The ability to trust the people you put your money into is of utmost importance. ‘Management’ is oft cited as one of the pillars of a company’s success, but management in this instance could also be defined as ‘trust’.

If I asked to borrow money from you in the street, your ability to trust me to get it back to you is everything in that deal being done. And yet, when it comes to investing, which is essentially the same process, we often discount management’s reliability as an important factor.

This can be a problem. See Wayland Group, ICC International, Namaste, Aphria, MedMen, and a host of others who’ve taken investor trust and placed little to no value on it. Those companies have (hopefully) realized trust is built over a long period, and lost quickly.

But not all understand this.

iAnthus (IAN.C) built a big stock chart, and a reputation, by virtue of their CEO Hadley Ford, portraying himself as the responsible, grown-up, non-self dealing, trustworthy adult in the US Multi-State Operator sector.

A recent bout of option repricing, intended to help keep key personnel as the share price went through a slump, brought that company undone when it became clear executives would benefit most from the new deal. That the options in question were good for several years, led some to ask if the company didn’t think it was likely to hit their strike prices in that time.

It was the first time iAnthus had faced trust as an issue, and it took three tries to get that situation right. First, it tried the nothing to see here approach. Then the ‘we hear you, but there’s a good reason we did this’ approach.

Finally, they went with a mea culpa, announcing that they’d heard investors loud and clear, and would revert the options for their executive roster.

https://equity.guru/2019/06/17/ianthus-ian-c-retools-stock-option-plan-pitchforks-torches-lowered-shorts-bail/

Still, some don’t trust the company like they did previously, and that’s going to make it slower going to get that stock price back up.

I’ve met with Ravenquest (RQB.V) just one time, and it did not leave me trusting them particularly.

I’d just met with folks from another LP that will remain nameless but are probably not hard to guess, who’d got in trouble with Health Canada over licensing, and they blamed their encounter squarely at the feet of Ravenquest, accusing them of interfering in someone else’s arrangement in an effort to ‘take over’ that deal. At the time, I dismissed this as unlikely and being a self-serving excuse, but Ravenquest had, a short time before, ‘taken over’ at Bonify, which had been accused of having brought in black market weed and selling it on to black market dispensaries.

When I met RQB execs, they talked in glowing terms about how they’d turned Bonify around and suspected Health Canada would ‘let them keep it going forward.’ The emphasis appeared, to me, to be less on ‘we do things right’ and more on ‘we’re getting a free LP.’

Shortly after our meeting, RQB announced a one year extension to their contract as Bonify chaperones.

Ravenquest Biomed Inc. will continue to provide management and consulting services to Bonify Holdings Corp. under a one-year contract extension. The one-year extension will begin when the initial three-month contract expires at the end of March, 2019, taking the entire term of the services agreement through March, 2020.

Jeff Dyck, Bonify’s chairman, stated: “The corrective action taken by Ravenquest has been very well received by the regulators. Health Canada has acknowledged the significant progress made inside our facility with respect to quality management systems. Our recent suspension was related to past issues.”

But, two days earlier, Health Canada revealed other ideas.

Ravenquest Biomed Inc. chief executive officer George Robinson, also acting president and chief executive officer at Bonify, has issued the following statement in response to the Feb. 4 Health Canada (HC) notice of suspension for sales at Bonify Holdings Corp.

“On Feb. 4, 2019, Bonify received a notice of suspension for sales from Health Canada. Shortly thereafter, HC issued a statement to the media which outlined the grounds for suspension. We are disappointed to see large discrepancies between the Health Canada media statement and the detailed notice we received in writing. What was presented to the public was very different than what we received in the written notice of suspension.”

Bonify’s suspension has not been lifted.

Ravenquest has spent much of their short life advertising themselves as being the adults in the weed space, the guys you’d bring in to fix your operation if you couldn’t handle it yourself. But, recently, that story has begun to unravel.

Maybe there’s a decent business in being the guys that are called in when someone else screws things up and experts are needed to untangle everything.

But this ain’t it.

