A comment on one of my Graph Blockchain (GBLC.C) stories from earlier this month made me stop and think.

The question was: “So what other block chain companies in your opinion would rise out of the ashes other then GBLC?”

My answer is that there aren’t many companies left where blockchain is still a viable investment.

That’s not just because the market is still recovering from 2017’s fascination with high-tech tulipmania, but because the distributed ledger system just isn’t as useful as blockchain zealots think it is.

But there are still a handful of companies doing good business who just happen to use blockchain, and if I were to choose one of those to bet on it would be Vitalhub (VHI.V).

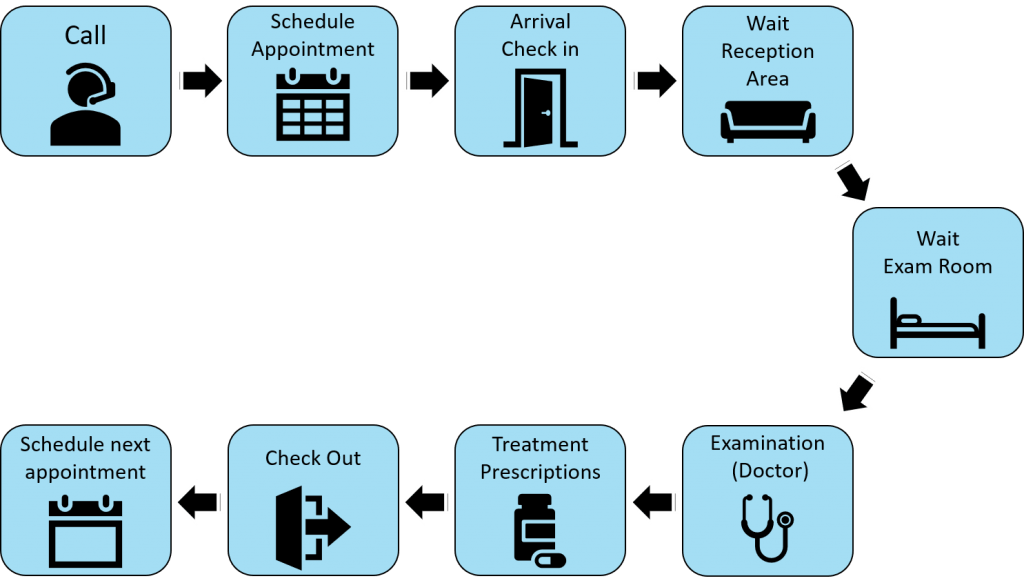

Vitalhub is a company that leverages blockchain’s limited effectiveness in a marketable way by developing and supporting software as a service based healthcare applications.

For example, their VH Chart system uses blockchain technology to streamline medical records to ensure that the right medicine gets to the right patient at the right time, which can be the difference between life and death.

That means one app to rule them all, combining charts, data, and other metrics into one easy-to-access data cruncher so your Uncle Barry gets the Azithromycin he needs to treat his inner-ear infection instead of penicillin, which would kill him.

According to a Johns Hopkins study, 250,000 people die in the U.S. every year due to medical mistakes.

The errors boil down to two main types: human error and system error.

The first will always be a problem, but the second is manageable and that’s the massive market hole that Vitalhub intends to fill.

Vitalhub’s vital statistics.

We’ve been tracking Vitalhub’s progress since March 2018.

The company spent most of 2017 and 2018 making strategic acquisitions and building out their base.

They’ve followed a strong benchmark in their M&A choices:

And bought some early properties that have some serious growth potential.

Acquisition highlights:

- B Sharp Technologies, a 20-year-old Canadian electronic health records (EHR) solution with $1.4 million in reoccurring revenue.

- HI Next Inc, a 19-year-old ‘web-based Electronic Health Record and care coordination platform built’ with a large U.S. install base and $2.4m in recurring revenue.

- Clarity Health, an Ontario-based mental health assessments unit with a startup-level $200k in recurring revenue.

- The Oak Group, including their proprietary ‘Making Care Appropriate for Patients’ (MCAP) system, which is used to place and identify patients for admission or continued stay at the most appropriate level of care.

They’re also making strategic partnerships designed to push their products out into the field.

For example, Vitalhub’s five year licensing deal with the Province of Nova Scotia to help the Department of Community Services find a digital case management solution. Another example is yesterday’s licensing of Vitalhub’s Treat EHR system to the Hawkesbury and District General Hospital to better manage their outpatient mental health programs.

Vitalhub is a company with a series of in-demand products and a steady upward trajectory.

Share prices slid by $.005 today to close at $0.165 and the company is undervalued at a market cap of $26.4 million.

Blockchain companies that recognize market opportunities, understand the limitations of the technology, and make smart decisions will be the ones that survive in the new post blockchain-mania market.

It’s really that simple.

—Joseph Morton

Full disclosure: Vitalhub and Graph Blockchain are both Equity.Guru marketing clients.