I remember the day Karim Rayani called me up and said, “I’ve got a plan for Marvel Resources (MARV.V) and I said, “Cool, okay, I guess,” and he got a bit annoyed at me.

I wasn’t taking him seriously because Marvel was tiny and there’s a lot of tiny mining explorers and as much as I like Karim – and I do – a tiny company with a small budget is unlikely to make waves.

But Karim started working his Moroccan street bazaar haggling magic and, before too long, he was collecting mining projects across the country.

Then he started doing the work, moving those projects forward, with JVs and land acquisition.

Fast forward one year and this is how it looks now.

Yes, that’s six Canadian provinces with Marvel DNA on them, and six different kinds of metals that those properties are sitting on.

- Uranium

- Rare earths (RREs)

- Gold

- Nickel

- Copper

- Platinum group elements (PGEs)

If you’re looking for pig iron, I hear Karim’s got a guy.

And he’s got JV partners too.

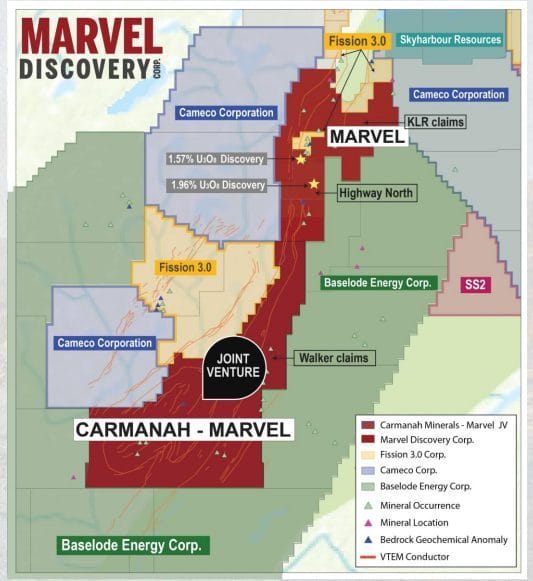

Carmanah Minerals (CARM.C) has a 50% stake in the KLR Walker, and Highway Project in the Athabasca, doing $1.5 million of exploration, firing over $400k in cash, and offering up 3.5m shares and warrants over three years. That’s good walking around money.

That project is butted right up against monsters like Fission 3.0 (FCU.T) to the north and west, and Cameco (CCO.T) to the east, west, and southwest. Skyharbour (SYH.V) is to the northeast. Everything else is Baselode Energy (FIND.V).

Marvel is the runt of that litter, but it’s smack dab in the middle of everyone, and with the smallest market cap outside of Carmanah.

Oh yeah – they also just staked a load more of the project. Now they own 17k acres of the thing.

Now maybe you don’t know uranium from a hole in the ground, but you’ve likely heard that sector has been active recently while other resource sectors have been eating dirt. That’s true – commodity prices have been on the rise and a lot of uranium explorers have been on a run.

But here’s the thing – the Murderer’s Row of Uranium right now, includes many of the the names mentioned above. For Marvel to be right in alongside Fission and Cameco, smelling their breath and competing for legroom, is a big deal for the plucky $5m market cap gatherer of rock properties.

Take Cameco’s 50% owned Cigar Lake project, which hosts a whopping 152 million lbs of U308 with a grade of 15%. Or McArthur River 2, which Cameco 70% owns, and has 392 million lbs of U308.

You know what else is interesting out there right now? Rare earths.

And Marv has some he’d like to show you.

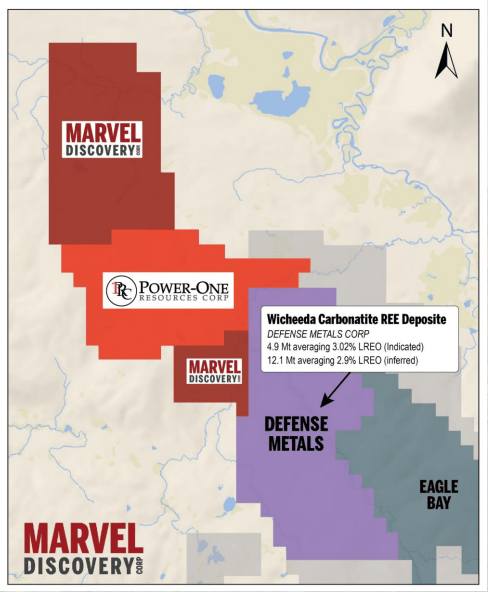

The Wicheeda North project 80km northeast of Prince George, BC, is butted right up alongside Defense Metals’ (DEFN.V) carbonatite REE deposit, featuring 4.89 million tonnes (Mt) at 3.02% light rare earth oxide (LREO) and an additional 12.1 million tonnes (Mt) at 2.90% LREO.

Same MO as in the Athabasca – Rayani has spotted the biggest beast on the plain and set up right alongside her at the watering hole, reasoning that the region has plenty more to offer and every advance DEFN makes will indicate good things beyoind its border.

- DEFN is a $50 million market cap explorer.

- MARV is $5 million.

