When a gentleman or mademoiselle makes a decision to honour the dark arts of predatory investing, occasions such as these times, when the black clouds of doom envelope the otherwise pleasant meadow that is the public markets, require one to seek out not the healthiest of companies, for they have already ascended to the heavens. Rather, one should seek out the decrepit, the beaten, and the damned, for they can be turned inexpensively and profited from completely.

This, dear reader, is my life’s desire; to find the corporate equivalent of a homeless individual, just as that individual is embracing sobriety, putting on a raggedy suit, and turning his life around, agreeing to deliver groceries for old man Ebbets so he can one day make an honest woman of the toothless hag he calls ‘sweety.’

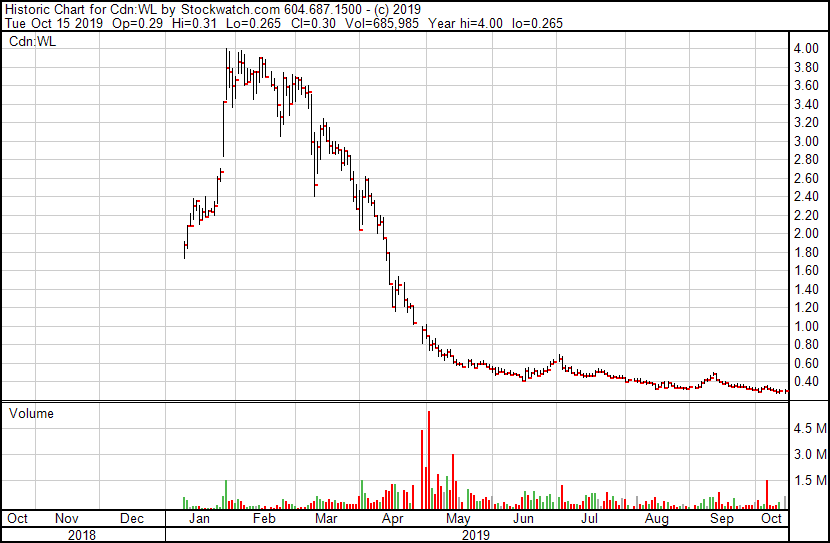

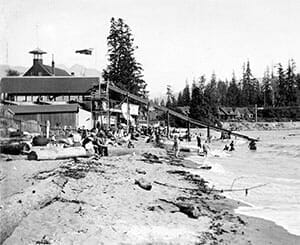

Westleaf (WL.V), which is and has long been a client for this website, is decrepit. It is beaten and damned. Its chart is reminiscent of the English Bay beach slide of yore, and fond memories as a boy of watching the bathers descend willfully into the cerulean deep, anticipating the odd occasion where a girl’s bloomers might catch on an errant nail.

To be clear, Westleaf has descended that slide, catching every single nail along the way.

It now sits up to its waist in excrementally tainted water, ready to climb out, if someone might provide a rope.

And that, dear readers, is where the robber baron strikes, because while Westleaf is ignored by many, it is not yet drowned.

As a company, it stands far below its once proud valuation of $400m+, a place where irrationally exuberant investors and dealmakers once figured any marihuana deal was a rich deal, that the market would just run if you sold it any old rope, thereby setting Westleaf up for a tumultuous fall that no amount of operational efficiency might have prevented. The company was, to be sure, constructed in such a manner that it could not help but fail early.

A $400m valuation for a store in Winnipeg? In a word, dreadful. The fall that followed was not hidden from view. It was ongoing and unpreventable, a sinking that would not end until the men at the wheel figured a way out of the iceberg mass it had been launched into.

The ship didn’t sink, but it took on a lot of water and has been slow sailing since.

Today, the company released tremendous news, that it has received a cannabis processing license that will allow it to create new ‘cannabis 2.0’ products that will become legal in mere days. That’s the completion of a shift that has always been the real drive of the company, but one that hinged on the unknowable; whether Health Canada would ever darken their door with permission to do so.

Their timing could, at once, not be more impeccable and also not be more awful.

Getting their license right now, and being able to create vape products right now, should be a godsend, a rapturous clarion call from the heavens that Westleaf’s time has come, damn it all, and that if you’re not on board, a pox be upon you.

And yet, to use the parlance of the times, after some ‘fucking idiots’ sold thousands of tainted vape products over the last several months on a largely black market, leading some unfortunate individuals to become ill and others to perish, one can still reasonably ponder whether ‘vapes’ will actually make it into the final rules to be released in Canada soon.

What should be Westleaf’s finest hour is, instead, yet another day of ‘wait and see’.

Westleaf has been largely forgotten by investors over the past year mostly because their business model – which was formerly ‘to open some marihuana stores’ – has quickly been recognized as not much of a business model at all in Canada.

