Marijuana legalization is sweeping the United States, but that doesn’t mean doing business there is easy.

iAnthus Capital Holdings (IAN.C) is navigating a complex web of regulations and financial bottlenecks as it seeks to become one of the fastest-growing regulated cannabis companies in the country.

iAnthus: by the numbers

Fresh off the launch of its flagship dispensary in Brooklyn, iAnthus is eyeing further expansion of its cannabis product line, including CBD oils and skincare goods. This means another brick-and-mortar location in Brooklyn later this year.

The intel was provided by the recently acquired chief strategy officer Beth Stavola, who recently sat down with the U.K.-based Proactive Investors on the sidelines of the Canadian Cannabis Capital Markets Conference in London, England. Stavola shed light on the maze of regulations and standards iAnthus must navigate to make its marijuana business operational in the world’s largest economy.

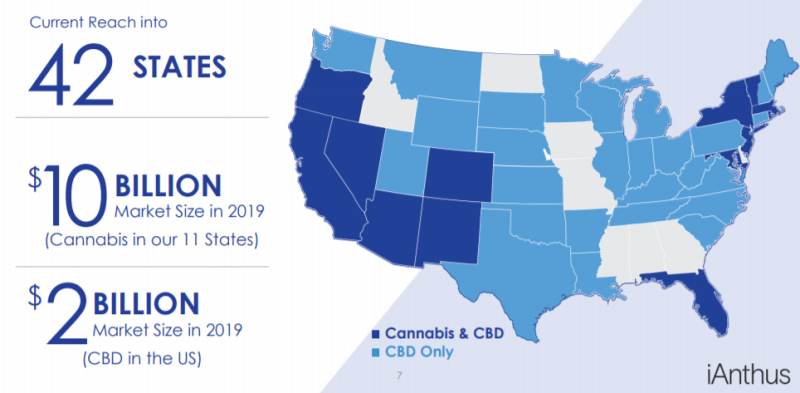

The vertically-integrated cannabis company operates in 11 states and has successfully grown its assets from less than $10 million to over $340 million. But each of those 11 states provides its own set of challenges ranging from banking regulations to packaging guidelines. Some states permit billboard advertising while others expressly prohibit it.

Oh, and then there’s the massive disconnect between legislation at the state level and prohibition over in Washington (marijuana is still a Schedule 1 drug for federal regulators).

“They regulate everything from the actual cannabis and testing, to packaging, labelling and any level of marketing,” Stavola said of the U.S. states. “Some places you have to have opaque packaging so when you’re creating a national brand, you have to take all of these things into consideration.”

iAnthus operates 35 bank accounts that require extreme attention because only the smallest and most obscure U.S. financial institutions deal with marijuana companies (you can thank the Schedule 1 designation for that).

Nevertheless, iAnthus operates 21 active dispensaries, a number that could reach 50 by the end of 2019. The company has a total of 68 dispensary licenses, so we can expect a steady expansion pipeline in the near future.

Digging into the corporate presentation, we find that iAnthus has 817,000 square feet of cultivation space and $525 million worth of production capacity.

Beyond these obvious metrics, there are some surprising ones, too. iAnthus’ CBD products are available in more than 750 stores across 42 states. Its product catalogue has more than 1,000 SKUs, or stock keeping units.

Common sense legislation gaining momentum

In her interview, Stavola said her company is keeping tabs on two landmark legislative proposals that could vastly change the nature of marijuana business in the United States. The first is the States Act, which seeks to ensure that Washington’s cold bureaucratic hands cannot meddle with states that have legalized cannabis.

The second is the SAFE Banking Act, which would allow marijuana companies to access the federally-regulated banking system.

Credit unions are playing an important role in pushing for such legislation and appear to have influenced a new resolution by the National Association of State Treasurers (NAST) that calls for “common-sense federal laws and regulations” for marijuana businesses.

NAST is an advocacy group that pushes for “sound financial policies and programs benefiting the citizens of the nation.” Its membership includes all state treasurers, employees of these agencies and private sector partners through a corporate affiliate program.

According to Ryan Donovan, chief advocacy officer for the Credit Union National Association (CUNA), something crazy like 50% of all cannabis businesses get robbed. If we weren’t talking about weed, this ratio would be totally unacceptable to anyone.

As far as the SAFE act goes, it has its fair share of bipartisan support. As MarketWatch notes, the bill is not only backed by a combination of Democrats and Republicans, but also by the banking sector, National Association of Attorneys General and the man himself, Treasury Secretary Steven Mnuchin.

Things seem to be moving in the right direction for the cannabis industry since President Trump fired Attorney General Jeff Sessions, who appeared hell-bent on enforcing federal prohibition.

Trump waited all of 12 hours after the midterm elections in November to sack Mr. Sessions. It had nothing to do with his view on marijuana, but the impact could be far-reaching for the nation’s budding cannabis sector.

Full disclosure: iAnthus Capital Holdings is an Equity.Guru marketing client.