The precious and base metals are getting hit. Copper has broken below our major trendline and rejected resistance. Gold has closed below $1920 and sellers are piling in on the retest. Silver has broken back below a major support zone, and more downside looks imminent.

Am I phased by any of this? Not a chance.

If you read my articles from a few months back, or are a member of the Equity Guru Discord group, I was expecting one large pullback on the metals. I was actually a bit upset that this did not happen, and instead metal prices rose. My thinking was that the US Dollar was going to get a huge bid on a hawkish Fed. However, now the markets realize the Fed will need to hike much more than 6-7 times to tame inflation. For more info on this, read my article explaining the current stock market sell off.

Fear is definitely back with money running into the US Dollar and bonds. We are getting another ‘everything’ sell off like we saw back in the early Covid days of 2020. Precious metals are not immune.

Another approach is the ‘deflation’ trade. Again, check out my current stock market sell off article linked above to understand what the market is sensing. Essentially that the Fed will need to bring stock markets down. China is being blamed for commodity drops as lockdowns continue in major cities. Funnily enough, I have been writing about something happening in Asia. I spoke about the Japanese Yen last week, which is probably the most important article I have written. The Chinese Yuan is already being devalued by the PBoC, and the Korean Won looks ready for a Turkish Lira/Russian Ruble/Japanese Yen like move.

Something is stirring, and it looks like Asia will be feeling the brunt of it. My take is that markets are prepping for this. Big money sees the signs and are going into safety assets and cash.

Timing is the tough thing, but I do believe gold and silver will bounce back hard given what will happen to the currencies. Take a look at the gold and silver prices versus the Japanese Yen. XAUJPY made new record all time highs, and XAGJPY was just a few ticks away from doing the same. As we see currencies take a hit, I believe most people will realize that central banks are stuck. An Asian crisis may lead to western central banks pausing or reversing current monetary policy. It sort of has to to ensure this financial house of cards doesn’t crumble with the Bank of Japan.

It seems like it was years ago when I talked about a forthcoming currency crisis. We are there now in my opinion, and the US Dollar will be the best performer. However, the confidence in central banks and fiat will be tested, especially in the countries seeing their currencies get decimated. I think that money will run into non fiat hard assets, particularly gold and silver but maybe even in Bitcoin.

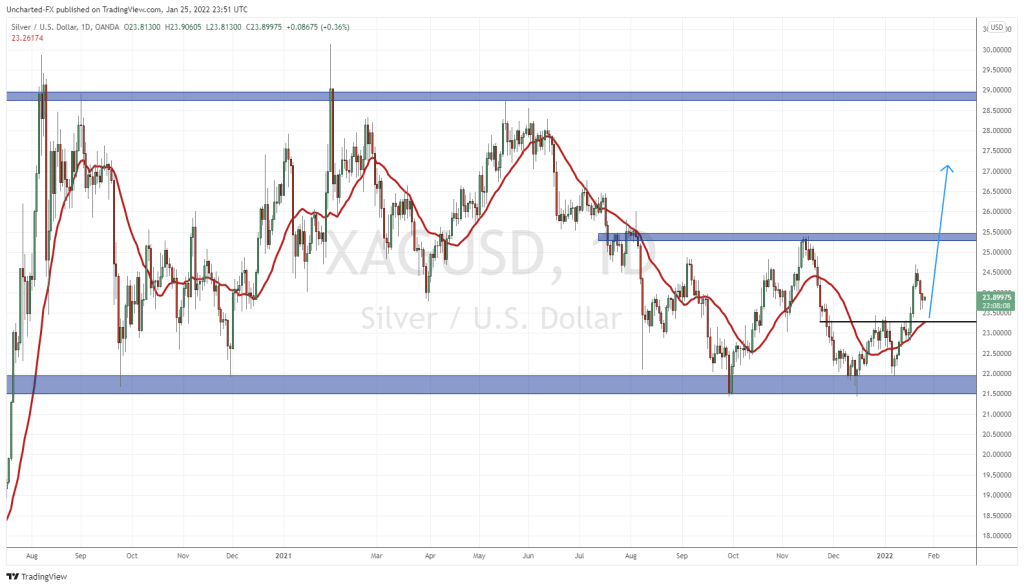

Silver had a battle at our major resistance zone of $24.30 in late February, early March of 2022. We finally confirmed a strong candle close above it which meant the bulls won the battle. But not the war.

Silver tagged prices at $27 before selling off. We did retest $24.30 and saw a nice bounce, but no momentum further. A few days ago, we closed below the $24.30 zone. What was once support now becomes resistance, or a price ceiling. Prices need to close back above $24.30 for us to flip bullish.

