gold over 17.25 metres, within a broader interval of 5.28 g/t gold over 42.0 metres, is the continuation of the same shallow mineralization and is collared 84 metres south of BR-101.

- The high-grade gold mineralization intersected in BR-020, BR-101 and BR-102 is apparently continuous and projects to within metres of the surface, below shallow gravel cover. Mineralization remains open to extension in all directions. Figure 2.

- A series of nine drill holes were completed within a previously undrilled gap in the LP Fault system (formerly, the Gap zone). Highlights include drill hole BR-120 which intersected 9.35 g/t gold over 6.50 metres, which included 97.50 g/t gold over 0.50 metres, within a broader interval of 1.66 g/t gold over 46.10 metres.

- Drill hole BR-121, completed on the same section as BR-120, intersected 4.91 g/t gold over 6.40 metres, which included 18.10 g/t gold over 1.00 metre, within a broader interval of 1.07 g/t gold over 73.85 metres.

- BR-120 and 121 transect the same gold zone 130 and 240 vertical metres below previously disclosed drill hole BR-075 (December 16, 2019), which assayed 16.80 g/t gold over 4.15 metres, within a broader interval of 1.25 g/t gold over 45.50 metres.

- Results show apparent continuity of gold mineralization over approximately 400 vertical metres from surface in this area, which remains open to extension in all directions.

Chris Taylor, Great Bear CEO:

“We continue to observe excellent lateral and vertical continuity of mineralization within the LP Fault gold system. Despite the ongoing COVID-19 pandemic, we have been able to maintain drill operations while continuing to protect our work crews with strict risk mitigation protocols. All geologists and geotechnical staff on site are Red Lake residents, which gives us sufficient staff for three of our five drill rigs to remain active. We plan to return to full drill capacity once pandemic-related work restrictions are lifted, and it is safe to do so. However, even with three active drill rigs the full estimated 300 drill hole program remains on track to be completed by December 2020.”

Harte Gold (HRT.T)

- 846.21 million shares outstanding

- $114.24M market cap based on its recent close at $0.135

Some might call it ‘Harte Break Gold’, but I’m keeping it on our list due to the ounces-in-the-ground, and the jurisdiction.

Ramping up a new mine is rarely a seamless task.

The news that jarred shareholders’ nerves, triggering a wave of selling, arrived in November of 2019.

read: Harte Gold Provides Third Quarter Update and Guidance for 2019

“Quarterly results when compared to the Feasibility Study were below target. Based on results to-date, full year 2019 guidance has been adjusted to 24,000 to 26,000 ounces at an AISC of US$2,000 to US$2,200 per ounce. Previous guidance was 39,200 ounces at an AISC of US$1,300 to US$1,350 per ounce.”

After the company made some ‘adjustments’ to its management team, it pushed through a hefty raise—168,750,000 Flow-Through Shares priced at C$0.16 for gross proceeds of C$27,000,000—funds it desperately required to bring the project back into the light.

On April 17, the company dropped the following headline:

read: Harte Gold Announces Continued Quarterly Production Growth

Positioning oneself in these shares today is a bet that current management will resolve the operational issues that torpedoed the stock months back. The current share price might look cheap, but you need to match it against the current 846.21 million shares outstanding.

Pure Gold (PGM.T)

- 359.23 million shares outstanding

- $427.49M market cap based on its recent $1.19 close

Pure Gold’s resource at its Red Lake Madsen Project currently stands at 2.1 million ounces at 8.9 g/t Au Indicated and 500k ounces at 7.7 g/t Au Inferred.

Just over a year ago, the company tabled a positive feasibility study (FS) based on a portion of the above resource block—3.5 Mt at 9.0 g/t containing 1.0 million ounces. These reserves serve as the foundation for a host of robust economics over a projected 12-year mine life.

“The Madsen Red Lake ore body is an exceptional foundation on which to build a gold mining company. With Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold included in a Mineral Resource of 7,196,000 Indicated tonnes grading 8.9 g/t gold for 2,063,000 ounces of gold and 1,880,000 Inferred tonnes grading 7.7 g/t gold for 467,000 ounces of gold, the Madsen Red Lake Gold Project is the highest grade development stage gold deposit in Canada and will be in the top 8 percentile globally when in production.”

The Feasibility Study

- Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold;

- Low initial capital requirement of $95 million including a 9% contingency;

- Mine life of 12.2 years with a 13 month pre-production period;

- Peak annual production of approximately 125,000 ounces with average annual gold production in years 3 through 7 of approximately 102,000 ounces;

- Life of mine (LOM) direct operating cash cost estimated at US$607 per ounce of gold recovered;

LOM all in sustaining cash cost estimated at US$787 per ounce of gold recovered; - Pre-tax NPV5% and IRR of $353 million and 43% respectively with a 3.0 year payback of initial capital;

- After-tax NPV5% and IRR of $247 million and 36% respectively with a 3.4 year payback of initial capital.

This economic study is anchored by a $1,275 gold price (gold is currently trading north of $1,750 as I type). The project’s economics will look vastly superior in this light. And the market is beginning to see the potential.

The stock broke out to multi-year highs in recent sessions.

