Canada’s Critical Mineral Strategy, unveiled in December 2022, is a comprehensive plan aimed at bolstering the nation’s critical minerals sector, which is crucial for the green and digital economy. The strategy is backed by a substantial investment of $3.8 billion, as allocated in the federal budgets of 2021-2022. It lays the foundation for Canada’s industrial transformation towards a greener, more secure, and competitive economy and includes measures to accelerate regulatory processes for critical minerals, with a focus on expediting projects and ensuring Indigenous communities are consulted throughout the value chain. For mining companies like West High Yield (WHY) Resources (WHY.V) and their flagship Record Ridge Project, the strategy presents significant opportunities.

Of the 31 minerals currently on the Canadian government’s critical list, magnesium holds a unique position. It is not only something vital to human health, it has extensive industrial applications due to its special properties. Its low structural density and high specific strength make it a valuable material in various sectors.

Why Magnesium?

One of the primary industrial uses of magnesium is in the production of alloys. Magnesium is commonly found in aluminum alloys and is used in die casting and the production of titanium. It’s particularly valued for its high specific strength when combined with silicon carbide nanoparticles. Magnesium alloys are used in manufacturing products like beverage cans, sports equipment, and car wheels. They are also found in photoengraving plates, dry-cell battery walls, and roofing materials. The modern metallurgy process has increasingly favored magnesium over aluminum and steel alloys due to its beneficial properties.

In the aviation industry, magnesium was previously utilized as a construction material. Its lightweight nature and resistance to high temperatures make it suitable for aircraft engines, landing gear parts, seats, wheels, and other applications. The historical use of magnesium in aviation can be traced back to the 1920s, where it proved reliable in various settings, later expanding to machinery parts, hand tools, and even vacuum cleaners.

The automotive industry also benefits from magnesium’s properties, particularly its lightweight nature and temperature resistance. This makes it an ideal material for automotive components, contributing to fuel efficiency and performance.

In electronics, magnesium is used in the production of devices like smartphones, laptops, cameras, and tablets. Its electrical and mechanical properties make it suitable for constructing primary batteries, and there is ongoing research to develop rechargeable magnesium batteries.

Magnesium’s role in organic chemistry is notable, especially in the preparation of Grignard reagents during organic synthesis. It also acts as a reducing agent in the separation of uranium and other metals from their salts. Moreover, magnesium ribbons are used to purify solvents, particularly in the preparation of super-dry ethanol.

Other notable uses of magnesium include its application in pyrotechnics due to its autoignition temperature, which makes it useful in emergency fires and pyrotechnic displays. In the paper production industry, magnesium plays a role in the sulfite process of paper making. It is also used in the combination with other non-metals to produce fireproof materials, which are then used in construction.

Pretty useful and yet, not well known, but demand continues to grow as the world optimizes manufacturing and advances technologies in its pursuit of net zero carbon goals. As an illustration, over the past decade, the average annual growth rate of global primary magnesium consumption has been around 5.1%, driven by growth in construction, automotive, aluminum, steel, and other industries. Looking ahead, it is expected that global magnesium production will grow at an average annual rate of 5.1% from 2020 to 2030, reaching about 1.4 million tons by 2025 and about 1.8 million tons by 2030. The demand for magnesium in automotive applications, particularly in the development of electric vehicles, is a key factor driving this growth. Will there be enough to supply this expanding global need?

Where’s it come from?

From a production perspective, China has been the major producer of magnesium, contributing significantly to the global supply, but this can’t last forever. China’s commitment to reduce greenhouse gas emissions has impacted its production of the critical mineral. The Pigeon Process, predominantly used in China, is less energy-intensive compared to the electrolytic methods but still has a significant environmental footprint, primarily due to reliance on coal for energy. In response to these environmental concerns, some Chinese magnesium producers have had to cut back on production or temporarily shut down, leading to a decrease in global magnesium output and increasing prices.

Another challenge in the global magnesium supply chain is the geopolitical risk associated with such a high concentration of production in one region where China accounts for over 85% of the world’s primary magnesium production. Any political instability or trade disputes involving China can have a significant impact on the global magnesium market. This was evident during the COVID-19 pandemic when magnesium prices dropped significantly due to disruptions in supply chains and then rebounded sharply as the situation improved.

