In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

SunOpta Inc (SOY.TO)

Market Cap ~ $555 million

SunOpta Inc. engages in manufacture and sale of plant-based and fruit-based food and beverage products to retailers, foodservice operators, branded food companies, and food manufacturers in the United States, Canada, and internationally. The company operates through Plant-Based Foods and Beverages, and Fruit-Based Foods and Beverages segments.

The stock is up 22.8% on news that SunOpta announced the sale of certain frozen fruit assets to Nature’s Touch, a company based in Quebec, Canada. The transaction is valued at $141 million and represents the Company’s exit from the frozen fruit business.

A strong gap up pop on this news and the stock did test the $5.00 resistance zone. A strong daily close today over the downtrend line could initiate a reversal and new uptrend.

Silver X Mining (AGX.V)

Market Cap ~ $38 million

Silver X Mining Corp. engages in the exploration, acquisition, and development of mineral properties in the Americas. The company explores for silver, gold, lead, and zinc. It primarily holds interest in the Nueva Recuperada project located in Huancavelica, Peru.

The stock is currently up 7.9% on no news. Around three weeks ago, the Company announced it would resume operations of its mining operations at the Nueva Recuperada Project.

The stock is currently in a range and investors are waiting for the break. A range is a stronger signal after a dominant trend as it shows exhaustion of the trend. In this case, the range developed after a downtrend indicating the selling pressure may be exhausted.

Marvel Discovery (MARV.V)

Market Cap ~ $7.5 million

Marvel Discovery Corp. engages in the acquisition, exploration, and development of mineral properties in Canada.

The stock is up 20% today on news the Company has entered into an agreement to acquire the Costigan Lake Uranium project, which covers 5,518ha located on the eastern side of the Athabasca Basin. The acquisition enhances Marvel’s land portfolio of uranium holdings at Key Lake, which is adjacent to Cameco, F3 Uranium, Skyharbour, and Abasca Resources.

The stock is testing key resistance at $0.07. What makes the recent technicals interesting is Marvel Discovery printed a double bottom pattern which triggered earlier this month. This pattern is traded as a reversal pattern.

Tenet Fintech Group (PKK.C)

Market Cap ~ $31 million

Tenet Fintech Group Inc., through its subsidiaries, provides various analytics and AI-based services to small-and-medium businesses and financial institutions. It offers Business Hub, a global ecosystem where analytics and AI are used to create opportunities and facilitate B2B transactions among its members.

The stock is up 19.6% on no news. However, yesterday the Company announced it had signed a strategic alliance agreement with the Canadian Chamber of Commerce’s (“CCC”) SME Institute as a provider of value added products and services that SMEs can use to grow their businesses.

One for reversal traders to keep on their watchlists. The stock is showing signs of bottoming and even a dirty looking cup and handle reversal pattern. A close above $0.35 triggers the pattern.

Gamelancer Media Corp (VRTS.TO)

Market Cap ~ $22 million

Gamelancer Media Corp. a development stage technology and entertainment company. The company provides direct advertising services to brands through its social media channels, as well as focuses on acquiring assets on esports loyalty and rewards programs to unite the global gaming community.

The stock is up 14.3% on no news. Yesterday the Company announced a strategic partnership with Just Media Group that encompasses a wide range of production and distribution services, with a primary focus on the flagship Mean Girls Podcast.

The stock printed all time record lows at $0.035 and the stock is currently attempting to base and find buyers here. Watch for some sort of consolidation to provide further evidence that a reversal is in the cards.

Top 5 Losers

Cardiol Therapeutics (CRDL.TO)

Market Cap ~ $77 million

Cardiol Therapeutics Inc., a clinical-stage life sciences company, focuses on the research and development of anti-fibrotic and anti-inflammatory therapies for the treatment of cardiovascular disease (CVD).

The stock is down 9.1% on no news. However two days ago the Company announced highly promising study results from international research, which showcased the remarkable potential of subcutaneously administered cannabidiol, the active pharmaceutical ingredient found in Cardiol’s groundbreaking CRD-38 subcutaneous formulation.

Clean technicals on this chart. The stock is ranging in a flag pattern. With today’s rejection coming at the upper portion of the trendline. Now we await a break.

Lithium Americas Corp (LAC.TO)

Market Cap ~ $1.89 billion

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada.

The stock is down 10.1% on no news.

The stock is breaking below recent support and many traders on message boards are calling for a bottom soon. $11.00 could be a support zone but when I zoom out on the chart, $10.00 is a stronger zone for support.

Methanex Corp (MX.TO)

Market Cap ~ $3.7 billion

Methanex Corporation produces and supplies methanol in North America, the Asia Pacific, Europe, and South America. The company also purchases methanol produced by others under methanol offtake contracts and on the spot market.

The stock is down 8.7% on news that it has signed a two-year natural gas agreement with the National Gas Company of Trinidad and Tobago (NGC) for its currently idled, wholly owned, Titan methanol plant (“Titan”) (875,000 tonnes per year capacity) to restart operations in September 2024. Simultaneously, the Company announced its intention to idle the Atlas methanol plant (“Atlas”) (Methanex interest 63.1% or 1,085,000 tonnes per year capacity) in September 2024, when its legacy 20-year natural gas agreement expires.

The stock is at a key support zone. If the daily candle closes below $55, we would have a breakdown and the stock could see itself heading down to the $52 zone.

GoviEx Uranium (GXU.V)

Market Cap ~ $109 million

GoviEx Uranium Inc., a mineral resources company, engages in the acquisition, exploration, and development of uranium properties in Africa. The company’s principal asset is the Madaouela project which holds 80% interest located in north-central Niger.

The stock is down 6.3% on no news. Two days ago, GoviEx announced the publication of its 2023 sustainability report covering the 12 months to June 30th 2023.

The stock attempted to fill the gap with a close over $0.20. This did not occur. The stock is now dropping and is testing some key levels of support. Judging by the previous daily candles with large wicks, there tends to be buyers here.

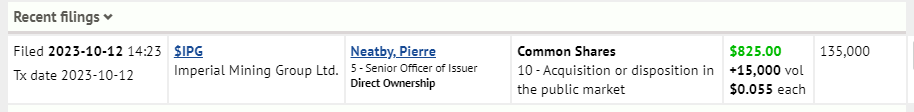

Imperial Mining Group (IPG.V)

Market Cap ~ $10 million

Imperial Mining Group Ltd. operates as a mineral exploration company in Canada. The company primarily explores for copper-zinc, gold, scandium-niobium-tantalum, and silver deposits.

The stock is down 9.1% on no news. However, there is a SEDI filing for insider buying:

Key support anyone? The stock is testing a major zone here and traders should watch to see if buyers begin to step in here. This could lead to a nice strong bounce higher. If we close below, then the breakdown would take us to previous record lows around $0.03.