Okay, so the world is burning, the Russians and Saudis are pouring low-cost fuel over it, the Americans are shocked that a reality TV show host with a penchant for scams didn’t make a clever President, Italy is in total lockdown, the Japanese are thinking of holding a spectator-free Olympics, Israel is putting anyone coming home from overseas in two weeks of quarantine, the stock markets are taking their biggest dive ever, and morons are hoarding toilet paper and hand sanitizer while lining up for the free havarti samples at Costco.

GOOD JOB, HUMANS.

At our office, we’re making plans for the inevitable request that we stop coming to work for a while, lining up our remote access programs and project management software – not because we’re panicked crazy people, but because there’d be little point traveling downtown for work if the people you’d normally be meeting aren’t around to meet for a while.

Gas prices are dropping like thunder on a per-barrel basis, while still topping out like there’s a shortage when you’re paying at the pump. Oddly, there doesn’t appear to have been a run on non-perishable food – yet – but if you feed your alcoholism by drinking hand sanitizer (what’s up, drunk uncle Bill), you’re probably better off switching back to vodka for the time being.

But on the markets, where panic is a pastime and fueling said panic is a profitable opportunity, there’s been no shortage of fear.

Basically, everything is down. The only differentiator is whether your company is down by a margin of error, or down by all the gains made since 2017.

In the weed sector, shit is getting real fast.

48North (NRTH.V) lost 21% on news it’s no longer a female-led company, with former CEO Alison Gordon being directed towards the plank, like former Co-CEO Jeanette VanderMarel was a few months prior. Gordon wasn’t afforded the luxury of having parting words in the news release announcing her departure, so one can assume it wasn’t so she could ‘spend more time with her family’, but rather enough shoes had dropped recently at NRTH that the words ‘we’ll ship your stuff to you’ might have been bandied about.

Dionymed Brands (DYME.C) officially gave up the game, announcing it would be delisted at market close today, which means if you still hold that stock you’ve officially been hungry hungry hippoed. DYME was a dumpster fire without the actual asset of a burned out dumpster.

As I wrote back in December:

If you still hold Dionymed stock, enjoy your tax write-off because it ain’t coming back, and what it owns isn’t going to cover what it owes.

Ravenquest (RQB.V) is perhaps the worst of the lot, pretending that it’s renegotiating leases while its landlord is actually seizing equipment.

As previously announced on Jan. 16, the company is in the process of renegotiating its lease in Markham while maintaining operations remotely as a result of the company’s highly sophisticated technological platform.

They’re actually not doing that at all. Despite claiming “that all its Health Canada licences are in good standing and operational.” the company is neglecting to add they’re not actually growing shit, and they can’t cover the $14m debenture they owe, and their much vaunted cylinder-grow technology, which appears to be great in growing mutant, stunted, microweed wrapped around light bulbs, isn’t on anyone’s shopping list.

Even if it was, they don’t appear to own it.

Ravenquest Biomed Inc. has been served with a statement of claim from Roto-Gro Inc. The claim alleges infringement of a Canadian patent related to a stackable modular rotatable gardening system.

Ravenquest is a steaming pile, and has long been that way, if we’re honest. Seemingly set on a business plan of telling tales on competitors in a bid to be allowed to take over their licenses when Health Canada shuts the naughty ones down, when that didn’t pan out, the company invited Bridgemark-connected folks onto its board, giving them $5m in cheap stock in return for a software company they formed a month earlier.

That’s right.. they let Bridgemark walk in the front door and walk off with the TV and silverware, and I dare say they didn’t do that without some financial incentive back the other way.

Two days later, RQB staff were told they were being let go.

Recently, the company announced it was going to be late with audited financials, presumably because announcing you’re out of money makes it hard to find new money. Only today did the company let the cat out of the bag that its landlord has locked them out.

