Love Is in the Air

Among the list of universal turn-offs, apparently, climate denial ranks pretty high. Probably right next to flat earthers. According to a survey conducted by OKCupid of six million users, a total of 81% said they were concerned about climate change.

To put things into perspective, this ranks higher than the 76% of 650,000 users who were concerned about gender equality in 2021. Climate change also ranks higher than the 66% of 2 million users in the United States (US) worried about gun control.

If that wasn’t enough, OKCupid claims that there was a more than 450% increase in people mentioning climate change and the environment on their profiles in April 2021 compared to the preceding four years. Even better, people who expressed concern about climate change received 37% more likes and 11% more matches.

It’s easy to pretend that you like to go on hikes to impress your date. Don’t act like you haven’t. However, pretending to be an environmentalist when you’re a climate denier sounds challenging, especially when 90% of 250,000 global users in 2021 said it was important that their date cares about climate change.

Looking back, even I used an “environmentalism” tag on my Tinder profile, and now I am dating an environmental scientist. Who would have thought? However, a dating app like OKCupid can be defined as “progressive” since it tends to have users who are more open-minded and concerned about issues like climate change.

This is just a hunch, but when it comes to progressive issues, I would imagine a dating app like Christian Mingle paints a very different picture. I mean, it took a non-discrimination lawsuit for the website to begin accommodating gay men and women. Anyways, let’s talk about some plant-based companies that may be worth adding to your dating profile!

Odd Burger Corporation

- $48.047M Market Capitalization

Odd Burger Corporation (ODD.V), originally called Globally Local, was founded in 2014 by James McInnes. The Company started as a grassroots vegan organization, bringing organic fruit and vegetables from local farmers to the doorsteps of its customers. Odd Burger is now a chain of company-owned and franchised vegan fast-food restaurants.

Furthermore, Odd Burger is a food technology company manufacturing and distributing its proprietary line of plant-based protein and dairy alternatives under the brand Preposterous Foods, located in London, Ontario. Here, Preposterous Foods creates plant-based products including burgers, chickUn fillets, sausage, and dairy-free sauces, which are then distributed to Odd Burger’s various restaurant locations.

The Company is on a mission to disrupt the fast-food industry by offering plant-based, minimally processed, and sustainable ingredients. Through various marketing strategies, professional signage, menu boards, and branded packaging, Odd Burger is confident in its ability to expand its brand presence. Furthermore, the Company utilizes state-of-the-art cooking technology and automation solutions to deliver sustainable fast food. Think McDonald’s, but without diabetes.

Latest News

On March 16, 2022, Odd Burger announced that it will open 36 new locations in the province of Alberta (AB) and British Columbia (BC). In terms of specifics, the Company has signed an area representative agreement with Sai-Ganesh Enterprises (SGE), a family-owned hospitality group specializing in franchising and commercial construction.

“One challenge in franchising is providing an ideal level of support and service to locations that are distant to our corporate headquarters, but partnering with Utsang and the SGE team of local experts has eliminated that concern entirely,” said James McInnes, Odd Burger co-founder and CEO.

To provide some background, SGE owns master franchisor rights for major brands like BarBurrito in Saskatchewan and area developer rights for Meltwich in the provinces of BC, Manitoba, and the Atlantic Provinces. SGE also holds an advisory role in the expansion of Fast Fired Pizza, a fast-casual pizza franchise, into Western Canada.

According to the agreement, this will bring three dozen Odd Burger locations to the western provinces over the next seven years. SGE will be responsible for overseeing franchise sales to individual owners, store construction, and support for franchise locations in its territory. Additionally, SGE plans on launching a corporate restaurant location in Western Canada, which will be used for training new franchisees.

Keep in mind, Odd Burger’s western expansion is already well underway. In fact, the Company recently announced franchise agreements in Calgary, AB, and Victoria, BC. These two new locations are in the site selection stage and will now be supported by SGE.

In addition to its western expansion, Odd Burger has established multiple locations throughout Ontario, including stores in Toronto, London, Windsor, Vaughan, Waterloo, and Hamilton. It is worth noting that store locations in Brampton and Whitby, and Ottawa, Ontario are also underway. Since I will be in London this weekend, maybe I will finally give Odd Burger a try!

