A few days ago, Standard Uranium (STND.V) closed a private placement financing at $0.05. By Friday, their stock closed at $0.065, up 30% with volume building.

Over the last month, Azincourt Energy (AZN.V) drifted back and forth between $0.025 and $0.03. By Friday, it hit $0.04 with massive volume eclipsed only once in the past year.

Over the last week, Skyharbour Resources (SYH.V) shifted from $0.44 to $0.55. On Friday it enjoyed a 10% stock price jump.

Three things unite these companies;

- They’re all clients of ours

- They’re all tussling for elbow room in the uranium-rich Athabasca region of Saskatchewan

- They’re all run by guys who *will not stop* until they have achieved sector success, in Jon Bey, Alex Klenman, and Jordan Trimble respectively.

That’s a good start, and they’re all doing good work advancing their properties and gathering new ones, but the heavier stock tides are coming from the growing understanding that the uranium sector is in the right place at the right time.

URANIUM AT BIG PRICE HIGHS:

It’s official!🧑⚖️ All 3 #Nuclear fuel brokers closed the week at an incredible Spot #Uranium price of $104 per lb #U3O8🤯 as the U-train climbed another $4.00 higher🚆 onto rusty tracks unused since it departed $105 station on 7 August 2007🚉 showing no signs of stopping.😤🤠🐂 pic.twitter.com/HyHuhaj7Qm

— John Quakes (@quakes99) January 12, 2024

Booyah.

Don’t take his word for it; here’s the editor of OilPrice.com:

IS THIS URANIUM’S MOMENT?

On Twitter on Saturday night, ‘uranium’ was a top 5 trending topic, because the cold snap that has taken over half of North America this weekend, turning roads icy from Vancouver to Texas and causing usually warm places to reckon with snowfall, has played havoc with the usual electricity baseload generators.

On Twitter on Saturday night, ‘uranium’ was a top 5 trending topic, because the cold snap that has taken over half of North America this weekend, turning roads icy from Vancouver to Texas and causing usually warm places to reckon with snowfall, has played havoc with the usual electricity baseload generators.

As the provincial government of Alberta was sending out text message alerts asking folks to turn their heaters off this past weekend, lest the power grid stop working, the shadow of nuclear energy loomed large over a place where gas production is the primary industry.

Admittedly, Alberta will do anything it can to avoid having a nuclear plant while its primary business is the world’s most expensive oil and gas, but the rest of the world is getting the memo that nuclear can do the business as long as you don’t build your power plants on earthquake fault lines or the Soviet Union in the 1970’s.

Admittedly there are always going to be NIMBYs who don’t want a nuclear power plant in their backyard, but Canada has nothing if not a million places where such an industry would be welcomed with nary a neighour for a hundred miles – AND enough uranium to turn the priairies into the Alberta of the 2030’s..

Uranium as a sector was having a good time of it before that cold snap, for loads of reasons, primary among them:

- War. Good gawd, y’all, what is it good for? Well, making uranium harder to acquire, for a start.

- Institutional investors have uranium fever and are buying it up hard.

- Nuclear energy is in fashion. Despite endless Netflix documentaries about how awful and dangerous it was in the 1970’s, today’s nuclear energy is safe enough that it’s becoming modular.

None of these issues are small things.

War in Ukraine makes that whole region, which used to supply western Europe with a ton of its power, a no-go area. The uranium that used to come out of the Baltics is having to be found elsewhere, and when global political powers are building more bombs, more uranium is needed than usual.

The billionaires are buying uranium because they can see power generation splitting off from their usually comfortable monopolitic hands into loads of smaller entities. Solar and wind are picking up speed but continue to be inconsistent, electric cars and increased local small-scale oil production are starting to impact gas prices to the downward side, and the old monster-sized coal plants that printed money for most of the twentieth century are being wound down because, gross.

Meanwhile, nuclear tech is quickly ramping up and the understanding that nuclear energy is green energy is an idea increasingly crossing into the mainstream.

