[LONG POST WARNING]

Contents

- Introduction – Confirmation Bias

- 1 GetSwift (GSW): In a nutshell. We pick at the carcass as best we can

- 2 Eternal vigilance is the price of profit

- 3 GSW hodlers had three get out of jail cards (OK, maybe more)

- 3.1 The GetStiffed Dossier – Nick Fabrio releases the kraken

- 3.2 Insightful bloggers pick apart the Amazon deal

- 3.3 Fidelity suffer massive brain fart as they inject 75MM at the top

- 4 Equity Guru don the rose-colored glasses and live to tell the tale

- 5 News is not what it seems – #shillnewsnetwork

Confirmation bias is our tendency to cherry-pick information that confirms our existing beliefs or ideas.

Think about the following statements:

• Iraq had weapons of mass destruction.

• Women are bad drivers.

Do you believe any of them to be true?

If so, why?

Now consider their polar opposites.

• Obama was born in America.

• Iraq never had weapons of mass destruction.

• Women are good drivers.

What if we told you:

Danica Patrick won the 2008 Indy Japan 300 and has enjoyed a highly sucessful career in motorsport.

Or that Obama provided proof, in the form of his birth certificate, after questions were raised during the 2008 Presidential election. (We’re looking at you Trump)

And the WMDs? Never found any did they. Trump was right on that one.

Still not convinced? You’re suffering from confirmation bias, whether you believe it or not.

So what can we do about this terrible human affliction causing us to hang on to cherished beliefs despite new information being presented to us?

Here are some suggestions

- Be receptive and open to criticism.

- Challenge your thoughts.

- Ask for opinions from outside, and collect information from diverse backgrounds.

- Try to think from different perspectives.

It affects us in politics, religion, relationships and (wait for it!) investing.

“What the human being is best at doing is interpreting all new information so that their prior conclusions remain intact.”

— Warren Buffett

You need to be good at quickly recognizing and correcting bad decisionsAsk yourself, “What fact would change one of my strongly held opinions?” If the answer is “no fact would change my opinion,” you’re in trouble. A person who is unwilling to change his or her mind even with an underlying change in the facts is, by definition, a fundamentalist.

Wherever the carcass is, there the vultures will gather

GetSwift (GSW.ASX) is a cloud-based logistics software company whose slogan is “Dispatch like Uber, track like Dominos, set routes like FedEx”

They sit firmly within the realm of ‘last mile logistics’ (aka ‘last mile delivery’), the toughest part of the supply chain.

In 2017 they attained ASX ‘market darling’ status with the share price soaring as high as $4.60 on December 4th. With shares offered at $0.20 back in 2016, many were sitting on paper fortunes.

Then the rot started to set in.

Feels like we’re gatecrashing this party pretty late – it’s 3AM, all the good looking ones have left and we’ve only got a few cans of Fosters to keep us company.

We won’t rehash all the gory details others have printed.

In a nutshell, the company:

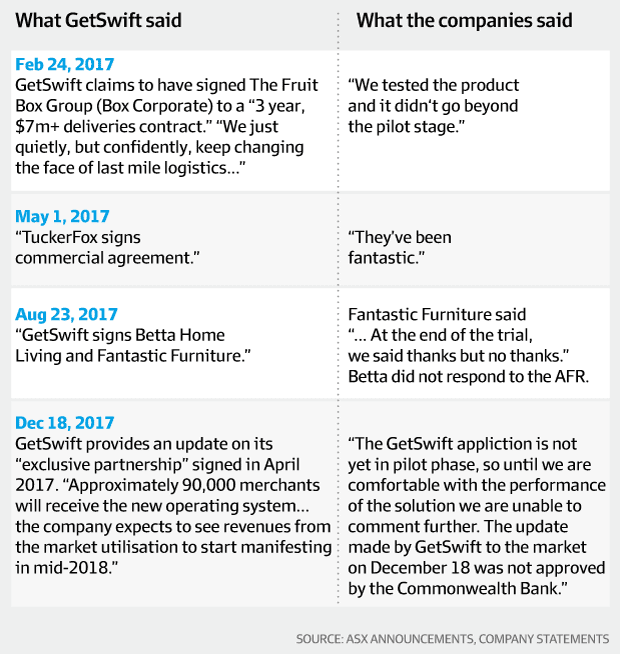

- Announced a number of deals, including one with Amazon.com

- Came under scrutiny from The Australian Financial Review (AFR), who sniffed around and began to put the boot in.

