A share consolidation (or roll-back) is an implicit admission that: 1. stock price is embarrassingly low, 2. there are a lot of shares outstanding. 3. the company is short of cash.

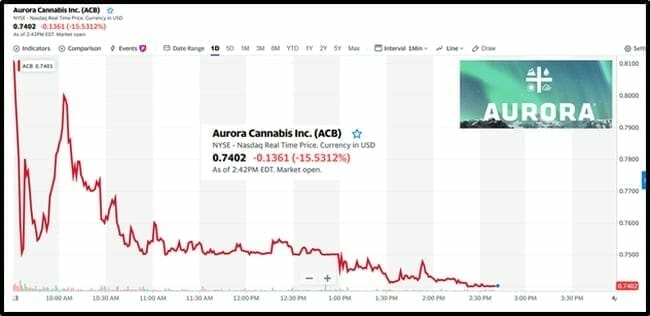

Aurora Cannabis (ACB.NYSE) just announced a 12-1 roll-back today.

Aurora has 1.3 billion shares outstanding and it is short of cash – but the roll-back has an auxiliary motivation.

Aurora Cannabis has spent the last 30 days trading below USD $1 on the New York Stock Exchange (NYSE). For public companies to remain listed on the NYSE, they need to trade north of $1.

Last Thursday, April 9, 2020 ACB was trading at USD $.90. Barring a further share price depreciation, at 2-1 roll-back would leave them with 650 million shares and a SP of $1.80. A 5-1 roll back would leave them with 260 million shares and a SP of $4.50.

A 2-1 or 5-1 roll-back would appear to leave plenty of wriggle room to maintain good status on the NYSE.

The 12-1 roll-back is an act of profound conservatism – or pessimism – or both.

To be clear, if you own 3% of ACB today, you’ll still own 3% after the roll-back.

Barring further SP depreciation, the roll-back – scheduled to take effect on May 11, 2020 – would leave Aurora with 109 million shares and an SP of USD $10.80.

But come May 11, 2020 – the SP may be lower than that.

It is trading down sharply today.

The April 13, 2020 press release also provided an update related to “ACB’s balance sheet flexibility, business transformation initiatives and COVID-19 operational response plans”.

ACB key highlights:

- $205 million of cash.

- Possible USD $350 million further raise.

- General and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative cost reductions

- Buying less stuff

- Making everything simpler.

- Q3 2020 cannabis net revenue expected to “grow modestly”

“We are taking appropriate actions to strengthen our cash position and maintain financial flexibility as we navigate through the current environment,” stated Michael Singer, interim CEO. “As Aurora drives towards generating positive free cash-flow, we are confident that our shareholders will be supportive of our further actions to solidify our balance sheet.”

Despite the COVID-19 pandemic, “all of Aurora’s facilities in Canada and internationally continue to be fully operational.”

ACB has reorganised physical layouts, adjusted schedules, instituted health screening and issued protective equipment. “Aurora has also introduced a special bonus pay program for active facility-based staff.”

“We have proactively taken the necessary steps to re-engineer our facility workspaces and provide office-based employees with ‘work from home’ arrangements,” stated Singer.

“The simple fact of the matter is ACB is getting around a THIRD of their product returned in real dollar terms,” wrote Equity Guru’s Chris Parry two months ago, “That means they either REALLY suck at growing weed, or they really sucked at figuring out what the market was going to look like when planning their business.”

Aurora is not the only cannabis company in pain. Over the last 12 months, the North American Marijuana Index has plummeted from 302 to 56.

