Week in Review (Week 7)

From a blazing 30°C earlier this summer to a crisp 13°C today, there’s no denying that it’s cooling down outside. I have already started to feel the effects of Canada’s encroaching winter, my favorite season. Every morning, a chilling breeze gently caresses my ear telling me that there’s no harm in snoozing my alarm just one more time. Warm thoughts of hot chocolate, Christmas music, and a blazing fireplace fill my mind as I struggle to roll out of bed for my morning meeting. When I am finally roused to consciousness, I am instead greeted by the deafening shrieks of my neighbor’s dog, the low rumblings of the garbage truck, and the whirring of our blender as my brother makes his first protein shake of the day. So, why is winter my favorite season? Is it because of the tranquil silence that fills the air in the early mornings and late afternoons? No, it’s because I can stuff my face like the insatiable glutton that I am. If packing on a few extra pounds is the price to pay for Christmas dinner, I would happily pay double.

However, what if there was a way to indulge over the holidays while also watching my waistline? Well, your favorite plant-based shill is here to tell you that there is! Sort of. In this week’s sector roundup, we will be taking a look at four distinct plant-based companies, including Farmmi Inc. (FAMI.Q), Beyond Meat Inc. (BYND.Q), Burcon NutraScience Corporation (BU.T), and The Very Good Food Company Inc. (VERY.V), an old-time classic. Even if you’re not a flexitarian, vegan, or vegetarian, you have probably heard of Beyond Meat, an industry titan in the plant-based sector. In fact, my favorite plant-based burger to date is A&W’s Beyond Meat Burger. Ranging from plant-based protein manufacturing to mushroom-based agricultural products, this week’s roster of plant-based companies is sure to pique your interest. Let’s get into it!

Farmmi Inc.

- $136.33M Market Capitalization

Farmmi Inc. (FAMI.Q) is a leading Chinese-based agricultural e-commerce and technology enterprise managing an industry chain of Internet marketing for agriculture products. The Company is more widely recognized as an agricultural supplier, processor, and retailer of Shiitake Mushrooms, Mu’er (Wood Ear) Mushrooms, and other edible fungi and agricultural products. Since going public on the NASDAQ on February 16, 2018, the Company’s strategic objective has been to create a global trading platform for agricultural products with Chinese geographical indications. Farmmi has a variety of well-known brands under its belt including its Forasen-branded Shiitake Mushrooms and Farmmi, an internet sales platform, which has more than 50,000 members. In addition to selling its products domestically in supermarkets, restaurants, and dining halls, Farmmi also exports its products to the United States, Japan, Canada, Europe, Southeast Asia, and the Middle East.

So, what has Farmmi been up to lately? Recently, on September 29, 2021, the Company issued a CEO update letter detailing an expansion of Farmmi’s addressable market through an acquisition and its expectation for increased growth and expanded opportunity. In her letter, Ms. Yefang Zhang, Farmmi’s Chairwoman and CEO, announced three pivotal steps the Company will be taking in the future to create greater value for Farmmi and its shareholders. Some of these steps include the acquisition of Jiangxi Xiangbo Agriculture and Forestry Development Co. (“Xiangbo”), the Expansion of the Company’s health and wellness business, and the establishment of a community group purchasing distribution agreement.

Farmmi has made tremendous progress over the past 20 years, as we have built an industry-leading agricultural brand specializing in the production, processing, marketing, and research of edible fungi products. In addition to continuing the deep cultivation of edible fungi, we are constantly evaluating strategic options to optimize and expand our business,” commented Ms. Yefang.

Most relevant to Farmmi’s plant-based mushroom business, the Company’s establishment of a community group purchasing distribution network will further expand Farmmi’s presence in the distribution network of agricultural products. Announced on June 23, 2021, Farmmi entered into a strategic investment and cooperation agreement with Sigma Holding Co. and Hangzhou Xuyue Interactive Culture and Media Co., whereby the companies will jointly invest in the establishment of a new company as part of a 50-year agreement. In doing so, the new company will be committed to becoming a comprehensive service provider of community group purchasing distribution networks. For context, a group purchasing agreement, or GPO, is an entity that is formed to leverage the purchasing power of many businesses to obtain better pricing for its member businesses. In addition to strengthening the Company’s presence in the agricultural supply chain, this deal is expected to improve its profits as well.

