We initiated Blackrock Gold (BRC.V) coverage back in April of 2018. Back then, it was a single project story, but a good one. The problem: Management was dragging its feet.

Even though Blackrock held a potential world-class asset (we’ll talk about said asset—Silver Cloud—a little further down the page), management was doing the square root of dick to move the project forward. The company’s stock traded aimlessly, with minor flourishes here n there, until one Andrew Pollard entered the fray.

Pollard was a Blackrock shareholder first. He was impressed with the project—he wasn’t so impressed with the team behind it. Feeling compelled, he took control of the company.

According to the May 14, 2019 press release announcing Pollard’s arrival:

For nearly fifteen years, Andrew Pollard has established himself as a sought-after management consultant within the mining industry. Mr. Pollard founded the Mining Recruitment Group Ltd (MRG) in 2006 and has amassed a “Who’s Who” network in the mining & finance world, leveraging his personal relationships to help shape what have become some of the most prominent and successful resource companies. In a sector where management is crucial, he has served as a trusted advisor to exploration companies and producers ranging in size from seed round through to over $100 billion in market capitalization.

CEO Pollard’s first order of business was to cancel a lowball $0.05 PP announced by the previous team three months earlier.

Next, Pollard began stacking his team with talent, announcing two key hires—Bill Howald and Tony Wood—within 14 days of taking control of the company.

Management is everything. You can have a great, company-maker of a project, but without the right team in place, things can fly apart at the seams. Significant shareholder dilution is often the result.

When Blackrock tabled a PP later that summer, at a 25% premium to the market at the time, CEO Pollard wrote a $100k cheque into that first financing. On that note, BRC’s insider trading reports filed on SEDI will reveal a CEO with an insatiable appetite for his own company’s stock.

There’s a genuine alignment of values here.

Note the market’s reaction to CEO Pollard picking up the Blackrock reigns on May 14, 2019:

Shareholder value was subsequently created from those lowly sub-nickel, pre-Pollard levels.

Shareholder value was subsequently created from those lowly sub-nickel, pre-Pollard levels.

The Tonopah acquisition

Not to diminish the multi-million-ounce potential at the company’s Silver Cloud Project, back in February of this year, Blackrock announced an option to purchase the Tonopah West Project from ELY Gold Royalties (ELY.V)—another company that’s no stranger to these pages.