- Got caught out telling pork pies i.e. misinforming the market.

- Watched the shareprice collapse from a high of $4.60 to below a buck.

- Is now facing numerous class action lawsuits.

GetSwift (GSW.ASX) shareholders are now in a world of pain. They have thrown away the hype-pipe and are calling for the green whistle.

GetSwift (GSW.ASX) shareholders are now in a world of pain. They have thrown away the hype-pipe and are calling for the green whistle.

It didn’t need to be that way, as information offering alternative views was readily available. You just had to want to find it.

Your job doesn’t stop when you click buy

So, you’ve bought some shares and you think you can sit back and wait for the money to roll in, right?

Wrong.

Now you have to start looking for signs you might be wrong. In fact, the safest assumption you can make after entering a market is that you are wrong until proven otherwise.

Take a scientific approach – Look for signs which contradict your thinking and give them some weighting. Jot them down on a notepad, stick post-it notes on the fridge or use Evernote.

Go looking for web articles that state the bear case. (or bull if you’re short). Challenge your existing thinking.

If the evidence stacks up, be willing to change your mind and, more importantly, act.

We’re fond of Peter Brandt, who has been in this game a long time. He describes part of his trading style as “Strong opinions, weakly held”

Think about that for a minute. Nothing wrong with having a strong opinion, unless you’re unwilling to let go of it.

In other words, it’s ok to be wrong, but it’s not ok to stay wrong (hat tip to Nick Radge)

Be like Peter or Nick.

GSW longs had chances to bail before the bus went over the cliff

Here are three. We’re sure you could find others if you looked carefully.

1. GetStiffed

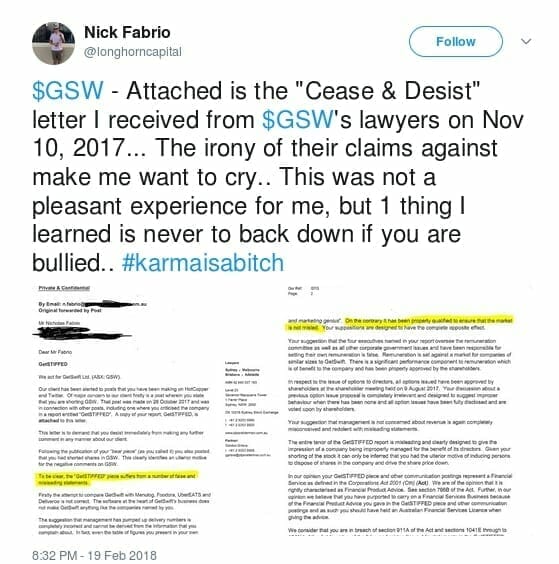

Nick Fabrio (@longhorncapital) is a Millennial. We like Millennials.

Nick Fabrio (@longhorncapital) is a Millennial. We like Millennials.

He describes himself as an intra-day trader and admits to favoring the short side. Nothing wrong with that although it’s not our thing.

If his trading results are anything to go by, he’s pretty good at what he does.1

In late October 2017, Nick put out a bearish note, titled GetStiffed (GSW:ASX)- A Bear Piece 3. We read it and thought the report clear and concise. It relies on publicly available information with some calculations thrown in for good measure and asks whether the then fully diluted market cap of $406 MM was justified.

What did Nick get for his efforts?

A Cease and Desist letter from legal eagles Piper Alderman, acting on behalf of GetSwift. (as Hinch would say Shame, Shame, Shame)

When posting the letter on Twitter, Nick comments “$GSW – Attached is the “Cease & Desist” letter I received from $GSW’s lawyers on Nov 10, 2017… The irony of their claims against make me want to cry.. This was not a pleasant experience for me, but 1 thing I learned is never to back down if you are bullied.. #karmaisabitch”

Attaboy!

