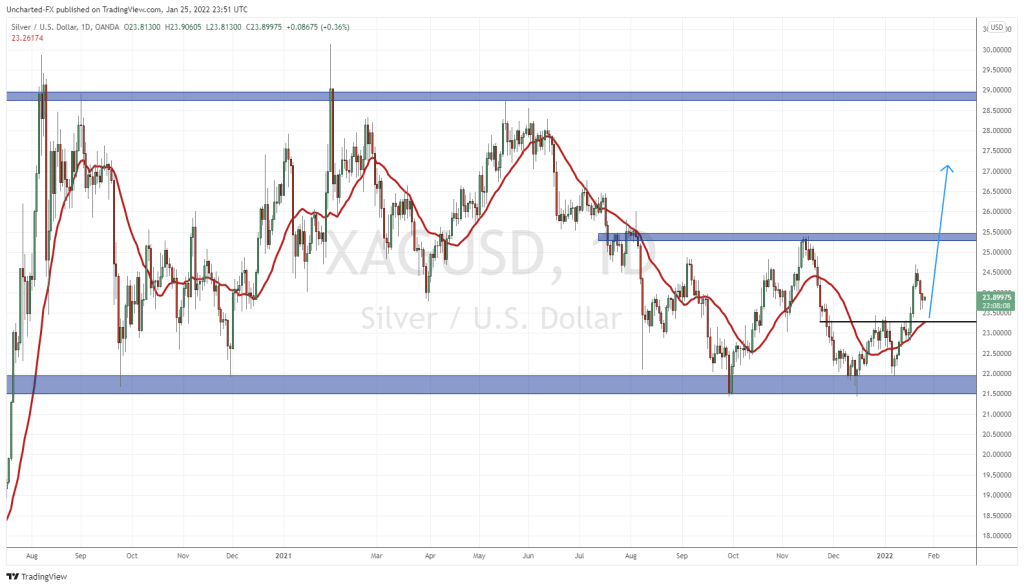

A few weeks ago, I called a new Silver uptrend. Our breakout level is still holding, and we just await the higher low swing. Before I go all nerdy on the charts, let’s talk about the fundamentals.

It is no secret to Equity Guru readers that I am a big fan of Silver and Gold. But I have a soft spot for Silver. I just love the metal and its history. I do believe it is one of the most undervalued hard asset commodities right now. You get the best of both worlds with Silver being an industrial metal and a monetary metal. Some say it is not a monetary metal, but when you compare Silver with Gold (the monetary metal) and Copper (the industrial metal), Silver correlates positively with Gold. It acts as a monetary metal, but the industrial aspects of it favor supply and demand mechanics. We will need more Silver for green infrastructure, and not many new Silver projects are coming online. It is a good time to be bullish on the white metal.

I prefer bullion. I am a stacker. My bullion collection has gone to the extreme now, where I initiated a project to buy a 25 gram or higher Silver coin from every country in the world. I have surpassed over 100 countries, and one day I will post some pictures. Heck, I even prefer wearing Silver over Gold (and if I do wear Gold it is always White Gold). I don’t know if there is a metaphysical thing but I generally feel much calmer and in control with Silver. Maybe it’s just me but let me know if you have the same experience.

Stacking is great. I suggest buying physical. For those that want the extra returns, then consider trading Silver paper contracts and Silver miners, some of which I will talk about here in this article. Caution: Silver paper contracts are very volatile and it isn’t for everyone. But if you accept the risks, it can be very lucrative.

Technically, Silver is ready to go. A breakout has been confirmed and we await the higher low swing. We will be hearing from the Federal Reserve today which will cause the US Dollar and other markets to be very volatile. Expect this with Silver and Gold. The markets want to see the Federal Reserve be hawkish, and hint at a rate hike in March 2022. Some say this will cause the Dollar to rocket, and precious metals to drop.

However, I think we will see a time when Silver and the Dollar will be rising. It is all about inflation which is a monetary phenomenon regardless of what they say about supply chains. We all knew this inflation was coming long before supply chain issues. The re-opening of the global economy was the missing piece.