Ravenquest is endeavouring to raise money while negotiations on the convertible debentures have stalled. Negotiations on the company’s two leases for Markham and Edmonton have not yet been finalized. At this point, Ravenquest has limited access to both of its facilities. It will continue to negotiate on its leases in good faith with its landlords.

BCSC, maybe you should toss an investigator in RQB’s direction?

Biome Grow (BIO.C) isn’t having the easiest of time with things in the Canadian cannabis space and, while you can accuse them of getting plans wrong the same as you can most anyone, at least they’re being open about it.

Biome put out a DETAILED, LONG list of their assets and how most of them will either be flipped, de-funded, or written off as the company focuses on its core business.

“The cannabis market has changed significantly over the past year, and we recognize that our initial capital-intensive strategy no longer makes sense in this environment,” shared Khurram Malik, chief executive officer of Biome Grow. “As a result, we have had to make difficult decisions in order to move the business in a different direction. We are working closely with stakeholders and creditors as Biome is straddled with significant liabilities and obligations in connection with these projects.”

- Red Sands brand: Discontinued, no money lost

- WeedVR: Discontinued, minimal initial outlay

- CBD Acres MOU: Mutually terminated, no money lost

- St Francis Xavier University research partnership: Terminated, no money lost

- Highland Grow expansion: Stalled, $1m loan returned, $2m outstanding

- Back Home Medical Cannabis: Expansion halted, reworking partnership with stakeholders

- Great Lakes facility: Construction halted, write-off likely at year-end

While there’ll be some write-offs, debts, and losses here, the biggest damage would likely be to ego. Biome had a wide plan afoot and is now shrinking back to things it does well, and which it can afford, which is far from a stupid move. In fact, it’s good to see.

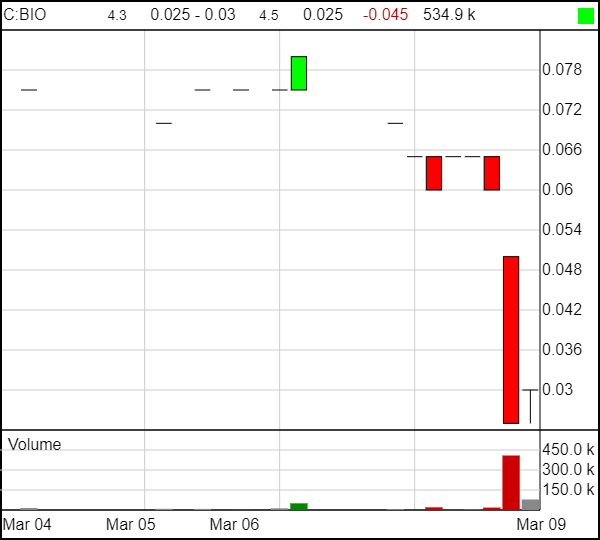

But that doesn’t mean Biome was rewarded for its honesty, and behaving like an adult in a room filled with toilet trainers. In fact, they got slapped hard on the chart, down 64% from $0.07 to $0.025.

Someone wanted to get out bad just before the close.

Now, you can either view that as a sign of the apocalypse, or you can consider Biome’s market cap is, right now, $2.79 million.

That’s all! For a functioning weed facility that sells a good amount of weed locally and which had a net loss of $1.4 million in the last quarter on rising sales of $1.4 million, while shipping 192 kilos of product. Some of that loss was attributed to rising staffing costs on the plan to grow their facilities, which has since been reversed, so one would expect the upcoming financials to be closer to break even.

At $0.025 per share, having just brought in $3 million in financing at 10x that price three months back, Biome has challenges. If it can cut costs and maybe flip an asset or two, it might be able to get out of this quarter close to break even. Assuming sales continue to grow, it might be able to accelerate out of the storm with a hell of an opportunity for stock profit.

But it’s going to be tight.

Clogging up the news release channels is Tilray (TLRY.Q), a stock we never talk about because, why would anyone buy it? Opening its public markets run with an insane US spike that took it to the stratosphere of valuations and made its CEO the highest paid CEO in the business, from day one the only play on the ‘ray has been to short it.

