This morning, a North American drone company that has decades of experience in the business announced word that a former White House Chief of Staff will be joining its board.

This is a big deal, because though drones have been a hot and cold market sector for years, right here, right now, is when the drone business is becoming real.

Because, this:

Washington (CNN) Chinese-made drones may be sending sensitive flight data to their manufacturers in China, where it can be accessed by the government there, the US Department of Homeland Security warned in an alert issued Monday obtained by CNN.

The drones are a “potential risk to an organization’s information,” the alert from DHS’s Cybersecurity and Infrastructure Security Agency states. The products “contain components that can compromise your data and share your information on a server accessed beyond the company itself.”

If I told you to go invest in cannabis companies right now because they’re dirt cheap, it’d be bad advice.

If I told you blockchain was coming back, and that there’s money to be made getting in there now, it’d be bad advice.

If I told you resources are coming back and now’s the time to get in on mining explorers, it’d be bad advice.

But despite the above suggested statements being good advice in theory, right now, everything traditional is being torched, largely because folks are worried about the world. You can run a good cannabis company and still be in trouble. You can make good money on blockchain and still get no respect from the market. And mining – it’s had a lot of false starts in the last few years. While it maybe headed to good times, they make not arrive imminently.

Will Trump do something crazier than we’re used to and go to war? Will China double down on tariffs? Will Putin spot an opening and take out Ukraine? Impeachment! Election interference! Civil unrest! Gun violence!

In times of peril, two things make sense as investments traditionally; gold and defense.

So when a new drone deal shows up, with defense industry potential, at a time when most of the market is hooped because folks are worried about the chance we’ll go to war some time soon, I’m interested. Making profit in times of fear is an age old method of making good money.

Draganfly (DFLY.C) is a drone deal that’s been an actual company since before the term ‘drone’ existed in the parlance, and that’s important right now, because companies built to float on the public markets based on sector heat are usually not actually companies. Draganfly is. It’s been around the yard a few times. It’s seen ebbs and flows and interest heat up and interest fall away and while others have failed, it has persisted. It has evolved, survived, and thrived.

Draganfly released its first quadcopter in 1999, when Amazon was still a book seller. It’s UAV model came with video capabilities in 2001, four years before YouTube existed. 2005 saw the company debut of self correcting flight positioning and thermal imagery. Saskatchewan police bought some, the first law enforcement agency to do so, in 2005, and it was used as part of a law enforcement homicide investigation in the US in 2009.

Worth noting: It was 2014 when the public markets got drone crazy for a hot minute, which was a year after the first time a drone saved a human life. The drone that made that save, the Draganfly X4-ES, is in the Smithsonian Institute.

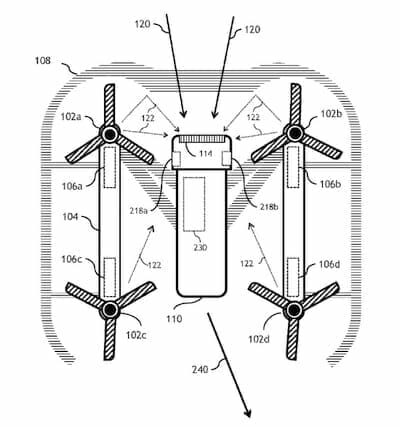

Since then, patents have come hot and heavy for the Draganfly crew. Folding wheels, rotor and wheel combos that can take to the land when needed, folding wings, dual wings for greater distance, and the first full-day flight time utilizing solar panels have come since.

Draganfly is a drone TECHNOLOGY play, and it’s built on real world excellence and runs on the board.

The reason the company is now public is because the public markets are the best place to find quick financing for growth.

We’ve seen drone deals before. A few years back there was a mini-sector boom in drone tech because all of our kids wanted one, and a few of us had experienced them showing up at our window unannounced and uninvited, like a floating red light of doom right as we’re getting to the vinegar stroke.

“We’re all going to have drones following us, taking selfies, chasing away bad guys” came the pump juice. “Every company will use them to deliver stuff!” they yelled.

And most of those deals did exactly what you’d expect a heat deal to do.. nothing.

As an example, Droneguarder (DRNG.OTC) has a market cap of $70,000. That’s not a typo.

DRNG says it’s developing a product that will house a drone on every building roof in a mini-garage that, when someone comes close to the building, will be unleashed to record the intruder and stream them to the building owner.

That idea, which seems dumb because it’s the definition of dumb, is dumb. It’s indicative of the last drone push where the idea was to find something for a drone to do to justify a company, rather than build companies out of actual need.

One drone company went the other way.

Drone Delivery Canada (FLT.V) turned their plans for goods delivery in remote areas into a $150 million market cap today, though it had touched $300m not long ago. They’re raising (and losing) a large amount of money on the regular, but also doing deals with big names – Air Canada, as an example – in partnerships. Govt funds to help them deliver their plan are not a pipe dream, considering getting cargo to remote communities is an issue for Canada’s feds.

But as an investor, I don’t want to buy into a $150m market cap unless I can realistically see that company double in the next year, and I don’t see that for a while. So I’m looking for something as legit, but with the value not yet stripped out of it.

At just a $37m valuation, what’s up, Draganfly?

Drone Delivery has a partnership with Air Canada. That’s valid.

Draganfly has partnerships or has sold product to:

- Royal Canadian Mounted Police

- Mesa County Sheriffs

- Corning

- Global Institute for Food Security

- Saskatoon Police

- Lower Colorado River Authority

- Maryland Department of Transportation

- Cybernetech Japan

- Ontario Police

- Australian Federal Police

- Sarasota County

- 7 universities…

…and a lot more.

A LOT MORE.