I believe, as do many analysts, that inflation will stick above 6% for sometime. What this means is the Fed will not be able to control inflation unless they raise rates above 6%…which is probably impossible with the amount of debt out there. Hence, we will be in an environment where the Fed will be raising interest rates, by 25 basis point increments, yet inflation will persist. Readers know that I use the term ‘confidence crisis’ to describe an environment where metals and the US Dollar can rise together. A period of time when people lose confidence in the government, central banks and the fiat currency. We could very well be at the beginning of this confidence crisis, as investors will soon realize the Fed will not be able to hike rates enough to combat inflation. Silver and Gold provide a great way to protect your purchasing power. I am bullish on Silver and Gold, but I am also bullish all commodities and hard assets for the inflation trade.

Silver is on the launch pad. The technicals are indicating another higher low swing. I remain bullish above $23.30. We could pullback to retest this zone, but as long as we close above it on the daily, another swing is coming. A close below this support means Silver fails the breakout, and I will have to reassess. Again, this could happen with a very strong US Dollar. But as of now, the apes at Wall Street Silver are holding the line.

Notice the last two day daily candles. Some nice wicks indicating buying and near our support retest. This is what I want to see. The actual trigger of the higher low swing is the breakout above recent highs around $24.50. From there, I am looking at $25.50 and then the $28 zone. The market structure looks really good.

I should mention that $21.50 is a huge weekly support zone that Silver has held six times now since October 2020. This is exactly where we created the bottoming pattern which adds another bullish confluence.

As Silver prices rise, one can also play silver miners. Here are a few companies I am watching. Two are riskier juniors, one is a producer, and the other is setting up to be a major primary Silver producer with a high Silver grade.

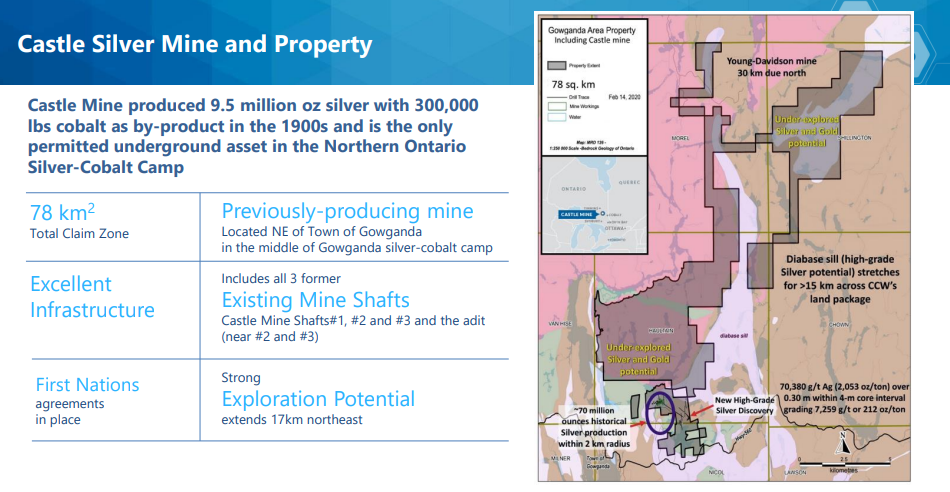

Canada Silver Cobalt Works (CCW.V)

If there was one chart to act on asap, it would be that of Canada Silver Cobalt Works (CCW.V).

Canada Silver Cobalt Works Inc. recently discovered a major high-grade silver vein system at Castle East located 1.5 km from its 100%-owned, past-producing Castle Mine near Gowganda in the prolific and world-class silver-cobalt mining district of Northern Ontario. This discovery has the highest silver resource grade in the world, with recent drill intercepts of up to 89,853 grams/tonne silver (2,621 oz/ton Ag).

Recent news details a drill result of high grade Silver up to 6,188.43 g/t.

