The question on many speculators minds today: what does 2019 have in store for gold and the companies that seek to dig it outta the ground?

That’s a tough one.

If pressed, I’d have to say that the next 12 months will be positive for the metal, especially for the miners, and exceptionally so for the small group of juniors with significant discoveries on their hands.

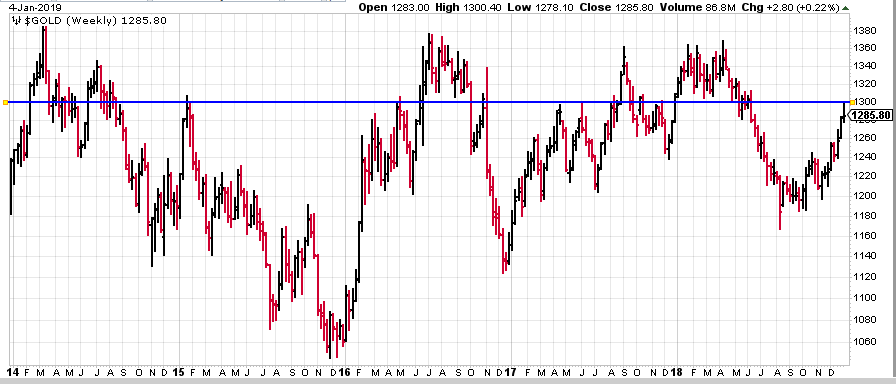

The technicals:

Gold, in U.S. dollar terms, is all of a sudden flirting with $1,300 again (blue horizontal line in the above chart). Note the number of rendezvous gold has had with this critical resistance zone over the past five years, and the number of times it has failed to maintain that level of intimacy.

A decisive weekly close above $1,300 would be a tell-tale sign that we’re on the verge of a sustainable rally. A close in the high $1300’s – say $1,380/$1,390 – would pretty much seal the deal in my mind.

Gold valued in other currencies is even more impressive – note the charts for gold priced in the British Pound, the Australia dollar, and the Canadian dollar:

If the above charts continue to carve out higher highs, that’ll be an extremely bullish signal.

The fundamentals:

On this current economic landscape, confusion is in the process of making its masterpiece: out-of-control money printing, rising interest rates, accelerating debt levels, Brexit, Saudi Arabia, US-China trade tariffs, a narcissistic sociopath in the White House who might be feeling cornered… These are uncharted waters, y’all.

In the midst of all this confusion and uncertainty, gold is a no-brainer.

In a recent gold offering here at Equity Guru, our very own Lukas Kane unearths a few unsettling facts re our neighbor to the south:

- According to The Wall Street Journal, “The Trump https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration expects annual budget deficits totaling $7.1 trillion over 10 years.”

- In the last 10 years, corporate bonds outstanding nearly doubled to $9 trillion, from $5.5 trillion.

- The total U.S. government debt load is about $21.8 trillion – climbing $100,000 every five seconds.

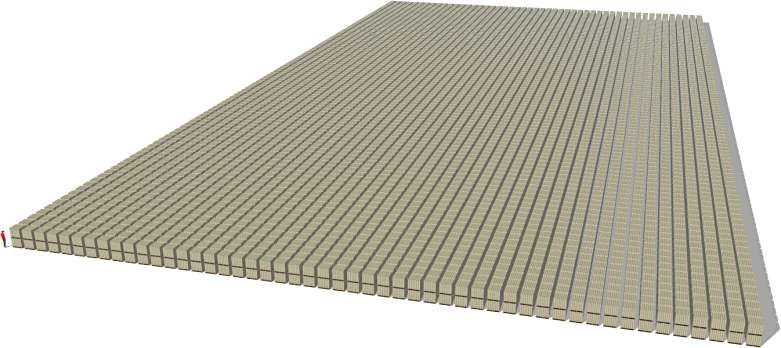

A visual might help at this juncture. The pic below represents one trillion dollars in double stacked pallets of $100 bills. The tiny image on the bottom left is a person standing next to said one trillion-dollar stack.

Now imagine twenty-two of these mad stacks of Benjamins. Clearly, uncharted waters.