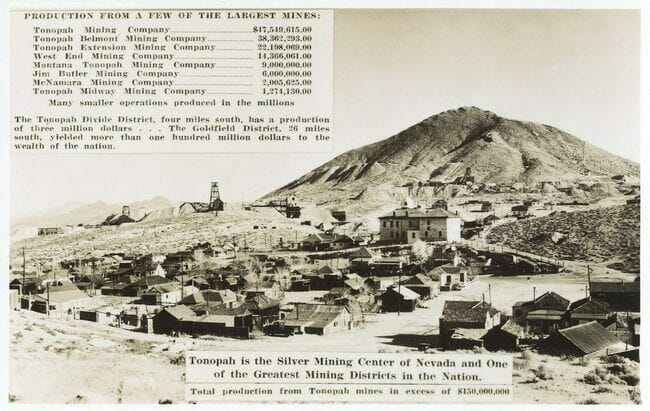

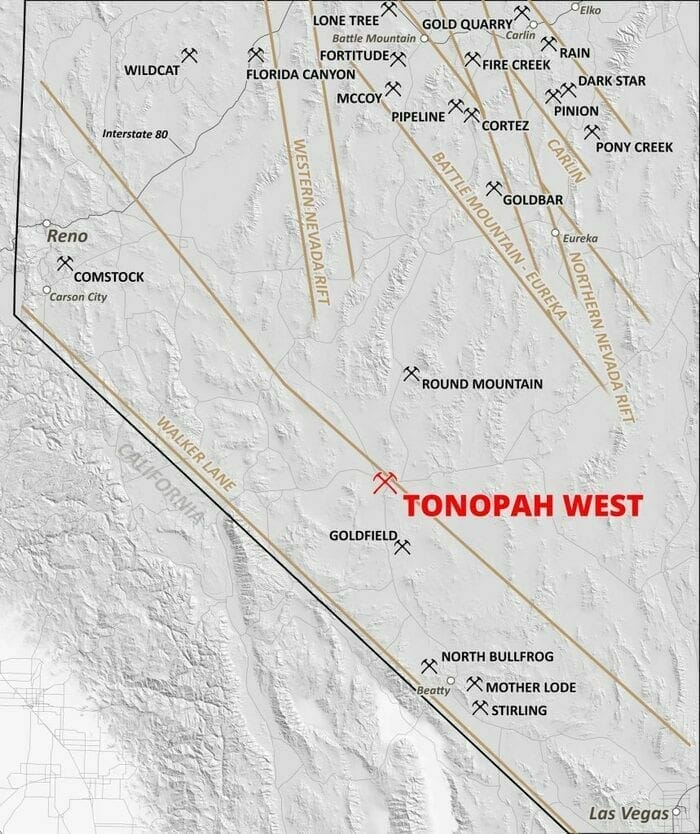

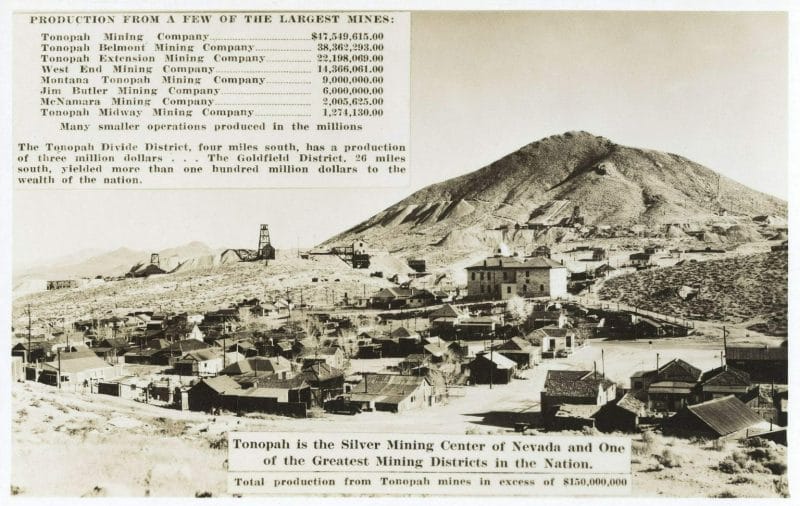

Located along the Walker Lane trend of western Nevada, Tonopah produced 174 million ounces of silver and 1.8 million ounces of gold from 7.45 million tonnes of material over its half-century production history (1900 to 1950). Grades averaged a dizzying 50 g/t gold equivalent (AuEq) or 2125 g/t silver equivalent (AgEq).

The company timed this acquisition well.

Located roughly halfway between Reno and Las Vegas Nevada, the project, once labeled Queen of the silver camps, is surrounded by infrastructure (map below).

Curious note (Western fans will like this): Wyatt Earp once set up a watering hole on this property.

Blackrock’s consolidated land position was good for 2.1 million tonnes of the district’s total (7.45 MT) high-grade production.

This acquisition marks the first consolidated ownership—some 97 patented & 17 unpatented claims covering 4.5 square kilometers—representing the largest claim package in Tonopah today.

This consolidated land position was good for > 28% of the district’s total high-grade production.

Low precious metals prices, and challenges with subsurface water volume—challenges that rendered mining nearly impossible due to the pumping technology of the day—shuttered operations.

The district lay dormant for decades. Claims, held tight by families and passed down through the generations, also limited activity in the district.

Bottom line: Tonopah’s subsurface layers have been subjected to very little in the way of modern exploration… until now.

Btw, those early H2O challenges are no longer an issue—pumps today can dewater these underground workings in a NY minute.

Tonopah is a unique project. It’s nearly turnkey. The company has 50-years of production history. They have stacks of underground mining maps. They know where the veins are at. They know their orientation—the strike, the dip… the grades.

The company has another big advantage with this asset: historic underground development work leapfrogged production, giving Blackrock access to rock that was being teed-up, but had yet to be mined. Translation: Blackrock does NOT have to prospect with the drill bit here.

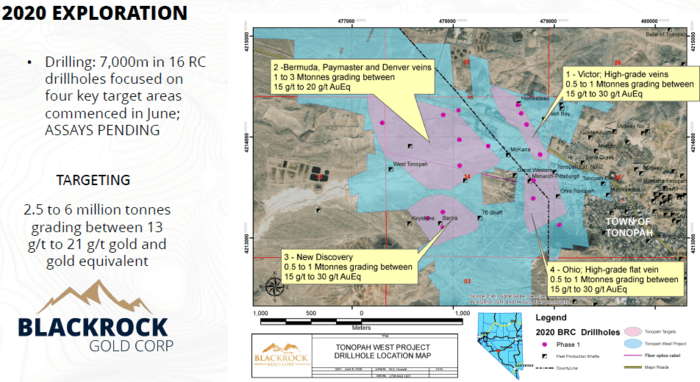

Blackrock has multiple targets with multi-million ounce AuEq potential in its cross hairs with its current 7,000 meter, 16 hole RC drilling campaign.