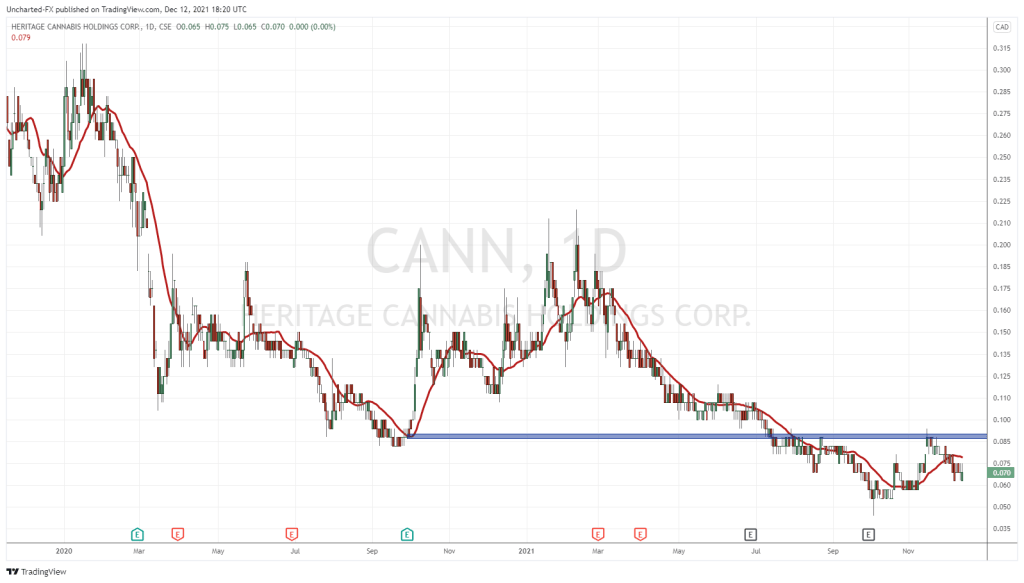

Some of the smaller companies with manageable debt are making solid business sense.

Gaia Grow (GAIA.V) is up 20% today to .03. It recently bought three pre-licence retail cannabis stores, in a deal that proposes Gaia will acquire “all of the share capital of 1202465 B.C. (Nelson store) and Patriot Cannabis Brands (2 Powell River stores) from Blackhawk.

The Nelson Store, located at 306B Victoria Street in Nelson, BC, has an Approval in Principle (AIP) issued by the BC government to operate a cannabis retail store.

With 350 heritage buildings, a fully restored operating streetcar and a thriving small business community, Nelson is “a combination of storybook charm and cosmopolitan sophistication.”

An AIP with BC government does not guarantee you’ll get a greenlight to sell recreational cannabis, although the odds are good.

“We have seven AIP applications,” recounted Kamloops, BC City Business License Inspector Dave Jones last year, “they are pretty well guaranteed a store now. It’s up to those store owners to do their renovations and get everything set up so the Province can come in and do its final inspection.”

On March 2, 2020, Gaia Grow signed an agreement with CannGroup for the sale of 15,000 kilograms of milled hemp powder to CannGroup for processing into cannabidiol oil and distillate.

Milled hemp powder is an ideal feedstock for the production of CBD oil and distillate, and is produced by separating the CBD-rich elements of the hemp plant (such as flowers and leaves) from the low-CBD elements (such as stalks and branches) and grinding them into a powder.

CannGroup has agreed to pay $110 per kilogram, so the total proposed deal is worth $1.65 million – about 25% of Gaia’s current market cap.

Gaia is a licenced hemp producer under Canadian Industrial Hemp Regulations with 4.2 million pounds of hemp biomass from its 2019 harvest and the capacity to mill one tonne of hemp biomass into hemp powder per hour..

Gaia has 1,494 acres growing in southern Alberta, an area equivalent to 1,100 football fields. The agricultural challenge is to simultaneously keep the CBD content high and the THC content low (they tend to creep up together).

On December 23, 2019 Aurora Cannabis announced that ACB Chief Corporate Officer (CCO), Cam Battley left the company to explore other opportunities.

“Battley, along with former Canopy Growth (WEED.T) CEO Bruce Linton, were two of the most vocal and bullish cannabis executives,” stated The Financial Post, “frequently participating in media interviews and honing their commentary into easily digestible sound bites”.

Battley was very good at his job, but ACB shareholders got nasty.

“More bullshit from Scam Battley avoiding to address the elephant in the room,” whined the sub-literate Grumpy Pot Investor, “$ACB is a failure and its ur fault!”

“I believe Twitter was a major reason for @CamBattley being booted to the other side of planet earth,” wrote Scam Battley on twitter, “It was becoming too embarrassing for ACB to constantly be bombarded with gripes about Cam’s bullshit”.

“I warned everyone earlier this year about Aurora’s cash burn,” wrote Stockemups on an investor bull-board, “Now the CCO has bailed on the sinking ship.”

In this August, 2019 Equity Guru podcast, Frederick Pels, the CEO of Gaia Grow, spoke with Equity.Guru’s Guy Bennett about crop insurance and the development of off-take partners “to ensure a successful sale and extraction process of the harvest.”

Aurora rolls back.

Gaia rolls on.

Stay tuned.

– Lukas Kane

Full Disclosure: Gaia Grow is an Equity Guru marketing client