There’s a rage in the air, a revolution. And it’s all about electricity, a push towards decarbonization and alternative energy.

Energy Storage is the foundation of this revolution, and storage means batteries, with lithium-ion batteries taking center stage.

Ceylon Graphite (CYL.V), a Sri Lankan focused explorer and developer, has an important role to play in this electrified new world.

Ceylon’s CEO, Bharat Parashar, calls graphite the “new oil.” His reasoning: if you break down the components of a lithium-ion battery, you’ll discover that roughly 60% is the anode. And the anode, Parashar explains, is all graphite.

So why is it called a lithium-ion battery? Why isn’t it called a ‘graphite-lithium’ battery instead? You see these… these are the questions (Peter Griffin voice).

According to Ceylon’s home page…

Sri Lankan “vein” graphite has the highest in situ purity in the world, in addition to low-cost, qualified local labour and generous government incentives.

That’s quite a claim, but the company isn’t just blowing wind.

Sri Lankan vein graphite is indeed some of the purest on the planet. It’s also a geological anomaly.

Of all the natural graphite materials, vein graphite is probably the most difficult to describe geologically, and various theories of its origin have been presented. As the name suggests, vein graphite is a true vein mineral as opposed to a seam mineral (amorphous graphite) or a mineral that is disseminated throughout the ore rock (as in flake graphite).

Its high carbon content gives it a distinct advantage over conventional flake graphite as the beneficiation effort required to achieve a high-grade concentrate is greatly reduced.

Ceylon’s graphite is nearly battery grade as it sits in the ground in its natural state. Its carbon content is greater than 90% with some of the better vein material pushing 98% or higher (typical grades elsewhere around the world run between 30 to 50%).

Last summer, the company put its unique resource to the test by shipping 30 kilograms of high-grade vein material to Dorfner Analysenzentrum und Anlagenplanungsgesellschaft mbH (no typo here), aka DORFER ANZAPLAN, for analysis.

The results were highlighted in a Nov. 2018 press release:

Ceylon Graphite Tops Spherical Graphite Parameters

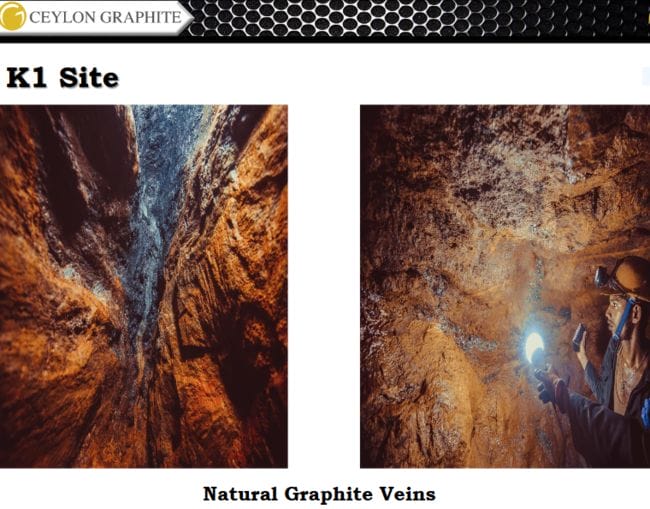

ANZAPLAN has certified graphite obtained from its K1 exploration site meets the parameters of spherical graphite required for battery and energy storage applications.

Regarding the quality of the test sample as it relates to grid storage, electric vehicles, hybrid vehicles, and consumer electronics:

“All analyzed parameters of the obtained spherical graphite product are in the range of typical comparable products. SEM images display well-rounded spherical graphite particles similar to products on the market.“

How do ya like them apples?

A bit of history

Sri Lanka has a rich history of vein graphite production that goes back nearly two centuries (the unusual nature of these rich, near-surface deposits were well known, and apparently used locally, since the mid 1600s).

Prior to WWII, Sri Lanka was the largest producer on the planet. Mining methods at the time were crude and inefficient and only the soft overburden (aka mud) was mined. Production ground to a halt when the miners hit bedrock, leaving much of the purest, highest-grade material untouched.

Today, the country’s output accounts for less than 1% of global graphite production.

That’s all about to change.