RQB’s Markham facility just harvested. 55 grams per plant. Every RQB team is exceeding our expectations. Well done and Markham team we are very proud. @RQBGlobal $rqb pic.twitter.com/Xbx10iQaqX

— george robinson (@cl2g) June 27, 2019

George Robinson tweeted out this photo a few days ago, boasting of getting ’55 grams’ from the plant.

Commenters were quick to point out, that ain’t a good brag.

55 grams a plant?

pic.twitter.com/8rSa2qZWIb— ɹʎƆ uoɯɐƎ (@EamonCyr) June 28, 2019

It’s supposed to be ripe when you harvest, fyi

— Weed Detective (@WolfmanZack_) June 28, 2019

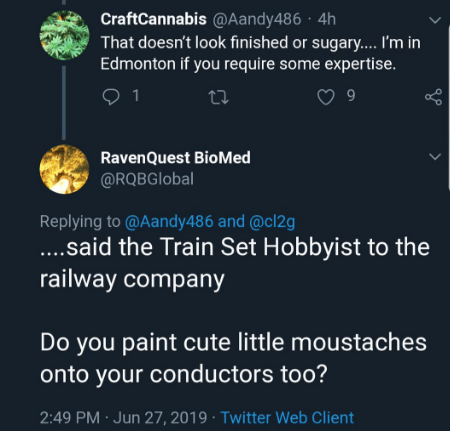

That doesn’t look finished or sugary…. I’m in Edmonton if you require some expertise.

— CraftCannabis (@Aandy486) June 27, 2019

Now, this happens sometimes. A pic gets tweeted when it shouldn’t, maybe the lights are bad, maybe there was a reason to harvest early, maybe the pic wasn’t intended to show finished product – we don’t know, could be nothing.

But the correct response, when faced with a wave of mocking from potential customers, is to explain yourself, and maybe even offer a self-deprecating apology.

Ravenqueazy went the other way.

Oof. Eventually, they deleted that tweet, but not before it was screenshat by others and reposted all over.

Now, this wouldn’t be worth mentioning if it happened once and someone got fired for it, but Robinson’s and Ravenquest’s Twitter feeds are awash in them fighting with a ton of folks who are, mostly nicely, telling them their product looks like crap.

Bunk. That’s a confused plant

— TommyBoy (@TommyBo28906026) June 22, 2019

The pistils are HUGE and not even close to dying back. They’re probably on some mandatory cycle where they pull regardless if the plants done or not

— lrn2grow (@lrn2grow) June 27, 2019

I don’t get why they’re proud of this 55g per plant WET…I’d almost want to hide this result if I were them

— BackWoodyHarrel$onVI (@deantfortytwo) June 27, 2019

2oz per plant ? You are an embarrassment to weed growing. We need 1.5 lbs per light. #dobetter

— McSpliff (@huatuojiaji) June 27, 2019

Even company defenders seemed to accidentally do the work of their naysayers..

Let’s not define quality by a photo, also why would a publicly traded company put out pictures of a bad product… while bragging?

— DW (@DoraWinifred92) June 27, 2019

The boss would soon chime in, picking fights with the naysayers, insisting 55g per plant is amazing, dismissing home growers showing vastly superior results to his own, and deflecting as others cast shade on RQB’s product.

Still no answer to where you purchased the weed you smoked that you attest to be from our gardens. Fess up or you look weak. Dont lose your cred now in this thread https://t.co/VfRl8IY6m8

— george robinson (@cl2g) June 23, 2019

You asked for proof and I showed you without being rude. This is my living room by the way, where I trimmed the plant. Best of luck. Remember it’s customers not shareholders that buy your products. And so far it doesn’t look good

— El Capitan (@donfazool) June 27, 2019

The boss would eventually claim the whole thing was a ‘social experiment’ which, well, is about the dumbest excuse possible.

“Social Experiment”

— ɹʎƆ uoɯɐƎ (@EamonCyr) July 1, 2019

Now, if all of this looks like a long line of internet drama, the likes of which yours truly hasn’t been averse to dropping his nuts into from time to time, you’re right. None of it really amounts to much.