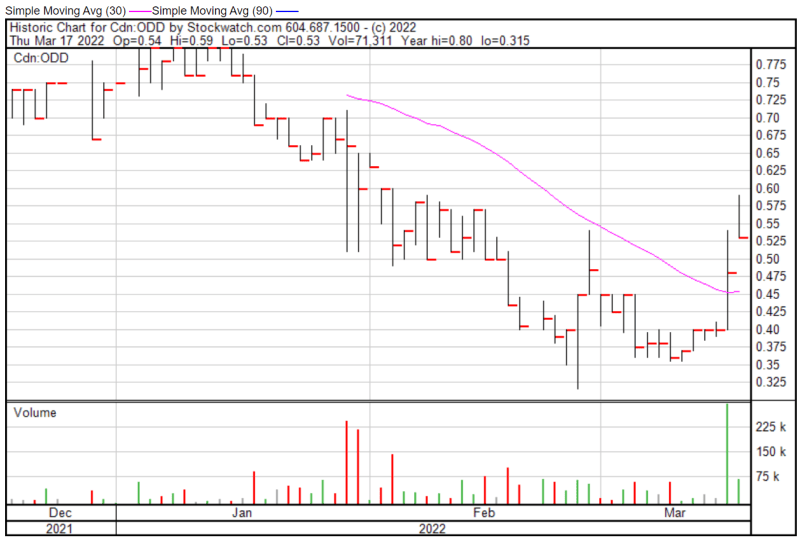

Odd Burger’s share price opened at $0.54 on March 17, 2022, up from a previous close of $0.48. The Company’s shares were up 3.12% and were trading at $0.495 as of 11:35 AM EST.

SunOpta Inc.

- $676.57M Market Capitalization

SunOpta Inc. (SOY.T) is a company specializing in the sourcing, processing, and production of organic, natural, sustainable, and non-GMO plant-based food and beverage products. The Company is guided by six core values, including speed, entrepreneurship, customer-centricity, passion, dedication, and problem-solving.

Ranging from oat beverage concentrate to fruit-based yogurt toppings, SunOpta offers a wide range of ingredient solutions. The Company is composed of Research and Development (R&D) leaders with industry experience working for national consumer packaged goods (CPG) companies. Furthermore, SunOpta is supported by its more than 1,400 employees throughout three countries.

What really sets SunOpta apart in the highly competitive plant-based market is its commitment to sustainability. To date, the Company has saved over 6.7 billion gallons of water since January 1, 2022. This amounts to roughly 3.7 million gallons of water saved per hour and 62,362 gallons of water saved per minute.

Latest News

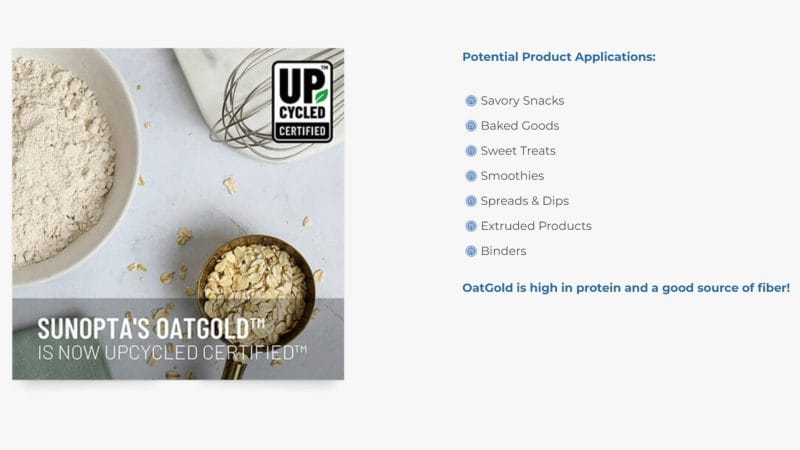

On March 3, 2022, SunOpta introduced OatGold™, a nutrient-rich oat protein powder for use in baked goods, snacks, dips, and spreads. More importantly, OatGold is now Upcycled Certified™. For context, Upcycled Certified refers to the world’s only third-party certification program for upcycled food ingredients and products. With this in mind, OatGold has met the rigorous standards of the Upcycled Food Association, a nonprofit focused on preventing food waste by accelerating the upcycled economy.

“We divert insoluble solids from the oatbase manufacturing process to create a reimagined ingredient that is nutrient-dense and delicious,” said Lauren McNamara, Vice President and Assistant General Manager, SunOpta.