Both have room to run, but any upward shift by Marvel will be expansive by virtue of how small it is at the outset.

Craig Taylor, CEO of Defense Metals, is bullish on the ground.

“Our recent results shows that the Wicheeda feedstock can be crushed, ground and floated to produce a rare earth flotation product with similar or better recoveries and grades to the top producers globally,” he has said. “Our project has many favourable conditions for success: mineralogy, metallurgy, infrastructure and community collaboration, further supporting a path to production.”

He’s right. DEFN is a fricking beauty. It’s close to highways, power lines, railways, and has all-weather roads. We talked it up a few years back when others thought there was nothing to see, and it’s laid out a case to move toward production well in the time since.

But all those things going for DEFN are also going for MARV, albeit in an earlier stage way.

Oh yeah, that Power One Resources (PWRO.V) blob on the map to the right, splitting the Marvel projects? That’s another spin out for MARV holders. Free stock on the way.

Let’s talk gold!

You like gold. You need gold. Gold will have its day again.

MARV has gold in Newfoundland on five different properties, with one of them also a spot where lithium has been spotted nearby.

I’m not even going to get into them because there’s too fucking many, some of them are JV’s with MARV’s mom, Falcon Gold (FG.V), Carmanah is in there somewhere too, and the news releases announcing work on those properties are, frankly, too much for me to get into.

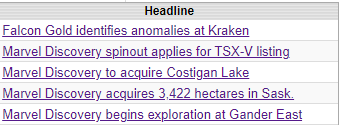

This is the newsflow from one month.

Anomalies! Spinouts! Acquisitions! Exploration!

You don’t like gold? Okay, how about some Quebec based Iron-Titanium Oxides?

No? Maybe Nickel? Cobalt? Copper?

If you really want to get out of the standard fare, we’ve also got an instance of titanium-vanadium-chromium in the Duhamel, Quebec Battery Metals Exploration featuring all of the above.

Shift back to Ontario, there’s another gold property butted right up against the $32 billion market cap Agnico Eagle (AEM.T), with visible gold in drill cores and drill results with assays as high as 50.6 grams per tonne near surface.

Also in Ontario is the Elliot Lake East Bull Project, which brings palladium and platinum into the mix.

The Power One spinoff will contain the Wicheeda REE Project asset and part of the Uranium, nickel, copper, PGE’s project at East Bull.

ENOUGH.

I can’t do this anymore. It’s too much. Name a metal, this dude has found a project hanging off the side of a bigger project, which has cost him next to nothing and, by and large, has been decently advanced in the time since acquisition.

It’s 2AM, and my head is melting with all these projects and metals and news releases and sister spinoffs and JVs and THAT’S THE POINT.

Karim Rayani has achieved exactly what he said he was going to do, the thing that nobody gave him credit for being able to do, the thing that makes Marvel Discoverya potential spiker every time pretty much ANY metal goes on a run.

If gold goes up, it’s got gold for days. If battery metals go on a charge, no pun intended, Marvel goes on a run. If uranium takes off, ditto.

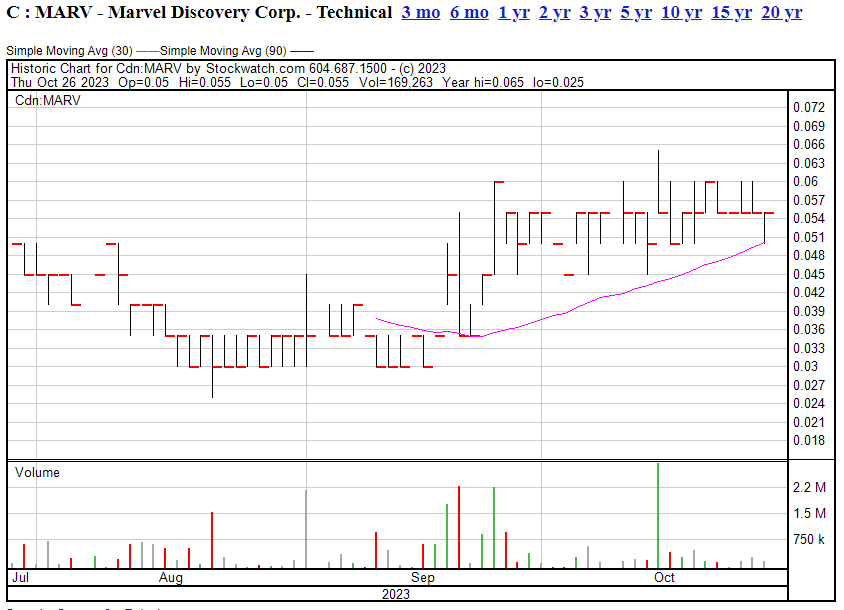

And take off, it is trying to do. Someone is selling MARV off at $0.055 whenever it wants to go higher, and my thinking is that’s not a forever issue.

When this breaks out of that $0.055 line, it should break hard.

Who knows, maybe I’ll be the one to break it.

— Chris Parry

FULL DISCLOSURE: Marvel Discovery is an Equity.Guru marketing client, and we own the stock.