There are nuclear reactors on aircraft carriers these days. The ability to build smaller reactors in more places without risking armageddon is something being actively worked on, and when that becomes the norm, the age old practice of accruing political and financial power by owning power utilities will change forever. The only way to reliably corner the market on nuclear energy when it’s mainstream will be to corner the market on nuclear reactor fuel.

THE NEW REALITY:

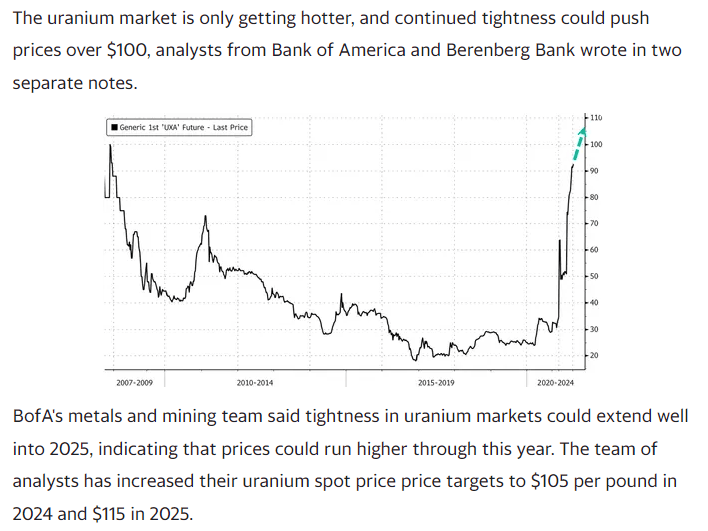

We’ve been telling you this for a long time. The uranium spot price in 2020 was $25; today it’s $105. Brent crude wishes it had that sort of price action.

And, as per our general theme that it’s better to be investing in places where the value hasn’t alredy been extracted, our eyes are firmly on the microcaps (Azincourt), smallcaps (Standard), and midcap (Skyharbour) players.

In the past few months, Azincourt (up from $0.025 to $0.04 in the past week):

- Optioned a new property and began exploration at the Big Hill lithium project, to give it some diversification

- Received permits for exploration at the East Preston uranium project

- Raised $1.2 million, over 90% of which was flow-through financing

Meanwhile, Standard (up from $0.045 to $0.065 in the last week):

- Staked two new projects in the summer

- Optioned two properties out to partners

- Released an NI 43-101 resource estimate on the Sun Dog project

- Raised $2.5 million in an over-subscribed financing

- Ended a year that started with them on death’s door, with eight projects in hand, and with plans and cash to actively drill three of them in the coming year

Skyharbour took it even further (up from $0.42 to $0.55 in the last week):

- Saw their partner, the aforementioned Azincourt, get permits for East Preston

- Saw two other partners complete QT and exploration plans for other properties they own

- Drilled the Russell Lake project themselves

- Raised $6.3 million in a financing including charity flow-through money at a 40% premium to the shareprice

- Staked 4.7 ha in North Saskatchewan

- Planned new drilling at the Russell Lake and Moore Projects

Every hour that people are freezing their asses off across Canada and the US this weekend, morte money is lingin up to fnd its way to these three companes, among others.

Of course, there’ll be a lot of interest in more advanced uranium explorers too, but I’m always of the opinion it’s a lot easier to double my money on a $4 million market cap company doing all the work you’d ask for, than it is to double my money on a $4 billion market cap company where others have already extracted the growth value in years prior.

The trick is figuring out which microcap is real, and capable, and has shown their work, as opposed to those who joined in over the last few months when lithium or gold wasn’t covering the cost of their girlfriend’s rent anymore.

I put it to you that if you call any of the three companies above and say, “What’s up, my man, Parry suggested I should call and get a rundown of what you’re doing,” you’re going to hear a lot of good things that will get you to an investing decision.

Nuclear is coming. The trick now is, how to get there with the best returns.

— Chris Parry

FULL DISCLOSURE: Like I said up top, these companies are clients. The fact that they’re good companies is down to the fact that we don’t do business with scumbags but, as ever, see a financial advisor before you make any investing decision and don’t take our word for anything… call the companies and make yur own mind up!