Conceptually, the company prioritized four broad target areas with the potential to host resources ranging from 2.5 million to 6 million tonnes with grades ranging from 13 to 21 g/t AuEq.

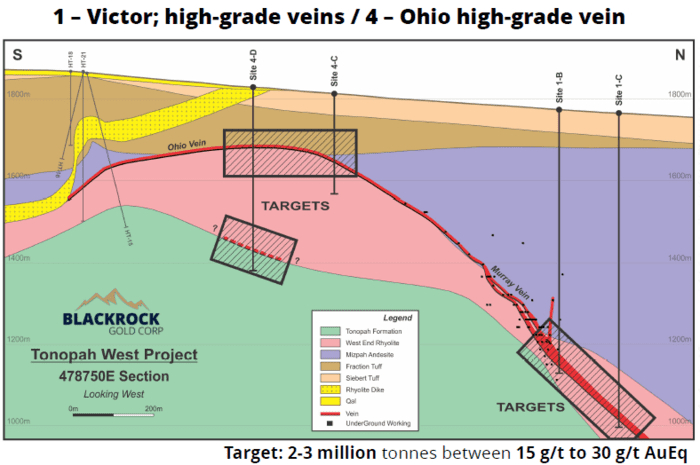

As per the above map, and a June 17 press release:

(The potential quantities and grades of the target zones set out below are conceptual in nature, there has been insufficient exploration to define a mineral resource and it is uncertain whether further exploration will result in the targets being delineated as mineral resources. The target zones are as follows):

- On the northern portion of the property at the Victor shaft, the underground workings encountered a high-grade vein on the 1880 level that had widths up to 24 meters. The target is the thick, high-grade vein below the 1880 level. The potential target ranges from 0.5 million to 1 million tonnes averaging 15 to 20 g/t gold and gold equivalent. Five drill holes totaling 2,750 meters are proposed to test the down dip portion of the vein system as well as test 800 meters of strike potential to the west;

- Through the KcKane shaft, three veins, Denver, Paymaster, and Bermuda/Merton, were mined from 1200 to the 1880 level. Geologic and assay reports indicate additional mineralization down dip and along strike. Five drill holes totaling 2,350 meters will target the veins along strike and down dip in the Mizpah and West End Ryholite lithologies. An area with potential ranging from 1 million to 3 million tonnes averaging 10 to 15 g/t gold and gold equivalent is the target;

- A new discovery was made using RC drilling in 1997 (7.5 g/t gold and 288 g/t silver over 3 meters). Follow-up drilling in 2018 cut two 1.5 meters zones grading 9.7 g/t gold, 715 g/t silver and 4.6 g/t gold, 401 g/t silver. This zone is within the same stratigraphic package as the Ohio vein located 1.5 kilometers to the east and may represent a similar flat-lying vein with a similar potential target ranging from 0.5 million to 1 million tonnes averaging 15 to 30 g/t gold and gold equivalent. An initial program of four drill holes totaling 1,185 meters is planned;

- Three drill holes totaling 750 meters are planned adjacent to the southeast portion of the property where the flat-lying Ohio vein was mined from the Ohio shaft. No geologic work to find the off-set portion was completed and the potential exists for the strike extension of the Ohio vein. The vein dips 20 degrees to the south, and the potential target ranges from 0.5 million to 1 million tonnes averaging 15 to 30 g/t gold and gold equivalent.

I got a little more detail re these first two targets during a recent call with CEO Pollard.

Target #1: The Victor vein is the confluence of two prolific veins up to 24 meters thick. The target here ranges from 0.5 million to 1 million tonnes with grades between 15 to 30 g/t gold equivalent.

The company is currently drilling Victor with an RC rig (they don’t need core to guide them). RC drilling is twice as fast as diamond drilling. It’s also way cheaper—there’s no processing (no logging or splitting). The rock chips are simply bagged and shipped off to the lab.

Target #2: The Bermuda-Denver Paymaster vein, the last series of veins mined prior to shutdown, also saw significant development work beyond the last section mined. The target here is 1.5 to 3 million tonnes with grades between 15 and 20 g/t AuEq.

This next slide from the Blackrock’s i-deck features the Victor vein, and Ohio (target #4 on the list).

Blackrock should have several holes in the bag by now. We should see our first set of assays in mid to late July. Expect regular assay-related headlines over the next 2-3 months thereon.

Blackrock should have several holes in the bag by now. We should see our first set of assays in mid to late July. Expect regular assay-related headlines over the next 2-3 months thereon.

