Commodities are taking off. As my readers know, I prefer this asset class as my inflation trade. This morning, we heard that inflation in the US came in at 40 year highs. Annual inflation is up 7.5%, the biggest gain since February 1982 and exceeding analyst expectations. But don’t worry, this inflation is transitory (temporary) right?

Something not getting too much attention are the agricultural commodities. Supply chain disruptions are quoted as the culprit for rising prices, but I think the agricultural commodity space fits in with hard asset commodities. I might be wrong, but all I know is that it is very likely both commodities and agricultural commodities will be heading higher. My job as a trader and investor is to position myself correctly.

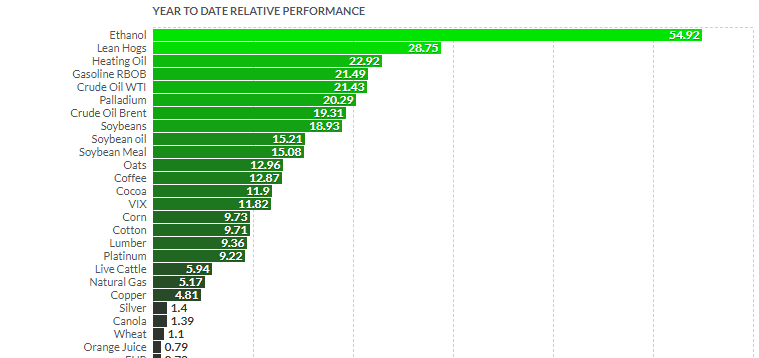

Agricultural commodities have been going crazy. Big pops in Orange juice, Cocoa, Cotton, Coffee, Lean Hogs, Oats and Corn to name a few. In this Agriculture roundup, I want to focus on Soybeans.

Soybeans of course are a popular staple in Asia. I remember on a trading floor chatting with some friends from China who told me soy (at that time) was cheaper than even rice, making it popular for the poor. Soybeans are getting popular here too as it is the basis for a lot of plant based beyond products. Although, I am now seeing a lot of non-soy options. There are people with soy allergies, and I am not sure if this is true, but I have heard soy raises estrogen levels…hence the term soy boy used to describe weak men.

Soybeans is all about China and their insatiable demand. When President Trump was in office, the moves we saw in soybeans were crazy. Great fun for someone like me who trades soybean CFDs. Soybeans moved on Trade war headlines as China promised to increase their purchases of US agriculture. Mainly soybeans. Although that is beginning to change as China looks to South American nations for soybeans, particularly Brazil. The United States dominates the Soybean market, composing 50% of the total global production. Brazil comes in second at around 20%. You can say Brazil will be the real winner in the trade war.

The Chinese definitely seem to be stockpiling soybeans and other commodities. Year to date (so from Jan.1st 2022 to Feb. 10th 2022) soybeans are up 18.93%. Soybean oil and soybean meal come in around 15%.

Soybean Oil is a vegetable oil and is one of the most used culinary oil in the world. Soybean Oil is also popular as a biodiesel. Believe it or not, but there are cars that have engines which can convert from regular diesel to Soybean Oil during production. They are known as ‘frybrids’.

Whatever is left from the extraction of Soybeans into Soybean Oil can be converted into Soybean Meal. This is used for high-protein, high-energy food for feedstock for cattle, hogs, and poultry.

So how can we play the soybeans move? Well if you want to be broadly exposed to the agricultural commodities, then I suggest playing the fertilizer companies and major producers and distributors. Some are listed here, but they regularly show up in my weekly Agriculture roundups. They will rise with rising agricultural commodity prices.

For those looking for specific investments in soy, well you came to the right place.

First off, one can trade options and CFDs. The futures ticker for soybeans is ZS.