Would Piper Alderman have taken such action if a similar styled note emerged from one of the large investment banks?

A 27-year-old trader, however, was considered fair game.

The tweet received 52 31 and 283 . Social media stats to die for 😉

If you were long GSW stock and came across Nicks report, it may have changed your thinking.

The shares were then trading around the $2.50 mark.

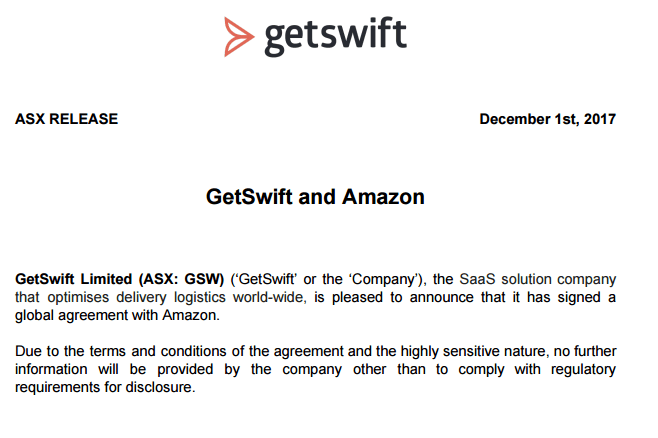

2. The Amazon Deal – Bloggers be like WTF?

What if you stumbled upon the blog of 10footinvestor on the weekend of 3rd/4th December 2017 while smashing back a buffet breakfast at Crown?

You may have read his post titled “GetSwift and Amazon”

It’s a detailed post and received some great comments, including one from Karen who says “There is another option that no-one seems to have thought of – Getswift could have signed with Amazon Web Services to offer their software to AWS customers through the AWS cloud platform. This explains why the number of deliveries or revenues cannot be determined, as it depends on how many AWS customers choose to buy the software.”

Insightful original thinking, right there.

If you were long GSW stock it may have changed your thinking.

The all-time high in the share price would come the very next trading session.

Some context: The company had just released what has been described as a bare bones announcement

Tells us a lot, doesn’t it?

Investors wasted no time in sending the stock soaring 84% on the back of the news, and the ASX suspended trading requesting further details.

Absolute fucking joke. How does the ASX even allow this to slip through?

Back to the 10footinvestor, who get’s busy typing the following:

Additionally, with such limited disclosure – the company announces a huge-sounding deal with Amazon but doesn’t disclose the slightest information about it – mug punters like myself must resort to rampant speculation. And, since there are no details being released about the deals, in my opinion it is impossible to determine what they are worth with any accuracy. Which of course makes it very difficult to value GetSwift.

In the comments section, he makes a further observation when replying to comment threads.

“In my opinion however, there is absolutely no way Amazon will build its logistics system around a white-label GSW even if they dump UPS/Fedex. There’s no way they’ll let something like GSW sit in their logistics chain clipping the ticket on every transaction (AMZN would do better to buy GSW in that case). If Amazon is bringing its deliveries in house, also it makes no sense to continue relying on a 3rd party delivery software system while controlling everything else. That’s because any 3rd party software failures/hacks etc could bork Amazon’s entire system – far too risky from AMZN perspective.”

— 10footinvestor

+1 on both fronts.

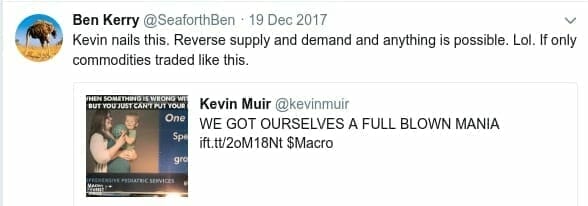

Enter Ben Kerry

Ben Kerry (@seaforthben) has only been blogging for a while yet there are some gems among his 40-odd posts.