Farmmi’s share price opened at $0.4527 on September 30, 2021, up from a previous close of $0.34. The Company’s shares were up 38% and were trading at $0.46 as of 2:03 PM ET.

Beyond Meat Inc.

- $6.646B Market Capitalization

Beyond Meat Inc. (BYND.Q) is an industry leader in plant-based protein, offering a beefy portfolio of products made from simple ingredients without GMOs, bioengineered ingredients, hormones, antibiotics, or cholesterol. Beyond Meat Inc. and Impossible Foods Inc. were pioneers of the plant-based sector, ushering in an era of sustainable, ethically sourced, delicious meat alternatives. I’ve talked about it before, but A&W’s Beyond Meat Burger, made with Beyond Meat’s Beyond Burger, was my first ever experience with a plant-based meat alternative. Sure, my expectations were low but after sinking my teeth into this burger, it was like an entire cosmos of plant-based food was unfolding before my very eyes. Taste aside, Beyond Meat has certainly been doing its part to lower its environmental impact by reducing greenhouse gas emissions, energy use, water use, and land use associated with the production of the Company’s Beyond Burger. According to a study published by the Center for Sustainable Systems, the production of the Beyond Burger generates 90% less greenhouse gas emissions, requires 46% less energy, has >99% less impact on water scarcity, and 93% less impact on land use than a ¼ pound of U.S. beef. Take that McDonald’s.

So, what has Beyond Meat been up to lately? On September 29, 2021, The Company announced that it has launched its plant-based Beyond Breakfast Sausage® Links in grocery stores across Canada, marking the Company’s entry into the Canadian retail breakfast category. In addition to packing the same flavor and texture as traditional breakfast sausage, the Company’s Beyond Breakfast Sausage® Links offer 12g of protein per serving and 35% less sodium than the leading brand of pork sausage. If Beyond Meat doesn’t want to name-drop any brands, I will! One measly Schneiders® Smokies – Original Recipe sausage contains 300 calories and 820mg of sodium, which equates to 34% of the recommended daily value. As someone who inhaled his fair share of sausages in university, get your mind out of the gutter, Schneiders® were some of my favorites, next to Harvest Meats’ Farmer’s Sausage. Cooked up on my George Foreman grill, many of my dorm room dinners consisted of sausage.

“We are thrilled to increase our better-for-you plant-based offerings in Canada with the debut of Beyond Breakfast Sausage Links,” said Heena Verma, Marketing Director for Canada, Beyond Meat.

Additionally, on October 14, 2021, Beyond Meat will be launching its Sleep for Sausage campaign. This campaign will reward Canadians for getting a good night’s sleep with free Beyond Breakfast Sausage Links. More specifically, participants will receive one Beyond Breakfast Sausage Link for every hour of sleep they clock. An interesting incentive to say the least, however, I can see a lot of passionate, sausage-loving Canadians getting involved in this.

Beyond Meat’s share price opened at $106.46 on September 30, 2021, up from a previous close of $106.32. The Company’s shares were down 0.55% and were trading at $105.74 as of $2:06 PM ET.

