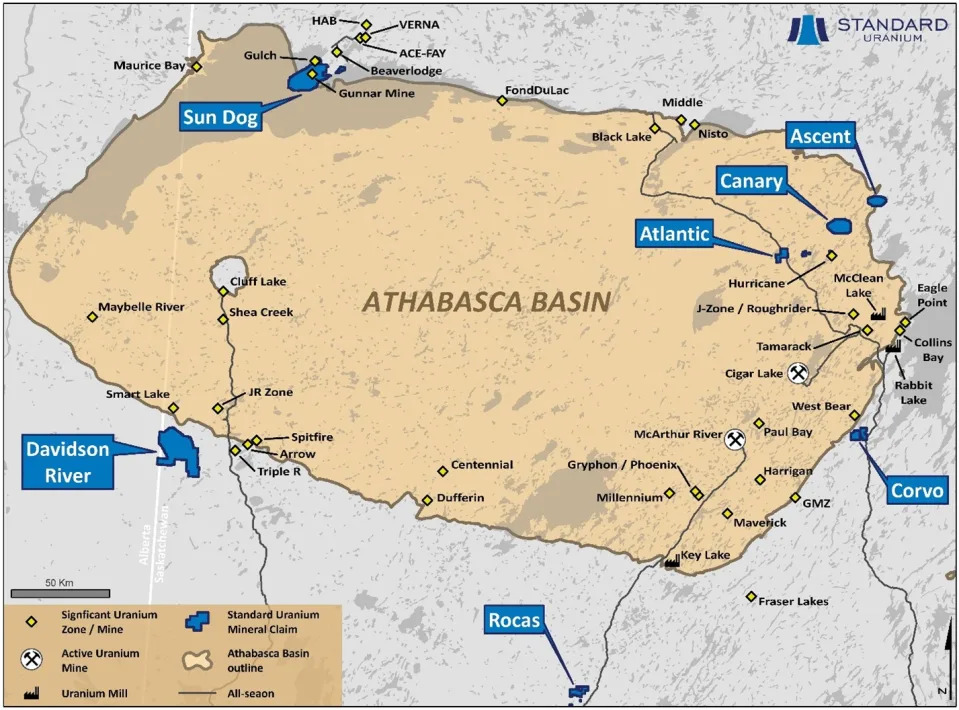

Standard Uranium (STND.V) is a junior uranium explorer operating in the Athabasca basin in Saskatchewan, Canada. The Company holds interest in over 199,095 acres (80,571 hectares) in the world’s richest uranium district.

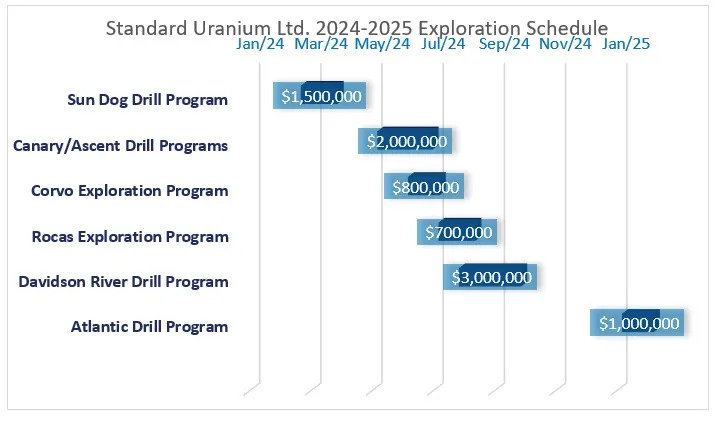

Today, Standard Uranium announced its exploration plans for 2024, comprising multiple targeted exploration programs to continue advancing its uranium projects in the Athabasca Basin, Saskatchewan, Canada towards discovery.

Standard Uranium holds nearly 200,000 acres of prime exploration real estate comprising eight projects across the prolific Athabasca Basin, which hosts the world’s highest grade uranium deposits.

2024 Exploration Objectives

- Plan and operate at minimum, three drill programs on three projects across the Basin, two of which will be partner-funded and provide operator fees to the Company.