On May 11th, the company dropped the following update…

read: Canada’s Next Gold Mine on Track for First Gold Pour in Q4

Darin Labrenz, President and CEO:

“We are not just building an integrated mining operation. We are building a fully-funded, long-life growth company uniquely positioned in the Red Lake camp, one of the world’s largest gold-producing districts. Our opportunity is tremendous: the real potential to become Red Lake’s next senior gold producer. Our 47km2 property possesses a proven, large high-grade gold system, with the same rocks, structure, timing, geology, grade and endowment potential as Evolution’s Red Lake mine just 15 kilometres away. Work to date has proven we have a clear and precise understanding of the geology and district, and we have demonstrated our ability to execute on our goals. Our future cash flow will fund our aggressive gold growth plans, and there is no more important time to be building a gold mine.”

Pure Gold will be pouring Au before the year is out.

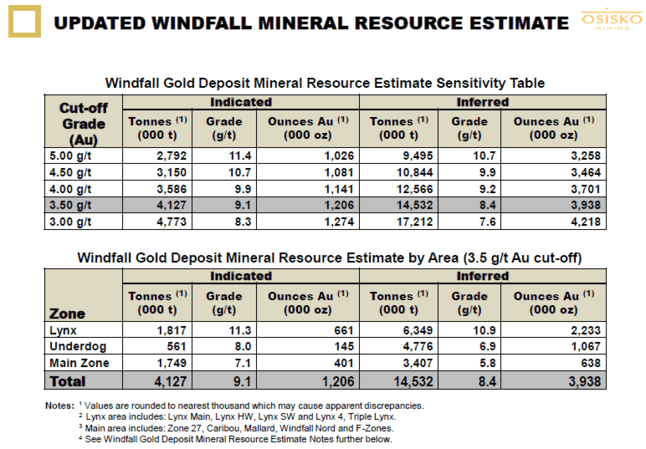

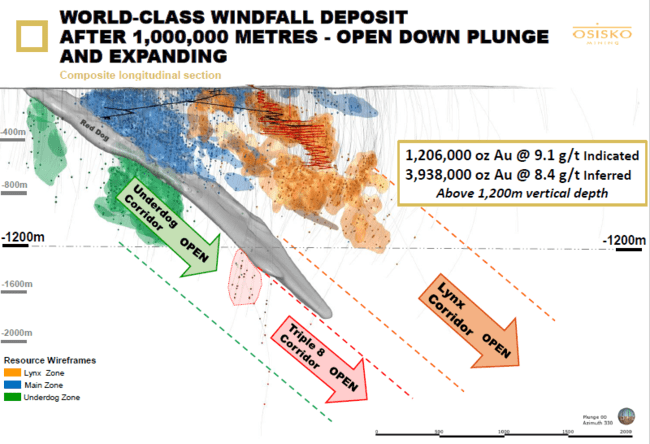

Osisko Mining (OSK.T)

- 291.07 million shares outstanding

- $1.17B market cap based on its recent $4.01 closing price

Osisko is solidly a member of the one-billion-dollar club.

The company’s assets include:

- A 100% interest in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau, Québec.

- A 100% undivided interest in a large area of claims surrounding the Urban-Barry area and nearby Quevillon area (over 3,300 square kilometers).

- A 100% interest in the Marban project located in the heart of the Abitibi.

- Properties in the Larder Lake Mining Division in northeast Ontario.

- Interests and options on a number of properties in northern Québec and Ontario.

The company has control of a (high-grade) world-class asset. With > 5M ounces, Windfall has Tier-1 potential, the object of every Senior Miners desire.

Osisko’s $1B-plus market cap comes after having drilled over 1,000,000 meters (or 1,000 kilometers).

Osisko’s $1B-plus market cap comes after having drilled over 1,000,000 meters (or 1,000 kilometers).

The volume of assay related drill hole data in Osisko’s Newsroom is daunting.

The company is well financed with more than $250M in fully diluted cash and equities.

250,000 metres of infill and exploration drilling is the expectation for Windfall in 2020, with no less than 20 drill rigs. Damn!

A feasibility study in progress

Final thought

With all this loose money sloshing around the system courtesy of the Fed’s rendering of Printing Presses Gone Wild, and the likelihood that interest rates will remain grounded indefinitely, it’s no wonder many of these high-quality Junior’s are beginning to attract a much wider audience.

In the next round-up piece, expected within the next ten days or so, we’ll work our way down the food chain and explore some of the less costly ExploreCos on our shortlist—those with market caps between $20M and $80M. That round-up will be followed by our always popular sub-$20M shortlist.

END

—Greg Nolan

Full disclosure: of the companies featured in this piece, only Metalla is an Equity Guru marketing client.

Good list, but I would like to point out that the real leverage can be found in smaller explorers that did good in 2011 as the metals exploded. Interesting: (TSX-Symbols) SSE, CBI, BHS, PSL, EAS

And AUMN on the NYSE.

Thanks.

For sure Jack. Note the last paragraph….

“In the next round-up piece, expected within the next ten days or so, we’ll work our way down the food chain and explore some of the less costly ExploreCos on our shortlist—those with market caps between $20M and $80M. That round-up will be followed by our always popular sub-$20M shortlist.”

One standout from the previous cycle was Pioneer Metals. I established a large position in Pioneer at $0.12 in 2001 after learning of its plans to spin off its uranium assets into a new company called UEX Corp. For each share of Pioneer held, I received an equal number of UEX. It was like a 2:1 stock split, except the additional shares represented a new company. The market failed to recognize the significance of the setup.

In 2002, Pioneer successfully completed the transaction, and it was an immediate success. In 2006, Pioneer itself was bought out by Barrick for $1.00 per share. In 2008, UEX climbed as high as $9.00 per share.

Not bad for a twelve cent anti.