The Middle East, Africa and Latin America follow China in terms of magnesium production significance, but also suffer from economic stress, internal struggles and souring geopolitical tensions. The key for North America’s continued progress will be to develop major magnesium discoveries domestically, securing a vital supply chain domestically.

Can Canada become a key player?

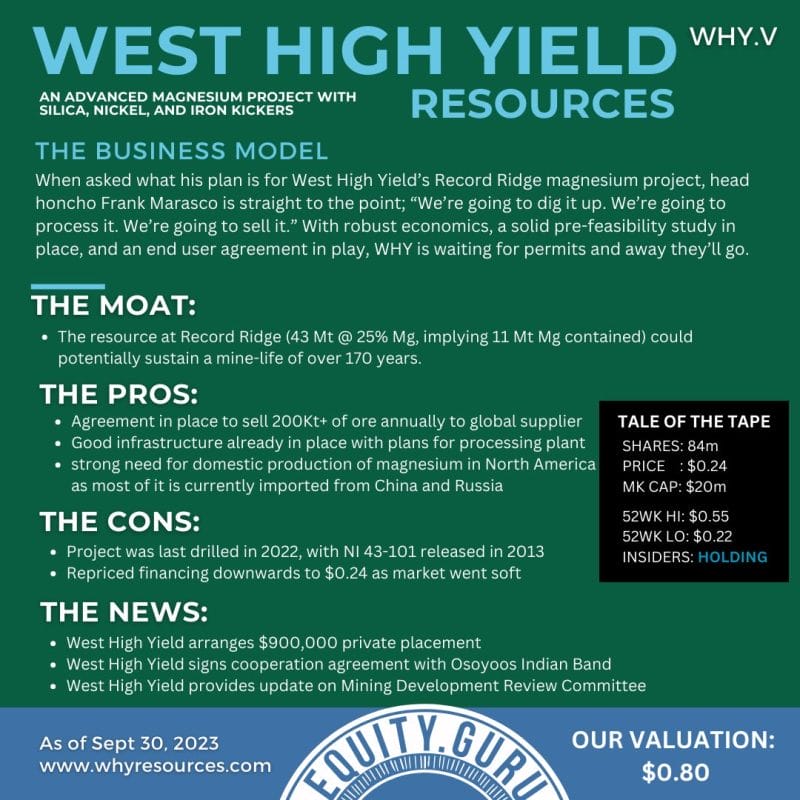

British Columbia is already known for its rich gold and copper mining history and the exploration of magnesium is no different. WHY Resources’ Record Ridge project, located near the southcentral city of Rossland, BC, is considered one of the largest and highest-grade magnesium deposits in North America. This deposit has garnered significant attention due to its substantial magnesium content and the potential for economic development.

WHY Resources owns 100% of the mineral rights to the Record Ridge project. The measured and indicated resources of this deposit have been estimated to be 43 million tonnes with a magnesium grade of 24.61%, containing approximately 10.6 million tonnes of magnesium. Additionally, the inferred resources are about 1 million tonnes at a grade of 24.37% magnesium, containing around 260,000 tonnes of the metal. These estimates were based on a cut-off of 21.9% magnesium.

A prefeasibility study of the Record Ridge project has projected an impressive after-tax net present value of US$872 million with a 5% discount rate and an internal rate of return of 72%. The mine, planned as an open-pit operation, is expected to have a lifespan of 20 years. The proposed mining and processing techniques are set to utilize a proprietary hydrometallurgical process aiming to produce magnesia (MgO) of at least 99% purity.

The significance of the Record Ridge deposit extends beyond its mineral wealth. The project has initiated a co-operation agreement with the Osoyoos Indian Band, focusing on advancing sustainability, sound environmental practices, good governance, and respecting Indigenous rights. This agreement demonstrates the commitment to responsible mining practices and the importance of engaging with local communities and stakeholders in mining projects. WHY submitted its amended permit application to the government back in October.

The development of the Record Ridge Magnesium deposit is poised to play a significant role in the magnesium market, especially considering the growing demand for magnesium in various industries, including automotive and aerospace sectors. The potential of this deposit to contribute to the economic growth of the region and the broader magnesium market is substantial. You may want to keep this one on your radar. As always, do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all.