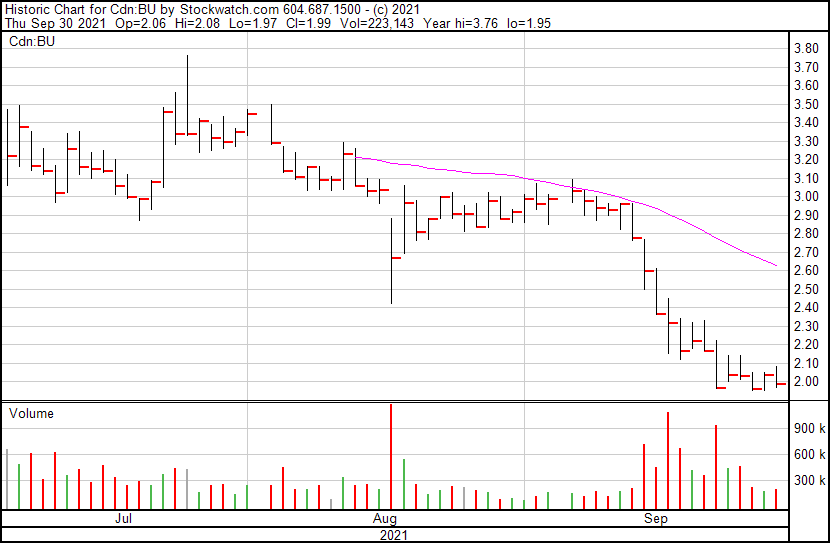

Burcon NutraScience Corporation

- $215.899M Market Capitalization

Burcon NutraScience (BU.T) is a global leader in innovative technologies for the large-scale production of high-quality, cost-effective plant-based proteins and ingredients for use in the global food and beverage industries. The Company is on a mission to improve the health and wellness of global consumers through the discovery and development of sustainable, functional, and renewable plant-based products. Utilizing its environmentally friendly and clean-label extraction and purification technologies, Buracon has developed an expansive portfolio of innovative composition, application, and process patents. In particular, the Company has over 285 issued patents and more than 250 additional patent applications. Furthermore, Buracon offers a variety of plant-based proteins, including canola proteins, pea proteins, and unique protein blends. Moreover, the Company’s plant-based proteins can be used for a wide range of applications including dairy alternative products, juices, meat alternatives, nutrition bars, and ready-to-drink beverages.

So, what has Burcon been up to lately? On September 21, 2021, the Company announced that Mr. Peter H. Kappel had been appointed as Chairman of Burcon’s Board of Directors. Additionally, the Company also provided an update on its operations. For starters, let’s talk about Mr. Kappel. Mr. Kappel received an MBA in Business Administration from INSEAD, a non-profit graduate business school. Afterward, he worked as the Chairman for British Columbia Lottery Corp., Managing Director at DVB Bank SE, and Accountant at KPMG LLP. With regards to Burcon, Mr. Kappel has worked as the Company’s Director since January.

“We are pleased with Merit’s recent production advancements and excited to know Merit is fulfilling more and more customer orders by the month,” said Johann F. Tergesen, Burcon’s president and chief executive officer

Before we get into Burcon’s business update, it is worth noting that in 2019, the Company established Merit Functional Foods Corporation in collaboration with three veteran food industry executives. Since then, Merit Foods has built a 94,000 square foot production facility in Manitoba, Canada, to produce Burcon’s novel pea and canola protein ingredients. Keep in mind, this facility is the first and only commercial facility in the world capable of producing food-grade canola proteins. Getting back to the Company’s latest news, Burcon announced that its Merit Foods facility would begin ramping up production volumes and sales at its new state-of-the-art facility in Winnipeg, Manitoba. Moreover, this facility is supposedly close to operating on a 24/7 schedule, indicating that the Company is on track to meet its optimization targets. Looking forward, Burcon is in discussions with several potential partners with the hopes of bringing a number of alternative plant-based protein ingredients to the plant-based industry.

Burcon’s share price opened at $2.06 on September 30, 2021, up from a previous close of $2.04. The Company’s shares were down -2.94% and were trading at $1.98 as of 3:26 PM ET.

