The legalization of the cannabis market in Canada marked a significant milestone in the country’s history. Four years after this groundbreaking event, the retail market has experienced remarkable growth, with a 122.3% annual increase in per capita stores and a 91.7% annual increase in per capita sales. There are now 3,305 cannabis stores across the nation, providing Canadians aged 15 and older with access to cannabis within a 5-minute drive in 59% of neighborhoods.

Despite this impressive expansion, the legal cannabis market in Canada still faces numerous challenges in terms of legal regulations, commercialization, and consumer education. As the industry evolves and matures, stakeholders must address these issues to ensure a sustainable and thriving market.

Legal and Commercialization Challenges

The diverse retail policies implemented by individual provinces have resulted in significant variations in cannabis access. While the implications of these differences are not yet fully understood, research suggests that increased retail access may be linked to higher rates of cannabis use and healthcare visits related to cannabis consumption.

Furthermore, Health Canada regulations requiring pre-packaging of cannabis products have led to an overemphasis on THC percentages as the primary indicator of quality. This has resulted in a systemic problem of inflated THC levels, lack of consumer education, and price compression, with responsibility shared among regulators, labs, brands, marketers, provincial distributors, retailers, and consumers.

Addressing these challenges will require a multi-faceted approach, including better consumer education, marketing strategies that highlight product quality beyond THC content, and increased transparency in testing and labeling processes.

Welcome to Cannabis 2.0

The hype surrounding the legalization of cannabis in Canada has died down, and now the industry is facing the harsh reality of needing to generate revenue and profit. The early heroes of the legal cannabis market are finding themselves under fire as they struggle to adapt to a competitive and challenging business environment.

In 2022, Canadians investing in cannabis businesses experienced a collective loss of more than $131 billion. Industry leaders, who once built their companies on the promise of a profitable market, are now calling for immediate action as profits dwindle. But the blame cannot be solely placed on over-regulation or the failure to curb the illegal market. The reality is that many of the largest and most influential Licensed Producers (LPs) were overly optimistic about market size and their share of it.

Nawan Butt, a portfolio manager at Purpose Investments, argues that the industry’s main issue stems from “too much capital applied too fast in a premature race to become the biggest and meanest.” He suggests that the promises made by industry leaders, many of whom have since left their companies, were simply unrealistic. In fact, a report by The Deep Dive revealed an 80% CEO turnover rate since legalization in 2018.

One prime example is Canopy Growth, which reported a 21% drop in revenue to CA$441 million over 12 months and an EBIT loss of CA$507 million. With negative free cash flow of CA$559 million, the company’s balance sheet looks strained, and the risks associated with investing in such stocks have become apparent. Canopy Growth’s struggles serve as a warning to potential investors about the inherent risks in this burgeoning industry.

So What’s Left?

The post-hype landscape of the cannabis industry is proving to be a bear market, with significant pullbacks in share prices and company valuations. Despite the setbacks, some investors see this as an opportunity to create generational wealth, similar to the investment gains realized by those who bought Amazon shares during the dot-com bubble. Cannabis 2.0 is now a testing ground for companies to prove themselves as viable, profitable businesses.

The New Kids on the Block

Trading on the Canadian Securities Exchange (CSE) under the symbol BCBC, the BC Bud Company represents the next generation of responsible cannabis operators, skillfully navigating Canada’s complex regulatory landscape. For decades, ‘BC Bud’ has been synonymous with high-quality cannabis, and the BC Bud Company aims to continue this tradition, capturing the energy and innovation that has long characterized the British Columbian cannabis industry.

Offering a diverse range of products, the BC Bud Company provides cannabis market consumers with premium, small-batch cannabis flowers, terpene-rich solventless hash concentrates, Canna Beans (chocolate-covered decaffeinated coffee beans), and Buds, a line of infused non-alcoholic craft beverages created in partnership with local breweries. Additionally, the company offers lifestyle apparel that reflects its brand legacy and aesthetic.

The BC Bud Company has established strategic manufacturing and brand partnerships to ensure the continued production of high-quality products. These partnerships include agreements with Habitat, Black Rose Organics, Tricanna Industries, Peak Processing Solutions, and Dunesberry Farms. By working closely with these industry partners, the BC Bud Company can effectively develop, produce, and distribute its products while maintaining a strong commitment to quality and sustainability.