We liked Ben as soon as we spotted him eyeing off one of The Macro Tourist’s tweets. If you not reading Kevin Muir’s stuff you’re missing out. We recommend you follow @themacrotourist and thank us later.

Back to Ben.

We came across a couple of his posts on GetSwift.

On December 2nd, 2017, (the same weekend as 10footinvestor) he chimed in with the following when talking about uncertainty and probability regarding GSW:

If this turns out to be another Davnet then the markers and reasons will be obvious. Management hubris, vague announcements, hinting at the potential of being taken over, threatening legal action on short sellers, aggressive and us/against them management style, limited cashflow, non-existence development budget, key staff resignations etc.

And then on January 21, 2018 he wrote a post in a similar vein to the one you’re reading now.

In fact it was while reading WHAT FACT(S) WOULD CHANGE YOUR OPINION? – GETSWIFT, we learned about Ozan Varol.

If you want to succeed at this game the learning never stops. Seriously.

When it came to GetSwift, others were thinking differently. Staying away from the Kool-Aid, so to speak.

You just had to want to find them.

Why would Amazon really be interested in a minnow like GetSwift?

Fast forward to 09 Jan 2018.

Steve Johnson of Forager Funds (big fans!) spoke about the mania gripping the market.

On the GetSwift/Amazon deal Johnson says:

Even the bulls of yesteryear would have been sceptical. One can only assume this is the same Amazon that built the world’s most sophisticated cloud computing service because it couldn’t find an offering that met its requirements. The same Amazon that already offers same day delivery to more than 8,000 cities and towns. The same Amazon that spent US$21 billion on research and development in the past 12 months.

I will be very surprised if Amazon buys logistics software off anyone. Let alone an Australian minnow with less than $1m of revenue.

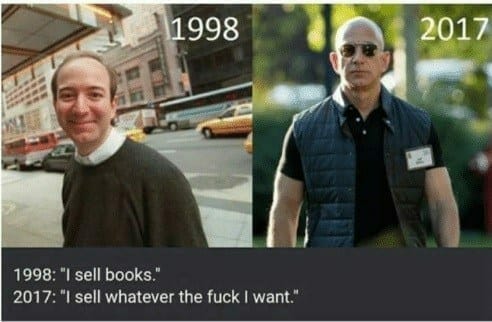

Prefer a visual?

You really think Bezos was about to let someone drink his milkshake?

If you were on Foragers’ email list (we are) and read his post (we did) it may have changed your thinking.

GSW was still trading above 3 bucks but you were on borrowed time by early January 2018.

The stock would be suspended after trading on the 19th of the month, the damage done. It was time to sit back and listen to your favorite Neil Young record.

3. Fidelity pile into the bus as it veers towards the cliff

The size of the raise was breath-taking. 75 MM, with shares issued at 4 bucks a piece in an over-subscribed round led by heavy-hitter Fidelity International.

Institutional support had arrived in spades. If these guys were willing to stump up the cash then it’s only natural many punters would have piled in, especially on a pullback.

FOMO is a powerful drug.

To be fair, there’s so much here which looks legit. Fidelity FFS!

What sort of DD did the boys in Boston actually undertake? Any?

As the AFR reported the shorters had just been handed the cannon fodder they so needed:

Ironically, Fidelity’s entrance onto the register allowed short sellers to get their claws into GetSwift in a meaningful way for the first time. Before its investment, finding stock to borrow to short was difficult.

Now though, the higher-ups at Fidelity must be demanding to know what sort of due diligence was done before it plunged in? How solid are the GetSwift growth projections? Were GetSwift shares every really worth $4?

In addition to Fidelity, some other big names had already been pulled into the register via a $24 MM raise in June 2017, including:

- Thorney Investments headed up by Alex Waislitz who has a formidible track record and is no newcomer to the world of finance.

- Regal Funds Management, a hedgie who have won awards for fund performance.

- IFM Investors.

When it comes to small-caps, capital raisings are usually opportunistic and can pinpoint the high water mark of their share price with alarming accuracy.

