Palantir had a monster rally yesterday, gaining 9.42% on a day when the Nasdaq was initially down 200 points, only to recover and finish basically flat for the day. I covered the Nasdaq and the levels of interest in yesterday’s Market Moment, so be sure to read that here. The chances of another leg lower are still there, and this will impact Palantir on a technical level. Or, if you want to get information real time, join me over on Equity Guru’s Discord Trading Room, where we have been trading this equity sell off.

Many turned bullish on Palantir on the 9% gain. I said it is not out of the woods yet on a technical level. And this is where technicals can come to our aid to make better investing or trading decisions. More on this under technical tactics, but first of all let’s look at the fundamentals driving the stock.

[youtube https://www.youtube.com/watch?v=PUy8cXc1S7c&w=560&h=315]

PLTR is a ticker that routinely showed up with the meme stock crowd. It is also a favorite of Cathie Wood over at ARK, buying up 1.3 million shares on Monday. Seen as a growth stock for the future, and I must admit, I am a fan of it for the long term.

It would be prudent to distinguish between investing and trading. As a investor, you have a longer time frame. I think it is a great idea to pick up some more Palantir on this dip, but I still think the bottom is not in. I like to blend my swing trading techniques with my investing. Essentially using market structure on the longer time frames and buying shares as investments once I know the downtrend is over. As they say, a falling market is like catching a falling knife.

The fundamental case has been strengthened with yesterday’s earnings report. Here are the key takeaways:

Palantir, the maker of software and analytics tools for the defense industry and large corporations, reported 49% revenue growth for its first quarter, beating Wall Street estimates.

- Adjusted earnings per share: 4 cents vs. 4 cents expected in a Refinitiv survey of analysts

- Revenue: $341 million vs. $332.2 million expected in the survey

The company said government revenue hit $208 million. It also beefed up its commercial segment during the quarter, with strong growth in the United States. Total commercial revenue hit $133 million.

The company said average revenue per customer grew to $8.1 million.

Palantir partly attributed the quarter’s growth to economic recovery in the U.S. and U.K., which helped boost commercial growth. The company said U.S. government revenue gained 83% year over year, while U.S. commercial revenue gained 72% from a year earlier.

Palantir said it expects to bring in $360 million in revenue in its second quarter compared with the $344.3 million expected