Drilling Highlights:

- Big Silver intercept grading 6,188.43 grams per tonne (g/t) silver and 0.35% cobalt over 0.50m in hole CS-21-47 located 16m downdip from Big Silver’s discovery hole CS-20-39 that graded 89,853.00 g/t silver (See press release January 29, 2021).

- A second Big Silver intercept grading 2,509.41 g/t silver and 0.10% cobalt over 0.50m in hole CS-21-73, that is located an additional 20m downdip from the intercept in CS-21-47 noted above.

Matt Halliday, President and Chief Operating Officer, commented: “Big Silver is living up to its name with the latest intercept of 6,188 g/t silver which has a gold equivalent of 74.67 g/t. We are especially encouraged by the 36m of total downdip extension; this type of continued expansion will be very important for our next resource update. In addition, we can’t wait to explore these structures further from underground after a ramp is constructed.”

Now this is a chart set up I would take all the time. A long downtrend with signs of bottoming at support. We then got a breakout and a retest which saw buyers jump in. All that is required to confirm the higher low at $0.20 is the break of recent highs above $0.24. Study this chart as this pattern keeps repeating on all types of assets. It is my bread and butter. As long as $0.20 holds, we remain bullish. A move to $0.30 and higher is on the cards.

Silver Grail Resources (SVG.V)

Silver Grail Resources (SVG.V) is an exploration stage company, engaged in the acquisition and exploration of mineral properties primarily in the Stewart region of British Columbia, Canada. The company explores for cobalt, silver, gold, copper, zinc, and molybdenum minerals.

This is an early stage company, but with an investment from Eric Sprott, and a market cap of just over $5.5 Million, it could be a sleeping giant. All it takes is one good drill result or headline to get this going.

The liquidity is not as great as the other companies mentioned in this article, so be careful. There seems to be a wedge pattern here, but in order to get that breakout with momentum, we would like to see a break with large volume. Once again, all it would take is a good headline or drill result.

Endeavour Silver Corp (EDR.TO)

Endeavour Silver Corp is a mid-tier precious metals mining company, engaging in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mining properties in Mexico and Chile. The company has interests in three producing silver-gold mines in Mexico. It also has exploration and development projects comprising the Terronera property in Jalisco; and the Parral properties in Chihuahua in Mexico.

Recently, Endeavour put out 2022 guidance. Here are the details:

In 2022, silver production is expected to range from 4.2 to 4.8 million ounces (oz) and gold production is anticipated to be between 31,000 oz and 35,000 oz. Silver equivalent production is forecasted to total between 6.7 million and 7.6 million oz at an 80:1 silver:gold ratio.

Consolidated cash costs2 and all-in sustaining costs2 (“AISC”) in 2022 are estimated to be $9.00-$10.00 per oz silver and $20.00-21.00 per oz silver, respectively, net of gold by-product credits. The Company’s 2022 cost outlook is higher than the prior year as inflation, royalties and mining duties are expected to increase in 2022.

A huge support zone is being tested for the fourth time in four months. Ideally, we wanted to see a bounce akin to the pop in October 2020. Instead, the last two support tests have taken the price above $5.50, but with no momentum being sustained. On Monday, we had a nice wick candle indicating buyers. Yesterday we then printed a nice engulfing candle. Positive signs especially at support.

Ideally, we want to see $6.00 taken out for the actual breakout, but buying at this support, especially if Silver is poised to make a higher low run, provides a great risk vs reward opportunity. We just don’t want the breakdown. a close below this support nullifies the set up.