But the difference is, I’m not a custodian of hundreds of millions of dollars of shareholder money. I also haven’t spent a small fortune setting up rotary growing facilities that, it would appear, aren’t doing so great. And I’m not the CEO of a company with one job (sell good weed) that appears to be failing in that one job.

Add to this the fact that Ravenquest appears to have put out an unbalanced balance sheet last quarter and, urgh.

Hey @RQBGlobal care to let investors know why your balance sheet doesn’t balance? Too busy fighting people on Twitter or what?$RQB $RQB.c #potstocks pic.twitter.com/HxU8Hiz6I5

— The Deep Dive (@TheDeepDive_ca) June 28, 2019

NOTE TO GEORGE: The correct response to all this was ‘We grow smaller plants because they’re in a rotary grow, which means they don’t have to stretch to hit the light, and because we jam more into a small space, the lower yields per plant actually play out as more product per square foot.”

You’re fuckin’ welcome. Call me for rates.

PS: Just noticed this, in RQB’s most recent financing news drop:

Ravenquest further announces it has engaged enPercept Inc., an influencer marketing agency, to provide market awareness services for a four-month period at a fee of $115,000 per month, to be paid in common shares for service at prevailing market prices. Securities issued are subject to a four-month-and-one-day statutory hold period in accordance with applicable securities laws.

Half a million bucks to get on Midas Letter? Maybe drop $10k on a social media intern, yo.

CROP INFRASTRUCTURE (CROP.C) HAS ZERO REVENUES, AND WHY THAT’S OKAY

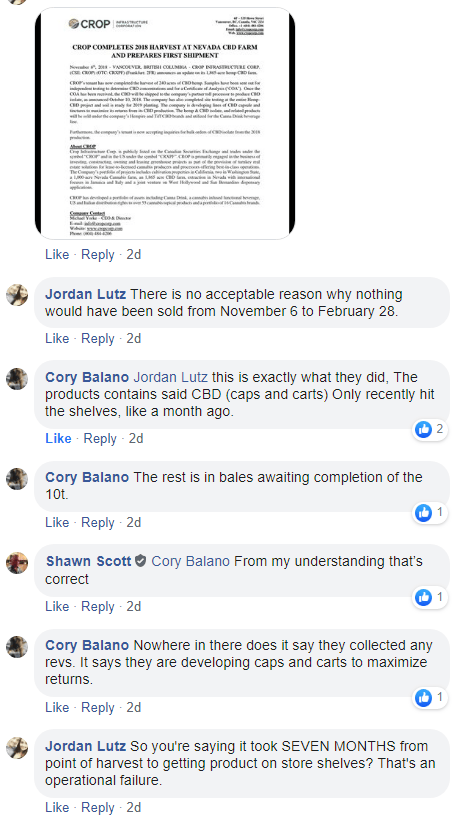

Folks be fighting on Crop Infrastructure messageboards about recent financials that showed no revenue in the past quarter, with that old issue of ‘trust’ being front and center.

Earlier, CROP mentioned it was harvesting.

The gist of the fight; on one side, folks who say ‘but you announced you were harvesting hemp! Why haven’t you sold any?’ and others saying, ‘because selling hemp in bales is dumb, you want to extract it into a value added product and CROP is building the equipment to make that happen’.

To be clear, both sides are right. Crop has been on an asset buying spree for most of the last 18 months, mostly using its own shares as capital, and we’re absolutely in a time in the life of the cannabis sector where companies are finally being expected to show actual returns on their work. That means revenue, if not profit.

It’s why Canopy Growth (WEED.T) is struggling a little and hasn’t lifted its share price in months as losses stack (and why execs are executing options and selling millions of dollars in stock).

It’s why Aurora Cannabis (ACB.T), despite being a long time collector of assets, hasn’t bought much recently.

And it’s why the late last year trend of buying foreign assets with no actual facilities, revenue, or even licenses has dried up hard since Namaste (N.C), Wayland (WAYL.C) and ICC International (WRLD.U) had to stop announcing fantasy deals and resort to death spiral financing to get by.

