Supreme Cannabis (FIRE.T), the marijuana grower behind 7ACRES, Cambrium and Medigrow, has received the green light from Health Canada to expand its production capacity by 28%.

Supreme will be among the first to meet the anticipated supply shortage that is currently bogging down Canada’s cannabis sector. Supreme is now positioned to continue expanding its business overseas, where demand for medical marijuana is surging.

28% production boost

Supreme announced Monday that Health Canada has approved a 50,000 square-foot expansion of its 7ACRES production facility located in Kincardine, Ontario. The additional space will house five new flowering rooms that will produce hand-crafted cannabis flowers.

The latest approval gives 7ACRES a total of 230,000 square feet of production capacity. The additional space will allow 7ACRES to boost its production capacity by 28% to roughly 33,580 kg.

With 25 flowering rooms, Supreme’s 7ACRES facility is expected to see additional efficiency gains. This means harvesting plants with better genetics, aroma, appearance and size.

“With five more flowering rooms at 7ACRES now approved by Health Canada, the finish line is in sight,” Supreme Cannabis President and Founder John Fowler said in a statement. “As 7ACRES continues to work towards full production capacity, we are excited to fulfill demand for our high-end cannabis from enthusiasts coast-to-coast.”

Jim Fowler, one of the marijuana industry’s rising stars.

Rush to fill the supply shortage

Since Trudeau’s government legalized recreational cannabis in October of last year, sales in the Canadian market have struggled to take off as expected. In fact, retail cannabis sales have declined since their peak in December.

Aside from B.C., which hasn’t stopped blazing since prohibition ended, sales across Canada declined 13% between December and February.

This stems from an acute supply shortage at the retail level. Health Canada has more than 800 cultivation license applications to go through and the lack of retail locations means there’s not enough of the legal stuff to go around. At least, not yet.

Canadians still turning to the black market

The supply shortage has amounted to a game of dollars and cents for consumers. According to a recent StatsCan survey, Canadians are still turning to the black market for their cannabis fix.

The survey, which covers the January-March period, showed that more than a third (38%) of Canadians are still buying their weed from the black market.

This is hardly surprising. An ounce of cannabis bought on the streets runs anywhere from $160 to $180. In licensed shops, that same ounce costs between $260 and $280. On a per-gram basis, illegal weed is 36% cheaper.

The StatsCan survey is almost exactly aligned with a recent report conducted by Deloitte. In that report, Deloitte estimates that about 40% of Canada’s marijuana consumption this year will come from illegal sources. That’s nearly $3 billion going into the pockets of your local black market weed dealers.

Investors looking to capitalize on a hundred years of pent-up demand for legal cannabis will naturally gravitate toward producers that have the capacity to meet the current supply gap. Supreme will likely live up to its ticker symbol and catch fire as its production and distribution networks continue to grow.

FIRE catches fire

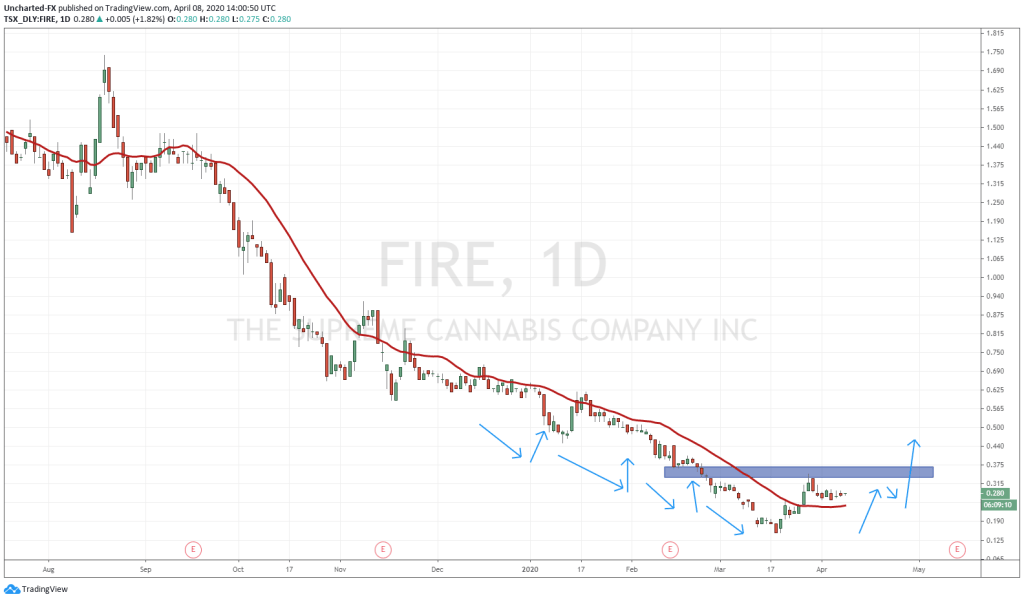

Shares of Supreme Cannabis surged on Friday even as the broader stock market slumped. While there wasn’t any single catalyst for the rally, a virtuous news cycle tied to Supreme in general and 7ACRES in particular had an impact on the stock’s performance.

FIRE stock surged 9% on Friday to close at $2.05, its highest since early April. The share price peaked at $2.30 on March 26 and is up more than 60% from its December low. The December flash-crash wasn’t unique to FIRE as the global stock market experienced a synchronized meltdown over Trump’s trade war and a hawkish Federal Reserve. (Oh look, the same thing is happening today.)

The stock was down 1% in Monday’s early morning session, mirroring a sharp drop across the entire market. The S&P/TSX Composite Index was also down more than 1%. South of the border, U.S. stocks plunged more than 2% after the open.

If fundamentals are to be believed, Supreme’s share price is poised for even bigger growth in the long term. Much of that growth will be tied to 7ACRES, which has emerged as one of the most respected brands in cannabis, and also one that is constantly expanding and boosting its revenue streams.

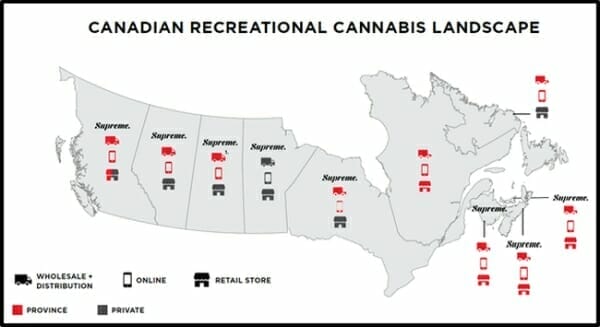

In addition to its now bigger Kincardine production facility, 7ACRES recently secured supply agreements with New Brunswick and Saskatchewan. The company is clearly widening its footprint across the country, which makes its current stock price attractive for buyers looking to capitalize on one of the industry’s fastest-growing companies.

Full disclosure: Supreme Cannabis is an Equity.Guru client.