It is pretty much known that the Federal Reserve is going to raise interest rates. The question is by how much? Most of the market thinks a 50 basis point hike is in store. The real fireworks will start 30 minutes after the rate hike announcement. When Fedchair Powell takes the podium and every trader, algo, investor starts breaking down every word that comes out of his mouth to determine what the Fed will do next.

If you have never traded an FOMC meeting, I encourage you to have the charts of the S&P 500, TNX, the US Dollar and Gold up on their 1-5 minute intraday charts and just observe the volatility. You will get a good idea why I tend to just wait until the Fed noise dies down before entering my next swing trades.

I keep my powder dry for Fed week. I might play a Forex pair that is not a Dollar pair (ie: EURNZD, EURAUD, GBPAUD etc) but I stay away from US markets and the precious metals. Just because I know the volatility will be off the charts when the Fed speaks.

This Fed meeting has an added element of drama as the Fed will have to decide whether they want to keep assets propped, or tame inflation. For more info on this dilemma and how it will affect the stock markets, check out my recent articles titled, “Stock market sell off explained” and “Is the Federal Reserve about to crash the stock markets?“.

Long time readers know that I have been bullish on precious metals and the commodity space. I have used the term confidence crisis a lot. A term to explain a period of time when the people are losing confidence in the government, the central banks, and the fiat currency. I do believe we are already in this period, and things are about to get more interesting in the next few months.

We have, and continue to, expect the US Dollar to be the strongest fiat currency going forward. This in itself will not only create many problems for the Fed, but for the rest of the world. When the market begins to find out that a Bretton Woods 3, Plaza Accord 2.0 type situation is likely coming, that’s when you will see gold truly shine. Currently, the stronger US Dollar is putting pressure on the metal but remember, there will be a period of time when both will move up together.

To answer if gold and silver have bottomed a day before the Fed, let’s take a look at two other major charts before taking a look at the precious metals themselves. Trust me. you will want to be watching these next two charts.

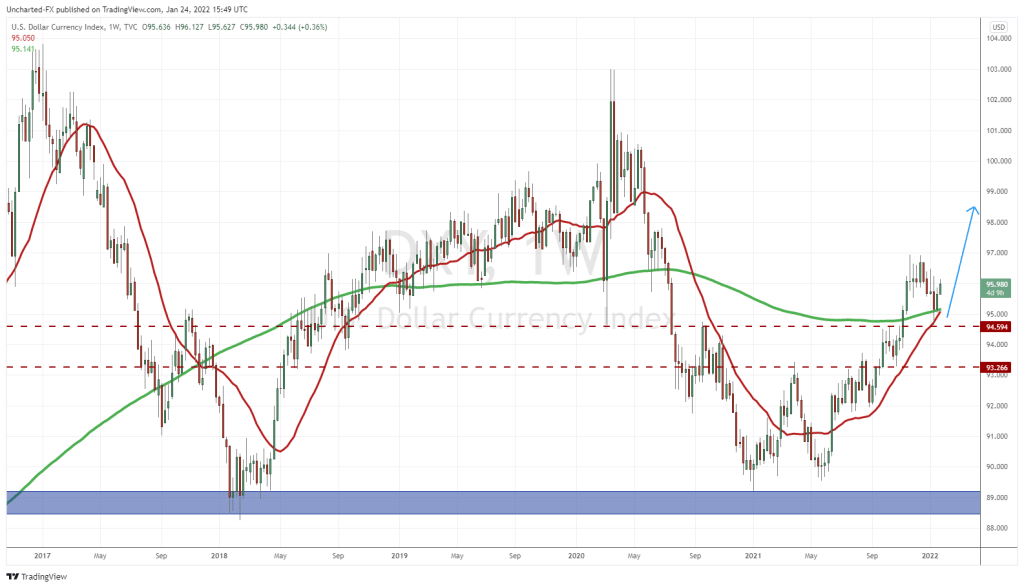

Above is the chart of the US Dollar Index, or the DXY. I have it on the weekly timeframe. Notice where we are at. Look to the left of the chart. This is definitely a pretty important resistance, or price ceiling, zone. I have to say, last week’s DXY weekly close above 103 was super bullish. The thing is, we do have wicks going back to 2016 that capped the DXY at 104. Note how last week’s candle also capped out at 104. The DXY is respecting this resistance.

Now let’s go down to the daily timeframe. The Dollar is acting as expected a few days before the FOMC meeting. We are just ranging between 103 and 103.70. Powell and the Fed will give us the breakout direction in either direction. The gold bulls are hoping for the dollar to reverse and breakdown.