Further to my chat with CEO Pollard, I learned that a 2nd RC rig could be mobilized to the project in the coming weeks.

CEO Pollard, from an April 27 press release:

“It’s truly amazing to me that right in the heart of the “Silver State” of Nevada, that one of the largest historic silver endowments in North America has been hiding in plain sight, largely untouched by modern exploration for the better part of 80 years. Due to the prolonged fractured nature of the claims that makeup what was known as the “Queen of the Silver Camps”, one of the most significant high-grade mining districts in Nevada has been completely overlooked for decades. Our initial program is targeting low-hanging exploration fruit, picking up right where past miners left off, with well-defined veins that were up to 24m thick when operations ceased. We’ve outlined a large program as all of the targets we’ve compiled are priority and as we’ll be using RC drilling, we’ll be able to work quickly and cost effectively as we aim to bring attention back to this storied district.”

There are a lot of eyes on this maiden Toponah drilling campaign. If the company succeeds in tagging the high-grades it anticipates, there will be a lot more eyes on this one.

Clearly, Tonopah is the value driver here.

Confidence is high.

Silver Cloud

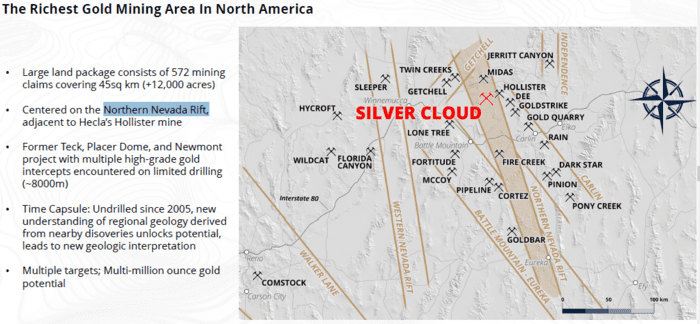

Silver Cloud, encompassing 45 square kilometers on the Northern Nevada Rift, is the definition of grassroots exploration.

Silver Cloud, encompassing 45 square kilometers on the Northern Nevada Rift, is the definition of grassroots exploration.

Limited exploration has been performed on this property. A bad royalty deal rendered the project unworkable until Blackrock fixed the situation back in June of 2019.

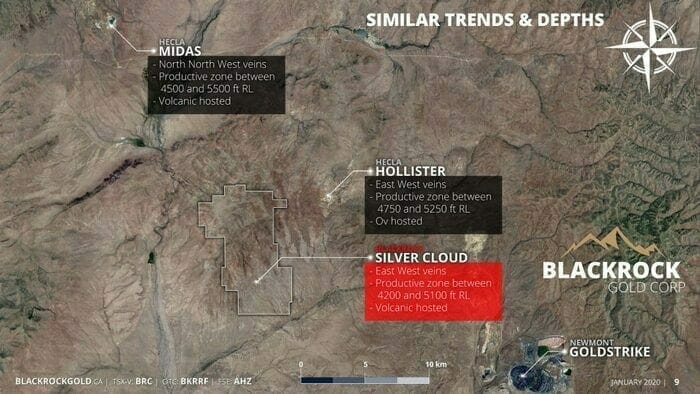

Note the project’s proximity to Hollister which produced at a head grade of 34 g/t Au.

They are also on trend with Midas which produced at a head grade of roughly 30 g/t Au.

Back in the day, Teck (TECK.T) and Placer Dome tagged 1.5 meters of 157.7 g/t Au and 1.5 meters of 12.5 g/t Au respectively at Silver Cloud.

Back in the day, Teck (TECK.T) and Placer Dome tagged 1.5 meters of 157.7 g/t Au and 1.5 meters of 12.5 g/t Au respectively at Silver Cloud.

Blackrock is chasing low-sulphidation epithermal gold-silver banded veins here, and these narrow high-grade structures can be elusive.

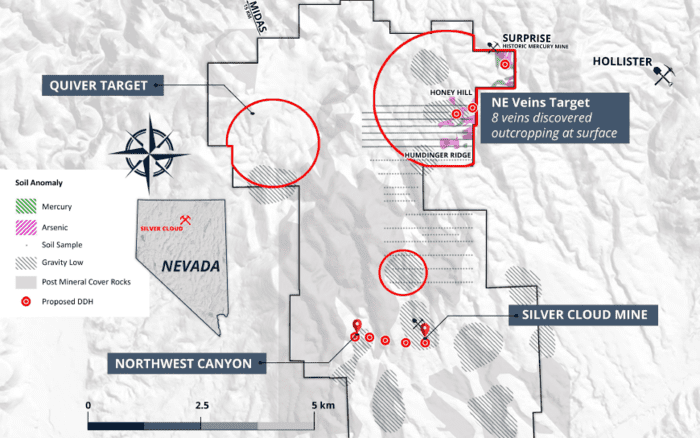

There are four key areas of interest at Silver Cloud. The company is currently stacking good science—geophysical and geochemical—to home in on these subsurface structures.

