Everyone loves a good earnings upside surprise. Wall Street is sure loving Netflix’s recently released earnings which has seen the stock surge 16%, the largest single day gain for the stock since 2021.

Netflix said that it added 8.76 million global subscribers during the third quarter, which was higher than the 5.49 million Wall Street expectations. This is the biggest quarterly net add total since it added 10.1 million subscribers in the second quarter 2020.

- Earnings: $3.73 vs $3.49 per share expected, according to LSEG, formerly known as Refinitiv

- Revenue: $8.54 billion vs $8.54 billion expected, according to LSEG

- Total memberships expected: 247.15 million vs. 243.88 million expected, according to Street Account

Wall Street really likes the ad driven subscriber growth. Netflix said its ad plan membership grew nearly 70% quarter over quarter. However, they did not disclose what percentage of its base is subscribed to the ad tier.

Revenue in the third quarter rose to $8.54 billion from $7.93 billion a year earlier. Net income came in at $1.68 billion, or $3.73 per share, compared with $1.4 billion, or $3.10 per share.

Netflix said it is keeping its ad tier pricing at $6.99 a month in the U.S. while its basic and premium services will see a price hike starting Wednesday. Netflix’s basic plan will now cost $11.99 (up from $9.99) and premium will be $22.99 a month (up from $19.99). Netflix’s standard plan will remain at $15.49 a month. This is to improve profitability and grapple with higher production costs.

In terms of forward guidance, Netflix forecast that revenue will jump 11% in the fourth quarter, reaching $8.69 billion, below Wall Street expectations of $8.77 billion. Netflix said it expects net subscriber adds will be similar to the third quarter. The Company also is paying attention to the currency markets, stating that the strength of the US Dollar in recent months will result in a roughly $200 million drag on Q4 revenue.

As for Netflix’s profitability, the streamer now expects its full-year 2023 operating margin will be around 20%, the high end of its previous forecast range of 18% to 20%. It also said full-year 2024 should see operating margins of 22% to 23%.

Analysts at Morgan Stanley have upgraded the stock to overweight and raised its price target to $475.

“We believe Netflix will deliver the objectives it set out a year ago, accelerate revenue growth back to double digits and expand margins,” Morgan Stanley said in a Thursday analyst note.

Truist analyst Matthew Thornton noted that the password-sharing crackdown could continue to propel subscriber growth into the next year. The firm also upgraded Netflix to a buy rating and raised its price target from $430 to $465.

“We upgrade to Buy with our thesis predicated on ongoing password sharing benefits (into 2024), advertising ramp (long-term), and share buybacks ($10b added), with top 3 tent-poles by 2025 (Squid Game, Wednesday, Stranger Things), with video games a free call option, and with optional growth levers available to NFLX,” Thornton said in the note.

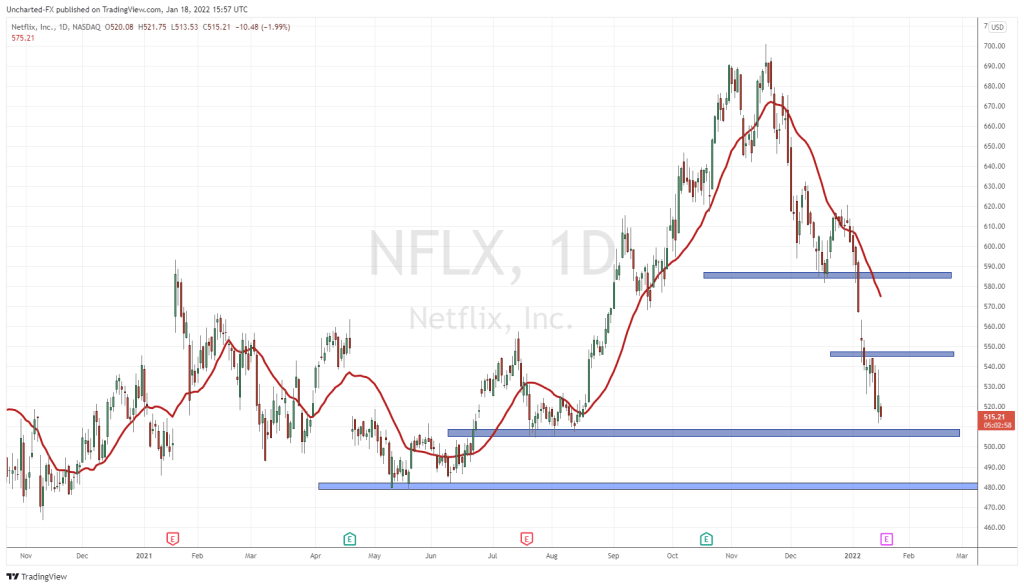

Our technical chart for Netflix was not looking too good before earnings. The stock had broken below recent lows at $352 suggesting that the majority of the market was expecting disappointing numbers. The reaction following released data shows you what happens when something is not priced in. Very volatile price action. The market is now reacting to this new data and likes what it sees.

Instead of following a bearish trajectory down to $320, the stock is now breaking above technical levels which will see it nullify the downtrend. First off, the stock is back above the current lower high at $380. According to market structure, this means the downtrend is now over and traders should expect higher lows and higher highs.

Secondly, the stock has also closed back above the trendline. A trendline with multiple touches which even connected the now broken lower high. Note too that today’s lows also respected this trendline.

And finally, the stock is now back above a major resistance zone. The stock is back over $400 and what was once resistance now becomes new support for the stock.

The next target for the stock? $480 is the major resistance, and is perhaps the reason why Morgan Stanley chose the $475 price target as it comes close to this zone. Traders and investors should also watch for reaction around the $450 zone.