A chart that doesn’t get too much attention is that of the 10 year yield. This week, we hit 3% on the ten year. Many analysts and traders are using this as the major resistance. Yields have been rising because the market expects the Fed to raise interest rates 6-7 times this year. The bond markets have priced this in. However, go back to read my stock market crash explained article linked above. Because maybe the markets have not priced enough.

Oh ignore my downtrend channel that you see in the chart. That is for another post. I don’t want to freak you all out, but I see the end of a 40 year bond bull market. Or in other words, the end of low interest rates, and the beginning of rising interest rates to levels that would terrify the debt leveraged middle class. I am talking about end of the current financial system levels. This is for another story, but again, we will find out whether the Fed wants to tame inflation or keep assets propped. The Fed could theoretically do yield curve control like they do in Japan…

I am getting ahead of myself. The things we macro traders have to go through sometimes. Back to the CURRENT ten year yield set up. If 3% is the resistance, then we could expect yields to drop here. Remember, gold yields nothing, so when yields rise, it tends to be negative for gold. A yield reversal would thus be positive for gold.

Powell could get yields spiking nicely above 3% depending on how hawkish he is at the Fed meeting.

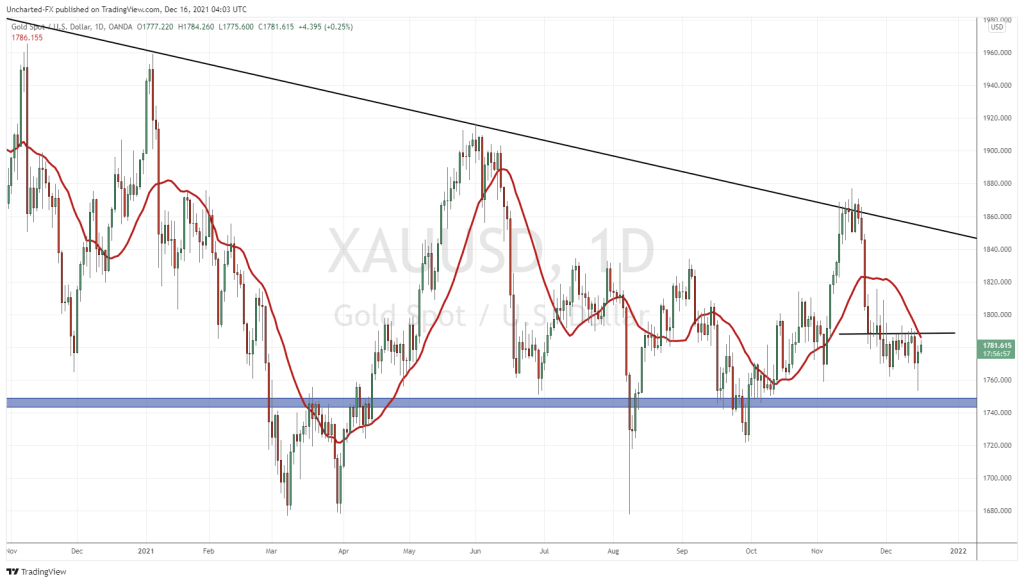

Now onto the main attraction. Gold.

In previous posts, and in our discord group, I have been saying that gold needs to reclaim 1920 in order to flip full bullish. This still stands. I actually just took profits on a gold short that I had when we retested 1920 after breaking below it after a month long range. My target was just above 1850.

Note where my support comes in. It comes in between 1840-1850. The current price action is displaying a nice support bid at 1850. This could be the bottom for this move. Personally, I like to wait for a range to develop to indicate selling pressure has exhausted, but we probably won’t get that now with the Fed up soon. Gold will be volatile, and if the market even gets a small sniff of the Fed going dovish, we could easily see gold breaking back above 1920.

So in summary: gold is at a major support zone while DXY and the ten year yield are at major resistance zones. If the latter two drop, gold could pop from here.

For the silver bulls. I am getting excited at the prospect of bouncing at a major support zone. Above is the weekly chart, and I am referring to the 21.50-22 zone. It has acted as support multiple times in the past two years. We just need to wait for a nice large wick weekly close candle. I will be monitoring the daily chart for signs of a reversal. Don’t worry, I will let you all know when I see signs of it.

But fair warning, silver can still make one more leg lower, just like gold, to deeper test the major support levels. All eyes are on the Federal Reserve and expect volatility. I encourage new traders to just wait for the volatility and noise to calm down. This usually means to wait for the daily candle to close post Fed and make our moves the day after.