When I write about Pure Global (PURE.V), people get confused because a) they’re always down, and b) they’re not a client company.

They should be a running joke, right? Like an Instadose or a Namaste (N.V).

Well if you bought in when I did, that’s even truer.

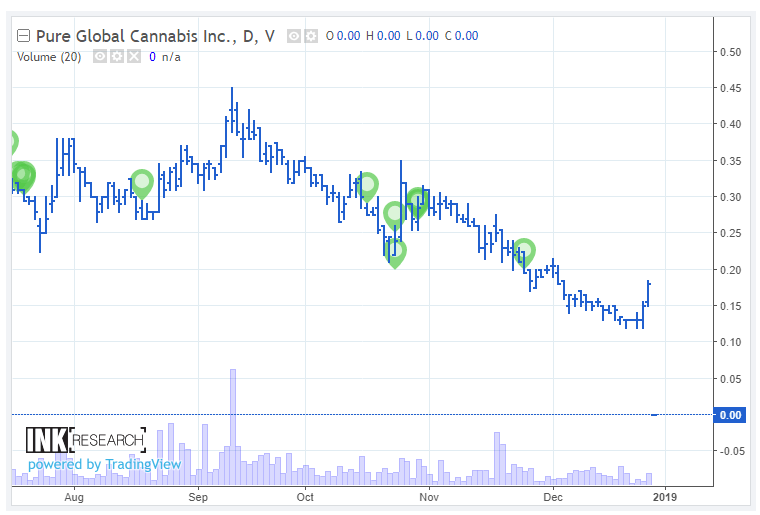

It hit the markets on opening day around $0.45, then immediately shredded to $0.35, then slumped to $0.22 before a yeoman-like rise, a few cents at a time, over the next two months.

And then?

That’s mid-September through til last week, a slump from $0.45 all the way down to $0.12.

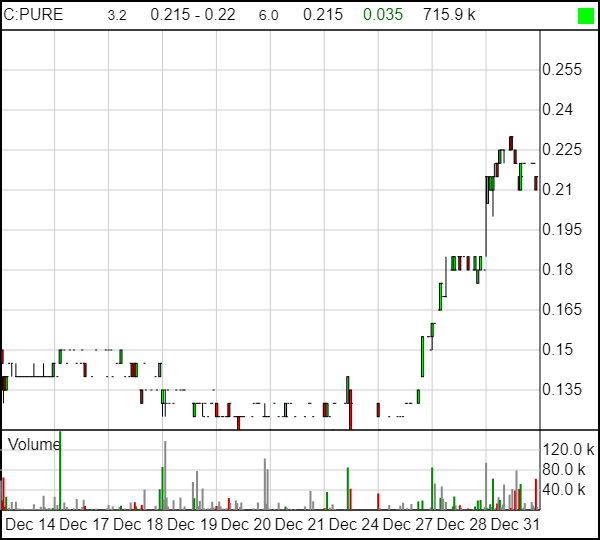

But in the last week, while others were being hit with tax loss selling (sup, Namaste) or CEOs offloading $2m in stock (sup, Namaste), or executives wiping out a year of investor outreach content on Youtube (sup Namaste), Pure was finding new investors, and fast.

That’s nearly a doubling of the stock just since Christmas.

Why is it happening?

The only real change in things during that time was the just released financials for the company, which show cash on hand of $14.75m (fair), $2.2m in inventory (okay), $6m in property and equipment (expected), a convertible debt note of $7m (a bit early to be building debt, but better than financing at a low valuation), and $5m in mortgage and liabilities.

These aren’t embarrassing at all. That’s business being done.

Having more money spent on management bonuses ($866k) than on salaries and wages ($504k), and almost as much on consulting, stock compensation and pro fees ($700k+), gives pause for thought.

And a $15m listing expense is… well, that’s a gut check, right there, especially coming on a net loss of $18m.

So why is the stock running?

Back on December 31, 2016, 16m warrants at a weighted average exercise price of $0.15 were allocated to investors, with an expiry date of 18 months after the company went public.

PURE went public in July. Those warrants are use it or lose it right now, and can be executed for a limited time.

I’m going to guess the company, which would like the dough they’ll bring in, and insiders at the company, which likewise would appreciate those warrants being used up, are doing anything they can to compel friendly parties to buy up, and friendly parties are indeed buying.

That wouldn’t be anything new for PURE management. They’ve been buying up the stock all the way down, which is usually a good sign of confidence within the organization.

Who’s been doing that buying?