And the shorts have enjoyed doing just that.

Now it’s down so hard the ambulance chasers are digging in.

On January 15, 2019, Tilray issued a press release announcing entry into a marketing and revenue sharing agreement with Authentic Brands Group (“ABG”), “an owner of a portfolio of global lifestyle and entertainment brands” (the “ABG Agreement”).

The Complaint alleges that throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operational and compliance policies. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) the purported advantages of the ABG Agreement were significantly overstated; (ii) the underperformance of the ABG Agreement would foreseeably have a significant impact on the Company’s financial results; and (iii) as a result, the Company’s public statements were materially false and misleading at all relevant times.

On March 2, 2020, Tilray issued a press release announcing the Company’s financial results for the fourth quarter and full year 2019. Among other results, Tilray reported a net loss for the year of $321.2 million, or $3.20 per share, compared to $67.7 million, or $0.82 per share, for 2018. In addition, Tilray disclosed that “the Company recorded non-cash charges of $112.1 million related to impairment of the Authentic Brands Group LLC (‘ABG’) agreement as well as $68.6 million in inventory reserves.”

It’s nothing, really. Tilray stock dropped because it was insanely over-valued, and anyone who bought in on that fakakte Authentic Brands news was going to lose their money some way or another, even if only by getting drunk and walking into traffic with their billfold wedged between their teeth.

“If you lost money on Tilray, call the law firm of you’re a moron who doesn’t look at market caps today!”

Frankly, today’s market activity was enough to put the shakes on the sturdiest of investors, not because we’re all going to die – we’re not – but because if the general population thinks we are, to the point where they’re hoarding fanny wipes, there will be a knock on effect out there in many places.

What we’re really seeing, for mine, is a long-laid plan from the Saudis and Russians to destabilize the US coming to fruition on the back of a pandemic.

While COVID-19 rolls about, the Saudis and Russians have decided to have a price war on oil, which makes the US oil business unprofitable overnight, which also damages the Canadian oil business and has a knock-on effect to the resource sector, and here we are.

Every time a concert is canceled or a sporting event is scheduled to go audience-free, the panic increases. Every time folks look at their 401k and see red, the panic increases. You can stand at the back of all that like it ain’t no thang, refusing to buckle to fear and greed, but when you can’t get to work because the transit system is closed, or your boss won’t let anyone come in, or the schools have closed, or nation states have shut their borders, your bravery will have no reward.

SO WHAT CAN WE DO IN THE MEANTIME?

Okay, let’s assume there’s going to be a bit of a meltdown here. It may not last months, but it will (and has) hurt. Folks are getting cashed up in case this thing sticks about for a while, others are looking for safe haven stocks.

Me? I’m looking for bargains.

TECHNOLOGY:

I’ve been picking away at AMPD Ventures (AMPD.C) for a while, warning along the way that the company is quiet just at the moment because it’s looking to put together substantial deals. It doesn’t need financing, it has contracts on the table, it’s growing its facility count, and its business (high performance computing) isn’t going anywhere in a crisis, but up.

The company has faced selling pressure for a while because the absence of news hasn’t allowed for much liquidity, but the current $8 million market cap is around half what it came to market with just a few months ago, and the group has kept costs pared to the bone early, looking to ensure it’s not reliant on endless financing to grow.

Today might not be the day to buy AMPD, but that day will be nearing and I don’t see the markets as having a whole lot of damage to cause a company that cheap, that doesn’t care if it stays cheap while it’s setting up its business. Watchlist – you’ll know when it’s starting to get serious, and there’ll be plenty of room to grow before it’s anywhere near ‘over valued’.