With historic and recent drilling, the company has its proof of concept confirmed in terms of vein orientation.

With historic and recent drilling, the company has its proof of concept confirmed in terms of vein orientation.

Where previous operators figured on a north to south orientation, Pollard and his team are looking east to west where they’ve pieced together some E-W strike.

The goal is to tap into the system’s boiling zone.

During their previous drilling campaign—a six hole program that included one deep hole—they missed their target, but are still in the hunt.

It’s important to know that at Midas, 25% of the known ore shoots came up barren with the drill bit. Translation: it’s easy to miss the mark—Blackrock could be a meter away from a high-grade vein and not even know it.

CEO Pollard’s comments from a June 18 press release:

“The stated objectives of SBC-006 were twofold: we sought to target the mineralized structure thought to have been previously encountered too high up in the epithermal system, downdip within the projected boiling zone. The second objective was to get an understanding as to the depth of the Ordovician basement lithologies in area to further define the geometry of the volcanic basin and assist with ongoing and future targeting. We were successful in hitting the structure downdip precisely as modelled, though it’s evident we encountered it within a rock package that isn’t ideal for a vein formation. This hole has been crucial to us in terms of understanding what this epithermal system looks like at depth, and by identifying the top and bottom of this mineralized zone, we are able to refine our targeting in search of the “Goldilocks horizon”. We have a very active summer and fall program lined up, including property-wide IP surveys, and a detailed mapping and sampling program to refine targeting prior to a planned 3,500 metre RC drilling program, consisting of 10-12 drill holes that is slated for September.”

As noted above, 3,500 meters in 10 to 12 holes are planned at Silver Cloud this September.

Directly adjacent to the Hollister vein system which trends east to west, a new target—the NE Veins Target—where eight veins were discovered outcropping at surface, will be the first to receive a proper probe with the drill bit.

The Quiver Target a little further to the west, where Newmont (NGT.T) encountered near surface veins grading 1 to 3 g/t Au, may also get a poke or two.

Cashing up on solid terms

We’ve been watching the PP arena closely here at Guru Central. We’ve noticed in recent weeks how high-quality deals almost always go into oversubscribed mode, and fast. Example:

May 8 news: BLACKROCK ANNOUNCES $2.75 MILLION PRIVATE PLACEMENT; TO PRESENT AT METALS INVESTOR FORUM

11 days later, on May 19, the company dropped the following headline:

BLACKROCK ANNOUNCES INCREASE OF PRIVATE PLACEMENT TO CDN$4.5 MILLION

CEO Pollard again:

“With a production profile that averaged 2125g/t silver equivalent over fifty years, the Tonopah silver district has already proven itself as one of the most significant silver-gold districts in North America[2]. In the 1910s this camp, which spans only four miles end to end, established itself as one of the largest producers in America, though the tumultuous decades that followed were enough to dethrone what was known as the “Queen of the Silver Camps.” The western-half of the district, newly-consolidated and of which we now control, represented where the last of the production took place when operations shuttered due to low metals prices. It’s precisely where these miners left off that we are targeting as the first group to conduct modern exploration on the historic workings. With over 7,000 meters of drilling lined up this summer we aim to be the ones to restore prominence to this prolific district.”

Final thoughts

Every mining camp has a story. And they’re always good stories involving some kind of journey, a treasure hunt, and real men and women of character.

Tonopaph’s story is told on Blackrock’s website, near the bottom their Tonopaph project page. It’s a good one.

Tonopaph’s story is told on Blackrock’s website, near the bottom their Tonopaph project page. It’s a good one.

Read: A brief history of the district

We’re in a buoyant market right now. High-quality stocks in this arena have seen their market caps rise, in some cases, dramatically. And this market has an appetite for high-grade stories.

The company has roughly $4.5M in the bank—that’ll buy a lot of RC drilling. It also has > 20 million in-the-money warrants, priced mainly at $0.30—that holds the potential for another $6M.

We won’t have long to wait for initial assays from the Victor vein at Tonopaph. And the potential for high-grade Ag and Au is certainly there.

END

—Greg Nolan

Full disclosure: Equity Guru does not currently have a marketing relationship with Blackrock.