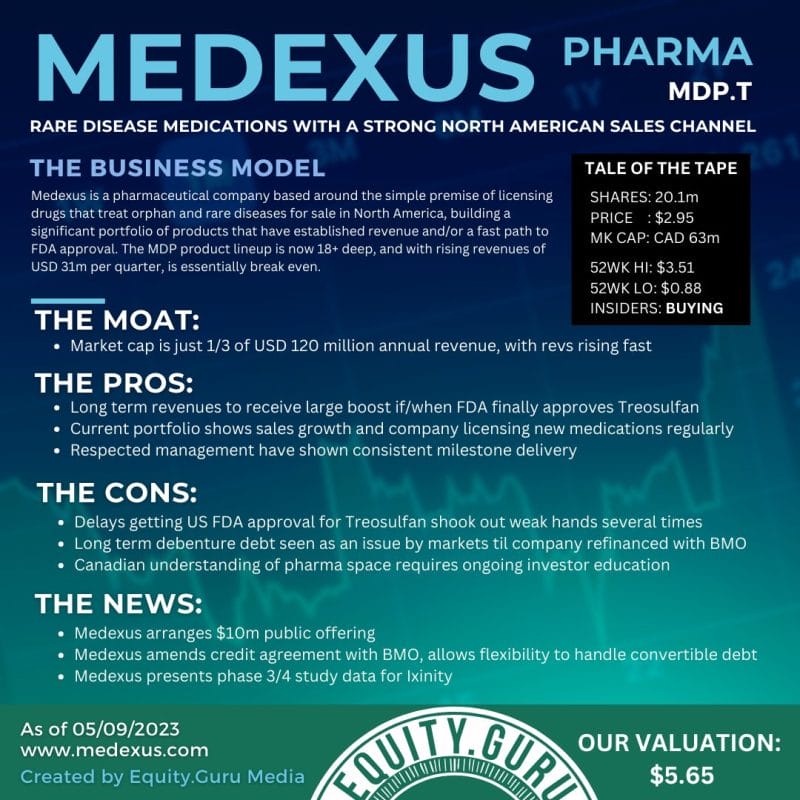

Hey y’all, Lucy Copperpot back for more analysis of Equity.Guru companies – this one is no longer on the client list, but I asked for permission to dig in anyway because I really think a ton of risk has been removed from Medexus Pharmaceuticals (MDP.T) that the market hasn’t factored in, and that’s a real opportunity.

Based on the Management’s Discussion & Analysis (MD&A) for Medexus Pharmaceuticals Inc., we can derive a clear financial picture of a company that has been responsibly run with a long term business model.

- Revenue Growth: Medexus reported revenues of $30.3 million and $61.9 million for the three- and six-month periods ended September 30, 2023, respectively. This represents a growth of 9.4% and 22.1% compared to the same periods in 2022. This increase is primarily due to the recognition of 100% of Gleolan net sales, strong demand for Rupall, and robust sales of IXINITY.

- Adjusted EBITDA: Adjusted EBITDA was $5.3 million and $11.9 million for the three- and six-month periods, reflecting increases of 26.2% and 95.1% year-over-year. This increase is mainly attributed to the growth in revenue and a reduction in operating expenses.

- Net Loss Improvement: The net loss for the three and six-month periods was $1.1 million and $0.4 million, which is an improvement of $1.6 million and $3.7 million, respectively, from the same periods in 2022.

- Operating Income: Operating income for the three- and six-month periods was $3.6 million and $8.4 million, showing increases of $1.7 million and $6.4 million from 2022, signaling better control over costs and efficiency in operations.

- Gross Margin: The gross margin decreased slightly due to changes in the product mix and effective unit-level price reductions for certain products.

- Liquidity and Capital Resources: Medexus had available liquidity of $37.5 million as of September 30, 2023. This consists of cash and cash equivalents and undrawn amounts under the credit facility.

- Product Highlights: The MD&A provides a detailed discussion on the performance of key products like IXINITY, Rasuvo, Rupall, Gleolan, and Metoject. Growth in unit demand and strategic marketing initiatives have contributed to the revenue growth.

- Pipeline Opportunities: Medexus is actively working on pipeline opportunities like Treosulfan in the U.S., and they are engaged in dialogues with the FDA for other product approvals.

- Operational Efficiency: There was a targeted reduction in selling and administrative expenses and continued investment in research and development, particularly for the IXINITY manufacturing process improvement initiative.

The financials and MD&A suggest that Medexus Pharmaceuticals Inc. is experiencing revenue growth and operational efficiency improvements.

The company is actively managing its product portfolio and engaging in strategic initiatives to drive future growth. While the net loss figures show that profitability has not yet been achieved, the trend towards lower losses and increased operational income is positive.

The company’s success in advancing its pipeline and managing its product mix will be critical factors in its long-term success. The MD&A also indicates a solid strategy for managing liquidity and capital resources, which is crucial for sustaining operations and funding growth initiatives.

Stock performance in recent months does NOT match the financial outlook, leading me to think there’s a strong opportunity in taking a long term position. Previous financing risks have been largely negated through refinancing and though the company isn’t profitable, it’s so close that it has a multi-year runway at its current cash position.

I give it a B+, upgraded to an A- based on market cap being only 1.5x quarterly revenue.

— Lucy Copperpot

FULL DISCLOSURE: The author has no commercial or financial relationship to the company, which is not an Equity.Guru marketing client at this stage