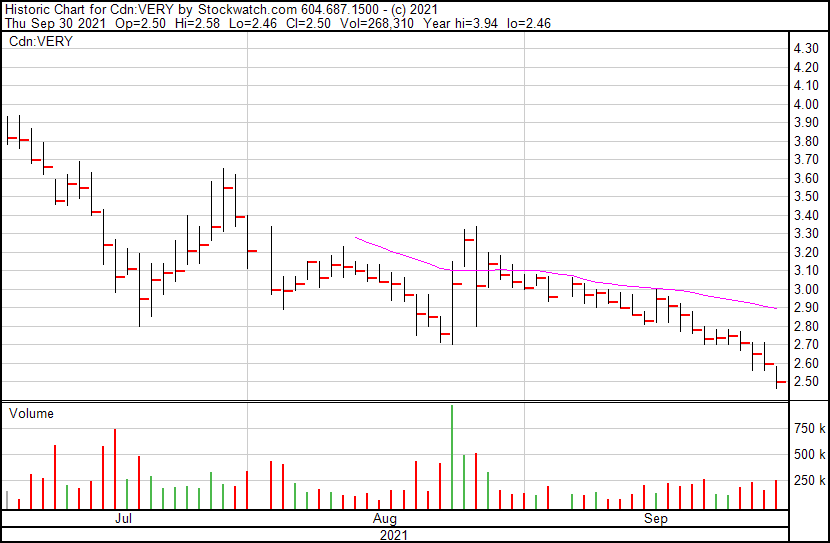

The Very Good Food Company

- 256.023M Market Capitalization

The Very Good Food Company (VERY.V) is a plant-based food technology company, credited for producing delicious plant-based meat and cheese products under its core brands, The Very Good Butchers and The Very Good Cheese Co. Lately, Very Good Butchers has been taunting me with its advertisements, flaunting its succulent patties in my face. If this keeps up, I may just have to order one of the company’s Butcher Boxes containing a range of products, including Butcher’s Select burgers, sausages, and meatballs, to name just a few. All Butcher’s Select products are made with minimally processes ingredients like pea protein, navy beans, chickpeas, garlic, onion, hemp seeds, and organic peppers. In addition to its plant-based meat alternatives, the Company also offers plant-based cheeses through its The Very Good Cheese Co. Here, customers can find a variety of plant-based alternatives for famous cheeses like cheddar, gouda, and pepper jack.

So, what has The Very Good Food Company been up to lately? On September 29, 2021, the Company announced that it has brought back its limited-edition Stuffed Beast, a plant-based meat alternative containing sweet potato and cranberry stuffing, wrapped in a plant-based roast. Intended to replace traditional Thanksgiving turkey, the Company’s Stuffed Beast has enough plant-based meat on its non-existent bones to feed 5-7 people. Additionally, the Company will also be offering its special Thanksgiving Box and Holiday Meat Box for a limited time, featuring fall and winter-inspired flavors. Sold under the Company’s The Very Good Butchers brand, the Stuffed Beast will be available in over 250 stores across the US at numerous retailers, such as Wegmans, Earthfare, PCC Markets, Metro Markets, and more.

“Holiday gatherings can be one of the most stressful and frustrating times for people following a vegan diet – especially Thanksgiving when the main dish is turkey – and our Stuffed Beast and boxes make any holiday gathering nutritious, delicious, and completely plant-based,” said Mitchell Scott, co-founder and CEO of The Very Good Food Company.

As someone who loves the holidays but hates eating the same Butterball turkey every year, The Very Good Butchers’ Stuffed Beast sounds like something I can get behind. However, I have never even tasted the company’s plant-based meat alternatives, let alone seen them at my local supermarket. With this in mind, my opinion means very little. On the other hand, numbers paint a very pretty picture for The Very Good Food Company. According to its Q2 2021 Financial Results, the Company fulfilled 24,025 eCommerce orders on June 30, 2021, compared to 11,194 year-over-year. In the same period, the Company sold 216,121 eCommerce units and 91,624 wholesale units, up from 92,381 and 40,488, respectively. In total, the Company’s various channels generated a cumulative value of $2,780,681 as of June 31, 2021, compared to $1,087,790 on June 30, 2020. This is a clear indication that The Very Good Food Company is expanding at an impressive rate.

The Very Good Food Company’s shares opened at $2.50 on September 30, 2021, down from a previous close of $2.60. The Company’s shares were down -3.85% and were trading at $2.50 at closing.