Pasha Brands’ (CRFT.C) buying spree of Canadian marijuana companies is just getting started.

On Monday, the Vancouver-based cannabis production and distribution company announced it has purchased CBD Therapeutics, Canada’s largest direct-to-consumer cannabidiol retailer.

It has been three weeks since Pasha became a publicly-listed company. Over that period, Pasha has finalized the acquisition of two iconic cannabis brands and unveiled a board of directors filled with marijuana industry all-stars.

While the terms of the deal weren’t disclosed, Pasha has acquired all of CBD Therapeutics’ trademarks, names and intellectual property. Pasha intends to re-launch the brand across the country “in the very near future,” according to the official press release.

Patrick Brauckmann, Pasha Brands’ executive chairman, said the folks at CBD Therapeutics have “made a strong name for themselves in the CBD market” thanks largely to their focus on education prior to legalization. CBD Therapeutics has developed a rigorous curriculum on CBD that is educates users on the benefits and application of cannabidiol.

That focus allowed CBD Therapeutics to grow its client base and enjoy strong brand recognition across Canada.

The merger appears to be a win-win scenario for both companies. CBD Therapeutics will help Pasha make inroads into the fast-growing CBD market. And by joining Pasha, the architects of CBD Therapeutics will move one step closer to their vision of making CBD products more accessible across Canada.

Rush to fill the supply gap

We’ve written before about the supply crunch facing Canada’s legal cannabis market, but the shortage is actually more acute for CBD products. The non-intoxicating extract has proven far more popular than even licensed producers realized, and this has resulted in a race to get product to market.

Canada’s direct cannabis market is expected to double to CAD$11 billion in the next six years, with extracts, edibles and non-edible derivatives accounting for the largest share of the growth, according to research from Ernst & Young.

Looking south of the border, the U.S. CBD market could be worth a whopping USD$22 billion in the next three years, according to Brightfield Group. Since there’s no shortage of products that can be infused with cannabidiol, this market segment will likely extend far beyond the nutraceutical category. Think dispensaries, smoke shops and even pharmaceuticals. There’s no limiting where CBD oil ends up.

B.C. wholesaler on the hunt for reliable CBD purveyor

Pasha Brands won’t have to look very far to find customers for its newly acquired CBD business. The company’s home province, British Columbia, has been unable to maintain a reliable supply of CBD oil.

“Demand for CBD products has been higher than what was anticipated by licensed producers,” Kate Bilney, a spokeswoman for B.C.’s Liquor Distribution Branch, said back in April. The province’s wholesaler, BC Cannabis Stores, has experienced a lack of supply for CBD products since prohibition ended.

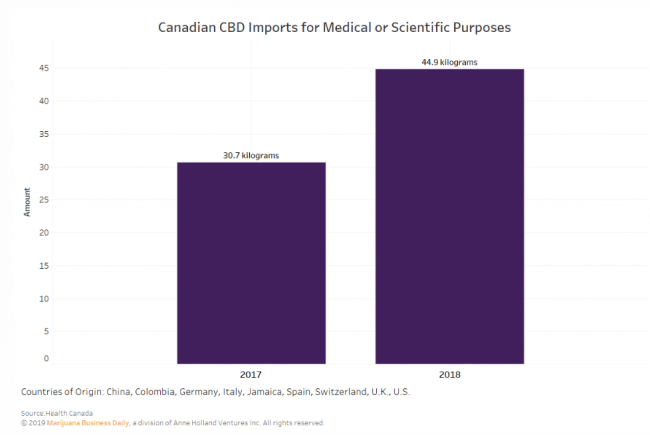

Imports have been on the rise since 2017 but have lagged far behind demand. In other words, B.C. and other provinces don’t expect to meet the supply shortfall by turning to international markets. Making matters more difficult is the fact that CBD oils can only be imported for medical or scientific purposes, according to Marijuana Business Daily.

By acquiring CBD Therapeutics, Pasha Brands is in a stronger position to address B.C.’s cannabidiol shortage. Combined with the purchase of the Health Canada-approved Medcann, Pasha is probably the most exciting Canadian cannabis brand right now.

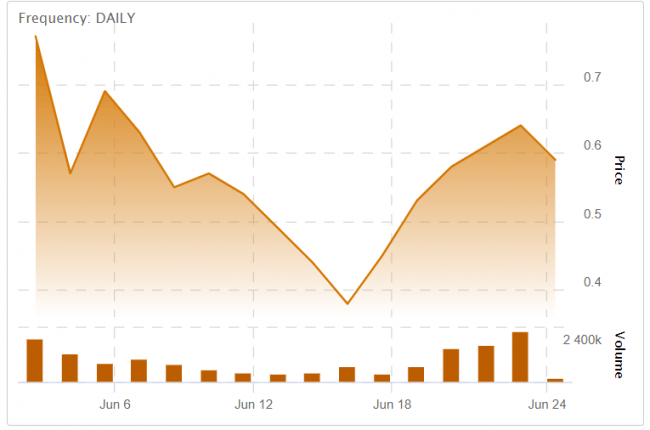

Investors have yet to catch on, and we don’t blame them. CRFT.C stock is barely a month old, and has been highly volatile through the early stages of its low-volume trading history.

Since going public, CRFT.C has traded within a range of CAD$0.23 and CAD$1.05. We expect CRFT.C to attract more bids as the company becomes a staple of Canada’s evolving marijuana landscape.

At last check, Pasha’s stock was valued at less than $0.60.

Full Disclosure: Pasha Brands is an equity.guru marketing client.

On page seven of Pasha’s CSE Listing Statement it states that CBD Therapeutics was bought on November 7 of 2018 . The terms of the deal are also disclosed.