So where can silver go in this downtrend before saying we have bottomed? I have some interim support at $23. However, I believe we will bounce from $23 back up to $24.50 before selling off again and forming a lower high in this downtrend. I am watching for our MAJOR support zone at $22.

The weekly chart above shows you how important this $22 level is. A major weekly support zone going back to 2021. If we close below it…well, we silver bulls will have to remain patient. Let’s just say it wouldn’t be too great, and we may have to wait a few more months before initiating a new uptrend. Let’s hope this doesn’t happen.

As this happens, we silver bulls get another opportunity to add to our positions. I still prefer stacking the physical. One can trade XAGUSD futures or CFDs or even the SIL ETF. But in this article, I will go over a few companies from a junior, to an intermediate producer and large caps.

Honey Badger Silver (TUF.V)

Market Cap ~ $14 Million

Honey Badger Silver acquires, explores for, and develops mineral properties in Canada. The company primarily explores for silver, cobalt, gold, and diamond deposits. Its flagship project is the Thunder Bay Polymetallic Silver Project covering an area of 16,800 hectares located in northern Ontario. The company also holds a 100% interest in the Clear Lake deposit that comprises 121 contiguous claims covering an area of approximately 2,500 hectares located in the Whitehorse Mining District of the Yukon.

The packages in Yukon hosts 12 past-producing high-grade mines with historic production of over 1.67M oz silver. If you know the Yukon, then you know about some of the crazy silver grades we tend to see.

Recent news regards Honey Badger acquiring a 100% interest in the Clear Lake deposit in the Whitehorse Mining district of Yukon for a total consideration of $250,000 in cash. This deposit is known to contain a significant amount of silver, zinc and lead.

The last assay result came out on February 14th 2022. Results from Plata in Yukon contained assays up to 16,687 g/t silver, 67.99% lead and 0.83% zinc. You can find the breakdowns here.

As always with small juniors and explorers, you need to look at the management and their track record, jurisdictions and the cash balance amongst other things. Financing is common since these companies are not making a profit and need to raise funds to pay for drills and other catalysts.

In terms of the stock price, well we have been ranging between $0.055 and $0.09 since July of 2021. A breakout is required. I am leaning more towards a pullback to the bottom level of the range given the predicted move to $22 on Silver.

Fortuna Silver Mines (FVI.TO)

Market Cap ~ $ 1.2 Billion

Fortuna Silver Mines engages in the acquisition, exploration, and mining of precious and base metal deposits in Argentina, Burkina Faso, Mexico, Peru, and Côte d’Ivoire. It holds interest in the Caylloma silver, lead, and zinc mine located in southern Peru; the San Jose silver and gold mine situated in southern Mexico; the Lindero gold project located in Argentina; Yaramoko gold mine situated in south western Burkina Faso; and Séguéla gold mine located in south western Côte d’Ivoire.

An intermediate gold and silver producer with 4 operating mines and a fifth mine under construction. I prefer these advanced stage producer plays along with the royalty and streamers. Yes, these producers do have a lot of debt, but if precious metal prices are going to rise and stay high for some time, producers will be racking in the money.

The big news out recently has to do with Fortuna’s Q1 2022 production. Here are some numbers:

- Gold production of 66,800 ounces; 93 percent increase over Q1 2021

- Silver production of 1,670,128 ounces; 13 percent decrease over Q1 2021

- Gold equivalent1 production of 103,098 ounces

- Silver production of 1.6 million ounces, a 13 percent decrease over the comparable period in 2021, was primarily driven by a 14 percent decrease in head grade at the San Jose Mine, which is in line with the Mineral Reserve average grade.

- By-product base metal production amounted to 9.1 million pounds of lead and 10.8 million pounds of zinc.

The chart of Fortuna looks very similar to that of the Silver miner SIL ETF. Same sort of structure. Unfortunately, an uptrend has broken down, and it appears as if FVI will fall to $4.00 alongside the drop in silver. If we could manage to close back above this trendline, like a close above $4.80, that would change my stance because then we would have a fake breakdown.