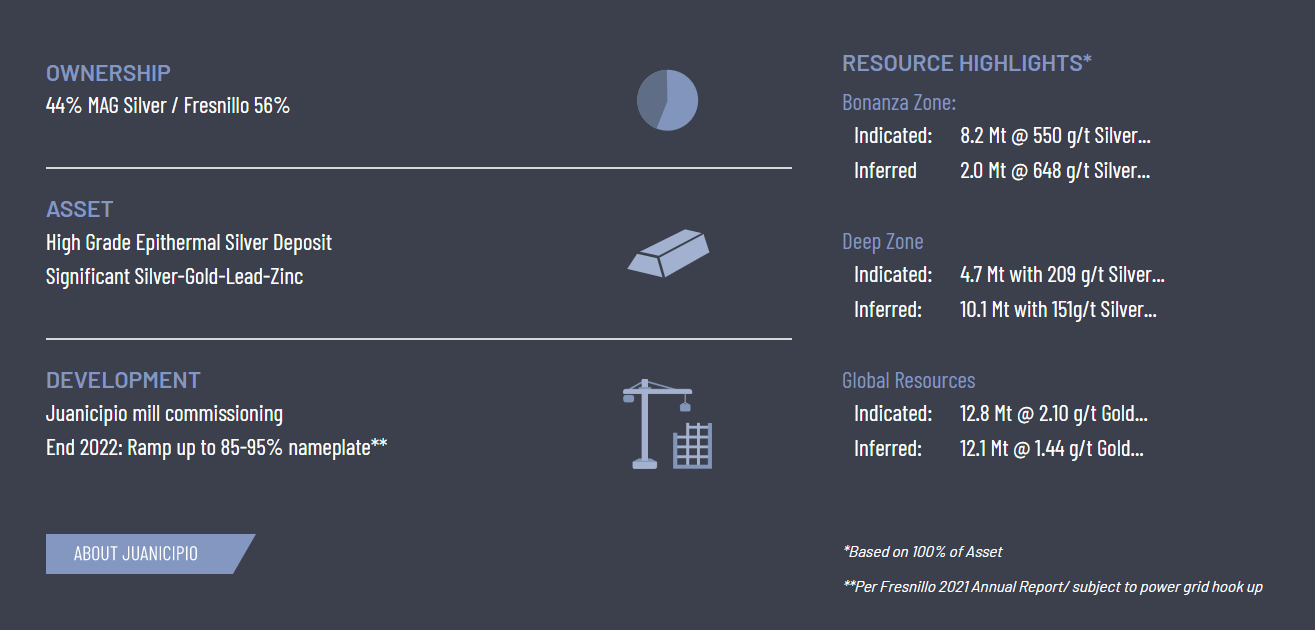

MAG Silver (MAG.TO)

MAG Silver (MAG.TO) is a company that has had Silver bulls excited for sometime. This is one of the highest grade and largest primary Silver assets in the world. I highlight primary because Silver tends to be found as a by-product. This is the largest primary silver miner coming into production in many years. Decades if I have my math right.

2022 is setting up to be a big year for MAG Silver with the mill commissioning and production ramp up.

By the way, you might be asking, “who are Fresnillo?”

Fresnillo plc is the world’s largest primary silver producer and Mexico’s largest gold producer, listed on the London and Mexican Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico – Fresnillo, Saucito, Ciénega (including the San Ramón satellite mine, Las Casas Rosario & Cluster Cebollitas), Herradura, Soledad-Dipolos1, Noche Buena and San Julián (Veins and Disseminated Ore Body), three development projects – the Pyrites Plant at Fresnillo, the optimisation of the beneficiation plant also at Fresnillo and Juanicipio, and three advanced exploration projects – Rodeo, Orisyvo and Guanajuato, as well as a number of other long term exploration prospects.

Quite similar structure to that of Endeavour Mining. $18.00 is a huge support zone holding since Fall of 2020. We have tested it multiple times in the past couple of months. We need to see bids here. A breakdown wouldn’t be great, but hey, I would be a buyer at lower prices.

I will be watching for support to hold. A break of $21.50 is what gets the stock going. As a company with high grade Silver and the one of the largest primary Silver miners coming online in years, I am a fan. Silver bulls will be hearing about this company and mine for many years to come.

In summary, Silver price is still supportive above our support. Expect major volatility today with the Federal Reserve. We want the close to remain above support. If we can get this post Fed, then the continuation of the Silver uptrend with another higher low, is in the cards.