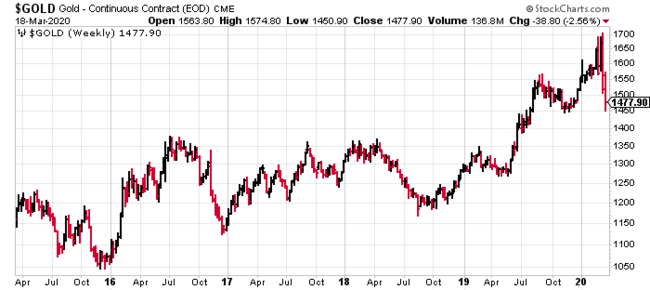

Some ask, “if gold is such a safe haven asset, why did it get sold so unrelentingly when the broader indices caught what-for?”

Great question.

Gold was sold because it was a source of liquidity during a liquidity event. ANYTHING even remotely liquid was sold during the panic, regardless of underlying value or safe-haven caste.

Without question, margin clerks played a major role in gold’s recent volatility.

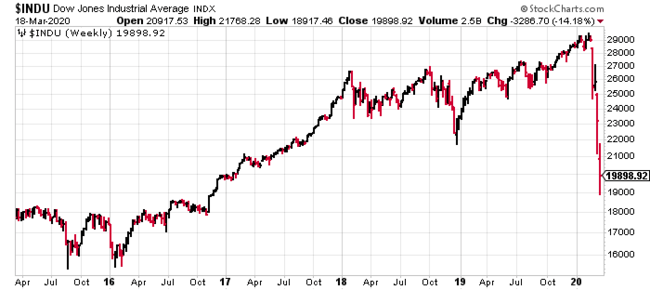

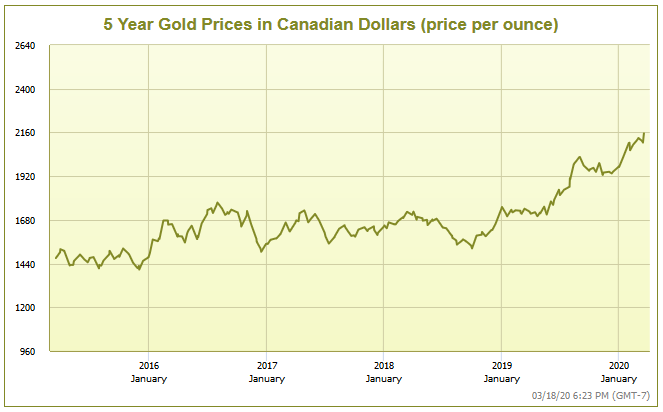

But let’s pit a five-year weekly chart of gold against a five-year weekly of the Dow 30…

Clearly, Gold asserted something of a safe haven role. Without a doubt, Gold was the better buy n hold.

Regarding the broader market meltdowns we’re witnessing, we did our part here, telegraphing the potential dangers well in advance of the carnage that lay ahead:

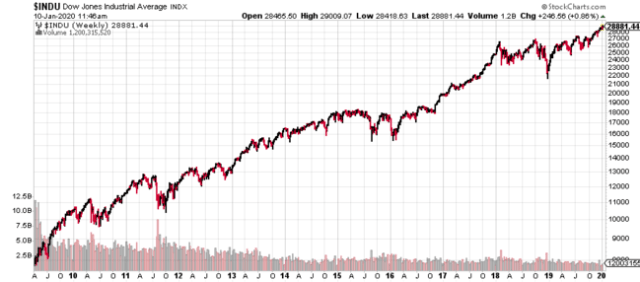

In a January 2020 offering—A “skies the limit” stock market = a house of cards?—we explained why the broader markets were destined for an inescapable date with gravity.

COVID-19 wasn’t on our list of potential catalysts, but it didn’t matter—“it wasn’t the pin, it was the bubble” (the debt)… all that was required was a good breeze and a few stiff gusts to bring the house of cards down.

An excerpt from that timely piece:

“The bull market in general equities has been in force for nearly 11 years—that’s some 130 months, unabated.

The above chart pattern represents the longest-running bull market in American history.

NnGulp!

Equities appear invincible. Indestructible. It would seem nothing—not a damn thing—can knock them off their “skies the limit” trajectory.

And market participants appear to have no conception of the concentrated risk—the ruin the market is capable of unleashing from these dizzying levels.

Of course, the history books are full of reminders of how seemingly functional markets’ can all-of-a-sudden malfunction—blow apart at the seams—in the blink of an eye. That’s history.

It’s gotta be different this time… right?

Fact is, there are a number of catalysts that could erupt and wreak havoc in the days/weeks/months ahead.

It might be time to consult your financial advisor and ponder the idea of reducing your exposure to general equities, and perhaps increasing your weighting in securities that function as a hedge.”

Helicopter cash

There’s been a lot of talk of an imminent (colossal) round of QE coming on. There’s talk of the U.S. gov’t sending out $1k cheques to everyone in the White Pages. Some are even calling for five-year interest-free loans to struggling businesses to help keep the lights on.

It all sounds well n good, and downright decent of politicians to be thinking along these lines, but there’s risk in these measures. Massive risk.

Lone voices in the wilderness recall the words of Grover Cleveland (the only U.S president to serve two nonconsecutive terms) when he vetoed an 1887 bill that would have helped Texas farmers struggling through a drought.