MAG Silver (MAG.TO)

Market Cap ~$ 1.7 Billion

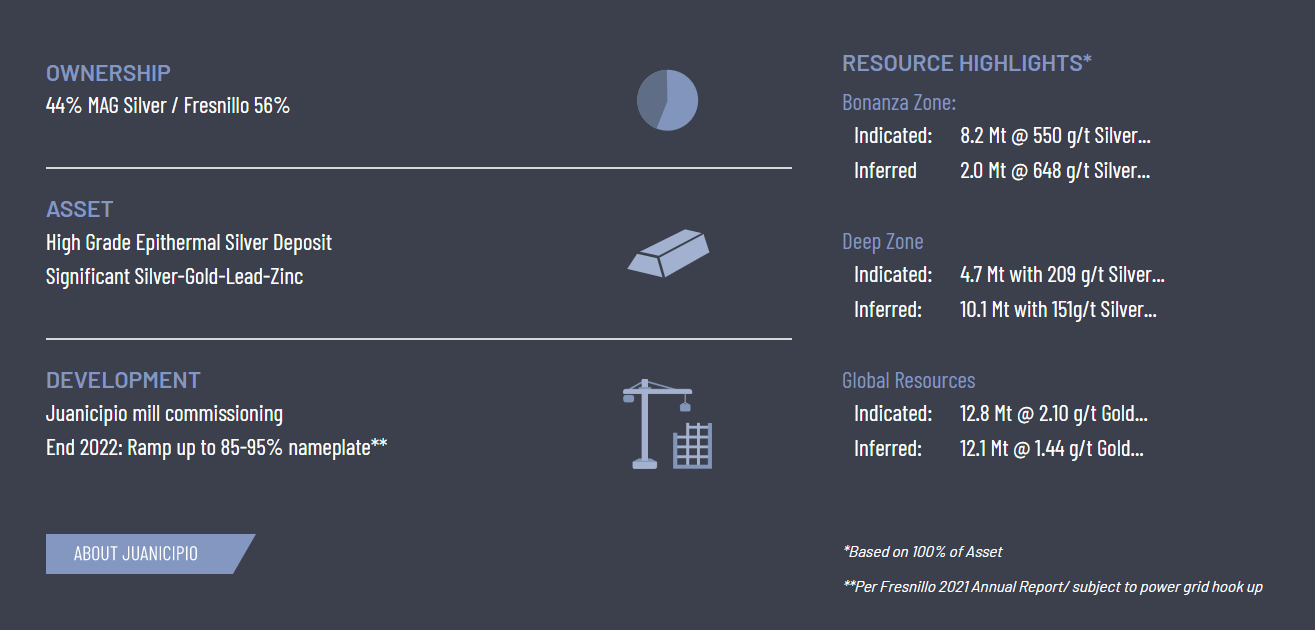

MAG Silver (MAG.TO) is a company that has had Silver bulls excited for sometime. This is one of the highest grade and largest primary Silver assets in the world. I highlight primary because Silver tends to be found as a by-product. This is the largest primary silver miner coming into production in many years. Decades if I have my math right.

By the way, you might be asking, “who are Fresnillo?”

Fresnillo plc is the world’s largest primary silver producer and Mexico’s largest gold producer, listed on the London and Mexican Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico – Fresnillo, Saucito, Ciénega (including the San Ramón satellite mine, Las Casas Rosario & Cluster Cebollitas), Herradura, Soledad-Dipolos1, Noche Buena and San Julián (Veins and Disseminated Ore Body), three development projects – the Pyrites Plant at Fresnillo, the optimisation of the beneficiation plant also at Fresnillo and Juanicipio, and three advanced exploration projects – Rodeo, Orisyvo and Guanajuato, as well as a number of other long term exploration prospects.

The company recently released 2021 results. Here are highlights:

- Processing at the Fresnillo plants is expected to continue until the Juanicipio plant is commissioned, with Fresnillo making available any unused plant capacity at its Minera Fresnillo and Minera Saucito operations, and if possible matching commissioning and ramp up tonnages that were previously expected at Juanicipio.

- For the three months ended December 31, 2021, on a 100% basis:

- 113,950 tonnes of mineralized material were campaign processed through the Fresnillo and Saucito plants, with 1,519,027 payable silver ounces, 3,641 payable gold ounces, 563 tonnes of lead and 800 tonnes of zinc produced and sold;

- Average silver head grade was 542 grams per tonne (“g/t”); and

- Pre-commercial production sales totaled $39,368 for the quarter (net of treatment and processing costs), less $7,593 in mining and transportation costs, netting $31,775 in gross profit by Minera Juanicipio in the quarter.

- For the year ended December 31, 2021, on a 100% basis:

- 251,907 tonnes of mineralized material were campaign processed through Fresnillo’s plants, with 2,974,524 payable silver ounces, 5,975 payable gold ounces, 1,065 tonnes of lead and 1,519 tonnes of zinc produced and sold;

- Average silver head grade was 470 g/t; and

- Pre-commercial production sales of $75,393 (net of treatment and processing costs) less $15,329 in mining and transportation costs, netting $60,064 gross profit in Minera Juanicipio for the year.

