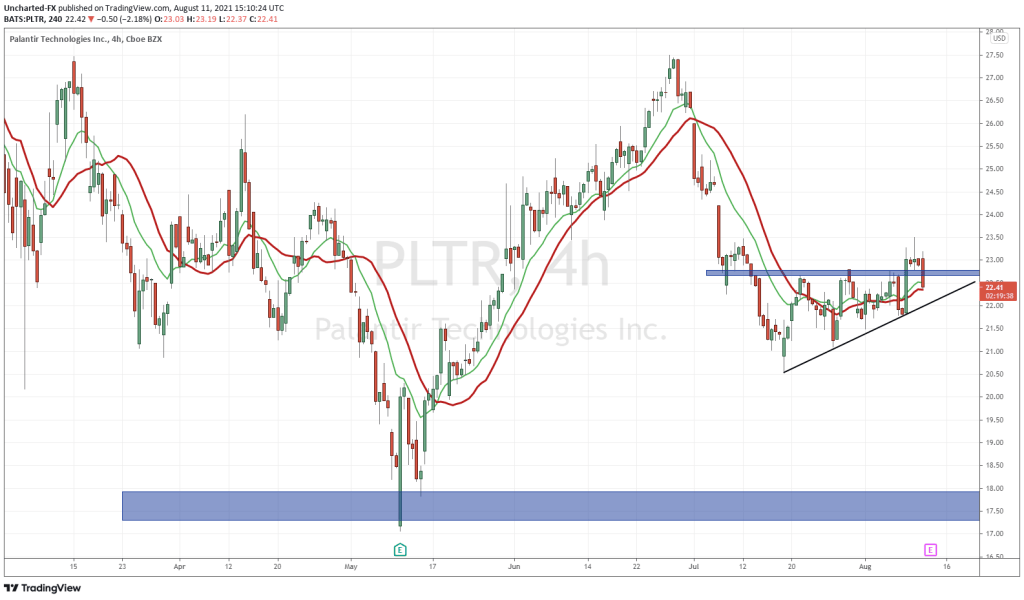

Palantir stock is up 4% at time of writing. It appears as if the retail and/or WallStreetBets favorite stocks are making moves. Add Palantir to that list. The last we looked at Palantir, was pre-breakout and pre-earnings. Check out our analysis posted a few weeks back BEFORE the breakout that we predicted.

Before we jump into the technicals, let’s look at some headlines.

Palantir delivered earnings on the 12th. They beat expectations:

-

Adjusted earnings per share: 4 cents vs. 4 cents expected

-

Revenue: $376 million vs. $352.3 million expected

Palantir’s revenue jumped 49% year over year for the second consecutive quarter.

Palantir said it expects revenue in the current quarter to come in at $385 million, which is higher than analysts’ projected $376 million. It said it now anticipates full-year adjusted free cash flow in excess of $300 million, up from in excess of $150 million. Palantir also reaffirmed that it expects annual revenue growth of 30% or greater through 2025.

Speaking about that large cash pile, do you all remember Tesla and Elon Musk? Tesla diversified their cash holdings by buying Bitcoin. In their SEC filing, they said they are even open to diversifying US Dollars by buying Gold. Well, Palantir has done just that…and maybe they buy Bitcoin next?

Palantir bought $50.7 million in 100 ounce Gold bars in the month of August. Also from the same CNBC article:

“Such purchase will initially be kept in a secure third-party facility located in the northeastern United States and the Company is able to take physical possession of the gold bars stored at the facility at any time with reasonable notice.”

What I think is more important is the fact Palantir is buying Gold to protect themselves from a Black Swan event. Palantir’s COO, Shyam Sankar stated, “You have to be prepared for a future with more black swan events,”.

Here is why this is important. Palantir is a company all about data and PREDICTING FUTURE EVENTS. If they are buying Gold to protect against a Black Swan, you should have some too.