Cleveland wrote:

“I can find no warrant for such an appropriation in the Constitution; and I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering which is in no manner properly related to the public service or benefit. A prevalent tendency to disregard the limited mission of this power and duty should, I think, be steadfastly resisted, to the end that the lesson should be constantly enforced that, though the people support the Government, the Government should not support the people.”

I know. Kinda harsh.

I heard Peter Schiff—an unapologetic gold bull—quote Cleveland recently. Economists like Schiff believe that the gov’t is about to do irreparable damage to the U.S. dollar with the printing press.

A currency’s value is based on the goods and services produced by the state. A massive bailout of this magnitude will result in a dramatic decline in the production of goods and services, not to mention a deluge of paper (money). If the U.S. keeps cranking out paper—some call it counterfeit—and production continues to fall off, the U.S. dollar will collapse and runaway inflation will grip the nation.

This is also a harsh reckoning. But it’s difficult arguing with the logic.

If you don’t know who Schiff is, he’s the man who called the financial disaster of 2008 well in advance.

Listen to one pundit after another publicly deride Schiff, laughing in his face as he detailed with unflinching conviction how chaos would roll out over the financial landscape pre-2008 (Lehman Brothers) meltdown. He was right.

The picture quality is poor, but there’s big-screen drama here…

Equity Guru’s Lukas Kane also referenced Schiff in a piece he wrote recently:

“The 2008 financial crisis was started by a drop in real estate prices, this one is started by the coronavirus,” Schiff told Kitco News, “What’s causing the crisis is not the pins, it’s the bubble; it’s the debt. Because we have even more debt now, this is going to usher in an even bigger financial crisis.”

There’s a flip side to the coin, another way this could play out: deflation.

From Ray Dalio’s The Implications of Hitting the Hard 0% Interest Rate Floor:

“Long-term interest rates hitting the hard 0% floor means that virtually all asset classes go down because the positive effects of interest rates falling won’t exist (at least not much). Hitting this 0% floor also means that virtually all the reserve country central banks’ interest rate stimulation tools (including cutting rates and yield curve guidance) won’t work. The printing of money and buying of debt assets that central banks are now allowed to buy almost certainly won’t work much (because bonds can’t be pushed much higher and they are also less likely to be sold to buy other assets of entities that are in financial trouble). Further, with this hard 0% interest rate floor, real interest rates will likely rise because there will be disinflation or deflation resulting from lower oil and other commodity prices, economic weakness, and more credit problems.”

Where gold comes in

Gold and gold equities, as we’ve pointed out ad nauseam in recent offerings, have a role to play in all of this madness.

I had positive experiences in both the 2001 and 2008 crises, trusting that my gold positions would not only survive the tumult, but go on a serious tear.

I found a recent article by Adrian Day particularly compelling as he recalled those liquidity events and golds response in the weeks and months that followed – No Time for Panic: Too Late to Sell But Too Early for Broad Buyin:

Quoting Day from the above article:

“If previous liquidity panics are any guide—2008, 2001, 1999, 1987—gold will recover very soon as the worst of the forced liquidation passes, and the gold stocks will be the first sector to recover. It may take a week or two, or more likely a month or two; gold stocks fell with the broad market into the October 2008 lows, and then started to recover. By the time the broad market had bottomed, not until March 2009, the gold stocks had more than doubled, far more. Within a year, the gold stocks were back at all-time highs.”

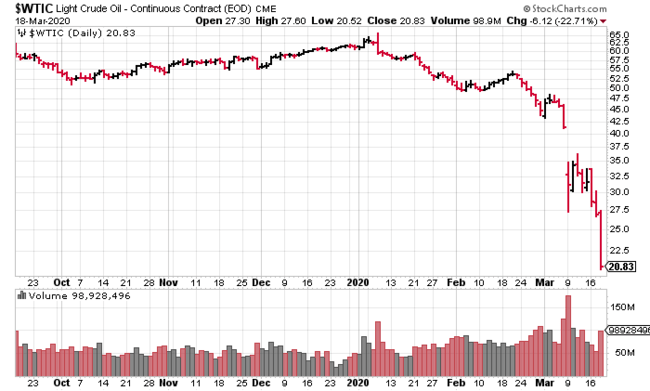

A weak currency and plunging oil prices put Canadian Producers in an enviable position

Energy is a huge cost driver—up to 35%—for Gold Producers, particularly those operating open-pit mines.

Energy = Oil.

Labor costs for mines based in Canadian provinces are denominated in Canadian dollars—no big surprise there.

The price of gold, based in Canadian dollars, is currently trading at roughly $2155, only a chip shot from the all-time highs registered only a few sessions back.

Summarizing the above:

- Plummeting oil prices means lower OPEX (operating expenses).

- A plunging Canadian dollar means lower labor costs, which also means lower OPEX.

- A near-record high gold price means increased revenue for every ounce produced.

- Lower OPEX and fatter commodity prices are a wicked set-up for a miner.

Keep an eye on Agnico Eagle’s (AEM.TO) next quarterly earnings, or any other miner operating in Canada.

The same can be said for companies with producing mines in Australia and Brazil.

Final thought

Got gold?

END

—Greg Nolan