Back in early July, I wrote an article titled, “3 Canadian tech stocks to watch in 2022“. VERSES (VERS.NEO) was included in my list and what a performance for the stock! Since IPO’ing back on June 29th 2022, the stock has rallied just over 186% from its bottom. During a time when major stock markets were mainly ranging.

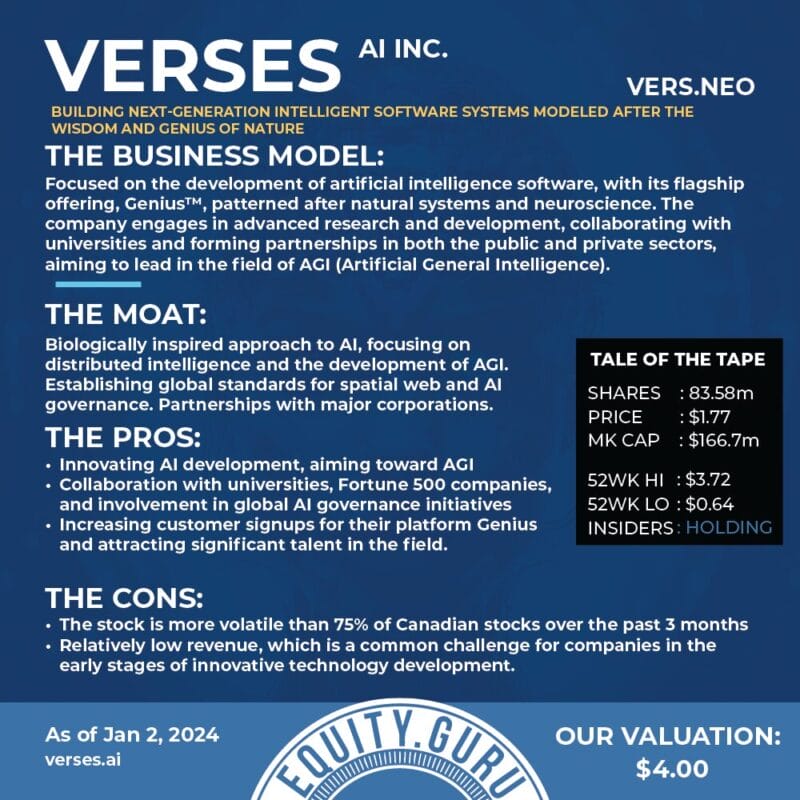

VERSES has the potential to be a real game changer. This company has created software that can globally interconnect any AI, human, machine or object and make any business, city or country run more securely and more efficiently on the spatial web, or in other words, the worldwide web of everything.

Not a hook enough for you? Chris Parry does a great job explaining the value here:

Or hear from the founder and CEO himself Gabriel Rene as he speaks with Jody Vance about deploying contextually aware AI applications.

VERSES with its groundbreaking AI operating system platform, COSM, is set to revolutionize such things as supply chain management by allowing managers to see and control all aspects of their supply chain seamlessly from a single dashboard. And then from here, think bigger in terms of cities and countries.

Our very own Kieran Robertson outlined the value proposition that VERSES brings, setting the stage for web 3.0:

“If Web 3.0 is like a slab of marble, then VERSES Technologies is the Sculptor”.

The COSM operating system (OS) is VERSES flagship product. The world’s first AI operating system which allows anyone to build intelligent apps for anything. This AI will interact directly on your behalf in the physical world. Data can be measured and tracked, and more importantly utilized to anticipate future data leading to better efficiency and return on investments.

This mixing of reality leading to optimal results and a performance increase is best demonstrated with VERSES’ Wayfinder.

This video demonstrates the real world example of VERSES technology. Using advanced AI, visual navigation and audio cues within this spatial order picking software to increase productivity, reduce errors, and rapidly boost ROI’s.

VERSES is planning to launch COSM globally in 2023. Investors can expect big things in 2022 as the company prepares for the launch. Spoiler: big things are already happening!

VERSES recently announced that it had expanded deployment of Wayfinder to all 18 North American distribution centers for NRI distribution (NRI) a leading third-party logistics provider. The deployment expansion follows a previously inked SaaS agreement between the two companies and builds upon Wayfinder’s success of a multi-site Wayfinder pilot program and is an integral part of NRI’s growth strategy.