So if balance sheets matter, is CROP toast?

Not in my opinion, but clearly the time has come for them to rationalize the business. Owning a little bit of something in every country on the planet isn’t the hot ticket anymore in the junior weed space, instead you need to show your actual work.

That said, showing your work can take some time. Harvesting hemp is a great start, and there’s no immediate need, once that’s done, to have your crop sold out the door to anyone who’ll toss you a few lira for it.

I mean, if you mine cobalt and cobalt prices are down, you leave the ore in a pile and wait for prices to catch up – as long as you have cash enough in the bank to get by for a while.

Certainly many LPs have stacked their product, drying it and storing it because they’d rather earn a premium for it later, maybe after processing it into other products, than sell it to the government right now and receive wholesale prices in return.

If you have a spare $50m in the bank, like a Supreme Cannabis (FIRE.T), as an example, you just don’t need to burn yourself out trying to supply the Nova Scotia Liquor Board for $5 a gram. Not when you can get a $7.50 selling directly to the consumer, or more by turning your crop into oil products.

Supreme is letting enough product out to show they have highest quality stuff, but not so much that it’s easy to get, or cheap to purchase – or that it’s going to be white labeled by someone else to keep shelves filled.

Much like their namesake in the streetwear business, Supreme is creating demand by choking supply. You want it? First you have to find it, then you’ve gotta pay for it, then you get to brag about having it.

7 Acres, a subsidiary of $FIRE, has had perhaps the BEST reviews next to MedReleaf products. Jean Guy / Wappa perhaps top the charts. Great job @john_fowler_jd, your focus on quality is paying dividends. 2/3

— Hamzah Ali Khan (@HamzahKingKhan) December 9, 2018

Supreme – 7ACRES Jean Guy is hands down a legit contender that is some fine couture chronic

bravooo! @TheSupremeFIRE @john_fowler_jd $FIRE

Ridiculously good

— Thomas George (@thomasg_grizzle) June 8, 2019

Let’s be clear, CROP isn’t in the category of companies so cashed up that it doesn’t matter if Q2 doesn’t bring in dough. It could certainly use some cash in a minute, and needs to show either execution on some of the deals it’s done soon, or the ability to flip non-core assets for a profit.

To their credit, they’re executing on that plan.

A few months back, they sold some assets, though not in the strictest definition of the term, and not necessarily in a way that would have had investor yodeling their glory from every rooftop:

Crop Infrastructure Corp. has entered into a purchase and sales agreement with World Farms Corp. (WFC) to divest its interests in Crop Jamaica and XHemplar SRL in Italy for $2-million worth of equity in World Farms. Crop will be retained as advisers in relation to research and development in plant science.

The investment comprises 10 million common shares in World Farms and represents a 19-per-cent ownership interest in WFC for Crop.

Meh.

https://equity.guru/2019/02/27/crop-crop-c-says-goodbye-jamaica-italy-2000-return/

But a few months later, that paper flip turned into a paper RTO, and suddenly things are more interesting:

CROP INVESTMENT HOLDING WORLD FARMS ANNOUNCES LOI TO GO PUBLIC ON THE CSE

Crop Infrastructure Corp. investment holding World Farms Corp. has signed a letter of intent with Graphite Energy Corp. to go public through a reverse takeover on the Canadian Securities Exchange. Crop currently owns 10 million shares in World Farms, which has also arranged a 30-cent private placement in connection with the reverse takeover.

On Feb. 27, 2019, Crop divested its interest in Italian and Jamaican joint ventures in return for $2-million in common shares of World Farms at a deemed price of 20 cents per share for a total of 10 million shares.

If CROP can make money for itself by spinning assets out as RTOs, that’s not a terrible plan – in a bull market.

It should be said, we’re not in one of those right now.

Still, a spin-out can sometimes give a deal a little mouth to mouth, by bringing in new investment, helping the original company get back to core assets, and/or by cleaning up the story some so that a future suitor who might not want anything outside of North America, has an easier takeover target.