Continuing on with Kane:

- In 2018, the U.S. debt-to-GDP ratio was 105%. In comparison Canada’s debt-to-GDP is 77%, Sweden’s is 41%.

- According to Bloomberg, “Global debt hit a record $184 trillion last year, equivalent to more than $86,000 per person — more than double the average per-capita income.”

Not for the faint of heart, Kane’s exposé can be accessed via the following link:

Read: Why the $867 billion 2018 farm bill is a buy signal for gold

Uncharted waters y’all… Seriously. Gold has to be considered a slam dunk here.

For balance, it’s important to consider both sides. Gold does have its detractors – those who cling to the ‘Gold is a barbarous relic‘ argument for example, a phrase originally coined by John Keynes.

There are some who characterize Keynes as an economic quack having sermonized the ideology of infinitely expanding sovereign debt. Removing golds link to paper money encouraged reckless behavior in the adoption of monetary policy – policies directly responsible for the debt crises we face today.

These are two distinct and diametrically opposed camps: those who embrace Keynes and those who despise him. I’m not a joiner, but I think I’d fit neatly into the latter.

Many analysts believe that it will require a move by the FED to put a bid under gold and the miners – a dovish signal re interest rates. In the spirit of quietude and tranquility, Jerome Powell, chair of the Federal Reserve stated the following last week:

“We are listening sensitively to what markets are signaling and will take into considerations growing downside risks. We will be able to adjust monetary policy quickly and flexibly should that be needed.”

Remember Ron Paul and his determined efforts to abolish the FED – why hasn’t that idea caught on? Seriously??

Peak gold:

The possibility that we’ve reached the peak in discovery and production may trump all other considerations in the gold debate.

We may be tapped out.

I always turn to South Africa as the proverbial smoking gun. Once boasting over 1,000 tonnes of annual gold production a half-century ago, South Africa produced a mere 139.9 tonnes in 2017.

That’s a wicked hit.

Once the top gold-producer in the world by a wide margin, South Africa’s gold mines have been slowing every year since 2008, with the exception of 2013 when production rose by a few tonnes. The nation is still home to the world’s deepest gold mine, the Mponeng mine, extending 2.5 miles underground.

Adding even more smoke to the plume, according to the Environmental Economic Accounts Compendium published by African Statistics Day, South Africa may completely deplete its reserve base in less than four decades. When you consider that South Africa is currently ranked the eighth largest gold producer on the planet, that is an ominous forecast.

How about the opinions of those closest to the action?

When asked for his views in a mid-2018 Financial Post article, Ian Telfer, chairman of Goldcorp stated:

“Are we bad at finding it? Or have we found it all? My answer is we found it all.”

Ian Telfer is not the only ‘expert’ who believes we’ve reached Peak Gold. There are others.

I sincerely hope Mr. Telfer is wrong, but when I think about the funds poured into mineral exploration over the past decade, the vast expanses of wilderness probed with our most sophisticated technology – geochemical, geophysical, and hydrogeological – I can’t help but believe he’s onto something.

And just how far, and to what lengths, will we go to uncover more gold?

I suspect we’ll see more of these crazy scenes in the years to come – drill rigs rolling down the streets of towns and villages, entire communities destined to be bulldozed and cleared to make way for new open-pit mines.

It’s a crazy world – someone oughta sell tickets.

The opportunity:

The technicals and fundamentals appear to support significantly higher precious metals prices going forward.

If Peak Gold is our new reality, resource-hungry producers will be on the hunt. New discoveries, though modest by historical standards, will be highly sought after assets.

That’s where we come in as speculators and investors in this crazy arena.

Though the odds are against it, I’m hoping for just one more crack at an Eskay Creek, a Hemlo, a Carlin, a Pierina… a FRUTA DEL NORTE!

Who can forget Fruta del Norte (FDN)?

The year was 2006.

Down to only a few dollars in its treasury, while drill testing a blind IP anomaly, Aurelian Resources hit an impressive 237 meters of 4.14 g/t gold and 8.5 g/t silver.

According to Aurelian’s President, Patrick Anderson, during a March 2009 Mining Markets interview:

“We were nearly out of money…We had no audience. The phone calls weren’t being returned. That was very frustrating. The defining moment, of course, is when we made the discovery.”