At the helm of the BC Bud Company is a seasoned management team led by CEO Brayden Sutton and President Josh Taylor. Sutton brings over 20 years of experience in the cannabis industry and has raised over $100 million for the sector. Taylor, with over 15 years of experience in the cannabis, CPG, and pharmaceutical industries, has contributed to award-winning products and business development ventures. The company’s advisory board includes Marc Lustig, a seasoned professional with a background in the pharmaceutical industry and a history of successful investments in the cannabis sector.

Technically speaking with Vishal Toora

Before we look at the chart of BC Bud (BCBC.CN), let’s take a look at the cannabis market as a whole. Only then will investors realize that BC Bud is doing something right and is garnering excitement.

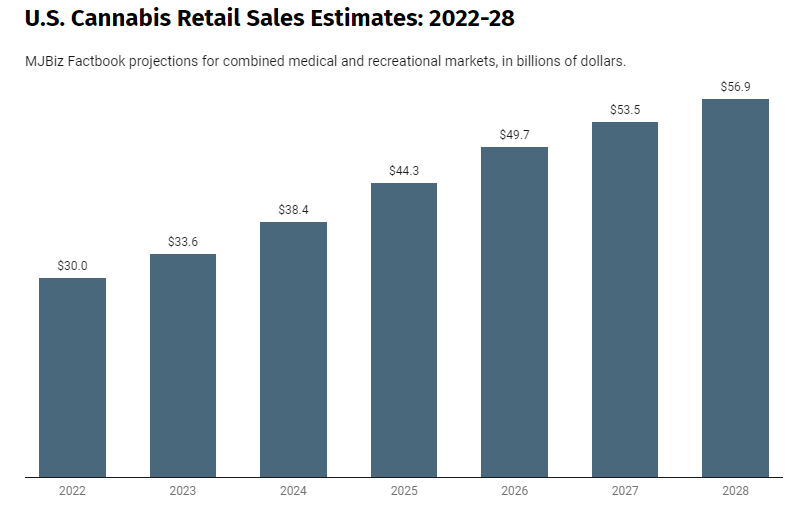

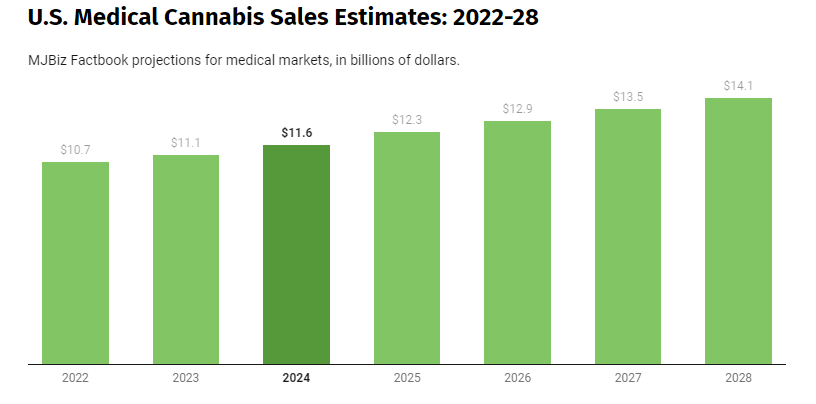

When it comes to the fundamentals of the cannabis sector as a whole, a lot of headlines have been on US legalization. Marijuana is a multi-billion dollar industry across the US and more States are expected to legalize marijuana to seek out things such as tax revenue and jobs. According to MJBiz, medicinal and recreational marijuana sales are projected to reach $33.6 billion by the end of the year.

In April 2023, Delaware became the 22nd US state to legalize recreational marijuana. The next US states that are likely to legalize, some are very close to, are Florida, Minnesota, Ohio and Pennsylvania. Headlines from these states in the future may be the catalyst marijuana stocks will need.

I say this because as I have mentioned in my previous technical analysis on this sector, it isn’t looking too good.

The Global X ETF (POTX) printed new all time record lows at $7.82 at the end of April 2023. And then a positive. Since making that low, the ETF has begun to range and has seen some strength in recent days. Have we bottomed? It is too early to say from a technical standpoint. If we can climb above $9.00, that would take out a recent lower high. This is crucial since the ETF is clearly in a downtrend. I have highlighted the blue boxes which showed previous ranges in this downtrend. As you can see, just because we ranged, it did not mean a reversal was on the cards.

The Pure US Cannabis ETF MSOS is showing some promising signs. The ETF made new all time record lows hitting $5.05 in April 2023, and the range has held for a long duration. We actually had a large influx of buyers as evident by the gap up on April 27th 2023. Buyers stepped in at the gap when MSOS tested it on May 4th 2023.