If you were long GSW and questioned the timing or the size of the CR or, more importantly, whether the bloody thing was really worth 4 bucks, it may have changed your thinking.

You may have taken some money off the table, even if you were still in love with the company narrative.

The shares were then still trading around the $4 mark, but the clock was ticking.

The shares were then still trading around the $4 mark, but the clock was ticking.

Five weeks later it was game over for GSW longs with the stock entering a lengthy suspension. When it resumed trading on 19th February the shares opened at $0.92 down a whopping 68% from the previous close of $2.92

Last week the stock traded as low as $0.53 and the message boards are awash with punters crying into their beers after HODLing.

Kids, it’s not an investment strategy!

We’ve drunk the Kool-Aid too

No one is immune.

Case in point – our own trade in Creso Pharma (CPH.ASX).

Case in point – our own trade in Creso Pharma (CPH.ASX).

Looking back, it’s like Jim Jones himself was holding the spigot open as we drank from the trough.

We were looking for a play in the ASX weed sector and CPH fit the bill. We stumped up some cash and started singing its praises.

November 22nd, 2017 marked peak enthusiasm for the name.

It’s been a good week here in the Equity Guru office as we’ve watched Creso Pharma (ASX.CPH) release a bunch of positive news which has seen its share price punch well into blue sky.

Up until that point, we’d taken the market announcements largely on face value, sticking to the narrative the company had crafted. We weren’t asking enough questions (we should have been!)

Then our thinking began to change.

The catalyst? – The capital raising in late 2017. Smelled fishy. We started to look for opinions on Creso which were different to our strongly held ones. And found them. Plenty of them.

The dominos began to fall into place, and we were no longer committed longs. In Lebowski-speak, Larry was about to enter a world of pain.

The very next piece we wrote about Creso, on December 5th 2017 had quite a different tone to it. We opened with

“We’ve handed out plenty of bouquets to Creso Pharma (CPH.ASX) since initiating coverage – time for a brickbat. That’s how we roll here at Equity Guru – client or not, if we catch you out we call you out.”

We were no longer fanboys, and said so, suggesting CPH shareholders needed to ask the following questions:

Q: How informed was the market with respect to this Chinese distribution agreement?

Q: When Blumenthal acts, does he act in the best interest of CPH shareholders or EverBlu?

We concluded with:

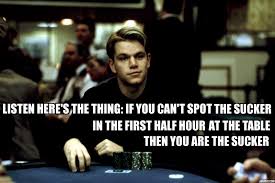

This will either be a great place to add some CPH to your portfolio or you’ll come to realise who the sucker is sitting at the table.

Still long the stock we were looking for a good place to get out. A few weeks later we found one.

On January 10th 2018, we stated we had “lost faith in management and the stock in general.” and we disclosed the fact we had sold our position, and the reasons why.

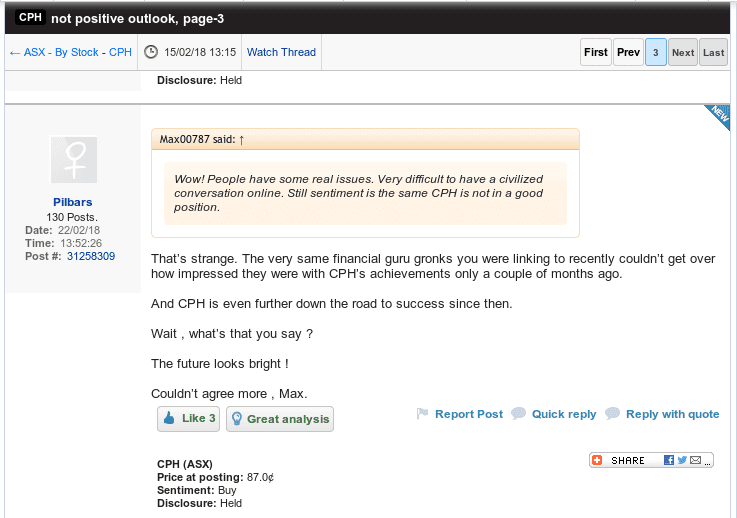

We’ve noticed some are questioning our about-face.

