Back in December, I wrote a few stories about C21 Investments (CXXI.C), and how, at a $50 million market cap and $0.71 share price, and with $35m in revenues coming in from US assets, it was a bit of a steal.

Someone, somewhere, agreed, and the share price of CXXI went on a tear from low $0.70’s to $2.50 in just three months.

I ain’t gonna lie; at $2, I sold mine happily.

Love the company, love the assets, but a win is only a win if you take your profits. It’s not a betrayal if you buy your shares back later at a discount.

Again, someone, somewhere, apparently agreed because the share price has now come back to a place where it makes sense again as an opportunity investment.

But before it reached the place where the falling knife clanged off the floor, CXXI went through a period where it wasn’t the master of its own destiny. It had a nice run, but sometimes those runs get picked up by the crowd and become stupid, inevitably followed by one pack claiming it’s a pump and dump, and another claiming it’s going to the moon.

The truth lies somewhere in the middle. CXXI had a good run that went a little too hard, and has had a backslide that’s gone a little too long.

And thus we’re presented with an opportunity.

First, for those who don’t know what it is:

We are a brand focused, vertically integrated cannabis corporation that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products. C21 has acquired cannabis companies in Oregon and Nevada, with holdings in the consumer branded goods and dispensary markets, and more on the horizon.

That’s a pretty decent summary, from the CXXI website.

Heres another:

C21 Investments Facts:

– 13 Licences

– 105,000 SF Active Cultivation

– 240,000 SF Available Cultivation

– 12,500+ lbs Flower Annually

– 365,000 gm Raw Oil Extraction Capacity (monthly)

– 5 Consumer Brands with 400+ SKU’s

– 50,000 Direct Retail Customers— Lance (@tbevel) June 10, 2019

So what do they own?

Here’s Silver State Relief, Nevada’s first dispensary which has now become two, complete with their own cultivation facility:

View this post on Instagram

We’re back at it! Tell your friends, Silver State Relief is on Instagram!

A post shared by Silver State Relief (@silverstaterelief_nv) on

“OMG, it looks like an Apple store!”

And they make money:

During the month, C21 Investment’s retail dispensaries completed a record 53,120 customer transactions compared to 38,076 for May 2018, prior to their acquisition by C21.

Elsewhere, Eco-Firma Farms is a 23k sq ft licensed grow in Oregon, which is nice but, frankly, dwarfed by the four outdoor wholesale-licensed Phantom Farms locations C21 owns in the same state.

Phantom also does vapes and pre-rolls, which it supplies to 125 dispensaries statewide, which would be a nice sized business even if that was all C21 owned.

But it’s not all they own.

https://equity.guru/2018/12/18/c21-investments-cxxi-c-made-tonne-moves-2018-looks-expand-2019/

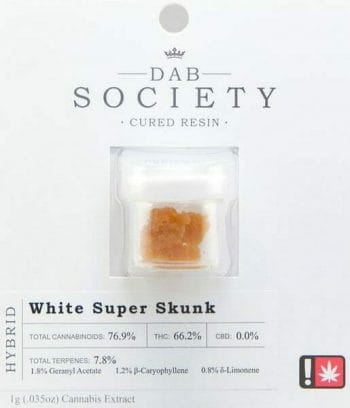

They also own Swell Companies, which makes all manner of products and holds several locally recognizable and well received brands, including:

Oregon as a cannabis market has had its challenges, but this team continue to dominate that state and have built brands that have expansion and acquisition scope. To that end, there’s much talk right now about those Swell brands having just shown up in C21’s Nevada dispensaries under license.

The company is leveraging its strong Silver State retail platform to launch its “Hood Oil” vape line in Nevada. Founded in 2015 under Swell Companies, Hood Oil offers branded extract products at an affordable price and the initial product launch includes vaporizer cartridges and batteries.

That’s how you build real nationally recognized brands – one state at a time, using the advantage and reach of your own verticals.

And check out the early results:

During the first four days of this launch, Hood Oil vapes generated approximately 13.5% of Silver State’s total unaudited gross sales.

Jesus on a pogo stick, that’s some nice revenue because Silver State does sales.

So there’s some real company there, run by real people doing a really nice job, with real money coming in the door. What next?

First, we figure out why CXXI fell so hard.

#FinTwit, do your thing:

That’s because $CXXI was bludgeoned to submission by shorts. First, because the run went too hard, too fast, w no news. Then IBs shorting to the $1.38 raise. Then debenture shorting & cover. It’s way overdone & w catalysts pending & the negatives behind it, recovery should start.

— Sammy J (@sammyj_19) June 11, 2019

This is accurate.

Next, we try to figure out if the market is ready to climb back on.

Finally a level 2 that makes sense. I know there are a lot of eyes on $cxxi waiting for a trend reversal to start or add to a position. If you’ve been patient this could be the type of level 2 you’ve been waiting for. Wise hands in at $1 won’t sell for a 10% gain either. pic.twitter.com/NllzeNp5kd

— StockStar (@StockStar10) June 10, 2019

Do the chart-heads agree?

$cxxi ascending triangle on hourly graph, 1.05 resistance pic.twitter.com/aJaXjkcl5H

— Danny (@d_kab1) June 11, 2019

All of that sets up nicely for some news to kick it back upstairs.

This morning, the company dropped some that points to that coming:

C21 Investments Inc. (CSE: CXXI and OTC: CXXIF) today announced unaudited revenue of US$3.2 million for the month ended May 31, 2019. Unaudited Gross margin (before fair value adjustments) is estimated to be 50%. This amount reflects revenue from the Company’s operations in Nevada and Oregon. These figures include revenue from Swell Companies, starting from the closing date of the acquisition of May 24, 2019.

Okay, if nothing changes for the rest of the year, that’s US$38.4 million in annual revs.

That said, things will most definitely change.

$CXXI is on pace to do USD68.9M in revs. This is extrapolated from the average Feb-Apr numbers and further extrapolation of one week numbers from Swell. This is the run rate of revs assuming no further growth. This is exactly how Select became a $1B company.

— PRATEEK SODHI (@SodhiPrateek) June 11, 2019

That heart attack chart is going to worry some investors, which will make the second wave harder going. I’m not going to suggest C21 will fly back to $2.50 in the near future, but that shouldn’t be the object of any investor’s decision-making going forward.

Those revenues are definitely highlight reel worthy. They will also likely come, at least in the next financial statements, with a net loss, which will happen when you’re expanding and raising money and paying debentures and, quite frankly, is standard across the US multi-state operator scene.

If I’m buying CXXI stock back now, and I’m doing exactly that, it’s not because I’m going to double my money in a month. It’s because this company is doing what it said ti would, making revenues it said it would, and because the craziness of the shorts vs pumpers war over the last few months appears to have moved on to Beyond Meat (BYND.Q).

— Chris Parry

FULL DISCLOSURE: C21 Investments has been an Equity.Guru marketing client, and the author has bought and sold the stock previously