Peter McKenna, CEO of NRI, commented, “Simply stated, we believe VERSES Wayfinder is a game changer, not only for us, but for the industry as a whole, which is why we are excited about our long term relationship. Throughout our pilot, the Wayfinder application added significant and immediate value to our day-to-day operations, directing warehouse workers in the most efficient pathways to improve individual picking performance by nearly 40%. Bottom line – we believe Wayfinder is driving competitive advantage and we look forward to realizing additional warehouse talent and cost benefits in the coming years.”

NRI Distribution provides e-commerce fulfillment, wholesale fulfillment, freight services, returns, repairs & warranty services, inventory management as well as value-added functions including kitting, pre-packing assembly and tagging.

NRI has operations across Canada as well as operations in the United States. The company was named one of America’s fastest growing corporations in 2019 by renowned business publication, Inc. Today, NRI has 1,200 employees across its distribution network utilizing 1.4 million square feet of warehouse space.

VERSES also has entered into an operating partnership with Tompkins Ventures, a leading supply chain matchmaking firm. The partnership gives Tompkins the right to introduce Verses’ and its technologies to companies within the supply chain industry to help accelerate the adoption of Verses’ technology portfolio. As a result of the agreement, Tompkins will receive a percentage-based commission on each successful business arrangement between Verses and a company introduced by Tompkins Ventures.

Dr. Tompkins has spent the last several years focused on digital commerce, unichannel and supply chain reinvention. He has also written or contributed to more than 30 books and over 1,000 articles and has been quoted in hundreds of business and industry publications, relating to supply chain excellence.

Dr. Tompkins added, “As is well reported throughout the media, there are two challenges facing the supply chain today – labor and inflation. To address these issues, companies must be smarter in managing the end-to-end supply chain, and I believe VERSES is approaching these challenges in an unprecedented but sorely needed new way.”

The company also announced that it had become a card-carrying member of the Digital Twin Consortium, an international organization based in North America which assists in creating collaborative partnerships between digital twin users and experts in industry, government, academia and tech.

Members of this organization come from a wide variety of industries from academia and research to mobility and transportation including big names such as Google, HSBC, Microsoft and Kaiser Permanente.

Perhaps the most exciting news for shareholders is the oversubscribed financing. The street just can’t get enough. Everyone wants in and the Verses has now secured total gross proceeds of $14.96 million CAD. They could have raised more if they wanted to. Verses will not have an issue raising funds in the future.

With money in the bank, Verses management has the funds to initiate catalysts for the stock. It is now up to management to do what they promised to do.

Look at that chart.

My readers know that I am not someone who likes to chase IPO’s early on because of the tendency to see early investors take their profits. I prefer to wait a bit until some more price action is confirmed and we develop price levels to work with.

The stock opened at $0.4850 before dropping down to $0.3850. From here, there was no looking lower. We bounced hard which led to a 186% rally from these lows to all time highs.

We saw some initial resistance or pause just above the $0.70 zone before we hit record highs at $1.10. I have marked this zone as support in case VERSES pullsback. We shall talk about this in just a second.

From the price action I am seeing, VERSES had developed a range between $0.95-1.05. A range usually indicates exhaustion. Not something which surprises me considering the major move the stock has made. I bet some people have been taking profits around the $1.00 zone.

How do we play the range? We wait for either a close above $1.05 or a close below $0.95. We have attempted many times to close above $1.05 but no success. Sellers jump in and we close below $1.05. This increased the probabilities of exhaustion. And as you can clearly see, we broke below the range instead.

It does seem like a pullback could be in the cards for the stock. A pullback which would provide new investors with a great opportunity to enter as some holders cash in on their gains.

A pullback could take the stock back down to the technical support at $0.70. And this may not be the company’s fault but rather due to broader stock market weakness and uncertainty. Especially as interest rates are set to rise this month.

As a technical trader, the other option to turn bullish would be VERSES reclaiming the $0.95 support zone.

For the long term, investors have a lot to be excited about with the 2023 release date for COSM, and plenty of press releases from now until then. And don’t forget the company has the cash in the bank!

If you are someone worried about volume, have no fear. This stock has been seeing large CONSISTENT volume since the first day of trading.

VERSES is one of the hottest Canadian tech stocks of this year, and the company is just getting started. This is one ticker to have high up in your watchlist!

Full Disclosure: VERSES Technologies Inc. is a marketing client of Equity Guru.