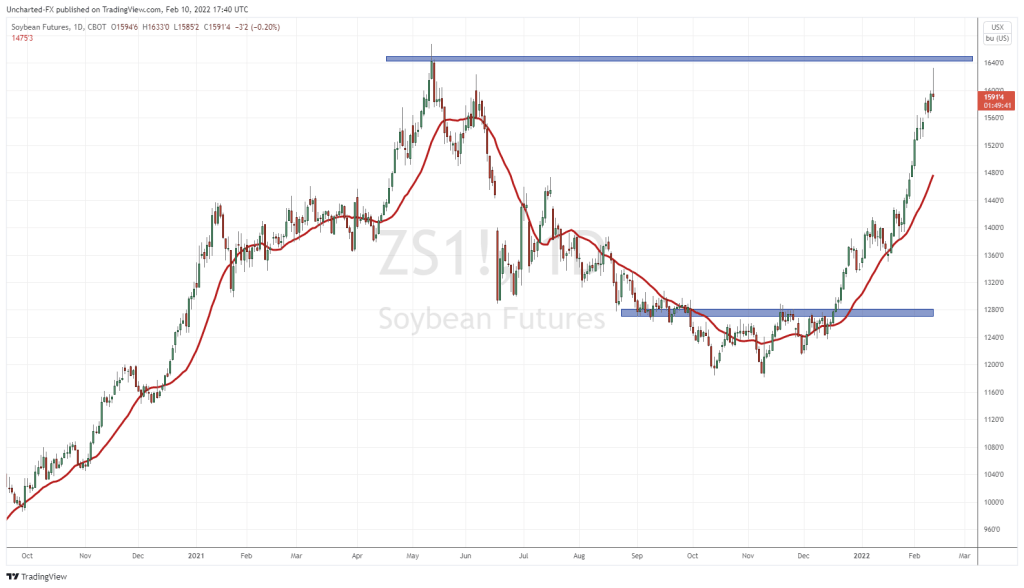

Some of my longtime readers may remember me going bullish soybeans when we broke out of the reversal pattern in mid December 2021. What a rally ever since, and we now are testing a major resistance zone. From a market structure perspective, we remain bullish above 1400, as that is the higher low we are working with. Another higher low can be confirmed with a pullback and then a breakout above 1640. With inflationary pressures, I think there’s a very good chance this happens.

If you are Canadian, you can trade futures via CFDs as I do. They are volatile, but one can make a very good amount of money with very little margin. This option isn’t for everyone.

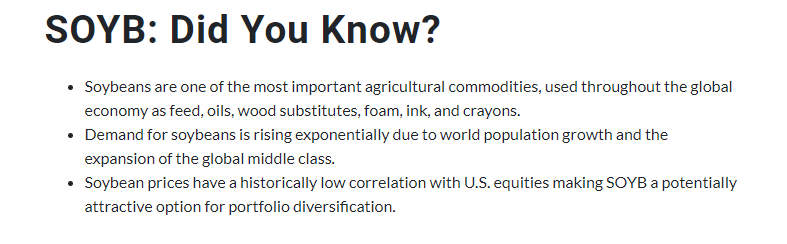

ETFs are becoming increasingly popular, and there is one for soybeans. The Teucrium Soybean Fund (SOYB) provides investors an easy way to gain exposure to the price of soybeans futures. Simple as it gets.

If ETFs and futures/CFDs aren’t your thing, then here are a few companies with soybeans exposure. I even have a couple of companies listed on foreign companies for those that are interested.

Burcon Nutrascience (BU.TO)

Burcon Nutrascience is a global technology leader in the development of plant-based proteins for foods and beverages. With over two decades of experience formulating high-purity proteins that have superior functionality, taste and nutrition, Burcon has amassed an extensive patent portfolio covering its novel plant-based proteins derived from pea, canola, soy, hemp, sunflower seed, among other plant sources.

One of the companies products is CLARISOY, a soy protein for use in sports nutrition beverages, dairy alternative yogurts and cheeses, powdered beverage mixes, coffee creamers, and other foods and nutritional products.

The chart set up is meeting my market structure criteria. After a long downtrend, the stock is looking ready for a reversal. We are currently testing a resistance zone, and a breakout gets the stock going. The catalyst could be earnings due out next week. Volume has risen the past two days on green days. Perhaps some frontrunning before earnings, and maybe for good reason. As I said, the chart is looking prime for a trend reversal.

