The countdown is on in the streaming service sector to see which of Netflix’s (NFLX.Q) future competitors will be the one to topple the king from his castle, and the competition is fierce.

Netflix has been the only dog in the yard for years. Lauded as one of the original disruptive companies, they gave television watchers the option of cutting the cord and separating themselves from the predatory traditional business model that had been the cash-cow of Disney (DIS.NYSE), NBC, Time Warner and the other entertain behemoths for years.

The previous model involved packaging TV programs into channels and selling them to consumers through cable or satellite distributors like Comcast (CMCSA) or DirecTV. These companies put them together into bundles, a percentage of which were actually watchable and interesting, and added ridiculous subscription fees while the networks collected billions of dollars from selling their customer’s captive attention to advertisers.

Cutting the cord made television watchable because there were no commercials, no censors to bleep out profanity or nudity, and you could watch your favourite show in its entirety anytime you wanted rather than wait for a pre-selected timeslot.

Naturally, that meant diminishing revenues for Disney, NBC, Time Warner, etc, especially when we consider the global video streaming service market presently has 613.3 million users compared to the 556 million users still using cable. It makes sense that they would want to get in the game, and that’s what’s happening in November.

Netflix has some competition already from companies like Hulu, Amazon Prime and Youtube, but nothing to the level of what they’re going to face come November.

“If there’s any one traditional media company that can compete with Netflix, it’s Disney. They have consumer awareness and content that people will pay for. That doesn’t mean Disney wins and Netflix loses. It means that Disney is one of the few that can successfully play that same game,” says Tim Nollen an analyst at Macquarie Group, an Australian multinational financial services company.

Disney brings a deep cultural history, including some of the most well-known and beloved characters and shows in the world, and of course, their deep pockets to the streaming service market. Deep enough to pay $71 to acquire 21st Century Fox, which brings with it titles like Star Wars and the Marvel Cinematic Universe.

The only way Netflix is going to be able to compete with Disney’s stable of tested and true content, not to mention their deep pockets, is to keep to (and improve upon) their core strengths.

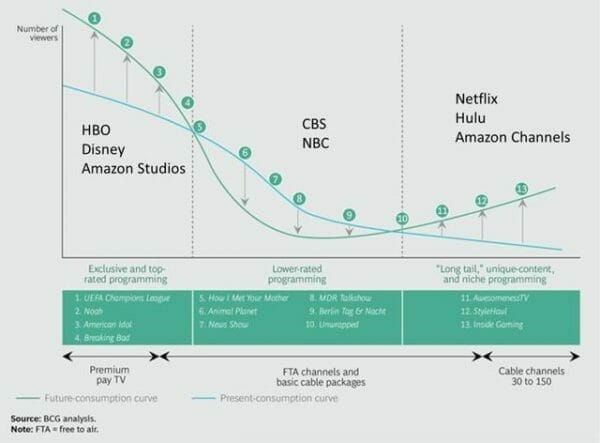

Their core strategy has always been to capture the ‘long tail’ of consumer interest. They carried that strategy over to content creation, where they focus on quantity over quality, which will help them avoid direct competition with other services that are more focused on a smaller quantity of premium content.

But unfortunately, their core strengths are fairly touch-and-go.

Here’s what we wrote about Netflix long tail original content previously:

It’s terrible overwrought tripe that nobody watches. The scrolling wheel of original content on the Netflix feed is a list of titles that few folks have given a second glance. For every Jessica Jones there’s three Iron Fists, and I preferred Birdbox when I saw it in theaters and it was called A Quiet Place.

Granted, when their original content hits, it can’t be beat:

For example, their original docuseries Our Planet was watched by 33 million households. Ava DuVernay’s four-part original series When They See Us reached 25 million households in four weeks, and Dead To Me had 30 million households in its first month.

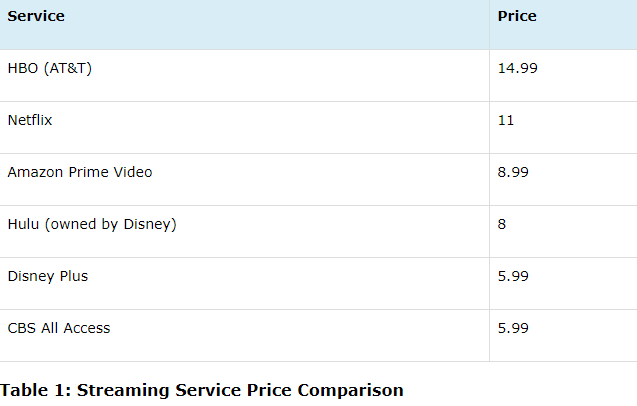

And then there’s the price.

The big names are going to be competing hard with each other come November, and one of the largest points of contention is going to be the price.

Source: stockwatch.comShares of the streaming service dipped briefly below $300 today but have since rebounded to close the day at $300.29.

—Joseph Morton