We hope that clears things up a little for you Pilbars.

The final word should be left to Mr Market. The CPH chart below shows the 20DMA crossing below the 50DMA – which hasn’t happened for many months. Looks to be a nice bear flag forming too.

Bright days ahead?

You decide.

Why smaller voices matter, including Twitter #shillnewsnetwork

Truly independent coverage of small-cap stocks listed on the ASX is in decline.

The AFR are doing a great job of exposing the shenanigans surrounding $BIG $CPH $GSW #kickassjob

Others, however, are dressing PR up as news or seem to have conflicts of interest when it comes to editorial independence. #ourshitdontstink

Take Stockhead for example, who arrived on the scene last year.

Take Stockhead for example, who arrived on the scene last year.

They have bona fide journos onboard with pedigrees that put my own to shame. (In my defense I did throw together a pretty mean poem years ago when I was trying to woo a lass on the Fairfax Ask Sam blog. She loved the poem but it all fell apart when I sent her my photo 🙁 * yells ‘Mother, Oreo smoothie, now!’ *)

FWIW, I’m sure we embraced animated GIFs before Stockhead 😉

I digress.

Stockhead’s About Us page states:

Stockhead’s journalism is 100 per cent independent. Editorial content is published at the sole discretion of the editor and is not influenced by Media & Capital Partners or any other interest.

If that’s the case then why have they only mentioned GSW in passing in the last few months?

The GSW story has it all: An ex-footballer, dodgy company announcements, multiple trading suspensions, a big US name piling in at the top, a spectacular collapse and lawyers circling the carcass.

Who wouldn’t want to write about it?

So why haven’t they?

When asked, Stockhead’s editor David Higgins declined to comment.

To be clear, we’re not singling them out.

A Google search for S3 Consortium Pty Ltd (CAR No.433913) returns results pointing to the following ‘news’ outlets:

A Google search for S3 Consortium Pty Ltd (CAR No.433913) returns results pointing to the following ‘news’ outlets:

- Next Investors

- Catalyst Hunter

- Finfeed.com

At least S3 are upfront with potential conflicts of interest:

How are we Paid for the Services We Provide?

S3 Consortium Pty Ltd fees are generated from services it provides companies who pay for reports and analysis and publishing articles and from advertising space on related websites.

What Fees, Commissions or other Benefits?

Employees of S3 Consortium Pty Ltd are remunerated in a variety of ways including salary, wages bonuses and commissions based on sales generated.

Do any Relationships Exist Which Might Influence The Service or Advice I Receive?

S3 Consortium Pty Ltd is not owned by any Fund Manager or institution. S3 Consortium Pty Ltd is remunerated by preparing articles and analyzing companies which are then published through S3 Consortium’s websites.

By ‘upfront’ we mean traverse a handful of pages until you locate their FSG. Better than nothing.

Dig a little deeper and you’ll find the following: “S3 Consortium Pty Ltd (ACN135 239 968) Trading as Stocks Digital is a Financial Services Company facilitating Advisory Services to Australian Domiciled Retail and Wholesale Clients in Securities. Information provided by S3 Consortium Pty Ltd.” (emphasis ours)

Then swing by Stocks Digital and have a gander. If you look hard enough you can find client logos but it’s not clear if these are current or past clients.

How about just throwing something in at the end of a story letting readers know. Like we do.

We’ll hazard a guess – it’s all about getting into Google News.

After all, if you look like a duck and quack like a duck you’re a duck right?

Straight from the horse’s mouth:

Firstly, a snippet from the Google News guidelines:

“We try to include as many different types of sites as possible in Google News, but we only include articles that offer timely reporting on matters that are important or interesting to our audience. Generally, we don’t include how-to articles, classified ads, job postings, promotional content or strictly informational articles like weather forecasts or stock data.” (emphasis ours)

then more from the Google News blog

“Credibility and trust are longstanding journalistic values, and ones which we all regard as crucial attributes of a great news site. It’s difficult to be trusted when one is being paid by the subject of an article, or selling or monetizing links within an article. Google News is not a marketing service, and we consider articles that employ these types of promotional tactics to be in violation of our quality guidelines.” (emphasis ours)

Bingo!

