As the legalized cannabis market comes of age in North America and worldwide, the mainstream media tends to focus on cannabis growers and cultivators. While we wouldn’t discount the importance of growers, there’s an emerging subsector with growth potential.

We are referring to cannabis real estate, an essential component of the worldwide cannabis ecosystem. Renting out land and equipment to growers and other industry participants is a solid business model. It has the advantage of circumventing certain legal issues by never having to actually “touch the plant.”

There’s an old saying among gold and silver investors: “Don’t invest in the miners; invest in the companies that sell the picks and shovels to the miners.” Similarly, we believe it’s a smart move to take a stake in companies that rent out real estate so that the cannabis growers and other participants can conduct their business.

CROP Infrastructure (CROP.C) excels in bridging that gap: the company’s subsidiaries have tenants who engage in cannabis-focused activities, while CROP receives a percentage of their profits as “rent.”

As Equity.Guru’s Lukas Kane explains, “CROP invests in producers and processors through lease programs and fee-based management options… It’s a cannabis-specific Real Estate Investment Trust (REIT) – with massive leverage to the frontier cannabis markets.”

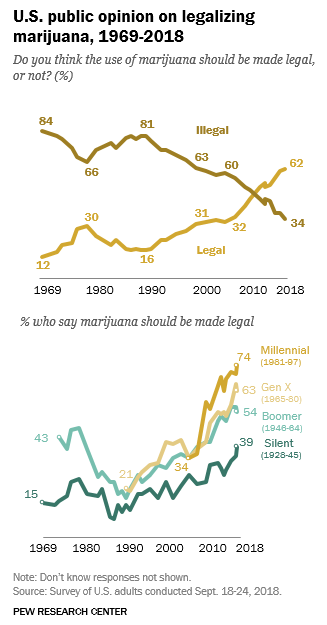

CROP provides a solution to the federal regulations (unfair ones, in our opinion) that prevent mainstream lending institutions from participating in the astonishing growth of the cannabis sector. 62 percent of Americans (and 74 percent of millennials) support marijuana legalization.

Adult recreational marijuana is now legal in 10 U.S. states and medical marijuana is legal in 33 states; and yet, the government still doesn’t allow big banks to finance the land and equipment needs of up-and-coming legalized cannabis companies in America.

It’s going to take some time for the government to catch up to the will of the people – and to recognize the healing potential of regulated medical cannabis, not to mention the basic right that adults have to partake of the plant if they choose to do so. Until career politicians finally come into the twenty-first century, the American cannabis market will have to work with the laws that are currently on the books.

Thankfully, there’s nothing on the books that prohibits investing in income-producing property and agricultural equipment, which is precisely what CROP’s subsidiaries do. Through affordable lease programs and fee-based management options, CROP is indeed “making history one farm at a time.”

According to a fresh press release from the company, CROP’s Park Project tenant has attained self-sustaining status within 12 months of acquisition as it launches its Tiff CBD cartridge line.

Achieving self-sustainability in such a short span of time is emblematic of CROP’s pivotal role in the burgeoning American cannabis ecosystem.

With CROP’s assistance, Park Project tenant is on the ground and running with its first batch of Tiff CBD produced. The cartridges and boxes for the Tiff CBD line are set to be sold as a full-spectrum product in Washington first, followed by introduction into other U.S. states with a no-THC product.

For Crop, $642,000 in lease, rental, and brand fees have been accrued from the tenant since the beginning of the year. That’s the beauty of CROP’s business model: they operate like a REIT, and don’t have to sell a single unit of cannabis products to turn a profit.

Cannabis is still a Schedule I drug and even if big banks were allowed to subsidize cannabis companies right now, they would do so reluctantly and charge extortionate fees.

CROP is proving that big banks aren’t the answer to the cannabis industry’s problems – and that nimble publicly-traded companies can provide financing solutions when governments refuse to take action.

“We are excited by the launch of the full spectrum Tiff CBD line in Washington as well as a multi-state no-THC Tiff CBD product,” stated CROP CEO Michael Yorke, “With the Park facility now self-sustainable and on the right trajectory, our bandwidth and capital can be focused on opportunities both where the company is present and as new states come online.”

Full Disclosure: CROP Infrastructure is an Equity Guru marketing client, and we own the stock.