There’s a lot going on underneath the surface with Isracann Biosciences (IPOT.C). A year in review won’t be much, mostly because this company hasn’t been public for a year. Instead, it’s more like a quarter-in-review, as the company only rolled into Atlas Blockchain, going public on the CSE (and OTC exchange as ISCNF) in October of 2019, but what makes this (and them) noteworthy is what they’ve managed to build for themselves in such a short timespan.

We knew about them as far back as April when we took note of their fully funded 230,000 square foot facility, under development at the time, with the angle being that this company was going to be well-positioned to take advantage of the EU’s nascent cannabis market, including Germany.

That’s still their aim, but now they’re closer to it.

“Our strategic aim is straightforward and leverages the national brand excellence of the Israeli agricultural industry combined with planned industrial scale production of low-cost premium quality cannabis targeting export into the massive European marketplace. It’s a uniquely scalable venture that combines numerous positive attributes including a team that knows how to execute.” said Darryl Jones, CEO of Isracann.

If you think about it, growing cannabis in Israel makes sense. Cannabis grows best in warmer climates with lots of sun, and most places in North America are not well-suited to it. In most provinces and territories, including parts of British Columbia, heavy percentages of a cannabis company’s revenue disappears into the coffers of power companies for large parts of the year.

But before the company could get started, they had to go through Israel’s renowned and somewhat difficult regulatory process to get themselves certified. Those certifications included not only the standard good manufacturing processes (GMP), but good agricultural practices (GAP) and Israeli medical cannabis – good manufacturing practices code certification.

Got those too.

After that, they submitted their architectural, agronomic and security plans for their proposed greenhouse in Nir, Israel to the Israeli Land Authority. Earlier this month, Isracann announced that they had received the phase 1 project profile roadmap, and the project underway included soil, water and atmospheric sampling.

Working companies produce their own kind of excitement. It’s not going to be the flash, shock and dropped jaws of the scandal kings and queens of the Canadian cannabis market. Instead it’s the quieter, slow-burn excitement of a company with its head down and putting in the work.

The details are important because it shows that this company prides itself on transparency. It’s not going to hide illegal weed behind false walls, or cobble together a series of low-value acquisitions for short-term bumps in stock price to fuel their next glut of private placements—this is a company paying attention to the details of their business with the goal of maximizing shareholder value.

If the details are putting you to sleep then that’s good. Daily progress turns into weekly progress, which develops into months. And when months in aggregate of daily progress turn into years of daily progress, then that begins to show where it counts—on the balance sheet. That’s what Isracann’s strategic aim is pointing. That’s what you want in an investment. When you sink your doughbucks into a company you want to know they’re doing the work.

Look at the board members and their track records.

And if you’re wondering who these guys are, then Equity Guru’s own Chris Parry has got your back:

- Daryl Jones is President and CEO. You may recall him from being the guy who took True Leaf (MJ.C) public in 2014, and exiting three years later with a 15x profit.

- Marc Zegal is Chairman. He’s the local market knowledge, having founded and financed several Israeli pubcos, including the $120m market cap Rada Electronics (RADA.Q), and being a former member of the Chicago Board of Exchange.

- Israel Moseson is COO, and has been in Israeli cannabis for five years currently.

- Brett Allan, who was part of the team that brought Emblem Health (EMC.V), Organigram (OGI.T), and Green Organic Dutchman (TGOD.T) public, is an advisory board member.

Deepak Anand is another advisor. He’s executive director of the Canadian National Medical Marijuana Association, a former VP of Cannabis Compliance, and knows everybody who’s anybody in Canadian weed.

Their latest news involves a memorandum of understanding (MOU) to form a joint venture with an additional cannabis farm property in Israel. This will result in a late stage buildout of an extra 880,000 square feet of property, wtih two recently assembled steel greenhouses (and approximately 200,000 square feet.) When you do the math, the full build-out will bring a 100% increase in the company’s current potential production capacity.

“We started with an ambitious, industrial scale farm concept, and that plan has introduced us to a number of key regional players, partners and stakeholder who share our vision and goals. The support has been amazing, the advice extremely timely, and the collective wisdom we have gathered is already melding into a seasoned team dedicated to success. We’ve gone from a single property with a production horizon that remains fully on track for later this coming year, to a proposed second property with the potential for achieving an even earlier production scenario employing shared resources with limited capital and risk. Our internal resource allocation is already shifting towards post-production efforts including product management and distribution goals.”

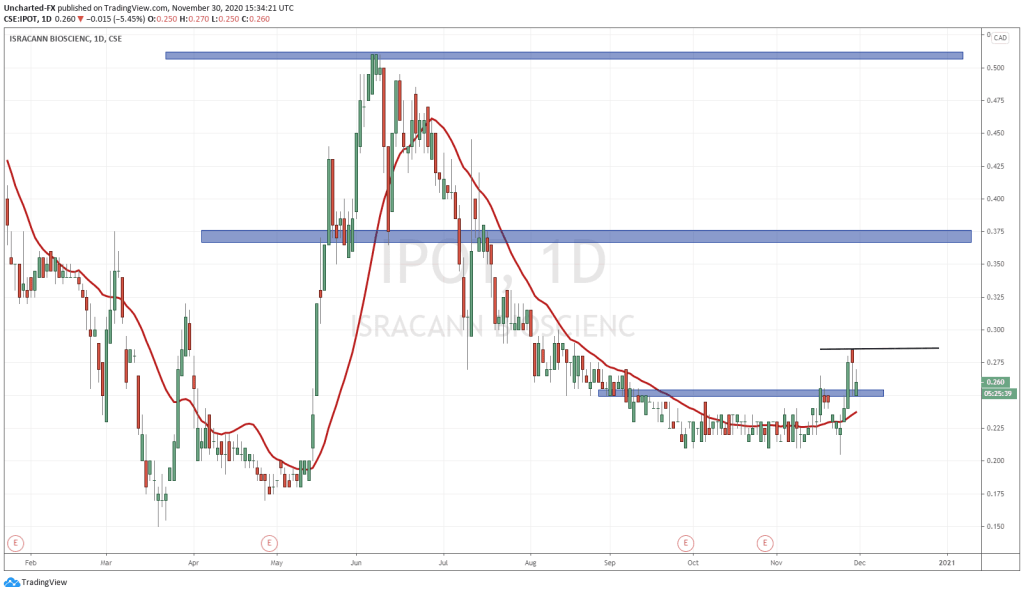

If you’re still not convinced that IPOT is the real deal for next year, look at this:

A cannabis company chart that actually trends up.

—Joseph Morton

Full Disclosure: Isracann Biosciences is an equity.guru marketing client.