Crop chief executive officer Michael Yorke stated: “The RTO is proceeding as planned and is now subject to final approval by the CSE. By divesting our Italian and Jamaican assets to World Farms, it has allowed Crop to focus and expand its operations in the USA, as well as gain a major investment.”

“It is significant for World Farms that it is already cultivating 100,000 cannabis plants with another 500,000 planned to be growing in Croatia over the coming weeks.”

CROP has a little stigma attached to it still, which World Farms doesn’t have. If World Farms debuts with a full sail, we may just see it become to new core of the business.

LIFESTYLE DELIVERY SYSTEMS (LDS.C) HANDS THE CAR KEYS TO JUNIOR

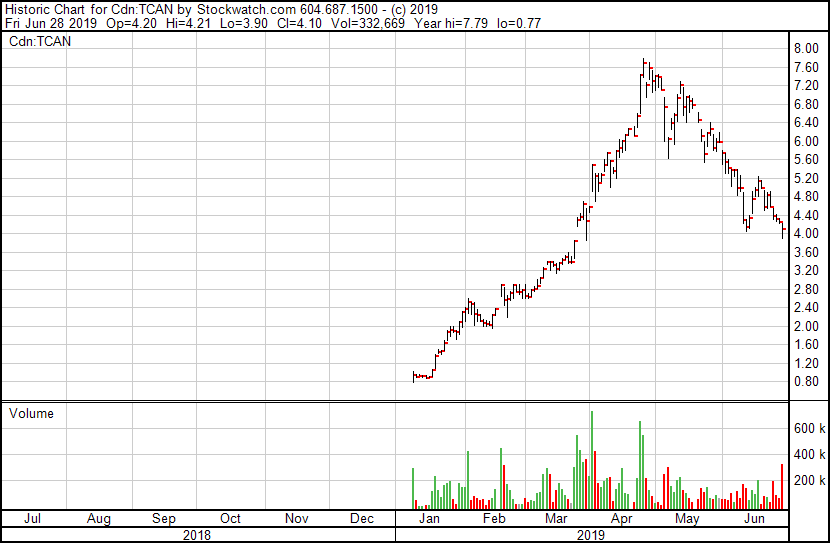

This tactic is not dissimilar to what Lifestyle Delivery Systems (LDS.C) announced Friday (or was it Saturday?) in that they’re looking to get swallowed by their own spin-out sister company, Transcanna (TCAN.C).

https://equity.guru/2019/06/30/transcanna-tcan-c-lifestyle-delivery-lds-c-plan-get-married/

LDS has wrinkles. It has lumps. Warts even. And recent news just hasn’t moved the needle like it used to. The company needed to show more progress than getting Cannastrips into 32 dispensaries in three years.

Years of missed targets, regulatory delays, technological workarounds and even, once, a visit by armed Sheriffs, have made it heavy going for LDS under its present management to inspire stock buying.

Transcanna, on the other hand, amid an admittedly heavy promotional spend, has lit things up in California. So why not rearrange the family tree?

A month ago, Transcanna got permits that would allow them to do what LDS is doing.

TRANSCANNA’S TCM DISTRIBUTION, INC. RECEIVES ADELANTO ADULT USE PERMITS FOR MANUFACTURING AND DISTRIBUTION

Transcanna Holdings Inc.’s wholly owned subsidiary, TCM Distribution Inc., has received an adult-use cannabis manufacturing permit and an adult-use cannabis distribution permit from the City of Adelanto, Calif.

[..] “The purpose of the Adelanto facility is twofold; first, it’ll be used as one of our Southern California satellite facilities for goods being transported from our 196,000-square-foot vertically integrated, cannabis-focused facility in Modesto. Second, with the non-volatility manufacturing licence we’ll be able to accommodate the production and packaging of prerolled cannabis products and other products of similar nature, then distribute them accordingly,” stated Jim Pakulis, chief executive officer of Transcanna.

Translated: We can make, and distribute, Cannastrips.