MINING:

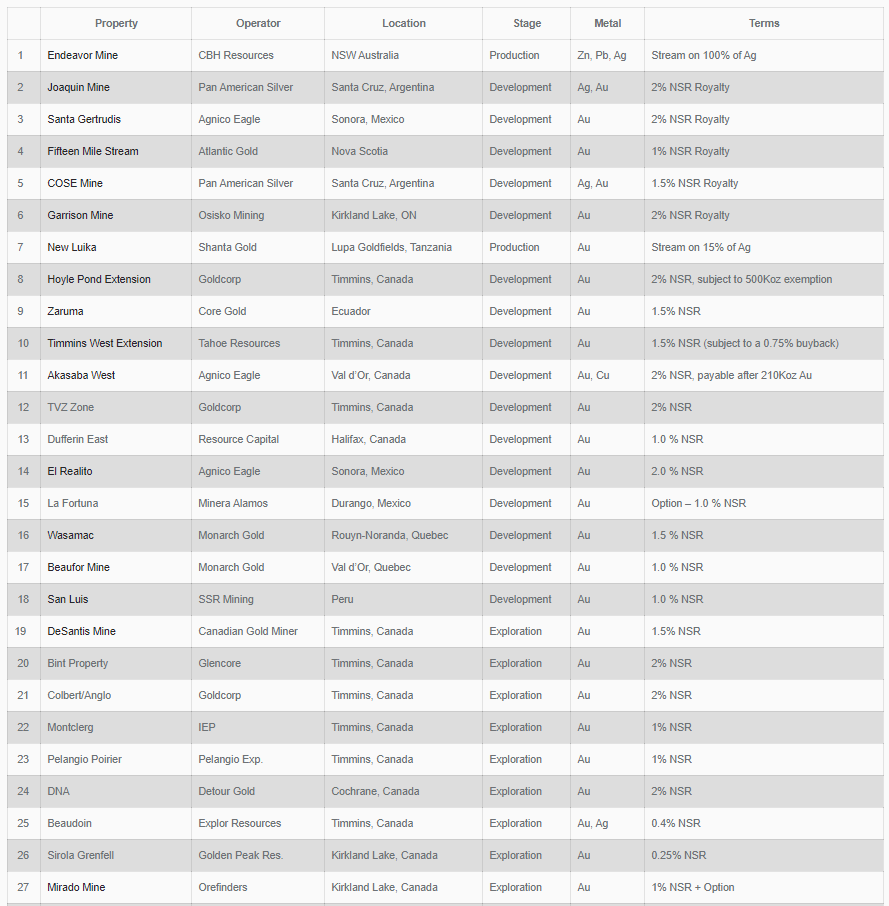

Metalla Royalty and Streaming (MTA.V) is a five alarm fire of revenue generation that, if you’re thinking gold might be a safehaven for you, could be your best bet. Yes, we know gold explorers aren’t running as hard as one might expect, but that’s because what the market is looking for is gold production, not exploration with five years before we see a rich, creamy nugget.

MTA royalties include:

Amazing, right?

Well that’s just the first page. The company has 42 royalties in total, with two in production, 18 in development, and the rest at the early exploration stages.

That’s, frankly, an incredible lineup of royalties generated over just a few years since we first started covering the company.

MILITARY:

Patriot One Technologies (PAT.C) is a longtime client of Equity.Guru’s and investors have generally been happy about that, because PAT’s tech has continued to be tested, accepted, and utilized by government players over the past two years of development.

A company that purports to sniff out threats like explosives and guns, recent acquisitions brought them into the visual recognition space which is in heavy utilization in the prison system.

The contract from Innovative Solution Canada (ISC) was awarded to Patriot One for its Patscan platform, with specific interest around the video object recognition software (VRS) solution for the detection of visible make-shift knives and cell phones, as well as disturbances and fights, all of which have been issues with correction facilities and their management teams. The platform was evaluated and prequalified under the ISC’s testing stream, formerly named the Build in Canada Innovation Program (BCIP). The testing stream helps connect Canadian innovators with federal government departments that are willing to test their innovation and provide innovators with valuable testing feedback.