Technical Tactics

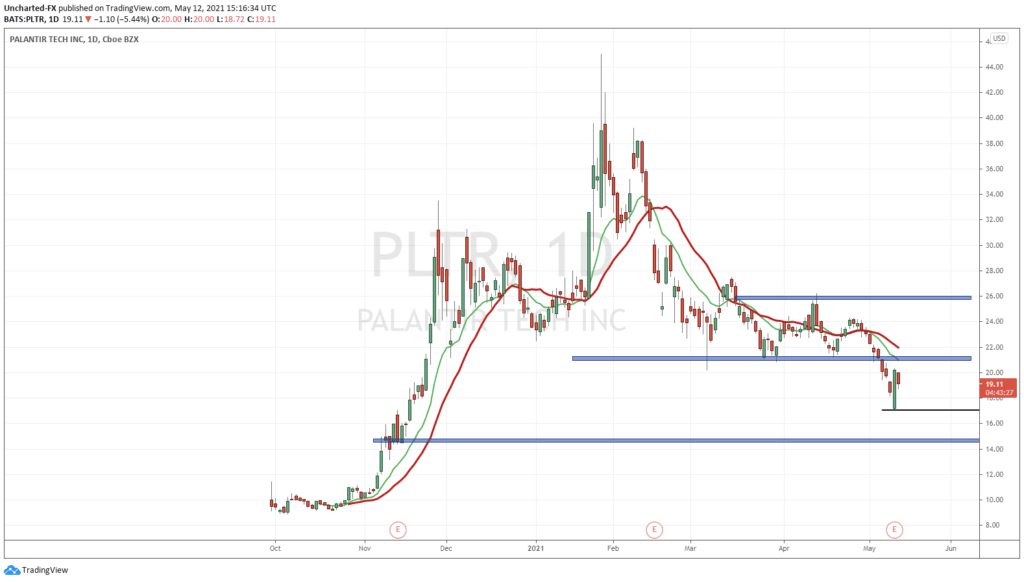

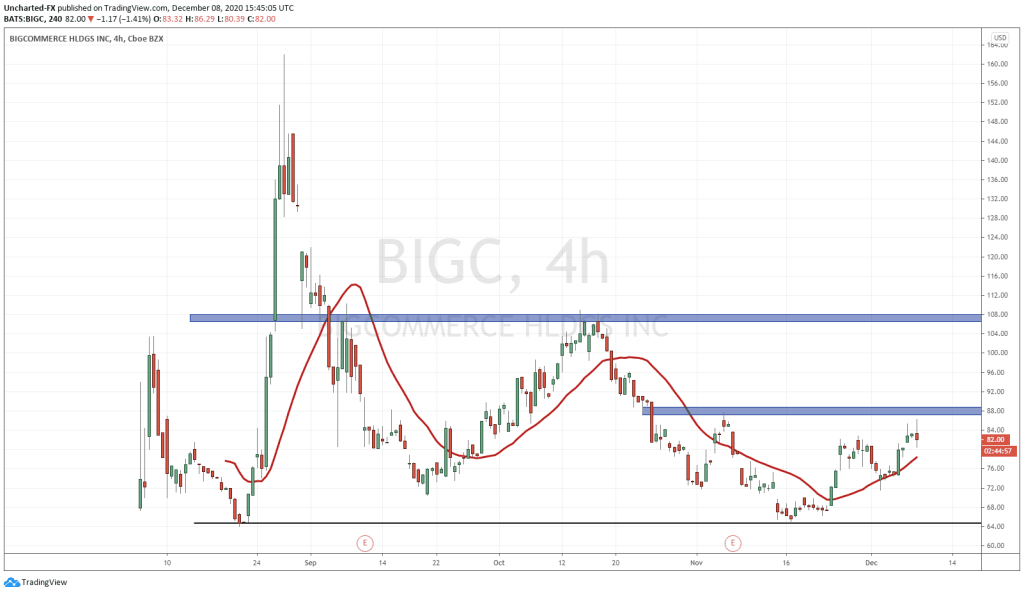

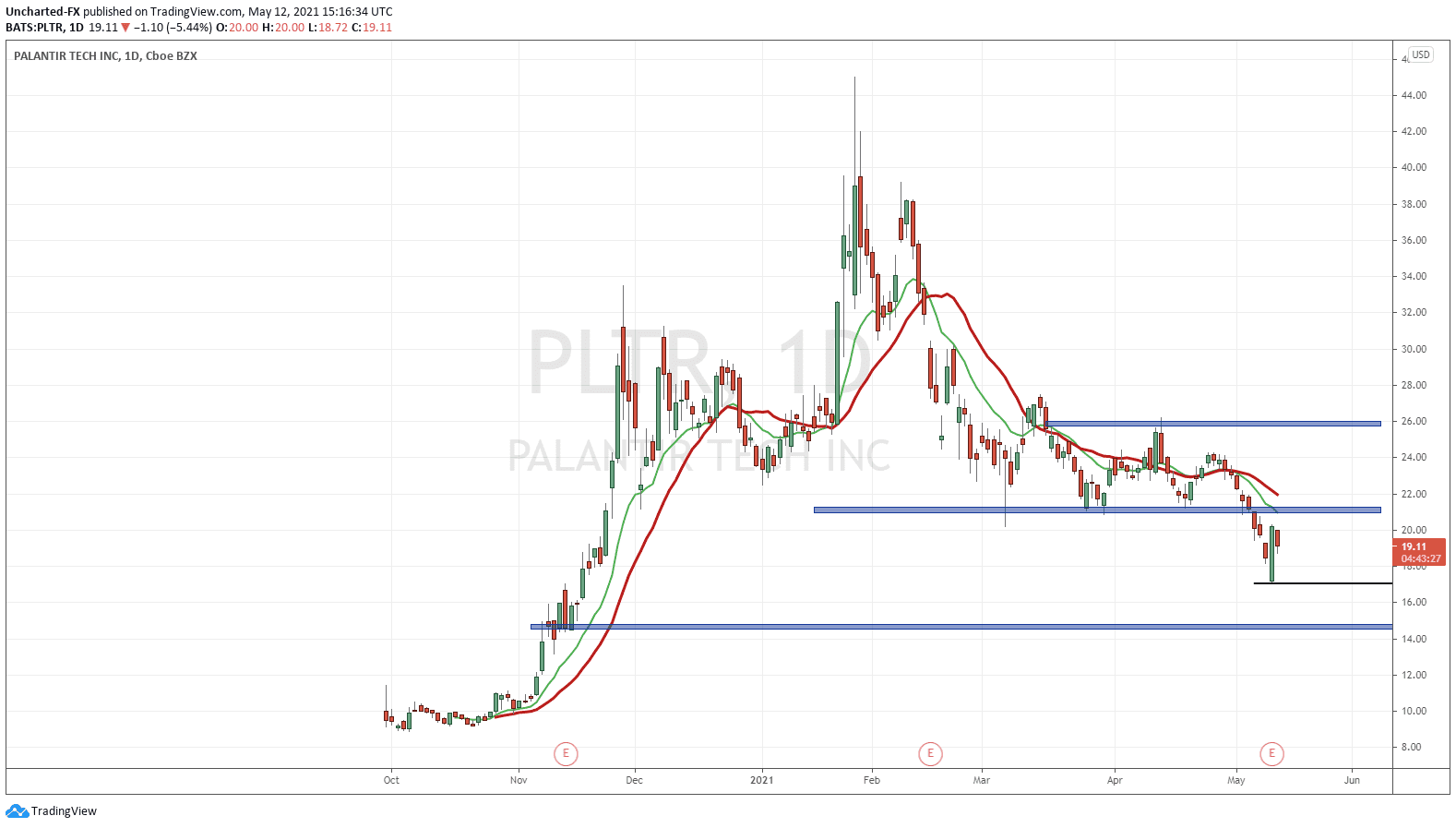

Above is the daily chart of PLTR. Some of you with experienced trading and technical eyes might even spot the somewhat slanted broad head and shoulders pattern.

If not, don’t worry too much about that. The important level is the $21.30-21.50 level above. Where my green 13 day moving average is.

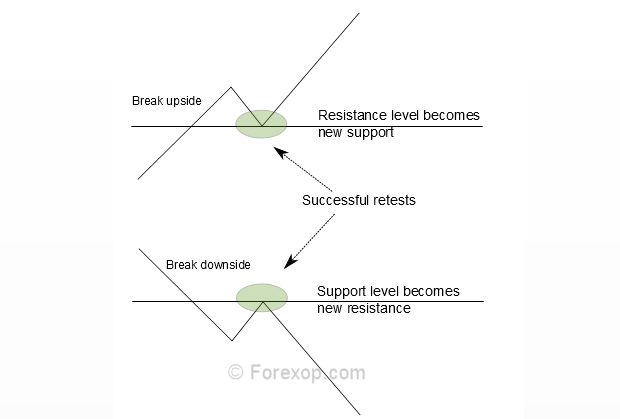

This level used to be support (price floor). Look at how previously price bounced four times from this support. Once support is broken, it now turns to resistance (price ceiling). This is just normal technical rules that applies for charts of any asset you look at.

Another rule of technical trading: Once a breakdown (or a breakout on an uptrend move) occurs, expect price to pullback or retrace to RETEST the breakdown zone before continuing the move lower.

So in terms of turning bullish, I would await for a close back above the $21.30 zone to NULLIFY the downtrend. As long as price remains below, another leg lower is possible as we remain in the downtrend.

For the leg lower, if we take out yesterday’s lows at $17.00, I would be targeting the $15.00 zone. This is personally where I would be looking to buy some shares for PLTR for the long term.

In summary the fundamentals are there, but we just need the technicals to line up. The technicals will bring in more algo’s, traders and more money, and will drive momentum. Currently, the market indices are red, with the Nasdaq down 1.95% at time of writing. As I outlined in yesterday’s post, there is still a price level I am watching for the Nasdaq to end the downtrend. Further pressure on the indices is what will drive Palantir down to the $15.00 zone.