- Complete initial exploration and geophysical programs on the newly acquired Rocas and Corvo projects.

- Execute inaugural drill campaign(s) on Canary, Ascent, and Atlantic projects, ripe for discovery with untested targets.

- Complete definitive option agreement(s) on one or more additional projects, securing exploration expenditures and non-dilutive cash-flow into the Company – Ascent project term sheet signed January 9.

- 2024 will be the most ambitious year of exploration activities for the Company to date. The Company is well underway on preparations for drill campaigns, in addition to planning inaugural reconnaissance exploration on the Rocas and Corvo projects.

Jon Bey, CEO and Chairman of the Company, stated: “2024 will be the Company’s most comprehensive and exciting exploration season to date. We strongly believe the uranium market will be one of the few bright spots in the investment landscape and we are planning to apply a modern approach to historical data and deploy more advanced analysis techniques in the upcoming drill campaigns. We have our projects ready for drilling with our First Nations agreements in place, drill permits in hand, and our vendors contracted. With the uranium spot price breaking the $100/lb barrier yesterday, the timing is fantastic to be embarking on multiple drill programs as new investors enter the uranium trade.”

Davidson River Project

In 2023, the Company expanded its flagship Davidson River project in the southwest corner of the Basin to cover more than 37,700 hectares. Standard Uranium plans to follow up on prospective drilling results from 2022 and test brand new high-priority targets akin to the neighboring JR Zone discovery within the new southeast claim blocks.

- Drilling in H2 2024 will comprise a follow-up campaign on Davidson River, located in the southwestern corner of the Basin.

- The summer 2022 program revealed the best intersections of prospective alteration and structure to date along the Bronco and Thunderbird trends, including wide graphitic structural zones on Bronco and oxidized alteration on Thunderbird, in addition to elevated radioactivity and dravite alteration.

- 2024 drilling will follow up on the most prospective basement structures and alteration zones intersected to date and begin testing new target areas within recently staked claim blocks.

- Data-driven machine learning techniques will contribute to drill targeting at Davidson River through anomaly detection and mapping of electromagnetic (EM) data, in addition to anomaly matching based on known world-class uranium deposits in the area including the Arrow and Triple-R deposits. The machine learning techniques will also be applied to the Company’s internal drilling and geochemical databases.

- Several kilometres of graphitic conductors remain to be tested at Davidson River, with Davidson River still containing massive blue-sky potential for high-grade discovery.

Sun Dog Project

The Company’s Sun Dog project has recently been optioned into a three-year earn in deal with Angold Resources Ltd. and incorporated into one of the largest land holdings in the Uranium City area. A drill program funded by Angold is planned for H1 2024 to satisfy the year-one expenditure requirements, which will be operated for a fee by the Company.

- Drilling will focus on land-based targets, with ice targets contingent on weather conditions. Targets are focused along the off-scale Haven trend, Skye and Java target areas, Mitchell Island, and along strike of the Gunnar mine:

- Perched high-grade uranium mineralization present at surface on Sun Dog will be properly tested at depth, and the Company aims to discover the high-grade “roots” of these mineralizing systems in the basement rocks underlying the Athabasca sandstones.

- The 2024 drill program is planned to follow up on the drilling conducted in 2022 & 2023, including intersections of dravite and illite/kaolinite clays, reactivated graphitic structures, hydrothermal brecciation, and anomalous uranium.

The Company also announced it has granted stock options to certain directors, management, and consultants of the Company to purchase an aggregate of 2,230,000 common shares of the Company at the price of $0.06 per common share until January 12, 2029. The Options will vest in intervals over a period of twelve months from the date of grant.

The stock is up 30% on this news at time of writing.

In previous articles, I spoke about support around $0.04 being tested. A range developed there and the close above $0.05 triggered a breakout. This breakout remains in play as long as the stock stays above $0.05. There is a trendline approaching around the $0.07 zone which has been a major resistance level. We know this because there has been at least three confirmed touches and rejections. A close above this trendline would be a major technical move for the stock, and one which would set up for a move up to $0.10.