The reasons for this are outside the scope of Westleaf’s responsibility; literally hundreds of competitors have opened across Alberta as that province has done god’s work and created a true industry, while the BC, Quebec, and Ontario markets have come to naught due to governmental ineptitude, greed, and hubris; the former due to a governmental insistence that public sector unions run everything, the middle because of a governmental tradition of always being slow and difficult, and the latter due to a governmental insistence that the industry be run like Father Flaherty’s Tuesday night bingo.

“And the next number is legs eleven! What’s that? Did I hear someone say Bingo? Oh, it’s Vic Neufeld again. 4th time tonight… nothing suspicious there. And thanks for your donation to the steeple fund, Vic, moving on…”

Westleaf does have three marihuana stores in Saskatchewan, but that’s sort of like having a romantic liaison in Winnipeg; one can say they’ve dampened their johnson, but was it really worth the journey?

Yet, I will gladly stand on the corner of any boulevarde, soap box underfoot, and yell loudly that one should consider calling your broker of stock and discussing the benediction of purchasing paper attached to the WL ticker symbol.

Your reward for reading this far is to learn why; because at a $43 million market cap, Westleaf is priced at the value of its own breakup.

‘The Plant by Westleaf Labs’ is an extraction, processing, and commercialization facility that, as of now, is licensed to operate and create vape products, for which it already has sales agreements worth $4m, and other products that don’t have the stigma of vapes, such as edibles, pills, and other things soon to be legal that adults may actually prefer to vaping. That license, and the facility tied to it, to my way of thinking, would come with a $20m price tag if one were to sell it.

‘The Plant by Westleaf Labs’ is an extraction, processing, and commercialization facility that, as of now, is licensed to operate and create vape products, for which it already has sales agreements worth $4m, and other products that don’t have the stigma of vapes, such as edibles, pills, and other things soon to be legal that adults may actually prefer to vaping. That license, and the facility tied to it, to my way of thinking, would come with a $20m price tag if one were to sell it.

To be sure, while it’s functional, it’s not yet complete.

The 15,000 square foot Phase I of the facility has been built to European Union good manufacturing practice (GMP) specifications and is designed to process up to approximately 65,000 kgs of dried cannabis per annum into anticipated high quality edibles, concentrates, vape and oil products, including Westleaf’s first in-house product, a line of vape pens under the brand General Admission, as well as products under the Company’s other house brands, Backstage, and wellness brand, Loon. The Plant has an additional 45,000 square feet of space to expand extraction capacity as well as add additional product lines based on consumer preferences once the additional products are licensed post October 17, 2019.

Though they’ll earn revenue from the facility as is, they’ll likely need more money to complete the build, if we’re honest. More on that later.

Thunderchild Cultivation is an unlicensed production facility at an early stage of completion, built on First Nations land, and which will provide local people with jobs aplenty. But that license situation brings risk, matched by the opportunity of working with the money and people of the local Thunderchild Nation. Phase 1 is 80k sq ft. Completion is due to match 130k sq. ft, which would be akin to a $300m business valuation, even in this dark market, but would likely bring $30m or so in its current state, if it had to be offloaded.

Thunderchild Cultivation Phase I (80,000 square feet) of the large-scale cultivation facility in Battleford, Saskatchewan is fully funded and on track for completion and submission of its Health Canada evidence package for a cannabis standard cultivation licence by the end of 2019.

We like the words “fully funded” in the current financing climate.

On the branding side, WL is fine. Prairie Records is an interesting twist on the dispensary model, but not a changer of games. Loon Cannabis is an intriguing oils brand, launched basically today with the bringing of a license with which to make them.

General Admission is basically the same as Loon only directed at the musical crowd, reasoning the same youthful adventurers who may choose to ‘toke’ down by the lake aren’t necessarily the same as those who may do so at the bandstand during a barbershop quartet rendition of Let Me Call You Sweetheart.

Backstage takes General Admission and gives it a high priced luxury spin for the cotillion crowd.

But none of those brands are worth a wooden nickel – yet – as they haven’t been created, shipped, or sold.

Yet.

Which leaves us with a $43m market cap company with a liquidation breakup value today of around $50m. That’s your downside risk, if everything goes to hell in a handbasket.

Your upside is the $150m-$300m of value that rolls in should Westleaf, which has already shown itself to be Health Canada-approved on today’s news, gets its production license and begins farming.

To be sure, the company doesn’t need that facility active to be a going concern. It can acquire feedstock from others and make and sell value-added products to others that, frankly, are more profitable than growing marihuana as a crop in a northern climate.

That said, having your own handle on supply and delivering on the capital that has been expended getting there would be a definite turnaround occasion and show that this thing was more than the smoke and mirrors that beset it at its origin.

Looked at another way – there’s not a lot of good news needed to get this company to a double from here, while many others, most with nine- or ten-digit valuations, would need a herculean lift to do same.

As a robber baron, I want doubles, I don’t want feelgood stories. If I’m betting on Westleaf, I’m betting on a small amount of buying being able to lift it hard, and in this instance we’ve seen that play out in the last several weeks.