And the city is on board:

The company is pleased that the Adelanto City counsel in May approved reducing the tax on transportation, distribution, manufacturing and cannabis testing lab services from 5 per cent down to 1 per cent. The counsel also voted to reduce the cultivation tax from $5 per month per square foot to 42 cents per month per square foot. The dispensaries tax was also reduced from 5 per cent down to 3 per cent.

To be clear, there is an ulterior motive in this move, and that’s around the amount of ‘in the money’ stock that becomes free trading in a week’s time.

Those setting up this company bought stock as cheaply as $0.05 in doing so, up to around $0.50, so the current $4+ share price is a crazy profit position that almost demands a sell-off one all the paper is free trading.

And the chart reflects the growing fear that such a drop will happen.

Green Organic Dutchman (TGOD.T) faced a similar paper tsunami last year, and tried to convince folks to ignore the likelihood of a sell-off with spin-outs and news, before ultimately just letting the chips fall where they may. Their stock, mostly acquired between $1.15 and $1.65, drifted as low as $2.25 (still a great profit) before climbing back over $5 in early 2019. Today it’s drifted, like most others, to $3.23, which is around a double for anyone who bought and forgot that early stock.

To keep those early TCAN investors from killing the stock when their paper is free trading, the company recently did a financing at $5 per share, and expected those who’d got in earlier at a cheap price to double down at that level.

“We’re all doing it,” I heard from some large holders. “One in, all in.”

To support that push, now we have action intended to demonstrate the company has grander ambitions than the current share price will attest to – the acquisition of a company they believe is undervalued, with management that has probably gone as far as it can go without churning out an entire new retail investor base that hasn’t lived through the ‘era of delay’ many of us associate with the company.

There is no premium to the LDS purchase offer. It’s a deckchair rearrangement. But it’s not a dumb idea.

In CROP, and Transcanna, what you’re being asked to do is trust.

Trust that the guys with the most to lose are going to let their bet ride. Trust that folks sitting on a lot of paper profit won’t turn that into real profits – yet. Trust that management has a plan that will spin that roulette wheel and bring you multiples – if you have the patience.

To be sure, these are my clients. Also, they became my clients knowing I tell the truth so, here it is.

I did not buy into that $5 TCAN financing. I am not buying CROP currently.

That’s not because I don’t believe in what they’re looking to achieve over the long haul, rather it’s because this is a time of downward pressure on the whole sector, and those companies in particular, and the the risk levels on these two are higher than normal. The economy in general is showing signs of strain, and there are things I want to see those companies doing that will show me they’re rockstars, that haven’t yet occurred. When they show me that ultra ambition, and show me that their big holders are locked in, and we churn through the inevitable paper shuffle, I want to be cashed up coming out of all that.

If these companies run in the meantime, I’ll have missed out, and I’ll regret that.

But if they don’t, and they have to go through a little selling and downward pressure, I’ll be presented with excellent opportunities to jump back in cheaper, later, and I won’t feel like a traitor in having done so.

You can like a company and not feel like now is the time for them. When TGOD was facing aits paper sell-off, we said it was a good time to step out and wait for your right time to reenter. Those that did, did well. Those that rode it down, ‘because we’re Team TGOD’, did themselves no favours.

Love the company, but love your money more. Ultimately, trusting that your money will be protected starts with your own actions.

CHEMESIS INTERNATIONAL (CSI.C) ATTACKS STRIP MARKET

Showing a growing reputation for delivering on their promises, Chemesis International is tackling LDS’ strip market head on, in both California and now Michigan, with a $6m supply deal.

CHEMESIS INTERNATIONAL INC. & RAPID DOSE THERAPEUTICS SIGN AGREEMENT TO BRING QUICKSTRIP ORAL THIN STRIPS TO MICHIGAN

Chemesis International Inc. and Rapid Dose Therapeutics Inc. have signed an additional definitive agreement to bring QuickStrip oral thin strips to the state of Michigan. The company previously announced a definitive agreement to produce QuickStrips for the state of California and subsequently to bring QuickStrips to Puerto Rico.

