Various members of the Canadian telecommunications cartel regularly try to upsell me on their products: They offer a four or a six month package for around $50 a month if I’d let them handle my phone, internet and TV.

Granted, once that deal’s up, the price will be back up around $160 a month for their inferior service, but they don’t mention that unless you ask.

My answer has always been no. I’ve been a Netflix (NFLX.Q) subscriber since 2015.

One of their sales people got pissy with me once because after the fourth time saying no, maybe sometimes I can get a bit obstinate.

Regardless, it’s noteworthy for two reasons:

- I’ve done that job and know that a shitty sales position is never worth getting pissy over.

- Why would anyone ever leave Netflix when they’re the best game in town?

Fast forward to 2019. Netflix’s days as the best game in town are numbered.

Behold! Signs of the apocalypse:

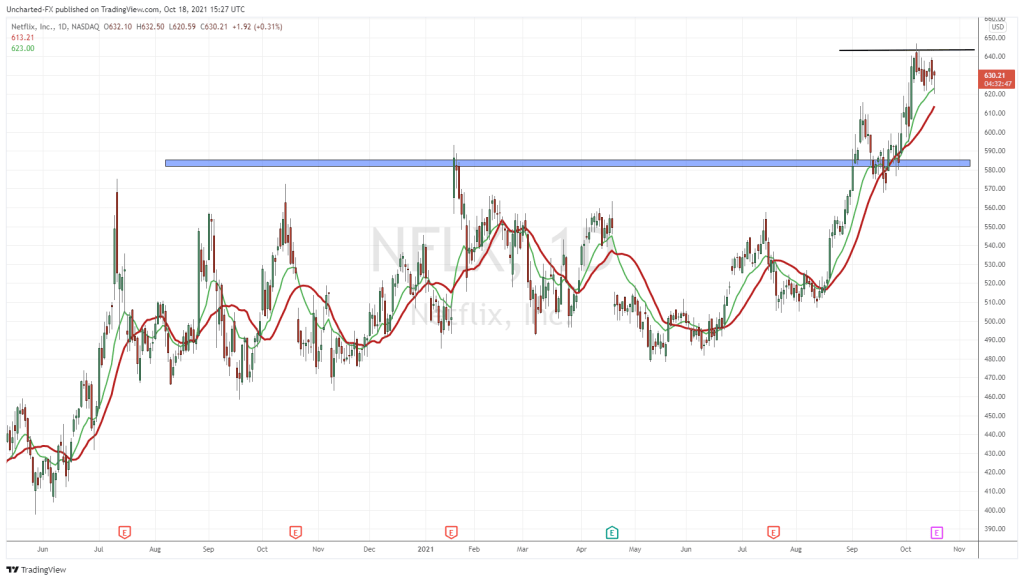

Netflix said they would attract five million new subscribers last quarter and they didn’t. Instead, they attracted 2.7 million. That sent Netflix shares plummeting down 10%.

But they’re optimistic:

“While our US paid membership was essentially flat in Q2, we expect it to return to more typical growth in Q3, and are seeing that in these early weeks of Q3. We forecast Q3 global paid net adds of 7.0m, up vs. 6.1m in Q3’18, with 0.8m in the US and 6.2m internationally. Our internal forecast still currently calls for annual global paid net adds to be up year over year,” Netflix said in a press release.

Fueled by what?

More Tosh 2.0 ripoffs like the Joel McHale show with Joel McHale?

Most of Netflix’s original content is touch-and-go. It’s terrible overwrought tripe that nobody watches. The scrolling wheel of original content on the Netflix feed is a list of titles that few folks have given a second glance. For every Jessica Jones there’s three Iron Fists, and I preferred Birdbox when I saw it in theaters and it was called A Quiet Place.

Granted, when their original content hits, it can’t be beat:

For example, their original docuseries Our Planet was watched by 33 million households. Ava DuVernay’s four-part original series When They See Us reached 25 million households in four weeks, and Dead To Me had 30 million households in its first month.

But it’s really like sifting through a field of shit looking for a diamond.

In the interim there’s old favourites. When the day is done, most folks want to find something mindless and repetitive to fill the remainder of their waking hours between work and sleep. For some, that’s shows like The Office, and for others, there’s Friends.

Soon, both shows won’t even be an option because Netflix is hemorrhaging content to other providers like Disney, HBO and Apple, which are consolidating their own content for their own soon-to-be-released streaming services.

Netflix lost Friends in a bidding war with WarnerMedia, which will pay $85 million per year for five years for the show. The Office is similarly gone. Last year, we lost the Marvel offerings: Jessica Jones, Luke Cage, The Punisher, and the limited series, The Defenders, all of which will have new life at Disney’s streaming service whenever it rolls around. (We won’t mention Iron Fist and hope that Disney forgets it existed)

But that’s the nature of competition, isn’t it?

Netflix had it good for the first few years. Now others have caught wind that there’s money to be made in on-demand services, and the company is going to compete with the big dogs, like Disney, Google and Time Warner, and their massive operating budgets.

The usual bevy of corporate wonks have come out right on time to staunch the bleeding:

“Our position is excellent,” Chief Executive Officer Reed Hastings said during a videoconference call Wednesday. “We’re building amazing capacity for content. Our product has never been in better shape.”

Sure. For now.

Stranger Things and Orange Is the New Black are solid offerings, and it’s still time-for-treats whenever Black Mirror drops, but what are they going to do when the other big telecoms siphon off availability of mind-numbing post-sleep brain candy? Because that time’s coming.

Advertising? Nope.

The company’s letter to investors indicated:

“We, like HBO, are advertising free. That remains a deep part of our brand proposition; when you read speculation that we are moving into selling advertising, be confident that this is false. We believe we will have a more valuable business in the long term by staying out of competing for ad revenue and instead entirely focusing on competing for viewer satisfaction.”

CFO Spencer Neumann says their only plan now is to increase the scale of their current 151 million user base: “Our calculus now for building a global network is that we’re best served to focus on that single revenue stream… and offer [the service] at a reasonable price. We think the subscription model is a terrific model for us.”

It might make sense for now, but when the big dogs get to the yard little pups like Netflix might want to run with a bigger pack. Apple’s (APP.Q) recent run of revenue bad luck with their slumping Iphone sales could be offset by a successful acquisition of a top-tier profitable company. With nearly $250 billion cash on hand they could write a cheque, handle the deals that bring shows like Friends and The Office, and let Netflix focus on their own original content.

It might not be happy times for Netflix, but competition could be excellent for the consumer. Maybe the ensuing price race-to-the-bottom will result in the average consumer subscribing to three or four services a month.

Imagine binge watching The Defenders season 3 on Disney’s platform, and then alt+tab your way over to Netflix to watch Stranger Things.

How’s that for optimism?

—Joseph Morton