North America’s legal cannabis market is just getting started, and until now, most of the focus has been on two major types of businesses: cultivators that grow the green plant and dispensaries that do the selling.

C21 Investments (CXXI.C) is addressing an entirely overlooked segment of the market: business-to-business (B2B) services that support the growth, distribution and sale of cannabis.

On Tuesday, C21 announced it was launching a new B2B cannabis distribution company that not only addresses supply-chain issues facing the nascent marijuana industry, but one that ensures more of its packaged goods end up in the hands of consumers.

In an official press release, C21 Investments announced it has created a wholesale distribution company called C21 Supply Co. The new distributor will accelerate the company’s B2B efforts in order to get more of its products on store shelves.

C21 Supply Co will initially serve the Oregon market before spreading to Nevada. Phantom Farms, Dab Society, Hood Oil and ECO Firma Farms are the packaged goods brands targeted for distribution.

Robert Cheney, C21’s president and CEO, said C21 Supply Co will play a key role in the company’s “vertical integration model.”

In other words, Cheney wants to make C21 Supply Co a one-stop shop for dispensaries that want to sell the company’s leading cannabis brands.

He said:

“C21 Supply Co. will be a single point of contact for efficient order processing and invoicing, making merchandising easier and more accessible for our wholesale partners.”

Oregon: A fine place to start

Oregon is nowhere near the most populous marijuana state, but it has already proven to be among the largest end-markets for THC and CBD products. Legal cannabis sales in the state are expected to top $1 billion in 2020, virtually doubling from 2017, according to New Frontier Data.

The state’s residents are also among the biggest consumers of marijuana products. More than half of Oregonians report to using cannabis on a daily basis, according to Brightfield Group. Only a third (34%) of California and Washington residents report the same.

Just last month, C21 completed the acquisition of Swell Companies, an Oregon-based cannabis producer with 41 employees. Swell is the creator of the aforementioned Hood Oil vape line, one of the biggest extract brands in Oregon.

It didn’t take long for C21 to transport Hood Oil across state lines. Through its Silver State retail arm, C21 recently launched the vape line in Nevada. It took something like four days for Hood Oil to rack up 13.5% of Silver State’s unaudited gross sales.

C21 made USD$103,000 per day last month, and we are eager to see how that impacts quarterly sales figures. At this rate, the company is on track to blow past its first-quarter revenue haul of US$7.7 million.

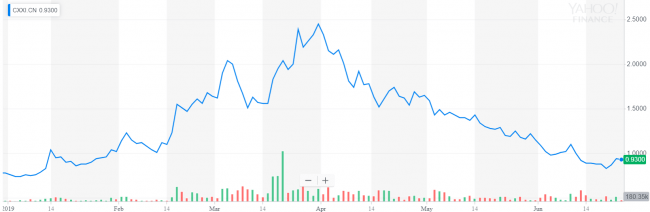

C21 is still a penny stock

Despite reporting massive growth, C21 Investments is trading for less than CAD$1.00 on the Canadian Securities Exchange. The stock, CXX.C, is down a whopping 62% from its March high of $2.45. Over the same period, the Canadian Marijuana Index has declined by around a third.

Clearly, marijuana investors have moved past initial euphoria and are now taking a more calculated approach with their stock picks. Since marijuana sales are improving, there’s strong reason to believe that the pullback is a tad overstated.

Earlier this month, GMP Securities said the sector’s selloff provides “a compelling opportunity for investors.” And while GMP was referring to American companies, C21 Investments has heavy exposure south of the border.

Against this backdrop, CXX.C provides good value for investors looking for a fast-growth pot stock at a discount.

Full Disclosure: C21 Investments is an Equity Guru marketing client, and we own the stock.

This is where Calyx CYX (ironically only one letter of on trading symbols) should have been by now. At least CXX is forging ahead and putting into action revenue generating platforms.

“More than half of Oregonians report to using cannabis on a daily basis”. Really? That seems incredibly high.