OatGold is an entirely upcycled smooth powder ingredient made using insoluble solids from SunOpta’s proprietary enzymatic extractions process used to produce oatbase, the primary ingredient for oat milk. Impressively, OatGold contains three times the amount of protein of oat flour and is rich in fiber.

In addition to being Upcycled Certified, OatGold has a neutral taste, is ready-to-eat (RTE), vegan, non-GMO, kosher, and certified gluten-free. OatGold is also allergen-friendly and does not contain any of the US major food allergens.

Looking forward, SunOpta intends to double its plant-based business in less than five years with the support of its plant-based production facilities. Thus far, the Company’s oat-related production has grown 100% in the last year. By 2022, SunOpta hopes to expand its oatbase production by an additional 50%.

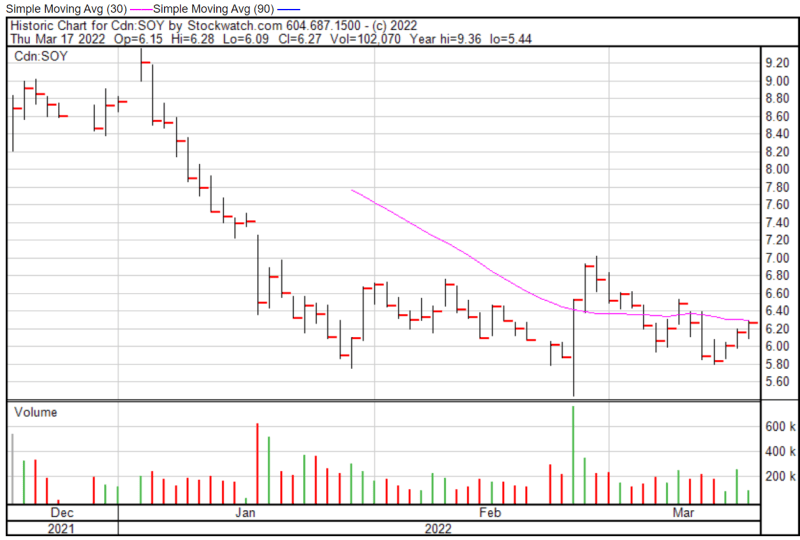

SunOpta’s share price opened at $6.15 on March 17, 2022, down from a previous close of $6.16. The Company’s shares were up 2.27% and were trading at $6.30 as of 1:27 PM EST.

Nepra Foods Inc.

- $16.931M Market Capitalization

Nepra Foods Inc. (NPRA.C) is a multi-category market leader in allergen-free and plant-based food ingredients and consumer products. The Company is credited for assisting several national brands to take products from concept to market with Nepra’s ingredients and plant-based expertise. In addition to selling its proprietary ingredients to other food producers, Nepra also manufactures its own plant-based foods for consumers.

The Company’s products are high in protein and fiber, low in carbohydrates, and are packed with nutrients. Some of Nepra’s products include tortilla chips, pretzels, and dips as well as plant-based alternatives for meat, eggs, and dairy. Nepra has established a business-to-business (B2B) portfolio with food producers across North America. Additionally, the Company recently established consumer distribution via direct-to-consumer (D2C) and traditional retailers.

Latest News

On March 17, 2022, Nepra announced a private label sampling of salad dressing made from the Company’s proprietary cold-pressed virgin hemp oil. The anticipated volume agreement is estimated to generate initial orders of up to 20,000 gallons of dressing per month to be sold in large retail chains across the US.

“Our new line of chef-developed salad dressings are formulated for consumers who want to add healthy fats and omegas to their plant-based diets but have limited non-GMO options available on grocery store shelves,” said David Wood, Co-Founder and CEO of Nepra Foods.

Nepra produces its refined hemp oil using a cold process to preserve natural omegas. In doing so, the Company’s virgin hemp oil is well-balanced for blending into a variety of clean label dressings, including Creamy Italian, Balsamic Vinaigrette, Citrus Thai, and Creamy Caesar.

Personally, I am not the biggest fan of salads or greens in general. However, the Global Salad Dressings and Mayonnaise Market is expected to reach $23.8 billion by 2026, demonstrating that my opinion doesn’t mean diddly. With this in mind, Nepra’s entry into the global salad dressing and mayonnaise market represents part of the Company’s vertical integration strategy, which will enable Nepra to better control its global supply chain and cost of goods.