Our understanding is you’re supposed to exclude this type of content (i.e. promotional).

Maybe we’re wrong ¯_(ツ)_/¯

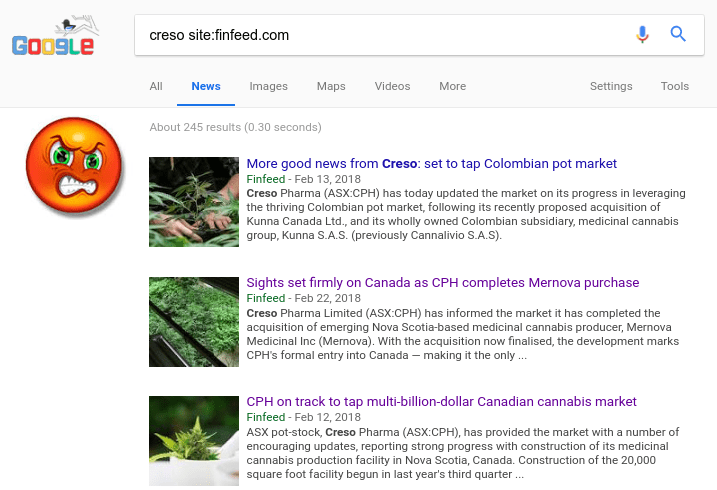

Here’s some ‘news’ from finfeed:

Got us beat how S3 do it. Looks like a complete crap shoot as to peeps getting in or not.

Don’t even get us started on the likes of ‘The Kaplan Herald’, ‘Hanover Post’, ‘Danvers Record’ or ‘Freeburg Standard’ – we’ve stomped out news spammers before and aren’t afraid to do it again. #getyourshittogethergoogle

Here at Equity Guru we often write stories about companies that aren’t clients, especially if they fit well with themes we specialise in covering. #weed #energymetals #blockchain

My colleague Stephan Hermann (who’s a little quirky but AFAIK doesn’t live with his mother) wrote one such article recently about Riot Blockchain. #notaclient #neverwillbe #notourtype.

[Hey Steph – has Gartman returned your call?]

As Fox Mulder says “The truth is out there”.

You just want to have to find it.

–// Craig Amos

FULL DISCLOSURE: Neither GSW.ASX nor CPH.ASX are Equity Guru marketing clients. The author has held stock in CPH in the past but does not do so at this time. We’re not in Google news *yet*, and yeah we’re a little shitty about it given it’s not a level playing field.

[IT guys – Please tell me this one won’t be as popular as what you threw out last week. The web server was running hotter than a coin-mining rig in New Mexico. If it does, and we have to get more dry ice you’re taking us all out for beers. ]

1. Nick posts daily screenshots of his trading account P/L to his twitter feed. We have not verified these but they look legit.

2.Pic credits:

Bezos meme: 10footinvestor, although we note the meme has appeared on many sites including 9gag.com and reddit.

Other memes: various.

Penthrox inhaler: youtube

Lemmings cartoon: Unknown (Google reverse image search undertaken)

Apple design tweet: Steve Johnson twitter feed

Other tweets: Attributed.

CPH chart: 4-traders.com

3. A list of Twitter handles referred to in this piece. You might want to give them a follow 😉

| 10footinvestor | @10footinvestor |

| Ben Kerry | @SeaforthBen |

| Forager Funds | @ForagerFunds |

| Kevin Muir | @kevinmuir |

| Nick Fabrio | @longhorncapital |

| Peter Brandt | @PeterLBrandt |

| Steve Johnson | @ForagerSteve |

| Swami2 | @stockswami |

| The Chartist | @thechartist |

| The Macro Tourist | @themacrotourist |

NB: Kevin Muir runs ‘The Macro Tourist’ blog – @themacrotourist is only used to publish links to his website articles.