Most of those bodies are government agencies, which means three important things:

- They’ve done the work on getting through due diligence at the highest levels

- They get paid on the first of the month, like clockwork

- Their deals ROLL. Government contracts rarely end without cause, so having those engagements currently means something going forward.

They’ve also filed 29 patents, with over half of those granted or pending, but these aren’t bullshit patent filings that, if asked about, they’ll say “we can’t discuss that.”

There’s an actual Draganfly page with detail on many of them. The Canadian patent for an ‘unmanned aerial vehicle’ was granted in 2008, as an example, which means they’re not just selling products, but taking royalties from products sold by other companies.

You want more evidence these guys understand their tech? They have a series of white papers on site, which is as nerdy as public company nerdness gets.

Want more? Testimonials from cops and universities and large public companies!

We worked with Draganfly on a project to use UAV’s for surveying of surface stockpiles of at our mine site. We had an initial briefing meeting with Andrew and Cory at their shop where the ran through some of the many benefits of UAV’s for our application and we were blown away at the quality of their product, service, and the overall ease of use. The guys came up to site and performed a survey with the commander. The data quality, 3D model, and simplicity of the whole process exceeded our expectations. I would strongly recommend Draganfly for anyone serious about UAV’s for surveying.. Leave your [China made] DJI at home.

— Cameco Corporation (CCO.T)

So that’s nice; a real business with real innovators and real runs on the board. Legitimacy is nice, but what’s the business model?

Put simply, Draganfly is evolving. It already pivoted from a consumer-facing products company to a law enforcement tool, and now it’s seeing a gaping opportunity emerge as the US and China fight a cold war. Mainly because 80% of drones are made in China, and because China’s army of drones is doing stuff like this:

…Which is causing concerns like this:

The United States’s Department of the Interior has grounded its fleet of drones from China as it conducts a review of the programme.Nick Goodwin, an Interior Department spokesman, did not provide a reason for the decision on Thursday but the US has become increasingly concerned about security in relation to Chinese electronics. Goodwin said the review had been ordered by Interior Department Secretary David Bernhardt.

“Until this review is completed, the secretary has directed that drones manufactured in China or made from Chinese components be grounded,” he said. [..]

According to sources familiar with the programme, the Interior Department has a fleet of 810 drones, almost all built by Chinese companies.

Only 24 are US-made and even those have Chinese electronic components, the sources said.

This is big.

Until now, the need for drone capabilities has outweighed the risk that foreign hardware would pose a security risk but, in the midst of a trade war, that’s no longer acceptable. US authorities need a newer, better, local solution, and Draganfly is it.

The company is presently working on border patrol, counter-terrorism, and battlefield payload programs that would bring in far greater revenues from government agencies than the current law enforcement and environmental support systems, and that’s the upside you’d be looking for if investing today.

Matter of fact, it’s why I invested in the last financing. Draganfly isn’t a client of ours, rather it’s an investment target that I think hits a lot of my needs in an investment, especially right now.

- Legitimate clients, past and present, who pay their bills

- Legitimate tech that can bring in licensing and royalties as a strong revenue base

- Market trends that point to this being a necessary tech sector, right here, right now

- Reasonable valuation, with overpriced comparables

And 5: A new board member in former Bush White House Chief of Staff, Andy Card.

If you’re going to try to get US military contracts, having a former cabinet member, under a Republican President, is not wasted time and effort.

Mr. Card, appointed in November 2000, served as Chief of Staff to President George W. Bush from January 2001 to April 2006. Prior to his tenure as White House Chief of Staff, Mr. Card managed and ran the Republican National Convention in Philadelphia [..] Before that, Mr. Card was Vice President-Government Relations for General Motors Corporation, one of the world’s largest automobile manufacturers.

That’s a big get.

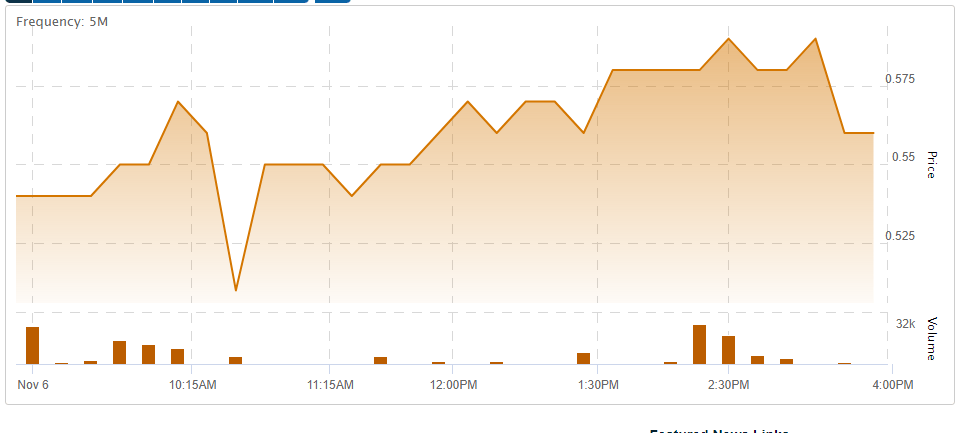

Draganfly doesn’t have a lot of market history to show you just yet, having been public for a day or so, but the volume on the open has been decent. I expect it to get interesting as they drop news and get the story out to new investors.

— Chris Parry

FULL DISCLOSURE: Not a client, but the author owns stock in the company.

Why didn’t you talk about the raise of 14m share at .50$ with 14m warrant at .50$ also, seems like a pretty bad raise to me ? No horse in this race just curious, you are usually pretty open about these things.

Wasn’t something I noticed but, yes, that’s a generous raise for those who got it.