“We are focused and committed to providing consumers in the U.S. medical and recreational cannabis markets a Smoke-Free Choice,” said Mark Upsdell, chief executive officer of RDT.

“RDT will continue to expand our strategic global partnerships and further strengthen our market share in the cannabis sector. This agreement with Chemesis improves the QuickStrip position as a growing international brand and delivery device to Michigan consumers, while simultaneously offering health benefits and improving patient outcomes.”

Chemesis expects to distribute QuickStrip in Michigan by the end of 2019.

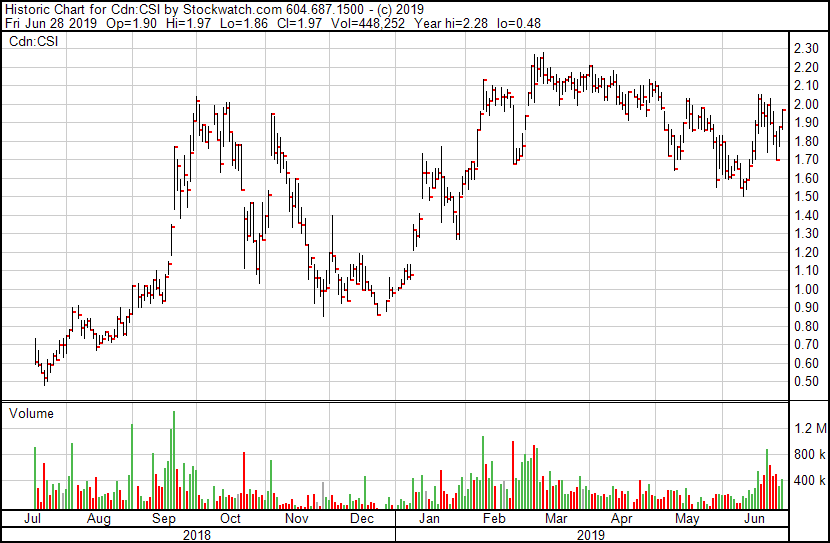

As a company, some have criticized CSI for having not told their story in as hypey a manner has some. But, motherfucker, check out this chart – at a time when nearly everyone is getting killed out there.

https://equity.guru/2019/06/13/chemesis-csi-c-quickstrip-puerto-rico-opportunity/

That’s what comes from announcing plans, then announcing the deals that will make those plans happen, then closing those deals, then bringing in revenues. The trust line is getting thicker on this one.

ASCENT INDUSTRIES (ASNT.C): THE OTHER SIDE OF THE TRUST LINE

Happy to announce a splinter of good news for former client, license-loser, and generally disappointing story Ascent Industries. Not only have they been acquired by a still mystery outfit in BZam (announced earlier this year), but they got some good news in Nevada Friday.

Ascent Industries Corp. has noted the successful conclusion of the Clark County licence hearing. The outcome allows the company to continue operations in Nevada, based upon the decisive compliance actions taken by the company and the new management team.

Ascent is grateful for the transparency, responsiveness and professionalism of Clark County, its process and its staff.

“We are absolutely committed to adhering to all regulatory requirements as efforts continue to advance plans to expand our operations in Nevada,” said Paul Dillman, chief executive officer of Ascent. Ascent looks forward to working with the regulators and officials to comply with all regulatory guidelines.

With a $29m market cap, the still halted ASNT stock will be one that could end up as an arbitrage situation. The deal to offload the troubled Canadian assets came to $29m after liabilities were assumed, and that leaves the stock still holding, “the assets related to Ascent’s cannabis cultivation, production, distribution, research and product development business outside of Canada in Oregon, Nevada and Denmark.”

The chance Nevada may see the Canadian troubles associated with the company and ban ASNT from that state was a serious one, but it appears that won’t be happening, which gives investors value above the current market cap.

How much value? That depends on whether the company tries to rebuild trust with what it has left, which would be a long journey, or liquidate.