What Ceylon’s got

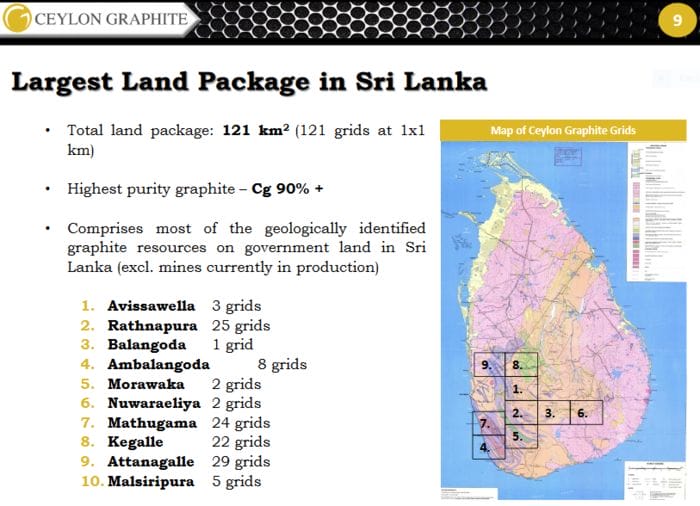

The company has secured a land bank of some 121 square kilometers (121 grids at 1 x 1 km) of highly prospective terrain.

These claims represent the largest land package in Sri Lanka (note the grids outlined on the map below).

A good number of these grids have visible graphite veins right at surface.

If you peruse the company’s press release archives, you’ll see that new vein structures – new discoveries – are popping up all over Ceylon’s map.

I count a half-dozen significant new discoveries over the past two years.

Last fall, the company tabled a preliminary resource estimate at its Malsipura Project:

Several low cut-off grades were determined for the block model. With a prioritization of the grade and considering the optimization of the continuity of the mineralized zone, the low cut-off grade of 2% Cg was retained. This permits to calculate a mineral resource of 159,544.05 tonnes averaging 8.15% Cg. This scenario is also identified as the base case for an Indicated Mineral Resource of 37,234.62 tonnes at 9.79% Cg and 122,309.43 tonnes at 2.76% Cg classified as Inferred Mineral Resources. These mineral resources contain all the known lump veins grading between 80.20% and 98.60% Cg over thicknesses ranging from few centimetres to 0.72 m. Their length ranges from few metres to a maximum of 75 m. A total of 13,000 tonnes of Carbon Graphite is contained within the mineralized envelope.

This resource likely represents only a fraction of what Ceylon will ultimately delineate across its 121 square kilometers of prospective terra firma.

The June 3rd news

Three weeks back, we covered news of a new discovery at the company’s M1 site – a discovery made while the company was driving a ventilation shaft underground (accidentally tagging a significant new discovery underscores the ubiquitous nature of the high-grade vein structures dotting M1’s landscape).

This June 3rd press release reported that this crystalline graphite vein had increased 2x in width as they chased it deeper.

CEO Parashar:

“The size of this vein is larger than anything we have seen below the surface – it is ‘Epic’ by any standards. We are delighted at the continued growth in the size of the vein. The M1 site continues to provide fantastic results and will likely be one of the largest graphite finds in Sri Lanka. Ceylon Graphite is looking good to soon start commercial graphite production.”

This is huge news and the market paid no attention. Don’t worry, it’s only a matter of time before the resource cycle turns. When that happens, it’ll be standing room only when results like these hit the stage.

Greater insights into this extraordinary company can be gleaned via the following Guru offerings:

Equity.Guru podcast: Ceylon Graphite’s (CYL.V) world-class Sri Lankan graphite connection

Ceylon Graphite (CYL.V) announces discovery of a new crystalline graphite vein in Sri Lanka

Ceylon Graphite (CYL.V) – another arrow in the quiver

Ceylon Graphite (CYL.V) to benefit from exploding EV sales in China

Final thoughts

Ceylon is on the cusp of production, and the mine plan is about as simple as it gets: identify a high-grade vein near surface, follow said vein, and mine as you go (Parashar sets a minimum vein width of 30 centimeters).

The company has applied for a mining license for its K1 project. It could come at any time. Environmental clearance should follow soon after.

This first targeted production is set at 4,000 tons per year and will be brought online at a mere $2M. With costs expected to run roughly $200.00 per tonne, K1’s economics are extremely compelling.

The multiple high-grade vein structures criss-crossing Ceylon’s massive land package offer the potential for numerous such mining scenarios.

With 54.77 million shares outstanding and a market cap of $7.12M, based on its recent close at $0.13, this is one of the best kept secrets in the resource arena.

END

~ ~ Dirk Diggler

Full disclosure: Ceylon Graphite is an Equity Guru marketing client. We own stock.