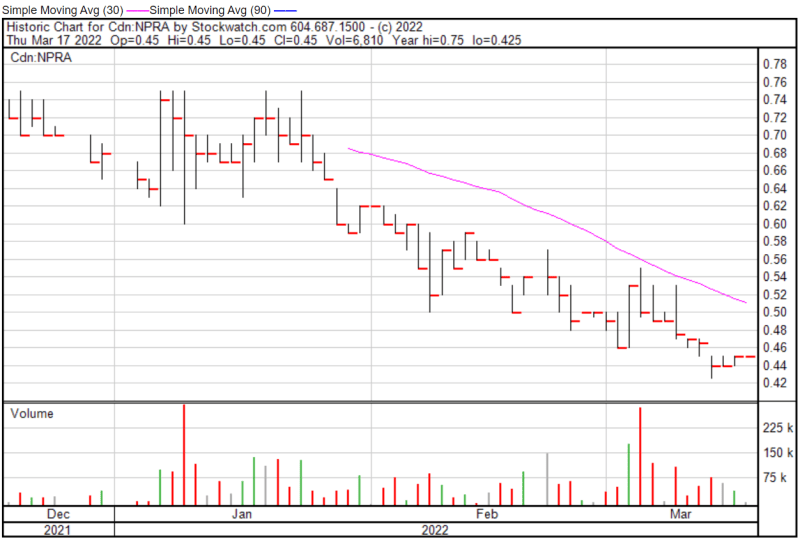

Nepra’s share price opened at $0.45 on March 17, 2022, compared to a previous close of $0.45. The Company’s shares were trading at $0.45 as of 11:33 AM EST.

Vejii Holdings Ltd.

- $5.72M Market Capitalization

Vejii Holdings Ltd. (VEJI.C) is a unified marketplace and fulfillment platform featuring more than 3,500 plant-based and sustainable living products and over 500 brands. The Company’s platform offers an easy-to-use, omnichannel experience for both buyers and vendors, leveraging big data and Artificial Intelligence (AI). In doing so, Vejii is able to connect brands with targeted consumer bases through organic and specialized marketing programs.

To be more specific, Vejii runs a brand and product agnostic marketplace that allows the Company to onboard vendors at a rapid rate. This allows Vejii to expand into new and growing product categories. The Company’s current product categories include grocery, nutrition, vitamins, supplements, personal care, baby & kids, and vegan wine. However, the Company intends to add home & garden, sustainable fashion, sustainable furniture, and sports & recreation products to its offering in the future.

Latest News

On March 16, 2022, Vejii announced that it has received approval from the Depository Trust Company (DTC) to make the Company’s common shares eligible to be electronically cleared and settled, also referred to as DTC eligibility. The Company’s common shares will continue to trade in the US under the ticker VEJIF on the OTCQB Venture Market.

“Our DTC Eligibility marks another step towards increasing market awareness for Vejii. We are working diligently to showcase the Company as a compelling, and innovative digital platform at the forefront of our industry. We believe that having DTC eligibility will make trading of the Company’s common shares more accessible to the US investment community”, commented Kory Zelickson, Director, and CEO of Vejii.

Having now received DTC eligibility, Vejii’s common shares can be distributed, settled, and serviced through the DTC’s automated process. In doing so, this will simplify the process of trading the Company’s common shares while also enhancing the liquidity of Vejii’s common shares in the US.

Additionally, on March 15, 2022, Vejii announced that it has signed a consignment and fulfillment services agreement with Unreal Deli Inc., the world’s only premium plant-based deli meat. According to the terms of the agreement, Unreal Deli will provide inventory into Vejii Fulfillment Services (VFS) for sale on Vejii Express, and through its own direct-to-consumer (D2C) consumer channel.

Just prior to this, Vejii announced on March 11, 2022, that subject to the approval of the Canadian Securities Exchange (CSE), it intends to consolidate its issued share capital on the basis of one new common share without par value for every four existing common shares without par value. If you’d like to know more about Vejii’s latest agreement with Unreal Deli as well as the Company’s proposed share consolidation, check out this article!

As of March 16, 2022, Vejii’s shares were trading at $0.05 at closing.

Full Disclosure: Vejii Holdings Ltd. (VEJI.C) is a marketing client of Equity Guru.