The boss. CEO Manny Panchal and family have been gobbling it up but good, going back all the way to the RTO day.

I hold a lot of underwater PURE and, despite having cleared out almost all my cannabis holdings pre-adult use legalization in October, I’ve kept a hold of my PURE stock. Yes, it might have been prudent to sell earlier and miss a loss, or sell this past week and get a tax write-off, but the tax loss sale requires you not to buy back for an extended period and, frankly, I feel like this unit is going to come up with something big, and soon, and I don’t want to be on the wrong end of that.

To be clear – that ‘something big’ won’t need to be too big to make the stock jump. It’s up 20% today on less than a million shares traded, and has nigh doubled on a bit over 2m shares traded over three days.

That’s a tightly coiled spring, son.

I’ve said before that I think Pure suffers from focusing on ‘doing business‘ rather than talking to the market, and I continue to believe that’s true. They’ve got a ‘do a deal with pharma’ CEO, not a ‘raise your profile and run the stock’ CEO, which has hurt them in the short term, but looms large in the long.

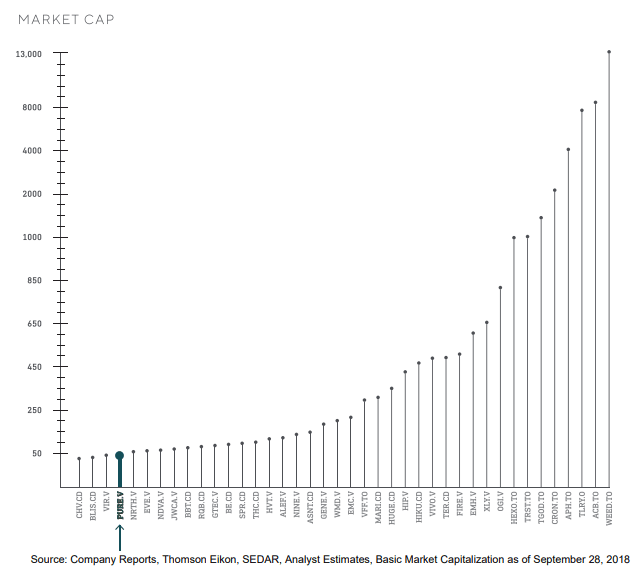

Here’s a capture from the Pure investor deck, the only thing in that deck frankly that screams ‘buy’ to me, mostly because ‘executive legitimacy’ is good nut not enough, and tech isn’t yet something the market is valuing in weed.

That’s from just before the October legalization changes, which also signaled the beginning of an expected value sell-off. Nobody still has these numbers as their value, but it’s an interesting guide regardless because sector-wide you’re looking at a 50% shred, give or take 15%.

That’s from just before the October legalization changes, which also signaled the beginning of an expected value sell-off. Nobody still has these numbers as their value, but it’s an interesting guide regardless because sector-wide you’re looking at a 50% shred, give or take 15%.

PURE, as you can see, has always sat at the low end of the value chain. Unknown, unrecognized, unheralded.

Today, that chart looks different:

CHV got licensing and climbed off the bottom to a now $32m value.

BLIS has done nothing all year and is now at $29m.

VIR is at $27m.

And PURE, having (as we’ve repeatedly said) nearly doubled in the last week?

Still just a $26.6m market cap.

That’s all. A licensed producer with 41k sq. ft in phase III buildout, an oil processing facility under construction, with expected capacity of 8,000 kg when they get their sales license in 2019, and it’s worth only $26.6m?

In 2015, the license this company holds would have been worth $40m by itself. In 2017, you could have added a zero to that.

But here we are, rolling into 2019 and PURE isn’t even cracking $30m?

Let’s put that into some perspective: Matica (MMJ.C), which has no licenses, has a market cap of $23.3m. I mean, you basically get a $25m starting valuation on a public weed company just by getting to the starting line. Ascent Industries (ASNT.C), which had its license suspended and its executive team fired for selling out the back door, that has a value of $49m, nearly double PURE’s market cap, based on today’s share price.

As we roll into 2019, the cannabis landscape will be forever changed based on many of the things we’ve seen go down of late. Leaders like Aphria (APHA.T) have been shown to be playing the game for the personal benefit of the boss and his friends, middle tier players like Ascent have been shown to be playing fast and loose with the rules, long time sufferers like Emblem (EMC.V) are tapping out, taking substandard low value offers because they know they’re out of ideas, and companies at the riskier side of things (sup, Namaste) are seemingly indicating we’re in the cash out phase.