Anderson continued…

“I checked (the assay results). Re-checked them. Called up the lab to make sure there weren’t any errors. I was terrified, terrified that we screwed up somehow.”

On the heels of that colossal hit, Anderson and crew tagged a staggering 8.4 grams gold per tonne across 205 meters, and 24 grams gold per tonne across 189 meters.

BOOM!

If those results flashed across my computer screen today, I’d be breathing into a brown paper bag while attempting to enter ‘at-market’ buy orders.

The rest of the Aurelian/Anderson story? Aurelian’s stock price soared from a mere $0.40 to over $40.00. In 2008, Kinross acquired Aurelian for 1.2 Billion dollars.

How can you not be romantic about the junior exploration sector? It’s the reason I’m here.

One of my roles here at Equity Guru is to scour the landscape in search of opportunities which might lead to a major discovery.

Granted, the odds of hitting on another FDN are not very good, but I refuse to give up hope.

Some of the more prospective exploration and development stories were currently following here at Equity Guru can be found in the following pages:

Cabral Gold (CBR.V) treasury stoked, drill targets prioritized, locked and loaded

Aben Resources (ABN.V) extends mineralized envelope at North Boundary – updates Justin project

Peak Gold and a classic setup in the mother of all mining jurisdictions

Market operators and a new high-grade acquisition for Nexus Gold (NXS.V)

(SWA.V) (WAF.V) (NXS.V) (ROXG.V) (EDV.T): How to get from China to Africa

Final thoughts:

Ball Of Confusion – that’s what the world is today, ah hey, hey (Love and Rockets version).

Though general equities are due for a decent bounce in the short-term, I suspect we’re going to witness extreme volatility across ALL asset classes over the next 12 months. I also think that gold, and in particular, gold equities, will dominate the landscape during this time.

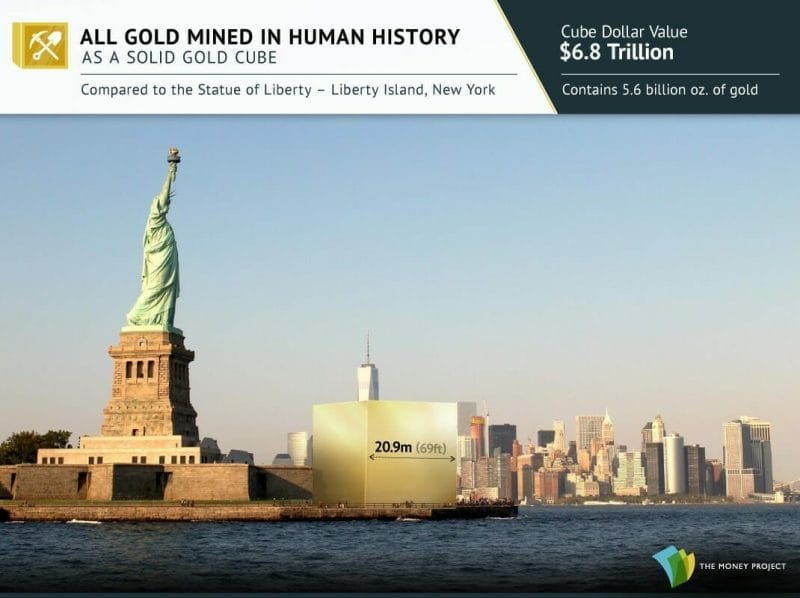

Gold is rare. According to the World Gold Council, only 190,040 tonnes of the shiny stuff has been mined throughout history. The cube in the above image lends perspective.

Gold has been used as money for thousands of years. It’s durable, divisible, and importantly, it’s impossible to run through a printing press.

I believe it was Doug Casey who coined the phrase, “It’s the only financial asset that’s not simultaneously someone else’s liability.” Very true.

I also like this one from Lukas Kane…

“Gold supply is finite. No act of Congress can magically make a tonne of gold appear on the lawn of the White House.”

In this era of out-of-control currency debasement, and spiraling, equally out-of-control debt, gold has a role.

END

~ ~ Dirk Diggler

Full disclosure: of the companies linked in the articles highlighted above, Aben, Cabral and Nexus are Equity Guru clients.

Feature image courtesy of How To Find Gold Nuggets