- Since commencing campaign processing of Juanicipio mineralized material from development headings in August of 2020 through February 2022, a total of 413,691 tonnes of mineralized development material have been processed through the nearby Fresnillo plant and starting in December 2021 in the Saucito plant:

- contributing cash-flow to offset some of the initial project capital; and

- de-risking Juanicipio’s metallurgical performance, which is expected to significantly speed up project ramp-up.

- A further 89,925 tonnes of mineralized development material with a silver head grade of 529 g/t were processed in January and February 2022 through the Fresnillo and Saucito plants.

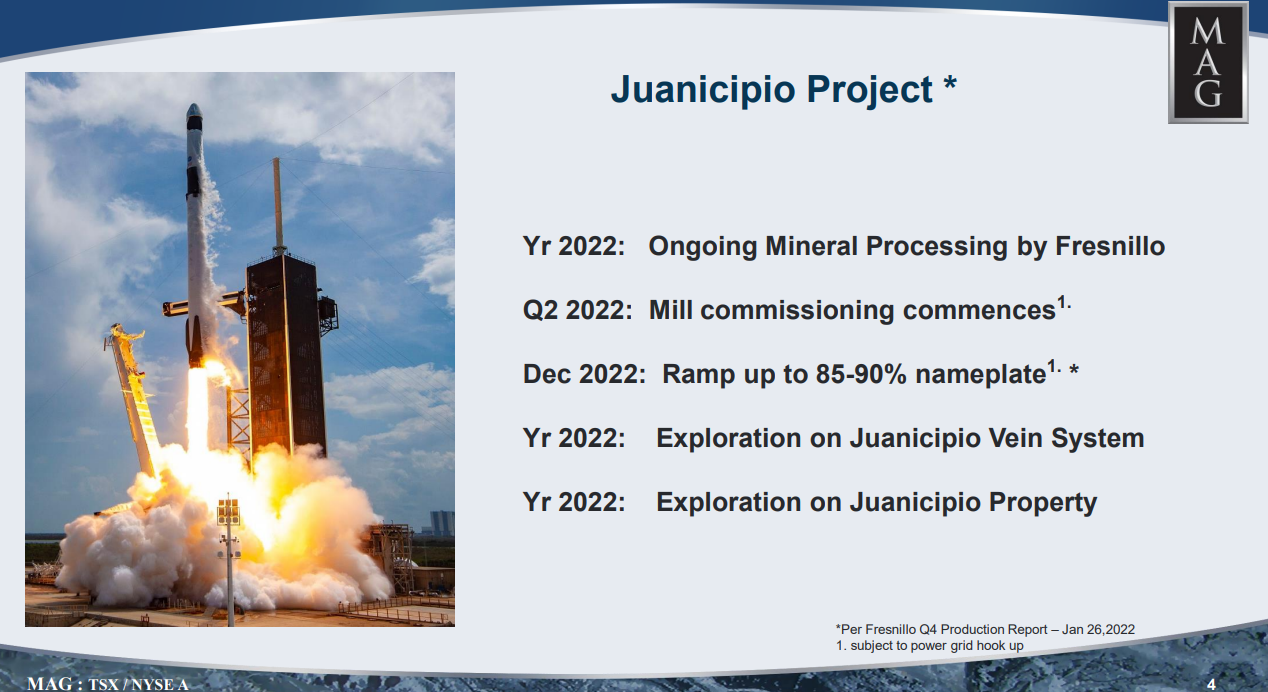

Above is what we should expect to see from MAG Silver this year as they ramp up production at the Juanicipio Project.

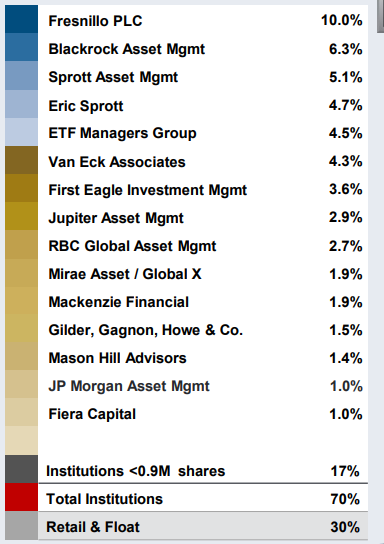

Here are also some big names that hold shares and are excited about this high grade primary silver miner. They’ve done their due diligence and like what they see.

Unfortunately, it looks like MAG Silver might break below current support we are testing. If so, then I would be looking at support lower at $15.

In summary, I am looking for the silver price to pullback as the stock market sells off and fear trade continues. I still believe precious metals will come out stronger in the end as we are about to witness madness in the currency markets. Watch Asia, and watch the Euro and Europe. It will be rough times, but hard assets are where you want to be. The US Dollar will be strong, but money in other deflating currencies will be looking at gold and silver.