That’s one side: This is another.

Xtract Technologies Inc., a subsidiary of Patriot One Technologies Inc., has secured a $975,000 contract with Canada’s Department of National Defense through the Public Works and Government Services Canada Division.

The contract is for a project related to improving situational awareness for the Canadian Armed Forces (CAF) and security personnel using video analytics, artificial intelligence and augmented reality. This project will continue previous work completed by Xtract.ai for the CAF to develop technology solutions to augment the situational awareness of its soldiers and address the following challenges:

- Detect, recognize and identify persons or objects of interest in a physical environment; and/or

- Track identified persons and objects of interest using seamless information sharing across a decision network.

The markets haven’t been overly fluffy with PAT for the last few months, but in a time when controlling areas where populations are gathering is going to be increasingly important, Patriot One is well positioned to benefit in a big way. Don’t dive in like a maniac, but watchlist it and keep an eye on this sector.

TECHNOLOGY METALS:

I love it when I hear mining explorers telling you about who they REALLY like, because it usually takes a decent amount of liquor and a tab at the Upper Brass to get them to open up about which of their competitors has something they wish they could replicate.

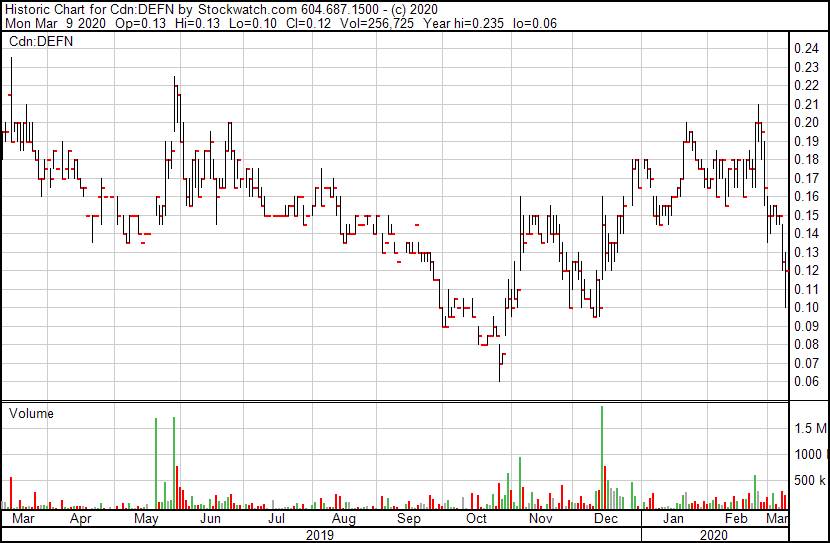

But I hear this a lot about Defense Metals (DEFN.C), a company looking for rare earths, which are metals we need in all sorts of tech in our pockets, and which China has a bit of a controlling market in.

A $4.75 million market cap explorer that just keeps pounding out the good work, they’ve taken a licking the past few days like anyone, but at $0.12 won’t be able to drop much further before the valuation piques the interest of acquirers. They’ve done the work, they’re finding good rocks, and their sector is beyond necessary to build out in North America. Watching this one HARD.

CRYPTOCURRENCY:

Long a laughingstock associated with the falls of Bitcoin and blockchain, HIVE (HIVE.V) has regrouped, reassessed its business model, cut costs and steered its GPU base to focusing on Ethereum rather than the expensive-to-mine Bitcoin. That’s meant a lot less costs on the production side, but also lower revenues on the other end of things.

For the quarter ended Dec. 31, 2019, income from digital currency mining was $5.0-million, a decrease of approximately 41 per cent from the same period in the prior year, primarily due to the company’s suspension of 200 petahashes per second of its ASIC cloud mining capacity at the beginning of October, 2019, and the remaining 100 PH/s in December, 2019, due to worsening bitcoin mining market conditions as coin prices declined while mining difficulty and network hash rates increased to a record high.