Promising signs indeed. Now MSOS is testing a key resistance zone which needs to break. What was once support is now resistance at the $6.50 zone. If we can get a strong close above this zone, we will be taking a large step forward in ending this downtrend and potentially the beginning of a new uptrend.

On the Canadian side of things, Horizon’s HMMJ made new all time record lows in April hitting $9.45. We seem to have formed a double bottom looking pattern with a nice breakout so far. I have drawn a horizontal blue rectangle around the $10.35 zone. This is the last lower high level we are working with. As long as this level holds, the downtrend remains intact. Let’s see if HMMJ can close above this level in recent days.

In summary, after long downtrends and printing new record lows, the Cannabis ETFs are showing signs of some life. Recent moves indicate reversals could be coming, but major lower highs and resistance zones still hold meaning the downtrends are technically still in play.

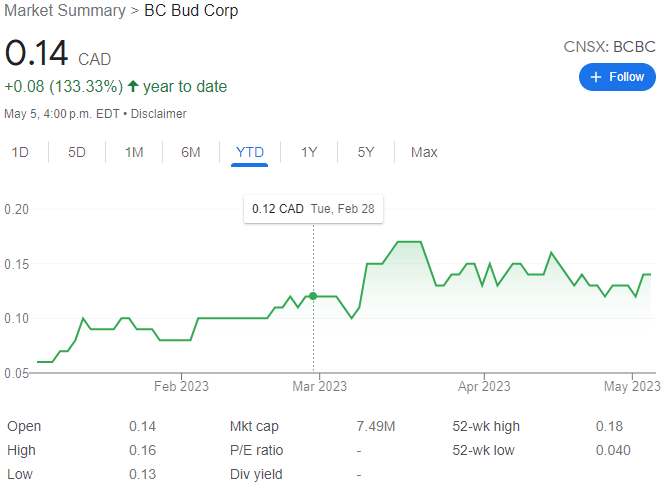

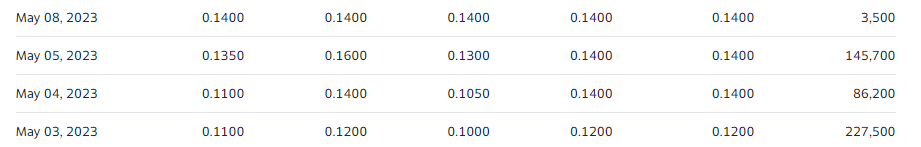

And then we have BC Bud. This stock confirmed a bullish breakout back in January 2023. I told readers that this stock was the only bullish cannabis stock I could find. Our support levels and resistance levels remain intact. $0.175 remains the major resistance level where profits are being taken. And $0.10 is the major support level where buyers step in. BC Bud remains in this range between these two price levels.

Volume in recent days has picked up, especially as the stock tested the $0.10 support zone.

The candle printed on May 4th 2023 catches my attention because it is an engulfing candle, the most powerful single price action candle. All this is telling us that buyers are at and defending the $0.10 zone with strength.

Going forward, the game plan would be accumulating shares when the stock tests or nears support at $0.10. The play is then waiting for the breakout above $0.175 with a strong candle close being the trigger to extend the uptrend higher. And there is a lot of room to the upside according to technical levels.

What’s Ahead for Cannabis 2.0 and BC Bud Co?

Analysts predict that the Canadian cannabis market will be worth between $4.9 and $8.7 billion in the coming years, contributing significantly to the national GDP and supporting thousands of jobs. This potential for growth and economic impact underscores the importance of addressing the industry’s challenges and fostering a sustainable and thriving market.

Companies like BC Bud Co are doing just that by focusing on developing meaningful products and narratives that extend beyond THC content. By highlighting unique genetics, terpene profiles and innovative product types while showcasing premium growers, BC Bud is steadily building a strong identifiable identity.

BC Bud’s informational promotion and emphasis on brand preference addresses the challenges facing operators in Canada’s strict regulatory atmosphere while the company’s business practices reflect its dedication to fiscal responsibility, sustainable growth and transparency.

In conclusion, the Canadian cannabis market has made significant strides since legalization but still faces ongoing challenges. Cannabis isn’t dead, not by a long shot, but it’s a far different beast than anyone had imagined. As such, the BC Bud Company is poised to make its mark as a reliable and innovative operator in this ever-evolving industry, delivering exceptional products to consumers and providing an interesting investment opportunty for shareholders.

BC Bud Co currently trades at $0.14 CAD per share for a market cap of 7.49 million.