SunOpta (SOY.TO)

Maybe the stock that draws a lot of soybean bulls due to its ticker, SOY.

SunOpta Inc. manufactures and sells plant-based and fruit-based food and beverage products to retail customers, foodservice distributors, branded food companies, and food manufacturers worldwide. The company operates through two segments, Plant-Based Foods and Beverages, and Fruit-Based Foods and Beverages.

The Plant-Based Foods and Beverages segment provides plant-based beverages, and liquid and dry ingredients that utilizes almond, soy, coconut, oat, hemp, and other bases, as well as broths, teas, and nutritional beverages. This segment also packages dry- and oil-roasted in-shell sunflower and sunflower kernels, as well as corn-, soy-, and legume-based roasted snacks; and processes and sells raw sunflower inshell and kernel for food and feed applications.

Two for two with good looking setups! SOY meeting market structure criteria! We also seem to have a mini cup and handle reversal formation too. I really like what I am seeing here. What I want to see for the breakout trigger is a daily candle close above $6.95-$7.00. We have some resistance at $7.50 too. However, the break above $7.00 would take out the current lower high meaning there is a good chance that a new uptrend is beginning. Earnings are due in the first week of March 2022, so keep that in mind.

Archer-Daniels-Midland Company (ADM)

Now for a big boy. Archer Daniels is a global leader in human and animal nutrition and the world’s premier agricultural origination and processing company. The company operates through three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition.

The stock is printing new all time record highs ever since beating out on revenues near the end of January 2022. We now have a support retest zone at $72, and then a major support zone below around $67.

This is one of the stocks for the broad overall agriculture play. We have seen many agriculture stocks like ADM printing all time record highs. As food inflation increases, the stocks will continue to break records.

Bunge Limited (BG)