On the financial side, we saw a dramatic shift with the Reserve Bank of New Zealand (RBNZ). The market was expecting the RBNZ to raise rates. They didn’t. One case in New Zealand was enough to lock down the entire country AND shift monetary policy. Some of those who believe the Fed has trapped themselves and cannot raise rates, point to the Delta variant as being the best excuse for the Fed to keep cheap and easy money policy going.

A Black Swan event is defined as an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. With the US rolling out booster shots next month because the vaccine protection wanes, the pandemic and new variants seem like the likely candidate for a Black Swan.

Technical Tactics

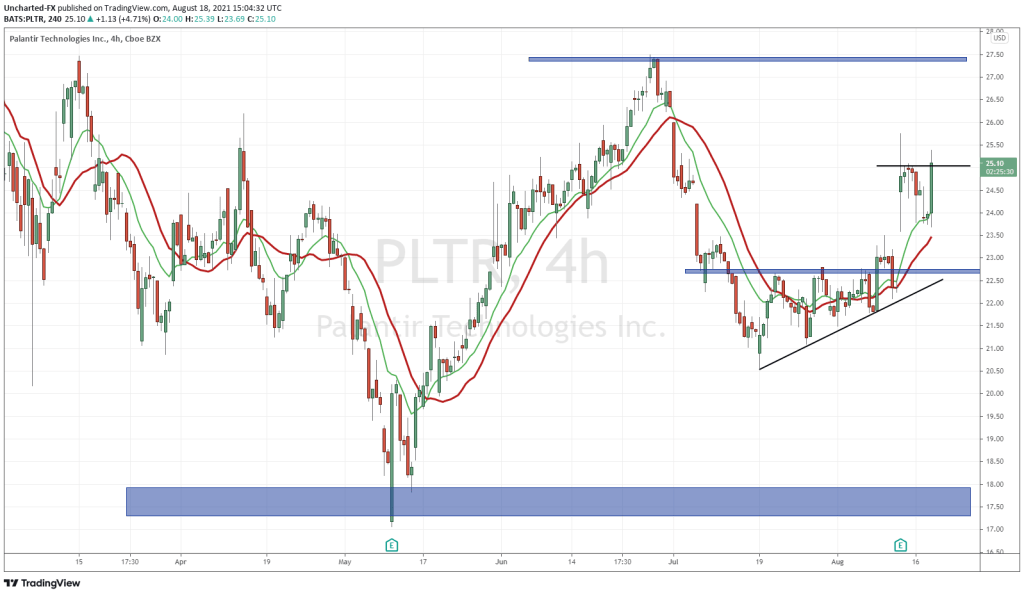

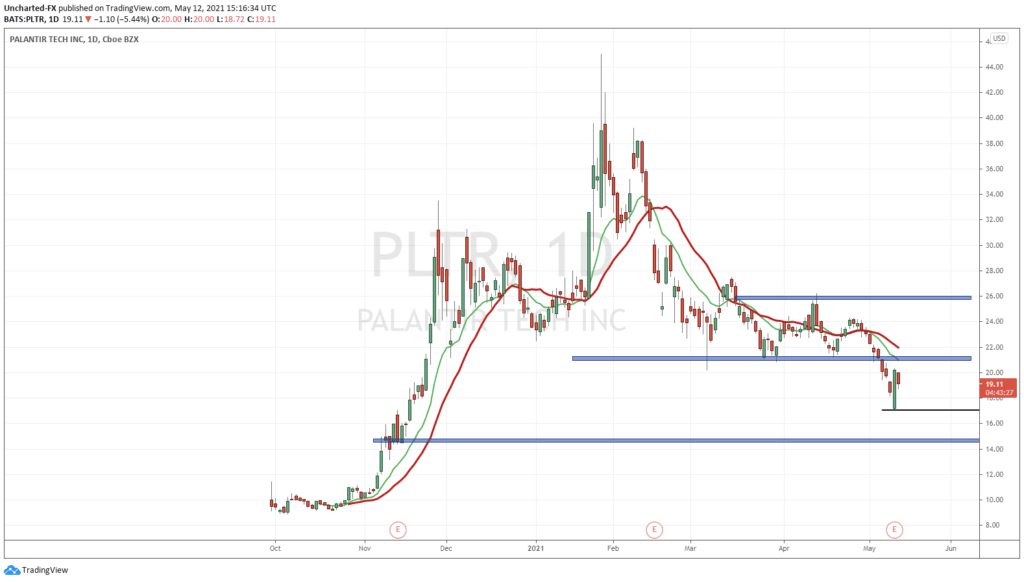

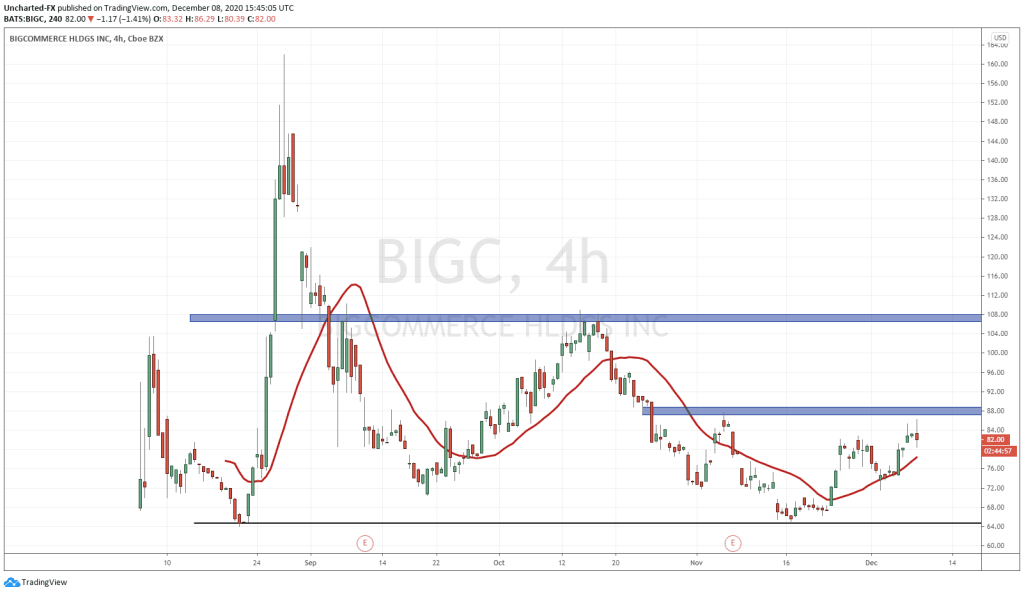

With the breakout above $22.75, Palantir is officially in an uptrend. Yes, we can retest $22.75, but as long as we remain above, the uptrend is likely to remain intact. There is one concern I have though. If this retest occurs, it means we would close below the large gap between $23.00 and about $23.50. Palantir stock gapped on earnings. Gaps act as support, and you can see how the current candle actually shot up when it came close to the gap. A gap fill, if price closes below $23.00 and thus fills the gap, would be bearish. It is likely then that the $22.75 retest would fail.

To the upside we just await for the higher lows. Palantir could be making its first higher low as I write this Market Moment. I have the 4 hour chart above, and what I want to see is a 4 hour close above $25.00. This close occurs at 10 am PST, so still a lot of time. The same market structure appears on the daily chart as well. We need a close above $25.00 by the end of the trading day.

If we get the $25.00 close, expect Palantir to continue to rip tomorrow. Maybe even a gap up tomorrow morning. Next resistance comes in at $27.50. Above that, we target the $30.00 zone. Once again, this is as a trade. I know a lot of folks want to hold Palantir as an investment for the long term. No problem. You can still use this analysis for buying opportunities.