Traditionally, mid-to-large sized public companies stick to their knittting. A biotech company stays in biotech, a weed company stays in weed, a gold company shies away from oil and gas.

But the beauty of being a microcap is you can be quick on your feet. Sure, you’ve got yourself a lithium project that checks all the boxes, but if you happen to spot a uranium deal out there in the wild and you have a couple of pokemon balls handy, why not catch them all?

Lancaster Resources (LCR.C) recently announced it has expanded its exploration portfolio by acquiring two promising mineral claims in the Athabasca basin, known for its high-grade uranium deposits. The move wasn’t exactly expected from a lithium player, but aligns with Lancaster’s dedication to supporting the clean energy transition, with a focus on their net zero business model.

THE PIVOT:

If I were to ask Lancaster what they think of the lithium space, I’m sure they’d tell me they see a big future and they have full confidence they can get their American lithium projects moving forward soon enough, but let’s be honest – nobody is giving any love to lithium right now.

You wouldnt find an investor who doesn’t think lithium is on a big growth path, but that path could take a while and, right now, nobody wants to be the only girl on the dance floor.

Lancaster management has figured this out and, rather than fight it – or sit around waiting – they’re doing the work of adding a second plan, and in a sector that is booming right now.

THE NEW DEAL:

The two new properties, Catley Lake and Centennial East, cover 3,036 hectares and 5,081 hectares respectively, and are strategically located near known uranium deposits.

Located in close proximity to Cameco‘s notable Centennial deposit, these claims are in a prime area for uranium deposits that are vital for nuclear energy – a key component in achieving net-zero emissions. The Centennial deposit nearby, with uranium concentrations as high as 8.78% U3O8 over 33.9 metres, illustrates the high-grade potential in this region. Another nearby deposit, Dufferin, further exemplifies the area’s richness with assays up to 1.73% U3O8 over 6.5 metres, underlining the promising context of Lancaster’s claims.

To be clear, being near massively successful uranium deposits doesn’t mean you’re on one yourself.

But it sure doesn’t hurt.

THE DIFFERNTIATOR:

Understanding the importance of responsible exploration, Lancaster plans to employ modern, innovative technologies to explore these claims in a net zero fashion in the hope they can mocve to production and supply the net zero green energy industry. This approach aims not only to identify high-grade uranium deposits but also to ensure that exploration is conducted with minimal environmental impact, aligning with global sustainability goals.

The decision to venture into uranium exploration is a strategic one. Andrew Watson, Lancaster’s Vice President of Engineering and Operations, emphasizes the role of uranium as a clean fuel source in the transition to clean energy, which makes this less of a pivot and more of a swerve. He highlights the synergy between exploring for uranium and lithium, underscoring Lancaster’s holistic approach to sourcing critical minerals essential for energy storage and electrification.

Parallel to its uranium exploration endeavors, Lancaster continues to progress on its Alkali Flat lithium project in New Mexico. The project has identified promising drilling targets for lithium-rich aquifers, a critical component for battery technology in electric vehicles and energy storage solutions.

Lancaster is planning a maiden drilling program to commence on permitting approvals. Archaeological representatives from the United States Bureau of Land Management (BLM) were on site last week for site review and cultural resources clearance. This review is an essential step in progressing the drilling regulatory process for approval by the BLM and New Mexico Energy, Minerals and Natural Resources Department (EMNRD). Lancaster is actively working with both regulators for drilling approval, which is expected in early Q2 2024.

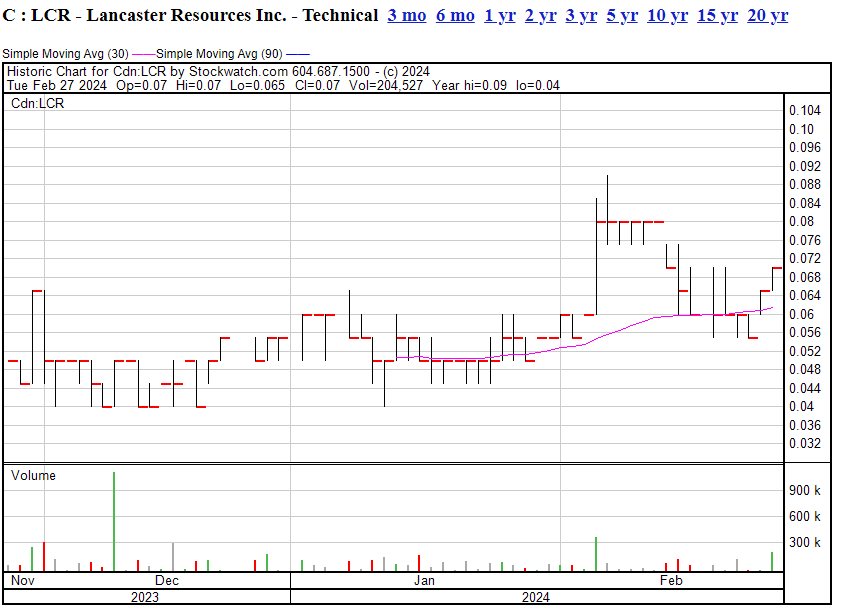

THE STOCK:

She’s building.

— Chris Parry

FULL DISCLOSURE: We own stock in this one, contributed to the recent raise, and the company is a client. Conflicted: Yup. But happily so.