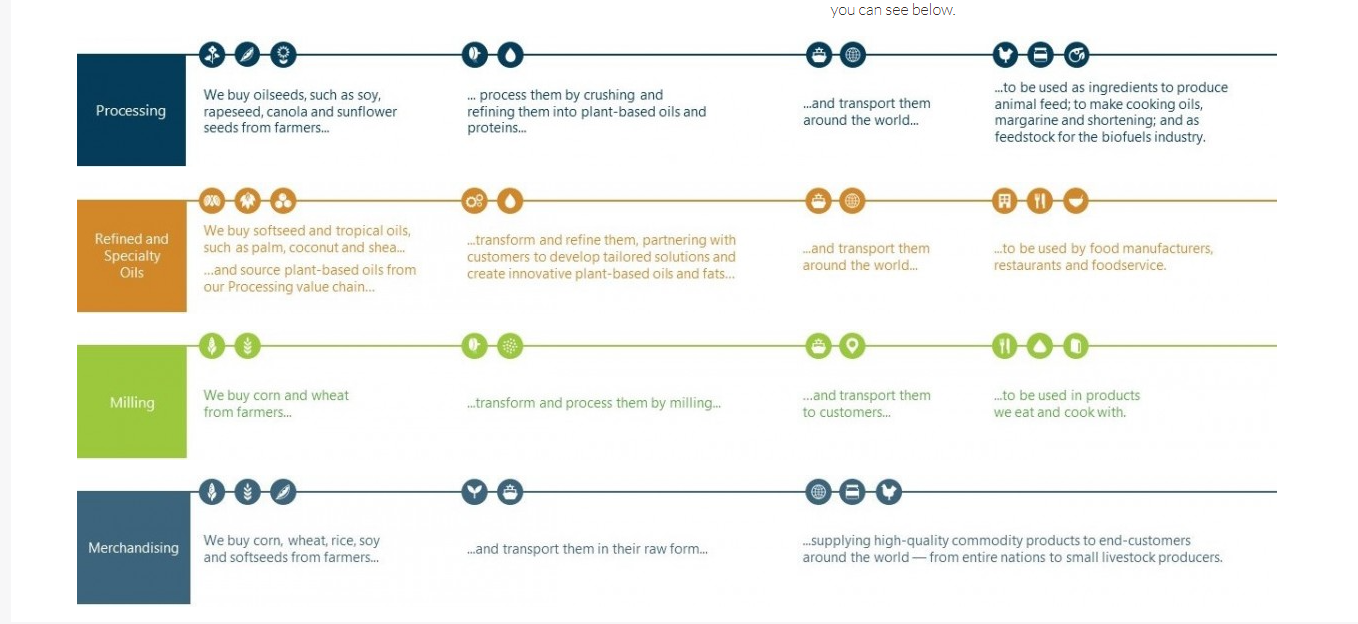

Bunge Limited operates as an agribusiness and food company worldwide. It operates through five segments: Agribusiness, Edible Oil Products, Milling Products, Fertilizer, and Sugar and Bioenergy.

The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains primarily wheat and corn; and vegetable oils and protein meals.

The Milling Products segment offers wheat flours and bakery mixes; corn milling products that include dry-milled corn meals and flours, wet-milled masa and flours, and flaking and brewer’s grits, as well as soy-fortified corn meal, corn-soy blends, and other products; and whole grain and fiber ingredients.

Bunge recently crushed it on earnings. A stronger-than-expected 17.1% jump in adjusted quarterly profit on Wednesday as large oilseed crops in North America and Europe and strong demand for processed meal and oil bolstered its core agribusiness unit.

The company posted adjusted net income of $533 million, or $3.49 per share, in the quarter ended Dec. 31, compared with $455 million or $3.05 per share, a year earlier.

That topped a consensus analyst estimate of $2.87 per share, Refinitiv Eikon data showed.

Revenue totaled $16.683 billion, up from $12.61 billion a year earlier and above an analyst estimate of $15.167 billion.

On the soy front, recent news details the owners of two strategic soy crushing plant in Southern Brazil appealing for a probe into a signed supply deal between Bunge and brewer Cervejaria Petropolis which is leasing the facilities. Bunge previously tried to buy the plants but the deal fell through. The assets are coveted because they produce high value soy byproducts for export using non-genetically modified grains.

I am really digging agricultural plays in Brazil. I really do think the Chinese will begin to look to this country and other South American nations for agribusiness.

The stock broke above a major resistance zone, although we are not near previous record highs! The major support is at $92, and we have already retested it seeing a big group of buyers step in on January 31st 2022. Very strong price action, and another company that will benefit from the overall rise in agricultural commodities.

Now for some that want to play foreign stocks.

Bayer (BAYN.DE)

Bayer is a household name. A German multinational pharmaceutical and life sciences company and one of the largest pharmaceutical companies in the world. Bayer’s areas of business include pharmaceuticals; consumer healthcare products, agricultural chemicals, seeds and biotechnology products.

Bayer has a CropScience subsidiary, but the big one is the buyout of Monsanto. We all know about that company and its GMO’s. They are a large player in the genetically modified soybean seed market, and there is now a corporate battle to create gene edited soybean and other seeds. I think I am going to stick with the organic stuff, but Bayer is definitely a major player.

Looking at the long term chart (weekly) and I see some promising development. We are still under the important 200 day moving average (green line), but there is a basing pattern here, that requires a break and close above 58 Euros. As we get closer to this zone, the 200 day moving average will also converge to that zone. I am looking for a 200 day moving average crossover and a resistance break in the future.

China Foods Limited (0506.HK)

China Foods Limited, an investment holding company, manufactures, distributes, markets, and sells Coca-Cola series products in the People’s Republic of China. It offers sparkling drinks, juices, water, milk drinks, energy drinks, tea, coffee, functional nutrition drinks, and sports and plant-based protein drinks.

The company is also involved in the production, sale, and distribution of beverage bottles; wholesale and retail of prepackaged foods, and raw and auxiliary materials; provision of supply chain information consultation, management services, and others; and wholesale of packaged foods.

The company is traded on the Hong Kong markets.

The stock is ranging, and there seems to be a major resistance zone upcoming at $3.50. Not going to lie, if I had access to Hong Kong markets, this is a basing pattern that would interest me, but alas, all I can do is trade the Hang Seng index which by the way, is looking bullish too.