Its EBITDA of $4.8 million last quarter was in stark contrast to a $27 million EBITDA loss a year earlier. Still, at an $81 million market cap, it’s tough to roll with the valuation. The reason I include it here is because 1) HIVE appears liquid at last and appears to have controlled its costs finally, and 2) if the market goes on a crypto run, HIVE will increase in value regardless of cap because it’s the name of the space.

MOBILITY:

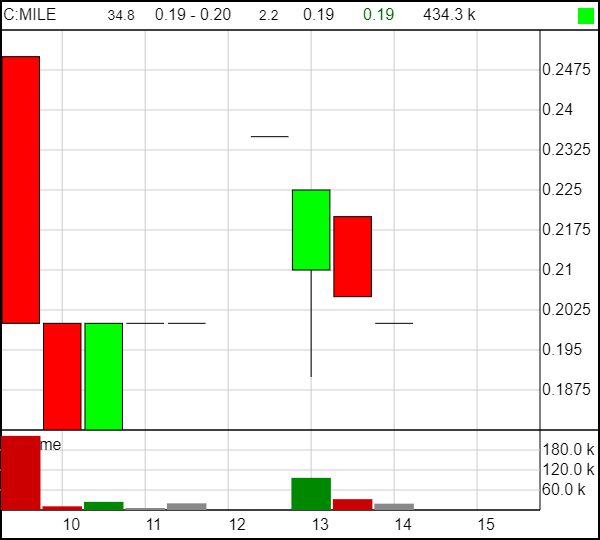

It picked the absolute worst day to go public in modern North American history, but the folks at Last Mile (MILE.V) will like that their company stock leveled off after a big opening drop.

Someone REALLY wanted to get out the first minute they could do so, and sold off in a hurry. That opened the stock at half the expectation, but it did flatten once it hit $0.20.

Sometimes with these new vehicles, someone in the insider group betrays trust and rushes for the exits, and that appears to have been the case here. It certainly happened with AMPD, mentioned above, and all you can really do when such a situation arises is hope the person in question buggers off quickly so the company can get a chance to engage in its business without having its head held underwater.

Last Mile is set to take advantage of the scooter revolution, which in many major cities has taken off like gangbusters, giving folks the ability to take a motorized vehicle, roll about with it as they like, and leave it on the street when they’re done, much in the way the car2go does now.

In some cities, this is already a bonkers business, and Last mile joins two groups that are right there fighting for market share, including the college campus focused Gotcha Mobility. Options include e-bikes, scooters, pedal bikes, seated scooters and trikes.

Our Guy Bennett wrote about the company yesterday, saying, “Gotcha has secured permits to deploy 20,000 vehicles, 80% of which are exclusive. This acquisition positions MILE as the third largest micro-mobility company by location in North America, after Lime and Bird.”

Hear the interview with Last Mile’s CEO below.

For mine, it’s a good deal, and if you’re looking at it today, you get it at half the price insiders were buying at.

Don’t hoard toilet paper. Don’t panic sell. Free up cash and apply it when the dust has settled and you’re sure you’re getting a bargain.

— Chris Parry

FULL DISCLOSURE: Last Mile, Defense Metals, Metalla Royalty & Streaming, and Biome are Equity.Guru client companies. The author and Equity.Guru have acquired stock in AMPD, among others.

Im laughing at the idiots out there, specially the toilet paper hoarders, why??

This is just a significant flue virus that the media just jumped on hard and there is no reason to panic.

Im laughing because I have a bag full of cash ready to jump back in when there are bargains galore, specially the gold sector.

More for me.

Keep up the good work and spread the news on bargains.

Can you please provide an update on Ampd? It’s been very quiet. Thanks.

Yep, I spoke to them a few weeks ago, they said they’re working on some new contracts but the process generally takes around three months to close and on-board new clients. COVID had slowed things down a touch but i expect news to land any day.