If that’s the new norm, if the largest players with the most market cap and biggest war chests can’t be trusted, and the middle players that had high values are hurting because those values were always based on comparables and not revenues, and if those billion dollar players are seeing their weed on government distributor sites right next to the weed from the smallest end of town, with no inherent marketing advantage to the guys who’s spent hundreds of millions building brands, then the smaller end of town becomes much more interesting.

C21 Investments (CXXI.C), for example, with a $35m valuation as they buy a company in the US that has $25m in 12-month trailing revenue. Or Livewell Canada (LVWL.C), which is halted with a $96m cap as it completes its $20m deal to buy supplement producer Acenzia, and its planned merger with Vitality, one of North America’s largest cultivators of bulk CBD isolates from hemp. Or Quadron Cannatech (QCC.V), which has a market cap one digit smaller than those mentioned, valued at just under $10m while selling an industry leader in extraction tech.

There’s CROP Infrastructure (CROP.C), with plays across the globe and just a $40m valuation. Heritage Cannabis (CANN.C) with its deal to take over BC oil play Purefarma, at just $60m valuation. GTEC Holdings (GTEC.V), with multiple Canadian grow plays and a retail program on top, for just $47m. Rubicon Organics (ROMJ.C), which has plays in the US that are advancing hard and has largely missed ‘the great value fall off of 2017’.

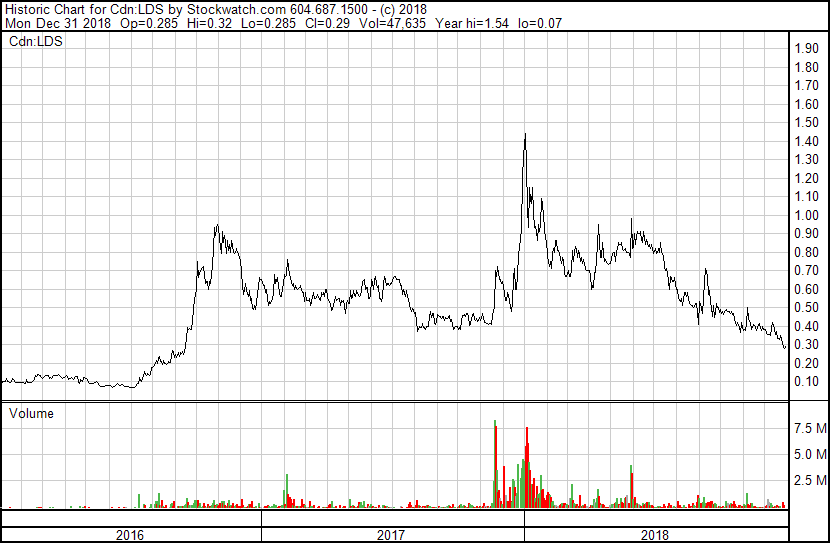

Or California oils/strips play Lifestyle Delivery Systems (LDS.C) which, while having had many delays this year, at a cap of just $31m, is purchasable at a share price lower than any point in the last two years.

Granted, in October, we told you to get out of all of these and save your cash. We said it was okay to be in nothing and just feel wealthy for a while, to roll around in your wealth that you’d created through being smart over the last few years.

We also said, when the market dips out, it’ll be great to be sitting there with a war chest, able to boss the table that you were formerly a small player at.

But PURE for $26m? If it doubled from here, it’s still so cheap it should be bringing multiple takeover suitors. I believe now is the time to place your bets, and that the small end of town, where prices aren’t insane and every up is a larger percentage move, is where you should be looking.

Because the guys with the REALLY big wallets, who can snap these bargains up whole? They’re coming.

That’s what 2019 will look like, friends. Someone’s going to roll up these little plays with screaming cheap valuations, and they will not be cheap for long as a result.

Happy New Year.

And sup, Namaste.

When you’re right, you’re right. 🙂

— Chris Parry

FULL DISCLOSURE: Basically everyone mentioned in this article but Namaste, Matica, Aphria and Emblem (and Pure) are Equity.Guru marketing clients.

That’s what “2019” will look like, not 2018. Thanks Chris for your year of guidance and happy new year!

Good catch JRC, thank you – it’s fixed.

I guess this is why they keep on using good marketing strats

Hi Chris,

Do you still have the same thoughts about Pure?

It is so quiet regarding IR..

Thanks!

I don’t understand why this company’s SP isn’t moving. Do you guys still think this is one of the better companies out there?