THE EXPERION (EXP.C) STORY: PRODUCTS, EXPORTS, PRODUCTS

If you judge all cannabis companies on their size, or on their current sales, there’s not much Experion (formerly Viridium) can do for you. It’s a small company positioned off to the side of where everyone else is playing. There’s a lawsuit a former exec is pushing that insists he’s owed a bunch of stock. There’s a product research acquisition out in Alberta. There’s a grow facility and license but, oddly enough, everyone has one of those these days.

So what is Experion and why would you care?

The theme is this article is trust, and I maintain anyone who sits and talks to EXP CEO Jay Garnett will come away trusting he knows what he’s talking about.

Maybe a little too much, if we’re honest, because he tends to get into the science pretty hard.

Garnett doesn’t see the long term value of his company in growing agricultural products people might smoke, and I agree with him. Yes, he’s going to keep growing said products and they’ll bring in some dough as they roll out into stores, but that’s not the core business.

And yes, they’ll white label some product for bigger players with a dearth of supply, but that ain’t it.

And yes, he just announced a big sale of product to Polish researchers, so that’s a nice thing. Money in the door. But that ain’t it.

Garnett isn’t that focused on moving from #84 to #83 on the Ontario Liquor Board’s sales numbers, or the right to lose money growing plants in high tech facilities only to sell them wholesale. He’s looking further on.

He’s looking to what cannabis will become. As Gretzky used to say, don’t chase the puck, skate to where the puck is going.

The entire fucking story is encapsulated in this passage, from a recent news release:

EXPERION’S BRAND, KANAB GOODS CO., WELL POSITIONED TO TAKE ADVANTAGE OF NEW HEALTH CANADA REGULATIONS

Experion Holdings Ltd. has provided an update on the company’s brands positioned to take advantage of Health Canada’s final regulations for value-add products (VAPs) such as cannabis topicals, edibles and extracts as well as Health Canada’s proposal to create a new category (cannabis health products) for therapeutic treatment of minor ailments such as sleeplessness or sore muscles or for use in pets, paving the way for a large new, untapped market.

The focus is on the continued development of Experion’swellness-centric brand Kanabe Goods Co, with which they plan to launch a plethora of value-add products (VAPs).

Garnett told me recently, “There are 50+ existing formulations we have the ability to produce in our facility right now, and we’re working with strategic partners I can’t name just yet for large-scale commercial rollout when the rules allow.”

“These health and wellness products such as non-intoxicating topicals and microdosed oils are an entry point for new consumers, broadening the market potential. The Experion management team has decades of experience in consumer-packaged goods and is well positioned to be a first mover in this category, which in turn will enable Experion to stand firm in our commitment of unlocking value for our shareholders.”

The value-add product regulations being rolled out by Health Canada and the federal government come into being on October 17.

Furthermore, Health Canada’s proposal for cannabis health products opens the door for a bigger opportunity. The proposal looks to treat health and wellness products with cannabis, similar to natural health products, which allows the product to make health claims based on evidence but without the oversight of a practitioner.

Let’s be clear: EVERY LP IS WAITING FOR THIS MOMENT.

Experion will have much competition when that door opens. They’re lurking, but they’re not alone.

Also – they’re already supplying larger LPs, so their trust level within those networks is high. If a top ten player wants a tincture quickly. why not look to the guy who’s been supplying you flower quickly? If you can’t grow enough flower to supply your existing customer base, where you going to go for the NHPs you’re going to need October 18?

Jay Garnett hasn’t built his story in the eyes of investors yet. But that’s an opportunity, because he’s working on the trust he needs to build for an audience of ten CEOs at potential large partners that can blow enough business through his facility that Experion may have no need to ever sell a flower to a liquor wholesaler ever again.

At this $24 million market cap, one of the lowest for any LP in the game? I’m placing some trust here.

— Chris Parry

FULL DISCLOSURE: Supreme Cannabis, LDS, Transcanna, CROP Infrastructure, TGOD, Chemesis, and Experion are Equity.Guru marketing clients. iAnthus and Ascent were clients previously, and the author may hold stock in any or all of those companies.