Look at the volume of trading it took to get WL from $0.325 to $0.48 barely a month ago; those were LOW trading days and it still ran to a 50% profit.

Of course, it then went the other way as vapes earned a reputation one might have usually reserved for cadaver thieves, but I’m of the belief this too shall pass.

So what could harpoon this whale in the making? What Captain Ahab lies one wave beyond our present vision, white knuckled rage just waiting for a chance to strike?

FINANCING.

The downside risk on an outfit like this is negligible on present valuations, but that assumes the company won’t take on enough debt to swing the thing out of arbitrage and into quicksand.

From a week ago:

WESTLEAF RECEIVES ADDITIONAL $5.7 MILLION OF CAPITAL FROM ATB FINANCIAL

Westleaf Inc. has signed amendment agreements to two of its existing credit facility commitment letters with ATB Financial resulting in an additional $5.7-million of capital available for use by the company. Westleaf has increased its term loan on The Plant, its fully completed extraction, manufacturing and product formulation facility, by $2.7-million and has secured a $1.0-million revolving credit facility to assist with working capital provided that any drawdowns in relation thereto can only be made after final receipt of a standard processing license for The Plant from Health Canada.

[..] With the increase in non-dilutive capital, Westleaf intends to accelerate its footprint of additional Prairie Record retail cannabis stores and to provide for additional start-up capital for The Plant.”

Fair. Senior debt is a decent way to finance in small doses, especially if it doesn’t come with death spiral interest rates and ties to assets that could cripple the company in a market slowdown.

On this front, while Westleaf has borrowed fairly heavily to build out, it hasn’t been bent over a molasses barrel on those borrowings.

The Plant Loan Facility provides for an initial financing in the amount of $4.3 million and is based on a ten-year amortization time period with the first renewal occurring at the end of the initial two year term. [..] At the time of the draw, an amount of $1.2 million was pledged and subsequent payments have reduced this amount to $478 as at June 30, 2019 (2018 – $766). As at June 30, 2019, The Plant Loan Facility had an effective interest rate of 6.95%.

FAIR.

On April 15, 2019, the Plant Loan Facility was amended to provide for an additional equipment finance term loan facility in the amount of $2.2 million (“The Plant Facility #2”) bearing interest at prime plus 2%.

BEYOND FAIR.

On May 10, 2019, the Company closed on a bought deal financing with a syndicate of underwriters for 12,000 convertible debenture units of Westleaf (the “Units”) at a price of 1,000 dollars per Unit for aggregate gross proceeds to the Company of $12 million (the “Offering”). Each Unit consists of one 9.5% senior unsecured convertible debenture (each a “Convertible Debenture”) of the Company having a principal amount of 1,000 dollars and 385 common share purchase warrants of the Company (each a “Warrant”).

CRIKEY.

9.5%? I’d have liked to be in that syndicate of usurious scallywags. This loan is the bigger of those currently in play for Westleaf and its interest rate is fairly voluminous. 9.5% is a little over the line between begrudgingly acceptable and not, but considering the 140m share count on the company, one might suggest they’d been painted into a corner by the need not to dilute the share count further.

That said, while we don’t like to see such numbers ideally, maintenance of the debt will see the company pay $1.1m in interest on the debt annually, which is manageable.

There’s another $24m borrowed on the construction of that grow facility, which isn’t an obscene amount to finance such an initiative. On that:

The effective interest rate on the Thunderchild Loan Facility as at June 30, 2019, is 5.95%.

In all, the company has brought itself a lot of credit it hasn’t yet used, but can on the delivery of milestones, and as needed.

With the close of the convertible debenture financing, Westleaf now has access to $57-million of capital (cash position as of April 30, 2019, adjusted for net proceeds of the convertible debenture financing), comprising approximately $27-million of cash and the ability to draw up to $30-million of undrawn, low-cost, non-dilutive capital under its non-revolving credit facilities with ATB Financial, subject to ATB Financial’s discretion in certain cases and subject to the satisfaction of certain conditions precedent.

So where does this leave us gentlefolk looking for a robber baron bargain?

The Globe’s David Leeder writes in the Eye On Equities column that [Canaccord Genuity analyst Kimberly Hedlin] continues to rate[WL] shares “speculative buy.” She cut her share target by a nickel to $1.15. Analysts on average target the shares at $1.13.

Ms. Hedlin says in a note: “We expect Westleaf’s extraction facility will receive its standard processing licence in the near term, which could serve as a catalyst for additional third-party tolling and private/white label contracts.”

Ms. Hedlin was correct as of today.

I too believe Westleaf is at an inflection point, and that its availability of credit at a fair-to-middling rate of interest, its progress on the compliance side with Health Canada, its low market cap compared to peers, it’s $11.2m in unrestricted cash on hand (as of last financials), and the 18 months of runway it has at current quarterly loss levels between cash and credit, put it in a rare position of likely stability through the next year of unstable sector conditions.

I like that for a throw of the dice.

For more, in talking pictures format, see below.

-MM