The spot silver price has been soaring! At time of writing, the commodity is up over 7% in three days of trading, putting a nice smile on the faces of silver bulls. Gold and platinum are doing nicely as well. Platinum has a very similar technical breakout and pattern like silver.

Readers know I am a big fan of precious metals, and silver in particular. I acquire bullion. I don’t really think about the price. Silver, gold, and yes cryptocurrency as well, are my anti debt assets. This is how I am betting against the central banks. I really believe you must own some non fiat assets. Inflation is a monetary phenomenon, meaning your fiat currency is weakening hence it takes more of that weaker currency to buy goods and services. A lot of this comes down to a confidence crisis in central banks and governments. I have spoken about this many times.

Essentially, I think the chances of a confidence crisis keeps increasing. We might even be in it right now. All eyes on the Federal Reserve and raising interest rates. The $1,000,000 question is how many rate hikes are possible before breaking governments and consumers who have taken out more debt. The Fed and Fed Presidents keep talking about the tool kit, but many contrarians think there aren’t many tools left. Time will tell.

This week has been another volatile week in the stock markets. But I want to point out something very important: Silver has been acting like the true safe haven asset.

I am not joking. Earlier this week, we had Gold down and Bitcoin down all due to rising yields and a rising US Dollar. The silver price was a green in a sea of red, and keeps on going. Is it due to inflation? Or geopolitics (Russia-Ukraine fears)?

Rising yields tend to be negative for gold, which also impacts the silver price. The reason is these metals don’t provide a yield. However, metals are rising and holding up well with rising yields. Meaning investors may be pricing in higher inflation. Inflation so high, that the Fed’s small 25 basis point hikes will be insignificant.

Now let’s get to the silver chart!

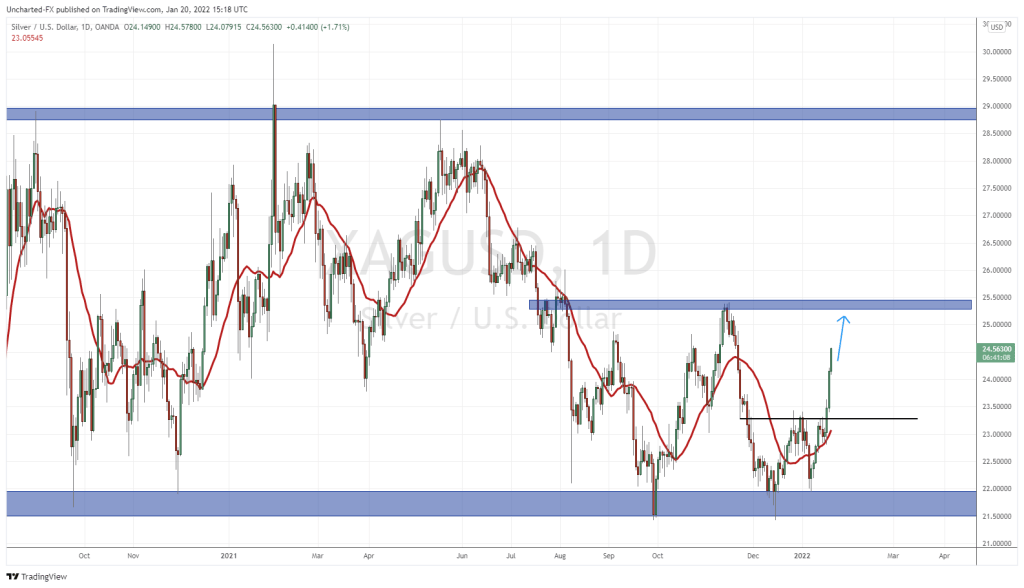

I want to start at the $21.50 zone. In a previous Market Moment, I notified readers about the silver price retesting a huge support zone. This $21.50 zone has been held four times in the recent year…make it five now. We actually played the large wick and breakout back in mid December 2021. We then played the retest on January 7th 2022.

Recently, my bullish stance has just increased as we have a breakout confirmation. The silver price has broken above $23.30. This has confirmed a double bottom pattern, but others say it looks like a cup and handle. In a book titled “Naked Forex”, the author points out a pattern that looks like a double bottom, but the second bottom test is higher than the first. Something like what we see on the silver chart. I just call it a higher low double bottom. To make a long story short, the author states this type of double bottom reversal is the most bullish.

The breakout definitely sustained momentum, and now we have two ways to trade the silver paper contracts. Once again, I prefer buying the physical commodity, but we can trade the paper contracts for gains. For new traders, just understand that silver is very volatile.

According to market structure, a new uptrend has begun. As long as we remain above $23.30, multiple higher lows should be expected. My first resistance zone comes in just above $25. Let’s call it the $25.50 zone. From here, prices could pullback, presenting us all with another entry opportunity. If we break above this price zone then we will be looking at $28 and higher.

Alternatively, we can make a higher low before we test the $25.50 zone. With three large green candles in a row, I wouldn’t be too quick to pick up contracts as of now. Ideally, I would want to enter on some sort of pullback. As with all breakout triggers, we expect a pullback to retest the breakout zone. This would mean a move back to $23.30. The issue is though, the silver price is looking very bullish, that a pullback lower to $23.30 might not be possible. Buyers might enter the day after the first pullback candle, meaning we could form a higher low without testing the breakout zone.

Not trying to make things complicated, but the real entry was the breakout we had above $23.30. Any entry now would be chasing so I recommend waiting for that pullback. For my silver bulls: keep stacking that physical, and we can trade the paper contracts and miners for nice gains. With the silver price breakout, there are tons of good looking silver stocks confirming patterns out there as well.